The Best Week to Close a VC Round💸, Why Retention Exposes Startups🔁, 10 Must-Have Startup Resources 📝

If you're building, investing, or just trying to stay ahead of the curve, you're in the right place. Every week, we break down the latest insights, funding news, and founder-friendly gems. Just what matters. Plus, we track the freshest VC funds deploying capital so you know where the money’s moving.

Let’s get into it 👇

Before we dive in, something we’re excited to share 🎁

We’ve partnered with Notion and VC Corner to put together a full stack of founder templates.

It’s everything you need to get started, organized by stage in your journey from idea to launch to scale:

Think pitch decks, data rooms, investor CRMs, PR launch trackers, hiring plans, and more. All customizable, and built to help you move faster.

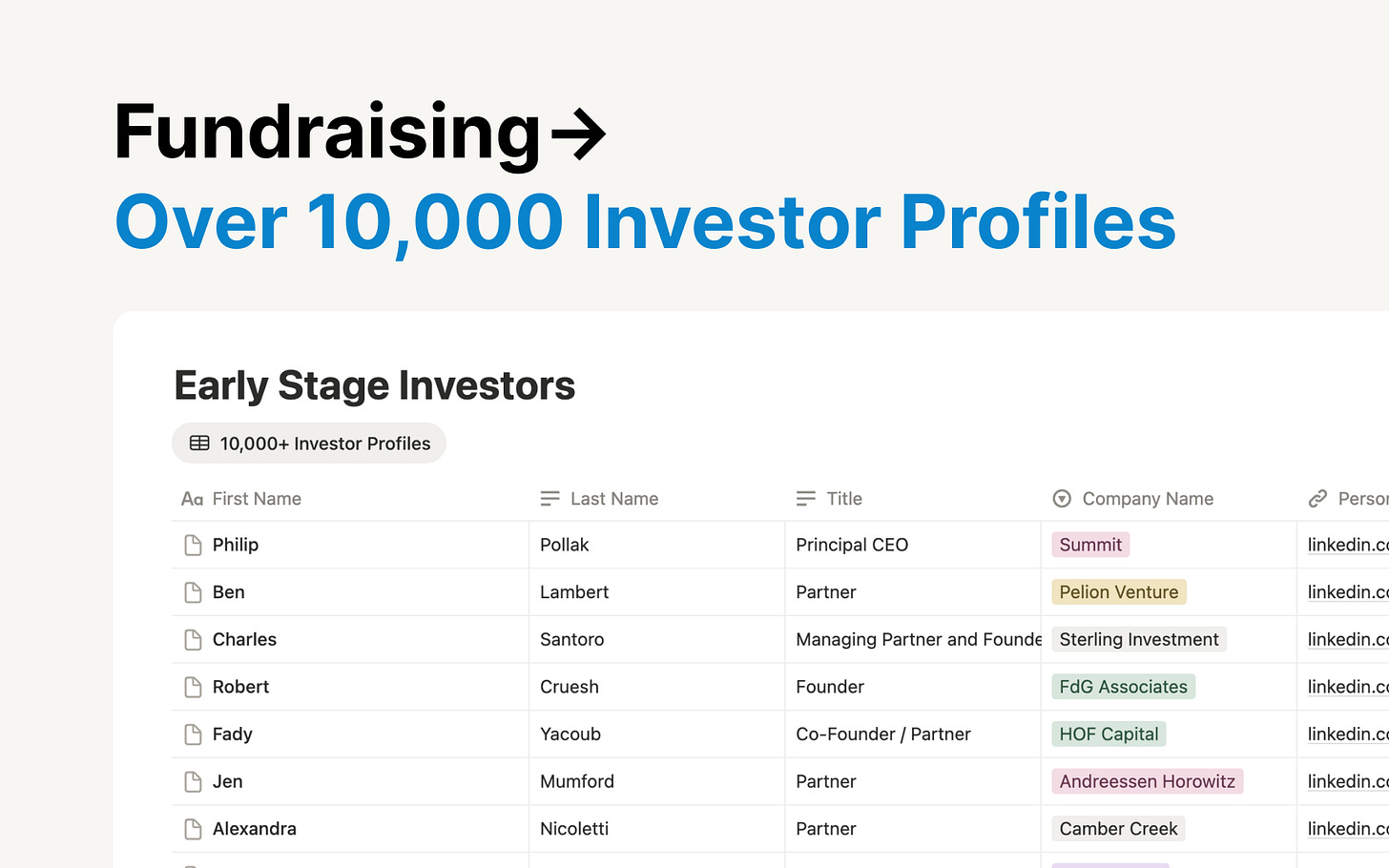

You’ll also get access to a fundraising database with over 10,000 investor profiles. Searchable, sortable, and shareable. The same tool we’ve used to help founders raise their first (or fourth) round.

