Is the MVP Dead?⚒️, Vibe Coding 101⚡️, Ramp’s Playbook for Growth🚀

If you're building, investing, or just trying to stay ahead of the curve, you're in the right place. Every week, we break down the latest insights, funding news, and founder-friendly gems. Just what matters. Plus, we track the freshest VC funds deploying capital so you know where the money’s moving.

Let’s get into it 👇

In-Depth Insights 🔍

How GTM Teams Actually Use ChatGPT 🧩

It’s not just for blog posts. GTM teams are using ChatGPT to localize content, break down sales calls, and write outbound that doesn’t sound robotic. The prompts are sharper, and the workflows are sticking. [Kyle Poyar]

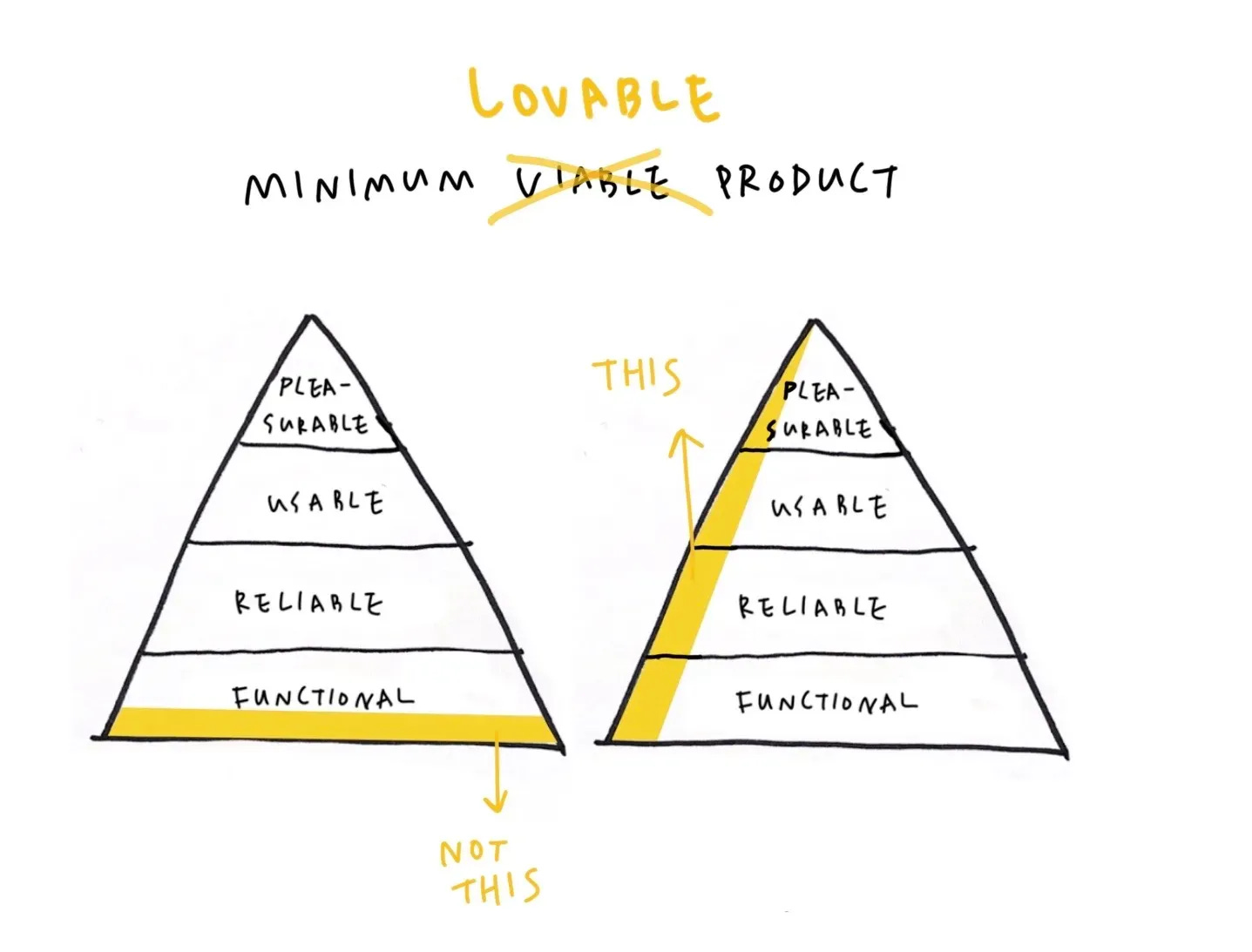

Startups Are Shipping Complete Products From Day One ⚒️

MVPs are getting an upgrade. With no-code tools and smarter execution, teams are launching early versions that feel finished. Easier to test, faster to learn, better all around. [Ruben Dominguez Ibar]

