The GTM Playbook🎯, 9 Reasons ICPs Don’t Book A Demo📉, The Investor Call Framework🗣️

If you're building, investing, or just trying to stay ahead of the curve, you're in the right place. Every week, we break down the latest insights, funding news, and founder-friendly gems. Just what matters. Plus, we track the freshest VC funds deploying capital so you know where the money’s moving.

Let’s get into it 👇

In-Depth Insights 🔍

Jeff Bezos on the 4 principles that differentiated Amazon from other companies 🧭

Bezos explains how an operating system built on customer fixation, invention, and patient bets compounds into durable advantage. He pairs long-horizon risk-taking with relentless defect-hunting to keep execution crisp while exploring new frontiers. [Startup Archive]9 Reasons ICPs Don’t Book A Demo 📉

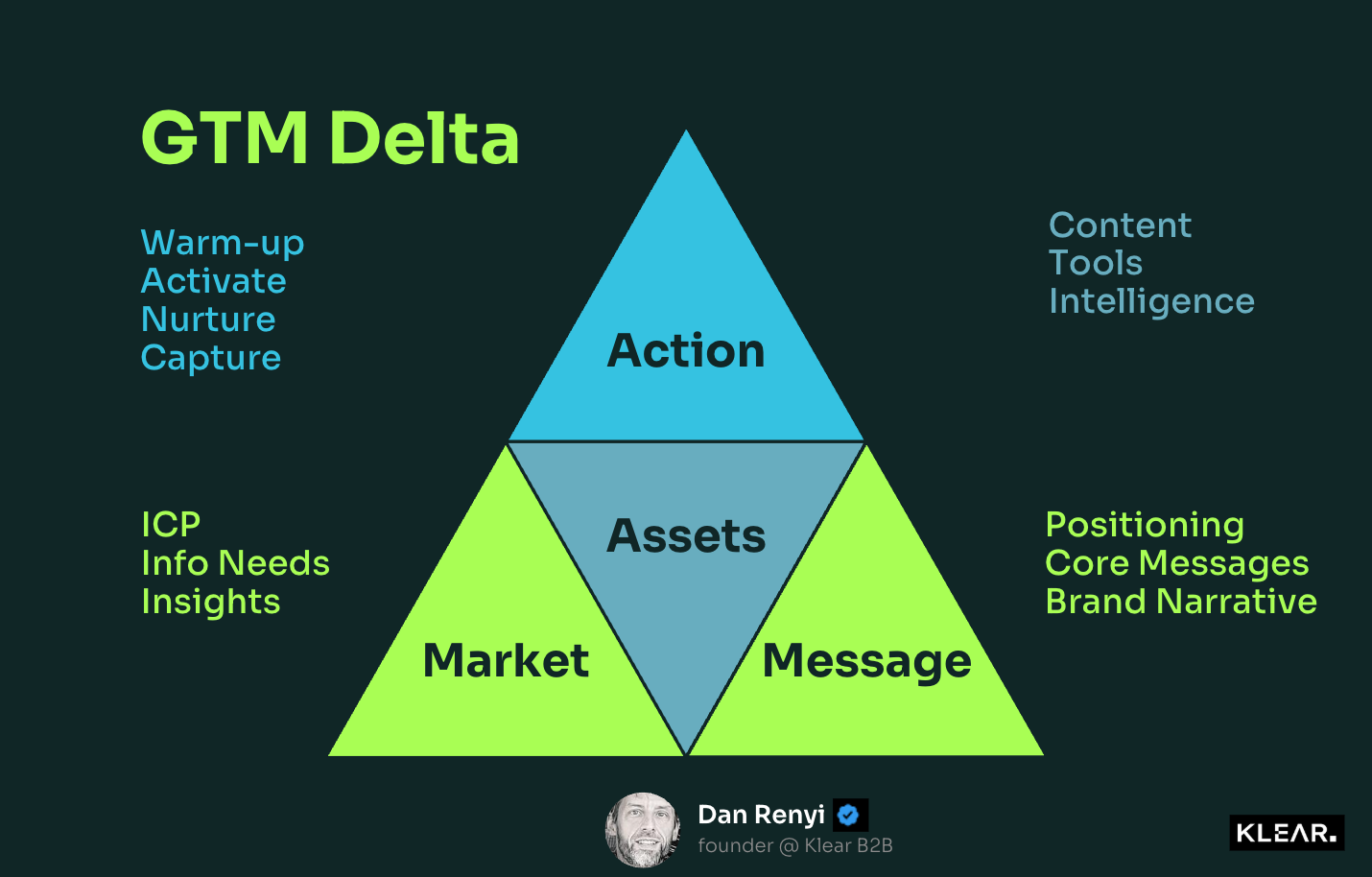

A diagnostic for weak conversion pinpoints foundational gaps such as market clarity, narrative, assets, and actions instead of blaming channels. Use journey “wizards” rather than content dumps to cut friction and move qualified buyers toward value moments. [Dan Renyi]