And yes, it’s all FREE. No paywalls. Use it, share it, and make someone’s day.

👇 How to use these templates for your workspace

In-Depth Insights 🔍

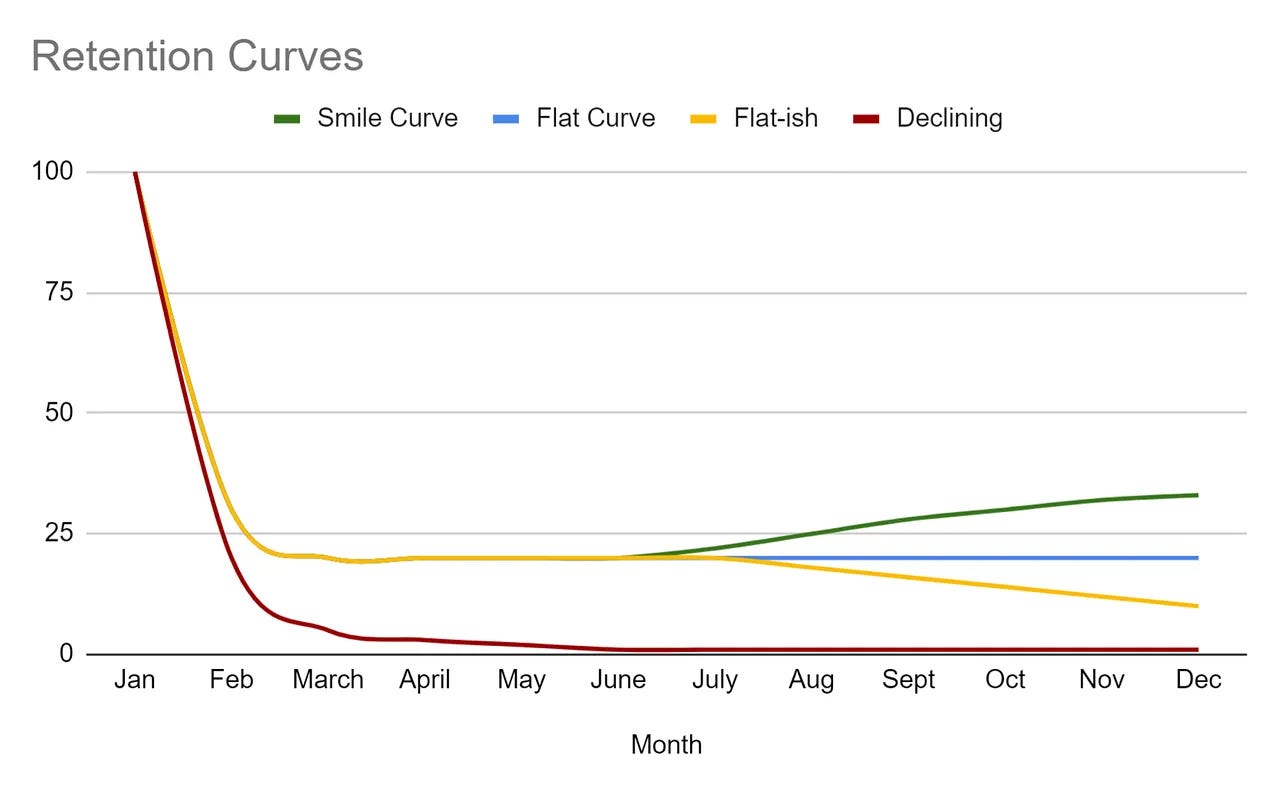

Retention Is Where Startups Get Exposed 🔁

Growth can spike fast, but retention is the metric that proves real product value across users and revenue. This guide breaks down benchmarks, curves, cohorts, and tactics founders use to turn retention into compounding growth.

10 Startup Resources Every Founder Needs 📝

From pitch decks that raised billions to templates for cap tables, financial modeling, and investor outreach, these tools save you time and headaches. If you’re building a startup, using these resources is the fastest way to get ahead without reinventing the wheel.

