🧩 The Hidden Tension Every Founder Feels — But Few Ever Name

How top founders navigate the invisible pressure between today’s metrics and tomorrow’s ambition — and keep investors aligned without losing control of the long game.

👋 Hey, Chris here! Welcome to BrainDumps—a weekly series from The Founders Corner. If you’ve been reading along, you know this series is a preview of a bigger project. Well, it’s finally here: The Big Book of BrainDumps is out now!

It isn’t a theory book—it’s the founder’s field manual. Inside, you’ll find 70 powerful frameworks distilled from 30+ years scaling software companies to hundreds of millions in ARR, 20+ years investing in 500+ B2B tech startups, and over $1B of shareholder value created. From raising capital to hiring your first VP of Sales, this book turns scars and successes into practical playbooks you’ll return to again and again. I expect most copies will become well-worn, scribbled on, and dog-eared—because it works.

If fundraising is an art, scaling a startup with VC partners is a balancing act — a delicate tension between what needs to happen this quarter and what truly matters over the next decade.

Founders often get pulled in two directions:

On one side, VCs want clear, near-term milestones to justify continued support.

On the other, your company’s survival depends on building systems, products, and capabilities that take time.

Most of the conflict, stress, and misalignment between founders and investors comes from not managing this balance deliberately.

This BrainDump breaks down the frameworks, systems, and communication patterns that high-performing Founders use to keep both sides aligned — and prevent short-term pressures from killing long-term potential.

Let’s dig into each one.

Table of Contents

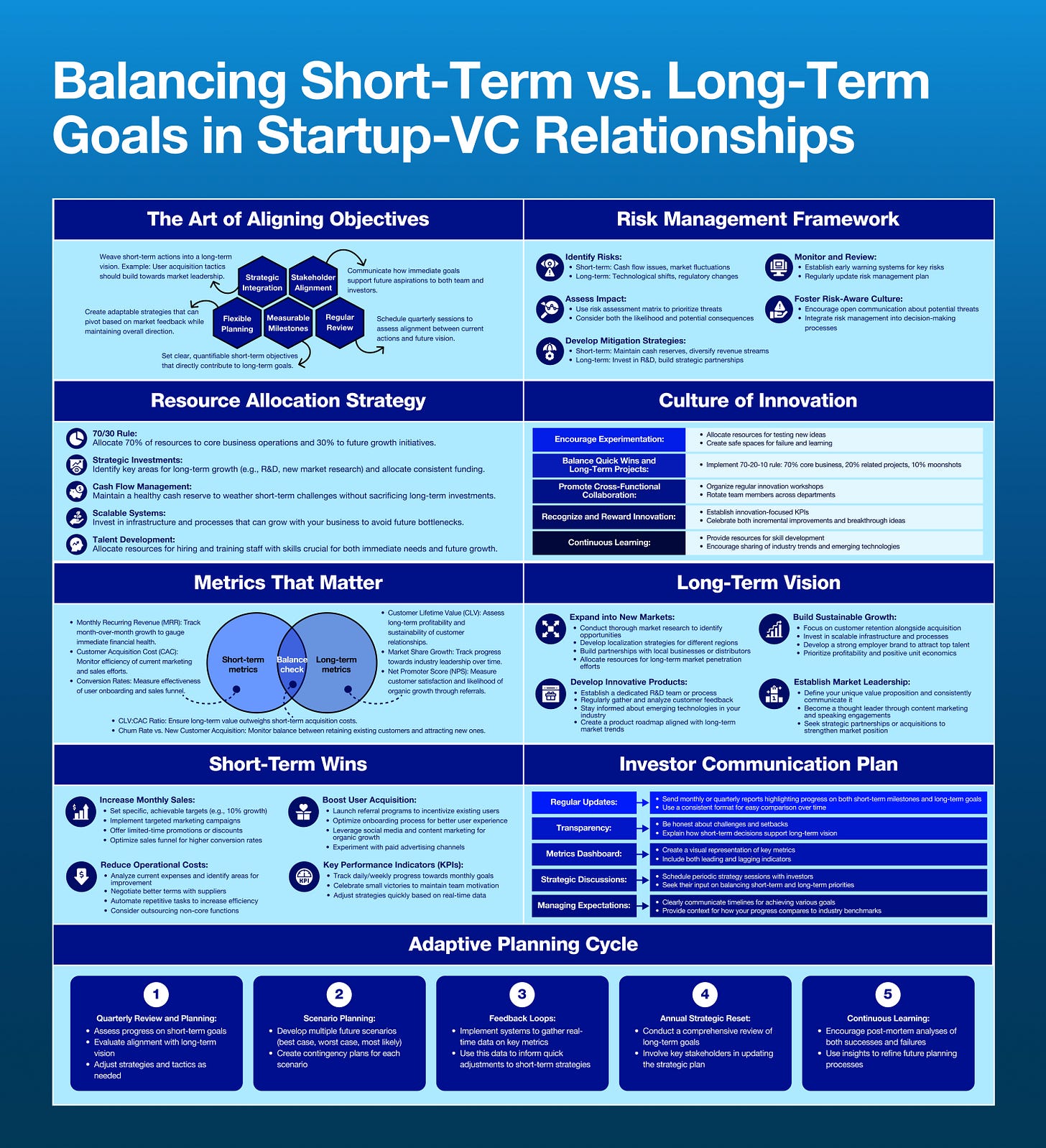

The Art of Aligning Objectives

Risk Management Framework

Resource Allocation Strategy

Culture of Innovation

Metrics That Matter

Long-Term Vision

Short-Term Wins

Investor Communication Plan

Adaptive Planning Cycle

Final Word

1. The Art of Aligning Objectives

Alignment doesn’t happen by accident — it happens by design.