The Age of Scaling Is Over! 🧱

With web-scale data tapped and returns tapering, progress shifts from “bigger” to “smarter” via test‑time compute, synthetic data, world models, and hybrid designs. Builders should prioritize efficiency, domain focus, and productization over raw parameter growth. [Samet Ozkale]The Investor Call Framework 🗣️

Turn a half hour into momentum with a sequence that sets context, demonstrates evidence, articulates the ask, and choreographs next steps. Calm objection handling and disciplined follow‑ups convert curiosity into conviction. [Martyn Eeles]Revolut’s trajectory to $75B: speed, standards, and global ambition ⚡️

A European fintech’s rise pairs rapid execution with rigorous quality bars while pushing into new regions beyond its home base. The next phase hinges on navigating regulation and translating product breadth into durable, multi‑market economics. [Nicola Ebmeyer]

The Merger Playbook: Crossbeam’s CEO Breaks Down Every Detail of the Deal That Worked 🤝

A founder’s account shows how combining network effects, aligning boards on clean terms, and “front‑loading pain” can reset growth and efficiency. One platform, one paper, and decisive customer migration turned dilution into compounding traction. [Review - FirstRound]The Startup Fundability Checklist: Are Your Metrics Investor Ready? 🧮

Benchmarks like CAC payback, NRR, efficiency, growth, and runway separate compelling stories from investable systems. Tune spend-to-return cycles and retention engines so capital fuels expansion instead of masking leakage.The Go To Market Sequencing Playbook Every Founder Needs 🎯

Win one narrow arena until motions rhyme, then expand via adjacent roles, use cases, and look‑alike markets. Depth builds loops; loops compound distribution—turning growth from motion into slope.

Notes From an Interview With Jony Ive 🎨

Craft is portrayed as a moral stance: finish the unseen, design among real lives, and let relationships shape outcomes. The deepest signal is not speed but care, communicated through small choices that scale into meaningful experiences. [Jim’s Blog]

Trending News ⚡

Kalshi’s $1B Raise Rockets Valuation to $11B 💸

Prediction markets are breaking into the mainstream as retail behavior shifts from passive watching to outcome-driven participation. Backing from top-tier funds signals growing institutional confidence in this consumer finance infrastructure.

AI Researcher Warns of Sweeping Job Displacement ⚠️

A leading academic argues that rapidly advancing systems could automate work across domains, reshaping corporate hierarchies and decision-making. He also raises a deeper concern: how societies adapt when meaning and purpose are no longer anchored in traditional employment. [Business Insider]Gen Z Sees AI as a Threat to Career Prospects 💼

A nationwide youth survey reports elevated anxiety about employment pathways as automation accelerates. Despite the concern, adoption is rising for study assistance and everyday productivity tools among young users. [Business Insider]Jensen Huang Predicts New Industries Around Robots 🤖

The Nvidia chief envisions support ecosystems for machines, including fabrication, maintenance, and customization, emerging alongside automation. He argues that roles defined by judgment, purpose, and complex coordination will endure even as task-based work is mechanized. [Business Insider]

Tech Leaders Split on AI’s Employment Impact 🧭

Some executives forecast significant white-collar disruption, while others anticipate productivity gains that reshape rather than erase roles. The emerging consensus: timelines and exposure vary widely by function, skill level, and the pace of adoption. [Business Insider]

Anthropic Preps for a Potential 2026 IPO 📈

The Claude maker is laying legal groundwork while exploring capital strategies that match soaring enterprise demand. Early talks underscore an environment where cloud, chips, and model providers are tightly intertwined with revenue growth. [Reuters]Aaron Levie: The Model Race Is Wide Open 🏁

The Box CEO says relentless iteration makes today’s benchmarks fleeting, while practical gains compound inside workflows. He expects agentic systems to augment teams rather than supplant core software, with humans steering outcomes. [Axios]OpenAI’s Investors Become Its Biggest Customers 🔄

A circular ecosystem is forming where backers provide infrastructure, data access, and enterprise channels in exchange for product integration and equity. The approach accelerates adoption but blurs the line between organic demand and engineered distribution. [Reuters]

Fundraising?