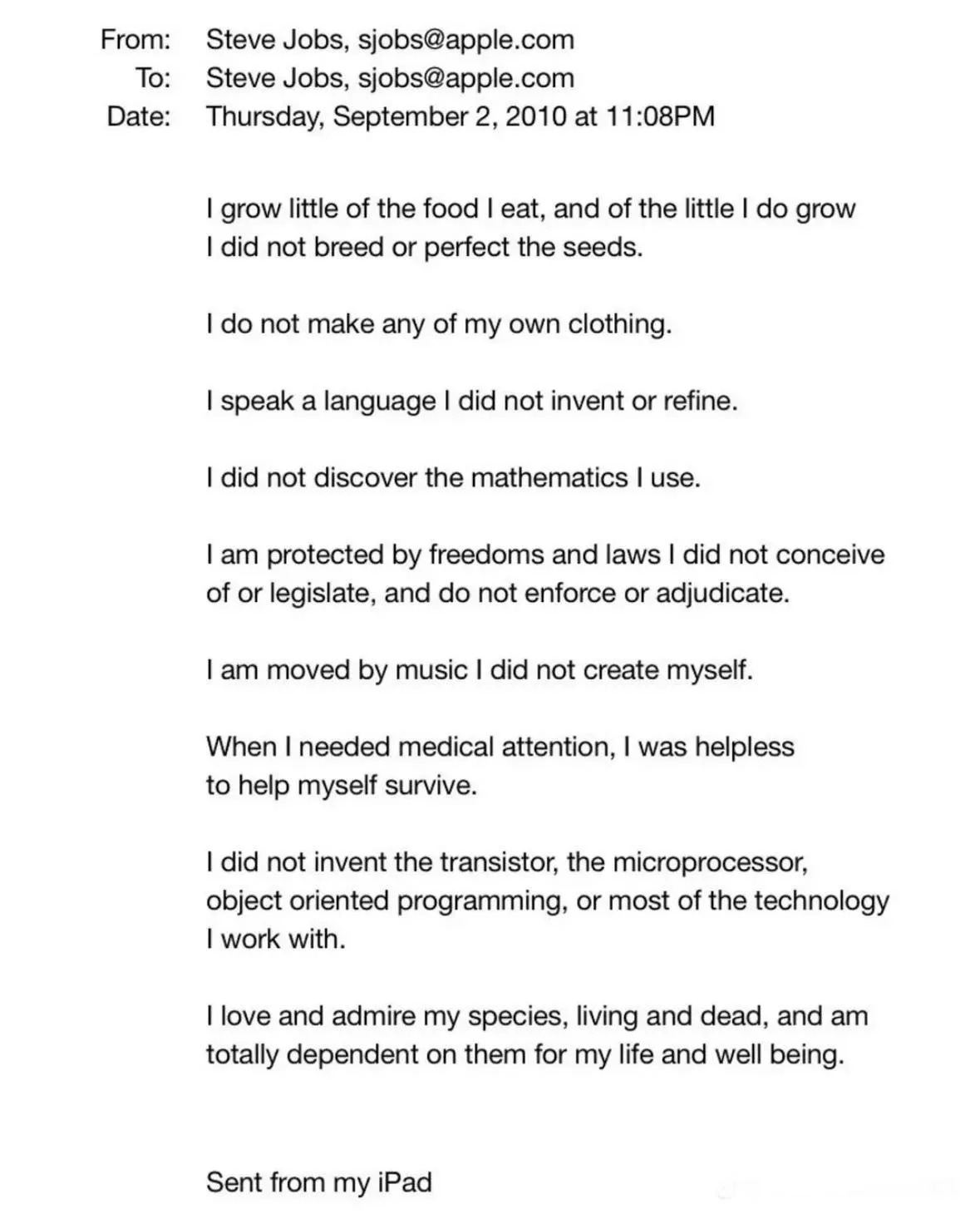

12 Emails That Shaped Tech Culture Forever 🔥

From Musk’s blunt “Return to Office or Resign” to Jobs’ terse “Stop doing this,” one sentence can set tone, enforce values, and define who stays or goes. Founders who master high-stakes emails shape culture long after the message is sent and remembered.The Six Red Flags That Kill Deals Before Investors Say Yes 🚨

