The Laws of Business: What Founders Need to Know in the US vs. Europe

Small Business OS: Thinking of starting your company in another country? Or expanding operations beyond borders? Discover the key distinctions between various U.S. and European legal regulations.

Startups move fast, but the law typically doesn’t. Whether you're launching in your home country or expanding across borders, understanding how local rules work can make or break your growth. A structure that works in Delaware might raise red flags in Berlin. A privacy policy built for California could fall short in France.

This guide breaks down the most important legal differences between the U.S. and Europe: from how companies are formed to how they hire, pay taxes, and handle user data.

If you're building a company that plans to scale across continents, these are the rules you can’t afford to ignore.

Table of Contents

Choosing a Business Structure

The Business Registration Process

Taxes and VAT

Employment and Labor Laws

Data and Privacy Compliance Laws

Helpful Resources and Next Steps for Founders

Knowing the Rules Beyond Borders

1. Choosing a Business Structure

Before you raise a dollar or sign a contract, you’ll need to pick a legal structure. It sets the stage for everything: taxes, liability, and how investors see you.

United States

In the U.S., most founders choose between an LLC and a C-Corp. LLCs are simple, flexible, and taxed like personal income. Great if you're bootstrapping or staying small. But if you’re aiming for VC money, skip straight to a Delaware C-Corp. It’s built for equity, stock options, and outside capital.

Sole proprietorships are fast and cheap, but you’re personally on the hook for everything. Not ideal if you're planning to scale.

Europe

Europe doesn’t have one-size-fits-all structures. Each country has its own setup, but most startups go with a private limited company, like a GmbH in Germany, SAS in France, or Ltd in the UK.

Some, like France’s SAS, are super startup-friendly with flexible rules, no capital-heavy requirements, and easy to issue different share types. Others (like a GmbH) can be a bit more rigid and paperwork-heavy.

Quick Comparison

Founder takeaway

If you're raising money, go with the structure investors expect. U.S.? C-Corp. Europe? Something flexible like SAS or Ltd. What works on paper won’t always work with your next round. Set it up right from the start.

2. The Business Registration Process

Once you’ve picked your structure, it’s time to make it official. That means registering the business, getting a tax ID, and ticking off whatever the government entity wants from you before you can operate.

United States

In the U.S., you register at the state level, not federal. You file formation documents with your state, usually online, and then get your EIN (Employer Identification Number) from the IRS. That EIN is your business’s federal tax ID.

Depending on what you’re doing and where, you might also need local permits or licenses, like a sales tax permit or a zoning certificate. But the whole process is fast. In places like Delaware, you can be up and running in 24 to 48 hours.

Europe

In Europe, registration runs through national systems, and things are a little more formal. You’ll submit your founding documents to a trade register, get your tax ID, and usually set up VAT registration early on.

Some countries, like Germany or France, require notarized paperwork and a proof-of-capital deposit before you're approved. Others, like the UK or Estonia, let you incorporate online in a day or two. It depends on the country.

Quick Comparison

Founder takeaway

In the U.S., registering a startup is fast and pretty painless. In Europe, it's doable; just expect more paperwork. The earlier you know the local process, the fewer surprises later.

3. Taxes and VAT

Startup taxes can be confusing fast. What you owe, and when, depends a lot on where you're based. The U.S. and Europe take very different approaches, especially when it comes to how you’re taxed on profits and what you charge customers.

United States

In the U.S., you deal with two layers: federal and state. A C-Corp pays 21% at the federal level, and then adds on state tax depending on where you're incorporated or doing business. Some states, like Wyoming or Nevada, don’t charge extra. Others, like California or New York, do.

If you’re an LLC, profits usually pass through to your personal tax return. But you still have to choose your tax classification carefully, especially if you plan to convert later or raise capital.