Vibe Coding Is Redefining What It Means to Build ⚡️

Founders are shipping full-stack apps using AI prompts instead of syntax. It’s less about writing perfect code and more about thinking in systems. The barrier to build just dropped [Chris Tottman]

Ramp’s Playbook for Growth 🚀

Ramp grew to a $22B company by moving with clear intent. Their approach focused on product quality, fast iteration, and aligning the team around what mattered most. [Ben Lang]Inside Dario Amodei’s Mission at Anthropic 🧬

Dario is leading Anthropic with a strong focus on both scale and safety. His approach is shaped by personal experience and a belief in building systems that are reliable and well-understood. [Big Technology]

Analytics Tools Are Finally Getting Useful 📈

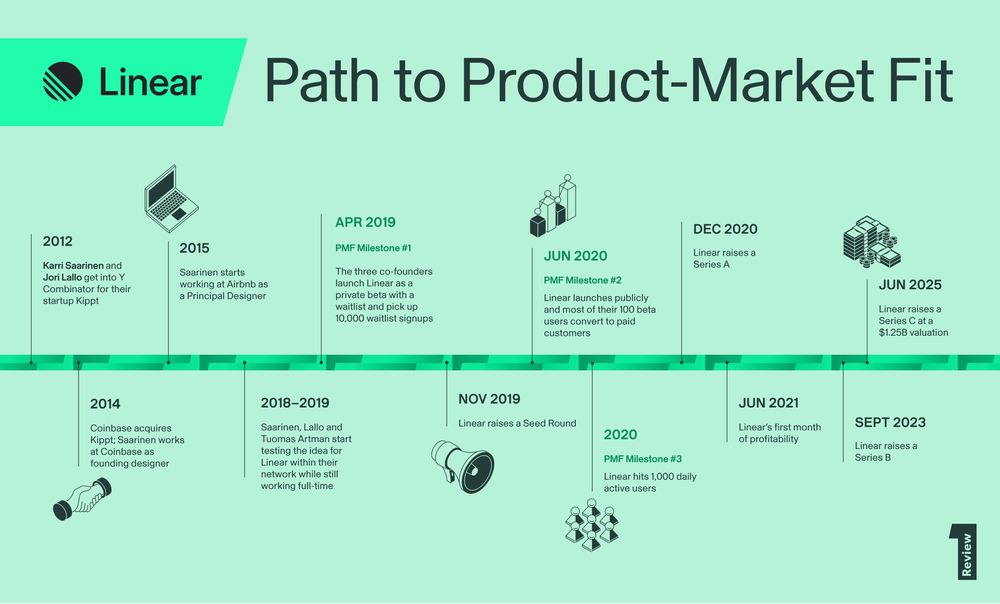

The next wave of analytics explains itself. AI now helps teams see what matters, predict what’s next, and act with context. Less dashboard staring. More decisions. [Chandra Narayanan]How Linear Built Something Teams Actually Love 🎯

Linear’s team built software they wanted to use. They paid close attention to design and stuck with their vision over time. That consistency helped them reach $1.25B in value. [First Round]