If you’re raising a round, Luis Llorens and The Founders Corner can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

Social Media Gems 💎

Passion Projects Spark Breakout Companies 💡

The insight underscores that many transformative ventures begin as personal explorations driven by curiosity rather than formal business blueprints. It encourages founders to prioritize user delight and craftsmanship first, letting structure and scale follow organically. [Z Fellows]NVIDIA’s Ecosystem Playbook: From Chips to Capital Control 🏗️

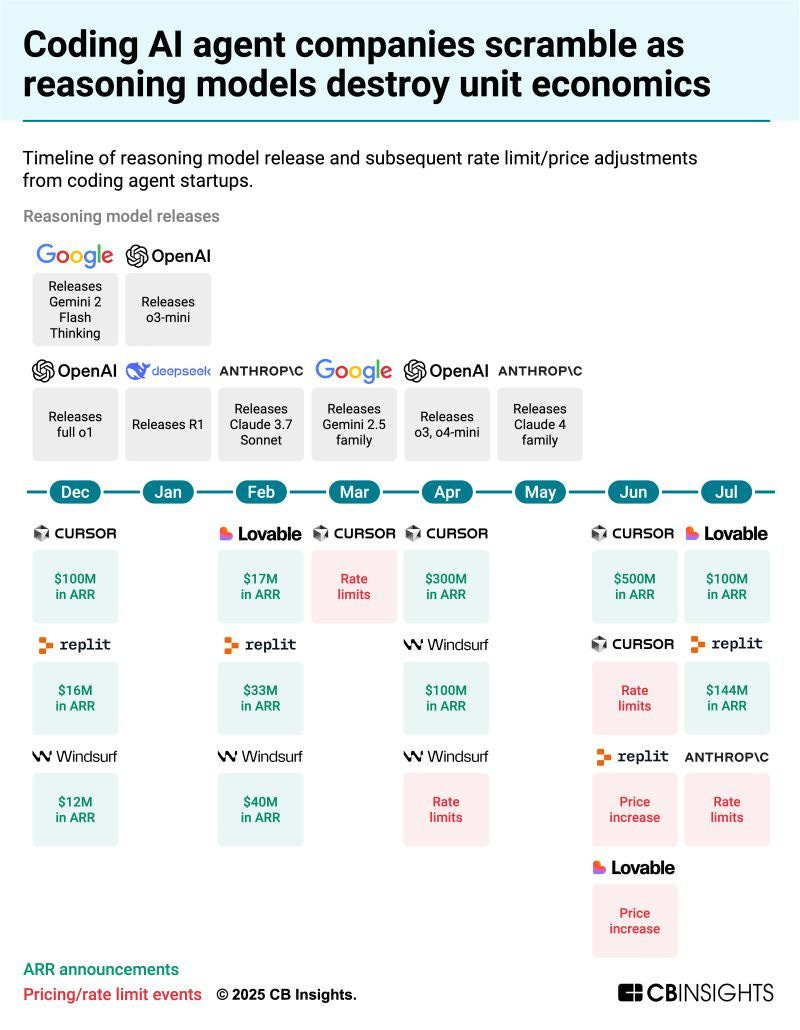

A $2B stake in Synopsys and hundreds of new alliances show a strategy that knits compute, design tools, and networking into a durable moat. Momentum spans cloud backbones, edge robotics, and sector‑specific AI, positioning one vendor to shape the stack and the spend. [Manlio Carrelli]Vibe Coding’s Cost Shock and the Path to Profitable Agents 📉

Reasoning models are inflating output tokens and prices, pushing unit economics underwater as repricing and rate limits take effect. Survivors will re-architect for efficiency with fewer calls, smarter chaining, caching, and deeper workflows until model costs normalize.Larry Fink’s Crypto U‑Turn Signals Institutional Momentum 🪙

After years of skepticism, BlackRock’s CEO says his view has “completely changed,” an admission that typically precedes scaled product development and asset flows. Expect more mainstream rails, deeper client demand, and faster institutional on‑ramps.Jensen Huang on Leadership, Listening, and Pragmatism 🧑💼

Huang highlights attentiveness, candor, and practical judgment as core traits he values when engaging with political leaders. The subtext is clear: in volatile markets, steadiness and clear intent matter more than volume or rhetoric.

New Funds 💰

Alantra raised €70M from EIF to fuel its energy transition growth strategy.

Unlimited launched a new fund bridging public markets with private VC-backed startups.

Conexus Venture Capital closed Fund II at $30M to back early-stage startups across Canada.

Nexus Venture Partners locked in $700M for Fund VIII to back breakout startups in India and the U.S.

Nazca Capital received €40M from EIF for its aerospace and defense-focused vehicle.

Indico Capital Partners secured €30M from EIF for its €125M Iberian VC fund.

SecondQuarter Ventures is raising a $2.6B fund to scale its secondaries strategy.

Anti Fund closed a $30M debut fund to invest in consumer brands and creators.

Propeller launched a $50M Fund III focused on ocean and climate tech.

Incore Invest hit €40M on its second close for Fund II, targeting European tech.

Expedition Growth Capital raised $375M for Fund III to scale growth-stage software in Europe.

Future Energy Ventures closed a €235M fund to back the next wave of energy tech.

India Global Forum launched a $250M fund to back high-growth Indian consumer brands.

CerraCap + Impact VC teamed up to launch a joint fund focused on tech-for-good startups.

That’s a wrap for this week.

If you want to stay ahead of the curve, make sure you're subscribed. No fluff, just real startup insights delivered straight to your inbox.

See you next time 🚀