Stop Sending Boring Investor Updates — Do This Instead

The art of crafting investor updates that investors actually read and act on.

If you’ve ever written an investor update and thought, “Does anyone actually read this?” - you’re not alone.

Most founders treat updates like a compliance exercise. Numbers dumped into a Google Doc. Some vague commentary. A perfunctory “let us know if you can help.” Then off it goes into the ether.

But when you nail investor reporting, the tone changes. Updates stop feeling like admin and start becoming leverage. Investors forward your notes to other operators. They reply with intros you need. They begin to see you as a founder in control of the journey, not just a passenger reporting turbulence.

The difference is not the numbers themselves; it’s how you tell the story around them.

Table of Contents

Why Investor Updates Matter More Than You Think

The Anatomy of an Update That Works

The Opening Line

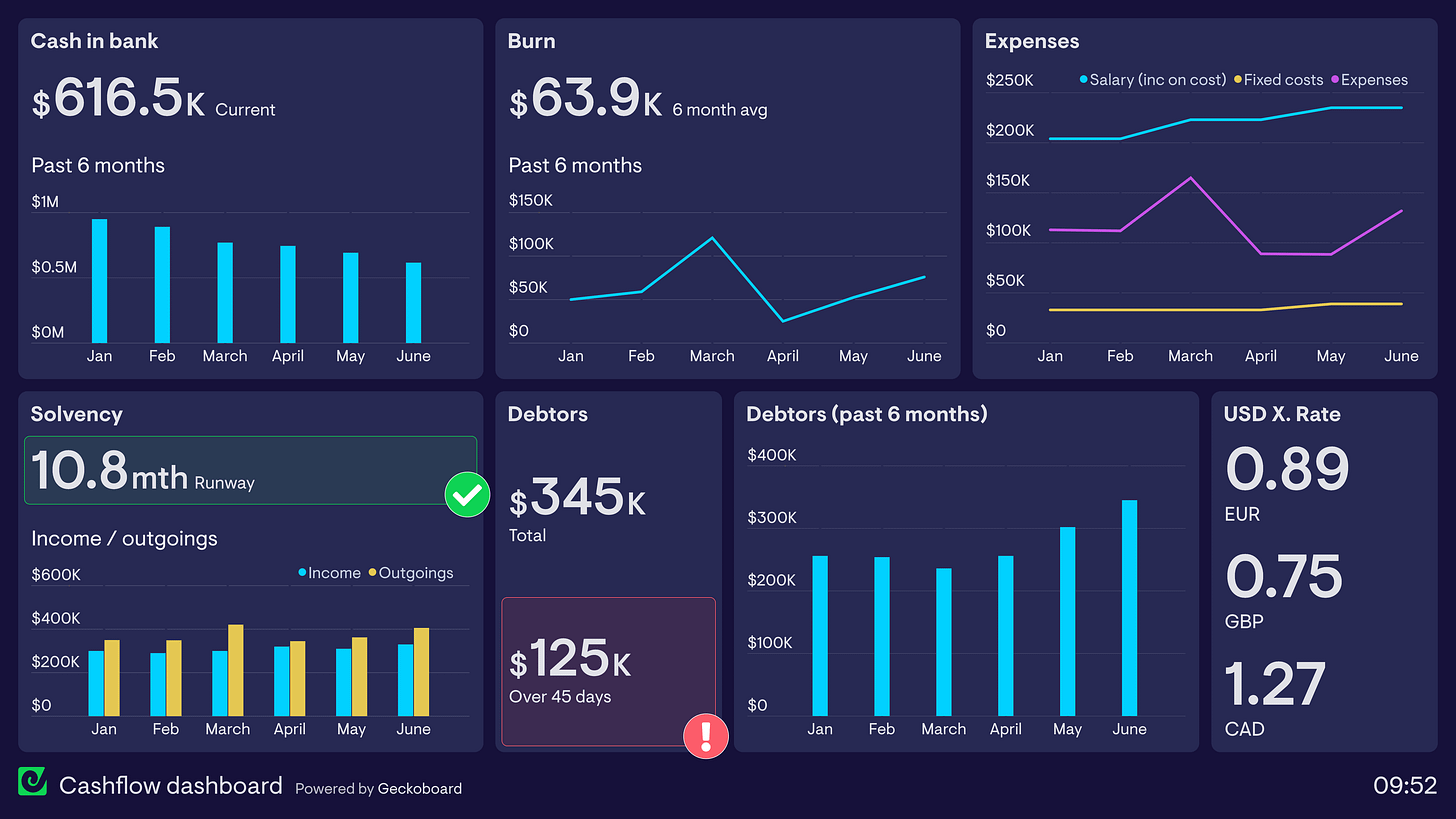

The Metrics

The Narrative

The Asks

The Outlook

🧠 Founder Wisdom: A BrainDump on Investor Updates

What to Leave Out

Why This Matters

Founder OS: The Two-Question Test

🚀 Closing Thought: Turning Reports into Allies

Why Investor Updates Matter More Than You Think

An investor update is not about compliance. It’s about trust and alignment.

Think about it from their perspective: your investors might have stakes in ten, twenty, or even fifty companies. They don’t wake up thinking about you; they wake up thinking about their fund.

Your update is your chance to put your company back on their radar, to remind them why they invested, and to give them a way to be useful. Done right, it transforms capital providers into active allies.

And selfishly, it sharpens your own thinking. The act of distilling a messy month into a clear story forces discipline: What truly mattered? What’s noise? Where are we heading?

At this point, most founders ask the same question: what does a good update actually look like in practice?

The structure, cadence, and framing I use is the same operating system I’ve seen work across boards, angel syndicates, and institutional funds. It’s not a template, it’s a way of thinking about updates as leverage, not reporting.

I’ve shared the full Investor Update OS with the community for founders who want to implement this without reinventing it.

Keep reading with a 7-day free trial

Subscribe to The Founders Corner® to keep reading this post and get 7 days of free access to the full post archives.