Trending News ⚡

Fireworks AI Is Quietly Becoming a $4B Backbone ⚡

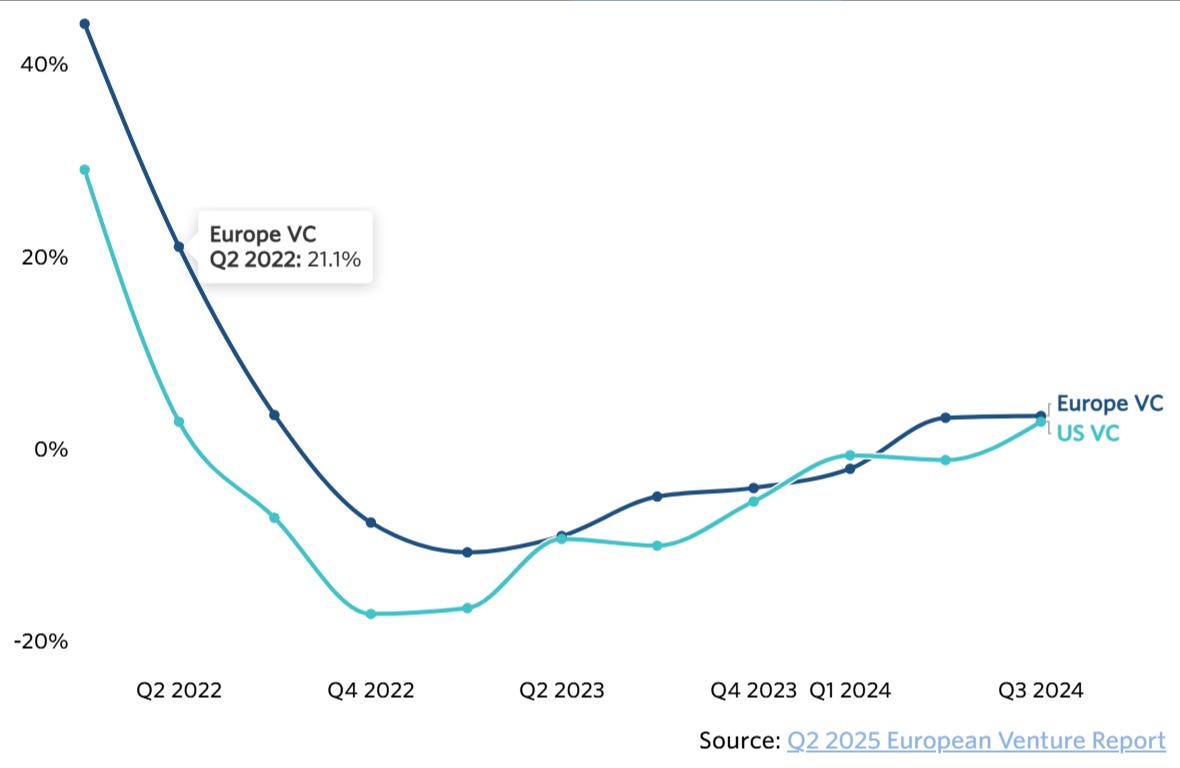

With blazing-fast inference and PyTorch-native infra, Fireworks is shaping up as the engine room for enterprise-grade gen AI. Backed by Nvidia and built by Meta alums, it's solving compute limits and eyeing IPO speed. [Tech Funding News]Europe’s VC Returns Take the Lead - For Now 📈

Thanks to early-stage bets and tighter valuations, Europe’s VC returns briefly outperformed the US. But with dry powder moving faster stateside and exits warming up, that lead may not last long. [PitchBook]

Anthropic Is Raising $5B at $170B Valuation 💸

Iconiq is set to lead a massive round for Anthropic, nearly tripling its value in four months. With surging revenue and sovereign fund backing, the AI arms race is shifting into overdrive. [Financial Times]Figma Just Landed a $19.3B IPO 🎨

Figma priced its IPO at $33 a share, beating the street and bringing new energy to public markets. With 13M users and $749M in revenue, it's a major win for product-first software companies. [Tech Funding News]OpenAI Picks Norway for Its First European Data Hub ⚡

“Stargate Norway” will run on renewable energy, power 100K Nvidia GPUs, and help expand AI infrastructure in Europe. It's a big step for both OpenAI’s global plans and Europe's tech sovereignty push. [Tech Crunch]Zuckerberg Says AI Glasses Will Be the Next Big Leap 👓

Meta is betting big on smart glasses. According to Zuck, they’ll define cognitive performance in the AI era. With billions poured into Reality Labs, this is Meta’s long game. [Tech Crunch]

GitHub Copilot Hits 20M Users as Competition Ramps Up 💻

Microsoft’s AI coding tool now powers 90% of the Fortune 100. With rivals like Cursor and Devin in the mix, the race to dominate AI development tools is officially on. [Tech Crunch]

Social Media Gems 💎

Why PE Firms Rarely Play VC at the Top Level 📊

Private equity and venture run on different math. Different timelines, risk appetite, and return models make it hard to win in both lanes. Most PE players are now going deeper into credit, infrastructure, and insurance. Venture is staying niche by design.