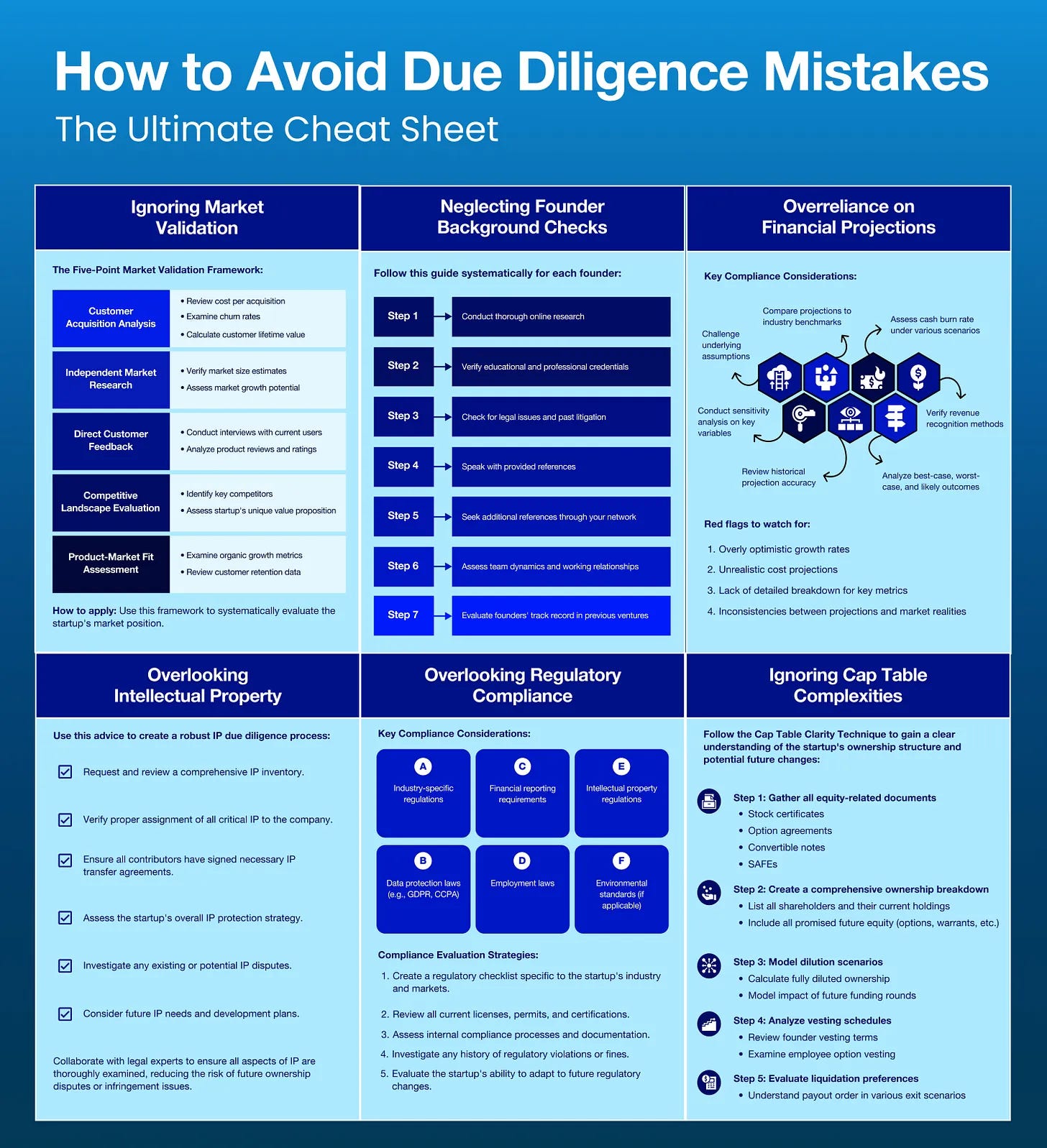

Founders lose rounds in due diligence, not the pitch room. Market validation, background checks, financial logic, IP, regulatory compliance, and cap table clarity decide whether investors pull the trigger. Preparation, documentation, and clean governance turn due diligence into a competitive advantage. [Chris Tottman]