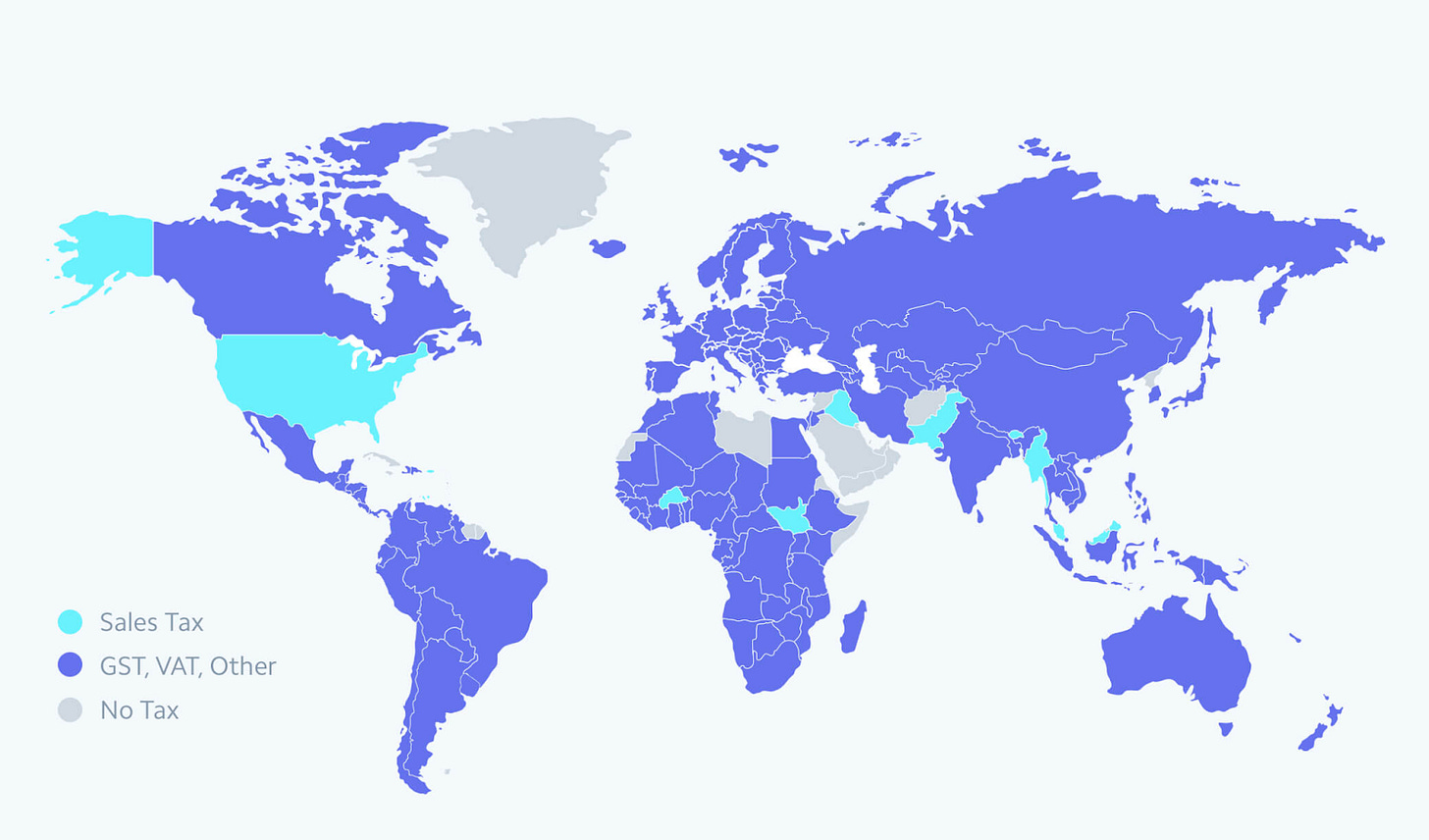

The U.S. doesn’t use VAT, or value-added tax. Instead, most states have a sales tax, which only applies at the final sale to the consumer. If you’re selling across states or online, you might need to register in multiple places depending on where your customers are.

(image courtesy of Stripe)

Europe

Europe runs on VAT (Value-Added Tax), a multi-stage tax built into pricing. You charge VAT on most sales, reclaim it on business expenses, and file regular returns.

Each country sets its own rate, but most fall between 19% and 25%. Once your revenue crosses a local threshold or you sell cross-border, VAT registration becomes mandatory.

On top of that, you’ll pay corporate income tax, which also varies by country. Ireland is known for its low 12.5% rate. France and Germany are closer to 25–30%. Where you incorporate really matters.

Quick Comparison

Founder takeaway

U.S. taxes are layered, but VAT-free. In Europe, VAT is everywhere and baked into how you operate. If you're planning to sell in both regions, build VAT handling into your ops early because it’s not something you want to add on later.

4. Employment and Labor Laws

Hiring looks very different depending on where you are. In the U.S., it’s all about flexibility. In Europe, its structure, protections, and paperwork.

United States

The U.S. follows an at-will employment model. You can let someone go at any time, for almost any reason. Employees can also leave without notice. It gives startups room to move fast, especially when the team is small and the roadmap keeps shifting.