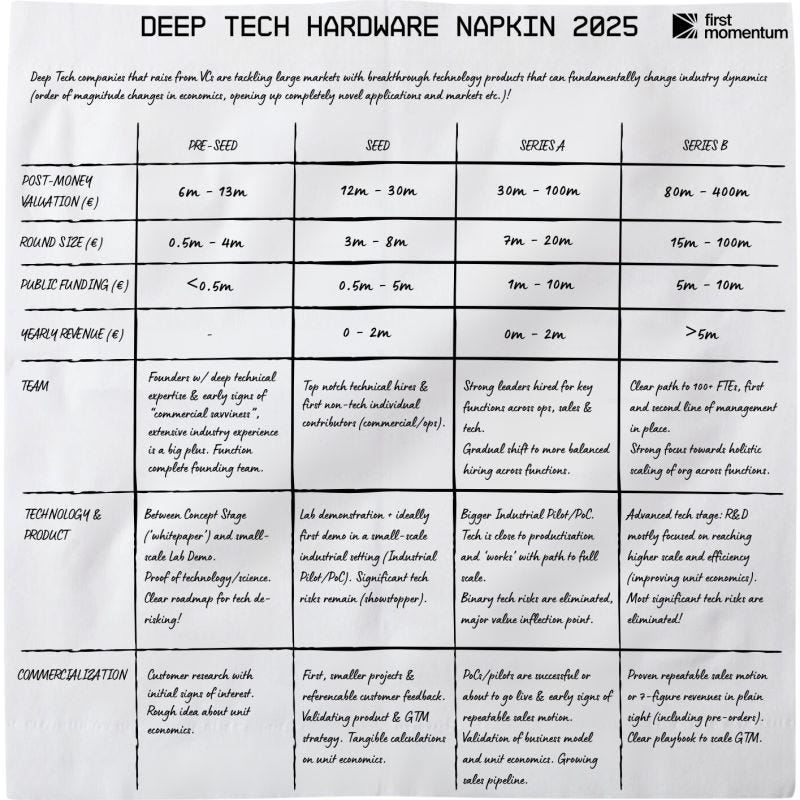

What Raising for Hardware Looks Like in 2025 🤖

Hardware rounds are getting bigger, even as teams shrink. Technical founders are front and center, with fewer commercial co-founders in the mix. Concept-stage bets are in, but VCs want real traction by Series A.

The AI Founder’s Kit: Tools, Capital, and Launch Fuel 📦

A startup-ready drop with $50K+ in free credits, tactical guides, and access to 2,000+ investors. Tools like PostHog, Supabase, v0, and Notion AI make this a go-to stack for idea-stage founders gearing up to build and raise.

Jensen Huang Says AI Will Create More Millionaires Than the Internet 💰🔥

Nvidia’s CEO believes the next five years of AI will generate more wealth than the past two decades of web innovation. His advice? Build vertical tools fast, focus on real-world utility, and ride the foundational model wave before barriers go up.