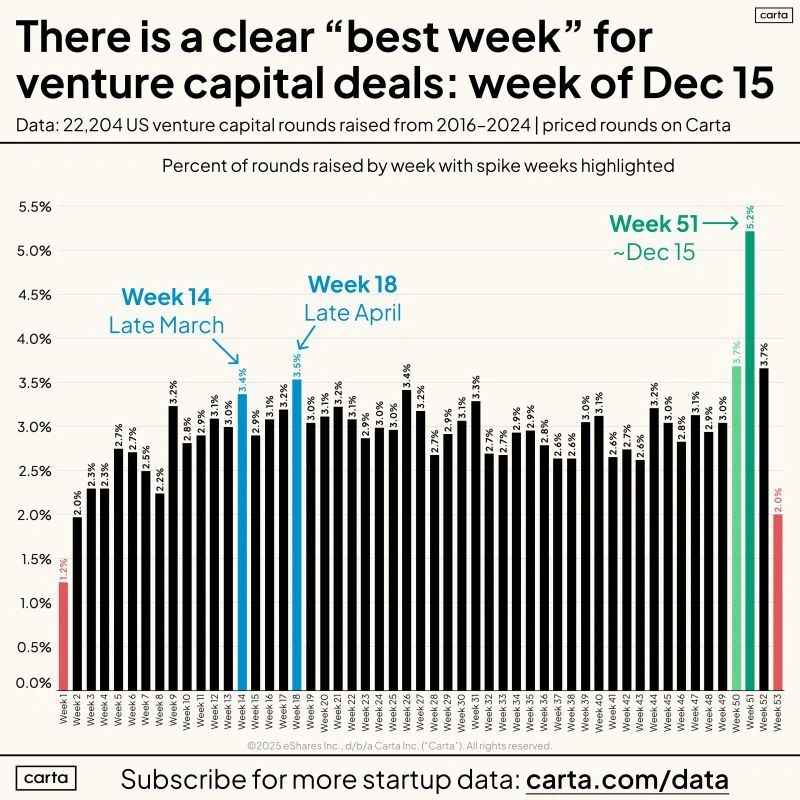

The Best Week to Close Your VC Round 💸

Data from 22,000+ US venture rounds shows December 15 week consistently sees the highest closures each year. If your round is already in motion, this is the moment to lock it down before year-end pressure fades.

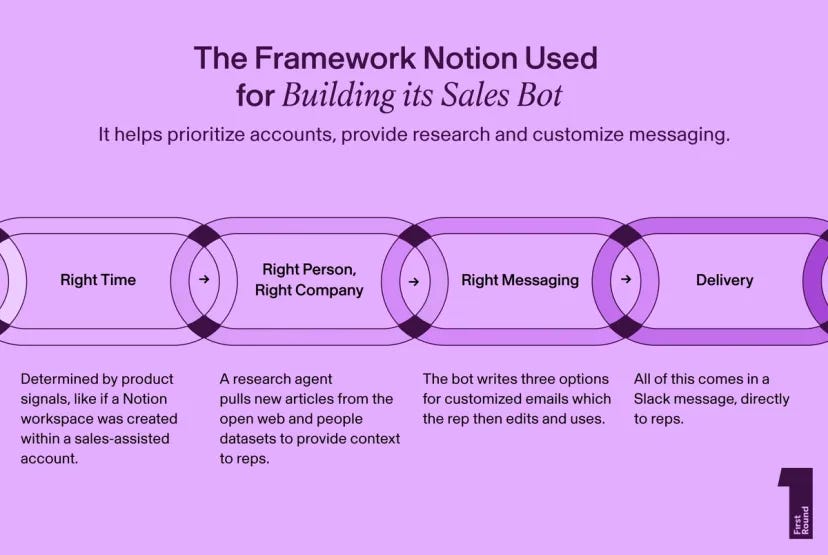

Notion Put an AI Engineer on the Sales Floor 📞

Theo Bleier spent a month with sales to uncover real problems and build tools reps actually use. From fixing copy-paste friction to automating account prioritization, his solutions sped up deals and improved outreach. [FirstRound]

LCMs Are the Next Step in AI Thinking 💡

Large Concept Models focus on ideas instead of words, improving reasoning, coherence, and cross-lingual understanding. This shift unlocks more stable, abstract, and meaningful outputs across text, language, and multimodal tasks.