This section identifies the six core goals that must be explicitly aligned between the founder and their investors:

Market expansion

Revenue growth

Product innovation

Operational excellence

Sustainability

Talent development

Founders get into trouble when they assume everyone shares the same definition of “success”.

Investors run portfolios. Founders run companies. The incentives aren’t always identical.

The key is clarity:

✔ What does “growth” mean?

✔ What does “success” look like?

✔ What is the agreed time horizon?

✔ What trade-offs are acceptable?

✔ What isn’t on the table?

If you don’t define alignment early, misalignment becomes inevitable.

2. Risk Management Framework

Founders often think VCs are risk-seeking.

They’re not. They’re risk-managed.

This section focuses on the three layers of risk founders must actively address:

Strategic risk — Are you focused on the right initiatives?

Financial risk — Can you survive volatility?

Operational risk — Can you execute reliably as you scale?

The founders who win investor trust are the ones who show they understand the risks — and have realistic plans to mitigate them.

Short-term risk management builds long-term confidence.

3. Resource Allocation Strategy

If you want to see a founder’s true priorities, ignore the pitch deck.

Look at the budget.

This part identifies the major categories of resource allocation that VCs scrutinise:

R&D and product innovation

Go-to-market investment

Hiring and capability building

Operational infrastructure

Margin protection

Future-proofing experiments

The core challenge:

How do you fund what drives today without starving what makes you dominant tomorrow?

The best founders build budgets in layers:

Foundation → Acceleration → Innovation → Optionality

It’s not just spending. It’s sequencing.

4. Culture of Innovation

Most companies don’t die because they fail to innovate — they die because they fail to innovate consistently.

This section outlines how founders can build a culture that balances discipline with exploration:

Encourage experimentation

Reward learning as much as outcomes

Protect time for innovation

Set boundaries on “shiny object syndrome”

Build mechanisms for rapid iteration

Innovation without guardrails creates chaos.

Guardrails without innovation creates stagnation.

The culture you design determines which fate you choose.

5. Metrics That Matter

Not all KPIs are created equal — and the wrong metrics create the wrong behaviours.

This part distils the core metrics investors watch:

Product adoption

Customer success signals

Unit economics

Revenue efficiency

NRR and logo retention

Operational leverage

Short-term metrics show momentum.

Long-term metrics show resilience.

Exceptional founders structure dashboards that track both simultaneously.

6. Long-Term Vision

This is where great founders differentiate themselves.

In the short term, you need:

Revenue

Traction

Growth

Narrative control

But long-term vision requires:

Market positioning clarity

Category creation or domination pathway

Scalable operational systems

Strategic moat development

Investors want evidence that you’re not just building a company — you’re building an inevitability.

Your long-term vision shouldn’t be fluffy. It should be a strategy with teeth.

7. Short-Term Wins

Short-term wins matter more than founders think — not because they prove success, but because they prove repeatability.

Short-term wins give investors:

✔ Confidence

✔ Momentum

✔ Proof of execution

✔ Validation of assumptions

But founders must choose these wins wisely.

A short-term win that derails long-term strategy is not a win — it’s a distraction.

The art is picking the tactical victories that ladder up to strategic inevitability.

8. Investor Communication Plan

Miscommunication is the silent killer of founder-investor relationships.

This section lays out the playbook for staying aligned:

Scheduled investor updates

Clear milestone reporting

Honest disclosure of risks

Transparency around pivots

Cannons before fireworks: big decisions before big announcements

When communication is proactive and consistent, trust compounds.

When it’s sporadic and reactive, trust collapses.

9. Adaptive Planning Cycle

Startups don’t win by sticking to a plan.

They win by updating the plan faster than competitors.

This cycle emphasises:

Quarterly priority setting

Monthly performance reviews

Continuous feedback loops

Strategic recalibration

Investor alignment updates

Rapid execution adjustments

Rigid plans break.

Adaptive plans bend — and keep moving.

This is how founders balance short-term urgency with long-term strategy without losing their footing.

The Final Word:

Balancing short-term and long-term goals isn’t a conflict.

It’s a discipline.

Founders who master this discipline build trust, avoid burnout, make smarter decisions, and maintain alignment with their investors through every turbulent stage.

It’s not about choosing between today and tomorrow —

it’s about building a company that performs today because it’s designed for tomorrow.

-Chris Tottman

Investors do not buy busy founders.

Investors buy transferable value and the ability to react when plans need reassessment.

The founders who really break away treat short-term wins as the required proof points for the longer, more complex vision.

That's the real skill here.