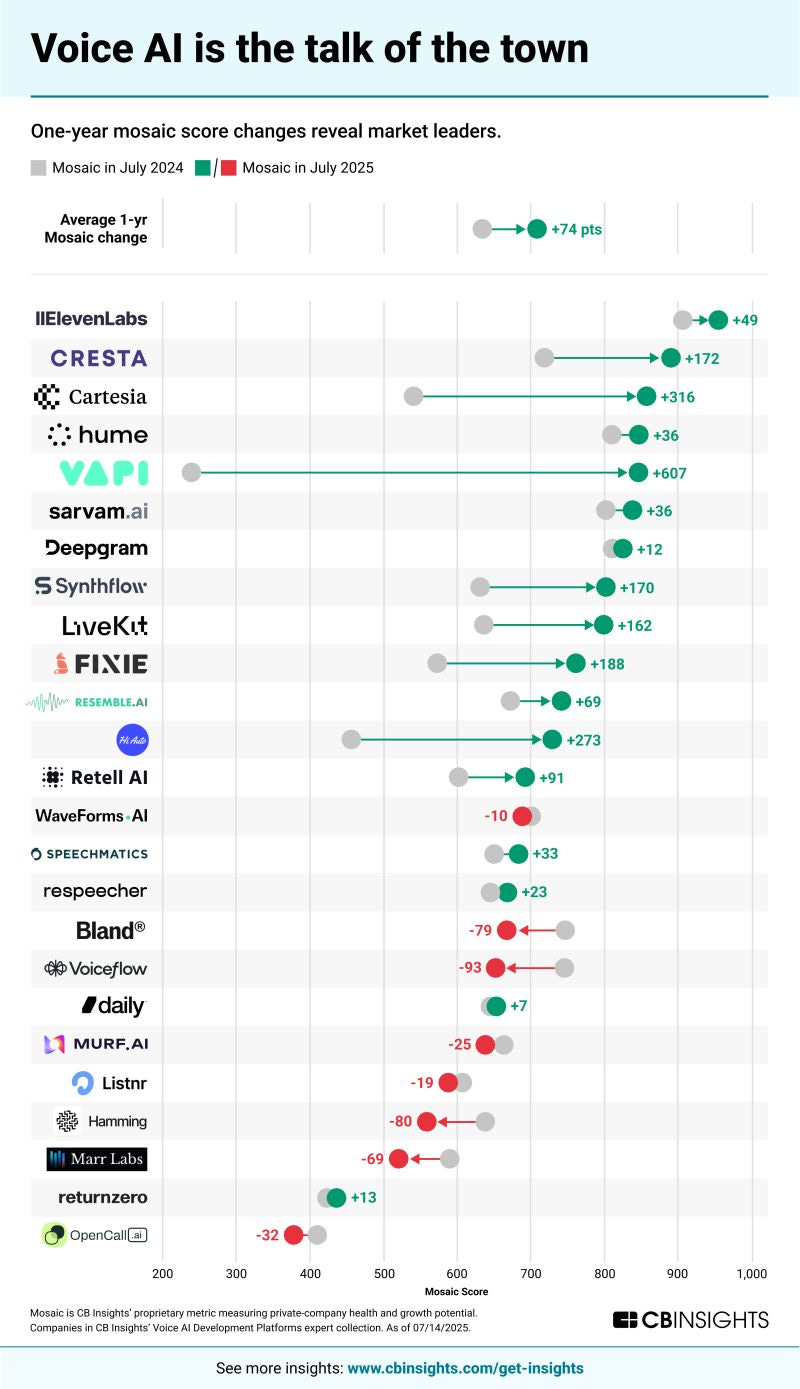

Voice AI’s Next Chapter Is Already in Motion 🗣️

Meta’s PlayAI is just the start. Startups like ElevenLabs, Cresta, and Cartesia are shaping voice as the new interface layer. Latency is dropping, integration is easier, and the M&A signals are already heating up.