Trending News ⚡

Why Trust Is the Real Battle for AI Encyclopedias ⚖️

Wikipedia cofounder Jimmy Wales says skepticism around Elon Musk’s Grokipedia was inevitable, especially when neutrality is in question. He argues that AI-written entries and strong founder influence make trust harder to earn in something meant to be a shared source of truth. [Business Insider]ChatGPT Opens Its App Store to Developers 📱

OpenAI is officially inviting developers to submit apps for ChatGPT, marking the start of a broader in chat app ecosystem. With integrations from names like Expedia, Spotify, and Canva, ChatGPT is positioning itself as a place where real work gets done. [TechCrunch]Google Takes Aim at Nvidia’s Software Moat 🚀

Google is upgrading its TPU chips to run PyTorch seamlessly, lowering friction for AI developers entrenched in Nvidia’s CUDA ecosystem. With support from Meta, the TorchTPU push signals a serious effort to give cloud customers more real choice in AI infrastructure. [Reuters]China’s Secret AI Chip Moonshot Comes Into Focus 🔬

China has quietly built a massive EUV lithography prototype in Shenzhen, aiming to crack the hardest problem in advanced chipmaking. The project pulls together ex ASML talent, state funding, and Huawei scale, with insiders pointing to 2030 as the real finish line. [Reuters]Lightspeed Secures a Record $9B War Chest 💰

Limited partners are consolidating capital around firms with long-term performance, and Lightspeed is a prime beneficiary of that shift. With deep AI exposure and recent IPO wins, the firm is positioned to lead large, capital-intensive bets in the next venture cycle. [TechCrunch]Amazon Eyes a $10B Bet on OpenAI 🤖

Amazon is in talks to invest roughly $10 billion in OpenAI, a move that could value the AI leader at more than $500 billion. The discussions signal OpenAI’s growing flexibility to partner across Big Tech as it scales compute, capital, and ambition. [Reuters]Nvidia Steps Into the Open Model Arena 🔓

Nvidia released Nemotron 3, a new family of powerful open source AI models alongside training data and tooling for developers. The move strengthens open AI infrastructure while positioning Nvidia closer to the model layer as competition around chips accelerates. [Wired]

Apple’s $400 Billion “What If” 😳

In 1976, Ronald Wayne sold his 10% stake in Apple for $800, just 12 days after founding. He avoided risk and stayed safe, while Apple grew into a $4 trillion company decades later.

Fundraising?

If you’re raising a round, Luis Llorens and The Founders Corner can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

Social Media Gems 💎

Startup in a Box: The Free Founder Operating System 🚀

A FREE Notion workspace with 58 founder-ready templates covering idea, fundraising, launch, and scale, built for fast-moving AI-native teams. Includes 10,000+ real investor profiles and up to 6 months of Notion Business with AI to help founders move faster with less operational friction.

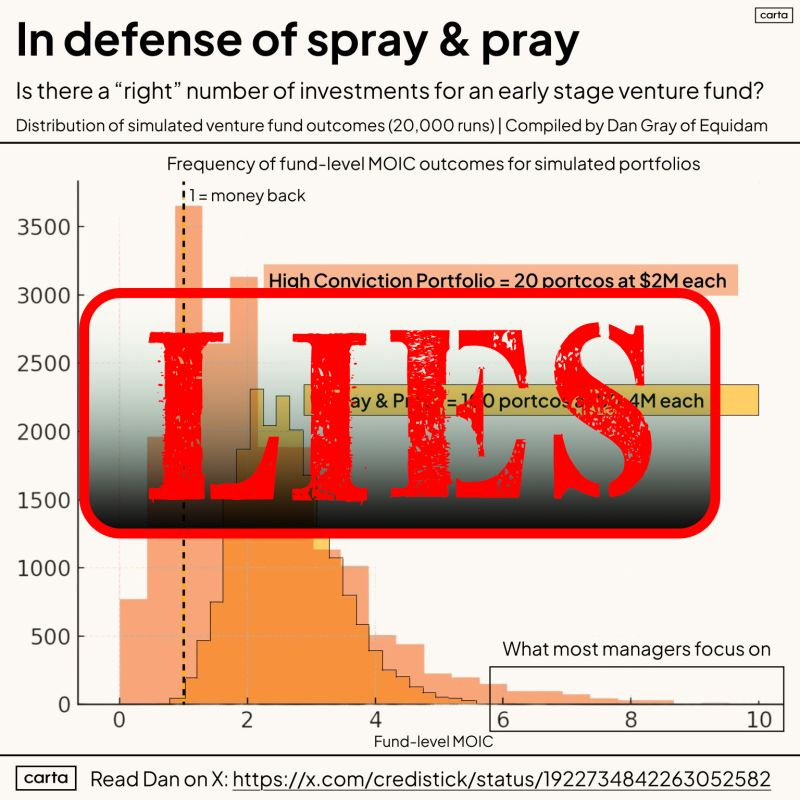

Why Spray and Pray VC Math Doesn’t Hold Up 🎯

Models that assume identical exit quality, ownership, and diligence across 100 bets ignore how venture actually works. When you account for time, valuation discipline, and follow on decisions, concentrated portfolios remain mathematically stronger. [Andrew Chan]