There are no federal rules requiring paid vacation or parental leave. Benefits like health insurance or PTO are company decisions, not legal mandates (unless you’re a larger employer under specific federal laws).

It’s lean, but it also means you have to work harder to attract and retain talent with perks, culture, and clarity.

Europe

Europe leans the other way. Most countries require notice periods, formal termination processes, and even severance in some cases. You can’t just fire someone without a reason and documentation.

Paid time off is baked in. You’re looking at a legal minimum of 20+ vacation days, plus holidays. Parental leave is long, paid, and expected. On top of that, employers contribute heavily to national health and social systems through payroll taxes.

You’ll spend more to hire someone in Europe, but employees also tend to stay longer and value stability.

Quick Comparison

Founder takeaway

If you’re hiring across borders, expect different playbooks. The U.S. gives you speed and control. Europe gives employees more protection, and you more paperwork. Plan ahead, especially if you’re scaling fast or managing a distributed team.

5. Data and Privacy Compliance Laws

If your startup collects user data, you’re on the hook for privacy compliance. And while the U.S. and Europe both care about protecting people’s information, they go about it in completely different ways.

United States

There’s no single national privacy law. Instead, it’s a patchwork.

California’s CCPA gives residents the right to access, delete, and opt out of the sale of their data. If you’ve got users in California, it applies, even if you’re not based there. Other states are now following with similar rules.

In certain sectors, things get stricter. HIPAA covers health data. COPPA protects data from users under 13. But unless you fall into those categories, your compliance depends on where your users live and what kind of data you’re collecting.

It’s fragmented, but manageable, especially if you build in privacy best practices from the start.

Europe

Europe runs on GDPR. It applies to any business handling personal data from EU residents, no matter where that business is based.

The rules are strict: you need a legal reason to collect data, clear consent for cookies, and easy ways for users to access or delete their info. If you transfer data outside the EU (like to U.S. servers), extra steps kick in.

Violations can get expensive - think multi-million euro fines - and regulators enforce them.

Quick Comparison

Founder takeaway

If you’ve got users in Europe, you’re under GDPR, no matter where you’re based. In the U.S., rules depend on what you do and where your users are. Either way, consider privacy early on in your journey. It’s way cheaper than fixing it later.

6. Helpful Resources and Next Steps for Founders

Here’s your shortcut to getting started. Whether you’re setting up in the U.S. or Europe, these tools will help you handle the basics, from forming your company to staying compliant as you grow.

United States

IRS EIN Application: Get your federal tax ID here. It’s free, and you’ll need it for banking, payroll, and taxes.

SBA.gov: Great primer on business structures, registration steps, and state-level rules.

State business portals: Each state has its own site. If you're incorporating in Delaware, California, or New York, check their official registration pages for forms and filing timelines.

Europe

StartUp Europe Club: EU-wide hub for startup support, funding programs, and expansion guidance across member countries.

gov.uk: UK’s official portal for incorporating a Ltd company, registering for tax, and staying compliant.

guichet.lu: Luxembourg’s business portal, a model of clarity and support for small businesses.

service-public.fr: France’s main portal for business creation, tax registration, and legal info for founders.

Founder takeaway

Don’t wait until you hit a wall. Bookmark what applies to you, scan the rest, and keep these close as you build across borders. A little time spent here saves a lot of time (and trouble) later.

7. Knowing the Rules Beyond Borders

The fastest-growing startups aren’t just great at building products. They’re great at navigating the rules that come with where and how they operate.

Whether you’re forming your first company or expanding across markets, legal systems will shape your path, sometimes quietly, sometimes loudly. Getting the basics right early on saves money, reduces risk, and makes it easier to fund.

Take time to review your setup. Ask whether it still fits your goals, your geography, and your growth plans. Laws will keep evolving. So should your playbook.

Good details there. In fact, my own recent long expansion covers he NA <> EU dynamics for founders to keep in mind on these lines. Which I expand in more details here - https://ankurashokg.substack.com/p/the-global-expansion-imperative

1. Market Fragmentation Reality

2. Regulatory Landscape & Data Governance

3. Team Structure, Regional Expertise & Talent Management

4. Value Proposition Translation

5. Deep Localization Requirements

6. Extended Decision-Making Cycles

7. Multi-Dimensional Pricing Strategy

8. Partner Ecosystem Dependencies

9. Regionalized Marketing Channel Mix

10. Distinctive Customer Advocacy Dynamics

11. And no UK is not EU ;)