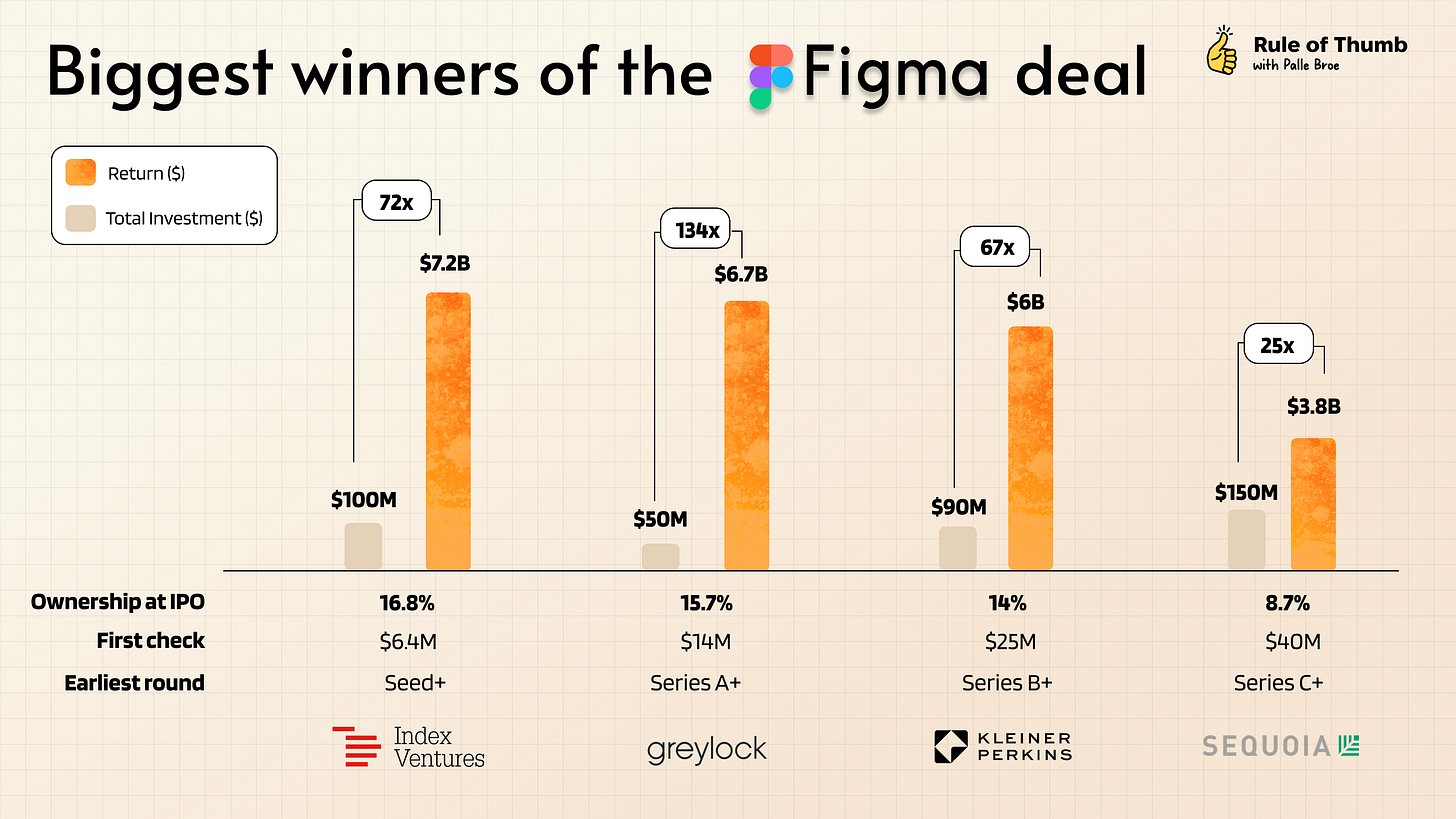

Figma’s $60B IPO Unlocks Massive VC Wins 📈

Index, Sequoia, Greylock, and KP just turned early checks into generational returns. Figma went from a $6.4M seed to a $60B listing, reopening the IPO window and spotlighting product-led growth as a winning path again. [Palle Broe]

New Funds 💰

Foxmont Capital Partners closed the first tranche of its $20M Fund III to back early-stage startups in the Philippines.

China Galaxy & CICC eyeing over $1B in investment vehicles to expand into Southeast Asia, targeting innovation and tech.

NEO Group launched a new private equity fund with a focus on Southeast Asian tech and consumer sectors.

Vietnam’s National Innovation Centre VC fund backed by the government, aims to support 100 Vietnamese startups by 2030.

Inflection Point Ventures rolled out a ₹500 Cr ($60M) fund through GIFT City to target 100+ Indian startups.

Sameer Verma former Nexus Venture partner launches solo GP fund to back early-stage Indian tech.

UTEC & Emerging Asia Capital Partners teaming up for a new fund to target deep tech and emerging markets across Asia.

Skyline Investors closed a $125M fund to support overlooked “micro-market” companies in the U.S.

KKR raised $6.5B for its second Asset-Based Finance fund to tap into private credit markets.

Yaletown Partners secured a $100M first close for its $250M Innovation Growth Fund III targeting Canada’s tech ecosystem.

Verified Capital debut fund closed at $175M to invest in early-stage climate and infrastructure tech.

Blackwood Ventures closed its first fund with over $25M to back pre-seed and seed-stage startups.

Anansi Capital vinay Iyengar launches Anansi Capital to support overlooked and underrepresented founders.

Juchain launched a $100M initiative to support early-stage Web3 startups in Asia.

360 ONE Mutual Fund rolled out a new multi-asset allocation fund under its New Fund Offer (NFO) scheme.

That’s a wrap for this week.

If you want to stay ahead of the curve, make sure you're subscribed. No fluff, just real startup insights delivered straight to your inbox.

See you next time 🚀

Great wrap up. Always interesting peering into the minds of those pushing forward the frontier companies, especially Dario and his thought process.

This approach with a curated list of content is really smart, and useful for the time-constrained reader. Great work guys!