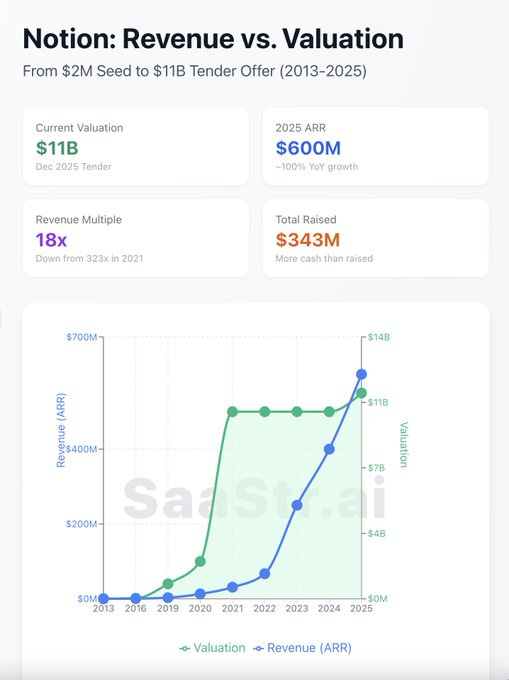

How Notion Grew Into an $11B Valuation 📈

From a $2M seed to $600M ARR, Notion let revenue compound until the multiple made sense, without chasing new rounds. AI monetization, disciplined growth, and patience turned a peak era valuation into a durable public scale outcome. [Jason Lemkin]

Inside the AI Capital Flywheel 🔁

Big Tech capital flows into labs and infrastructure, cycles through chips and data centers, then returns via model licensing. Chipmakers get paid first while labs and hyperscalers carry the risk that demand and pricing eventually justify the spend.

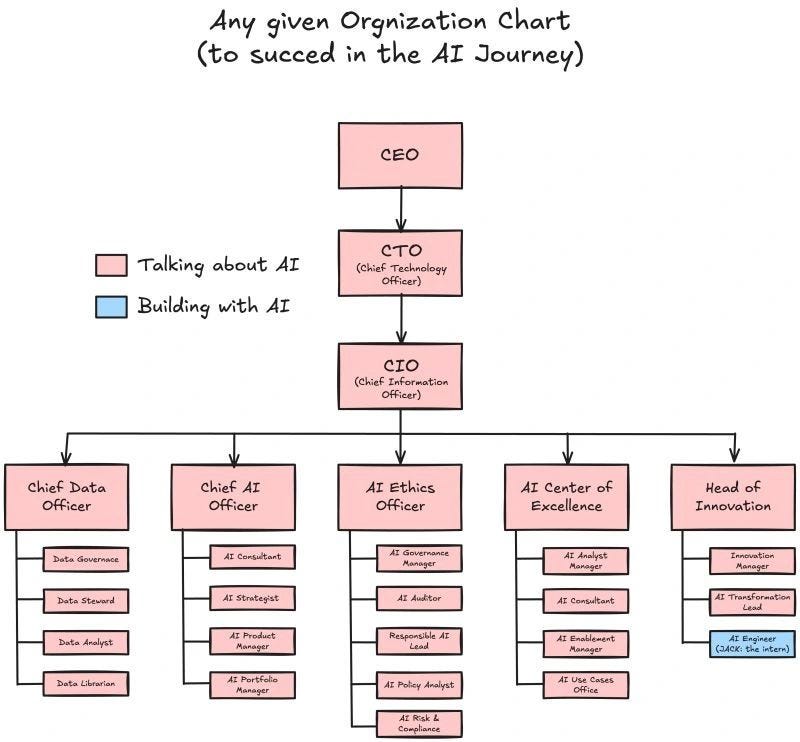

Why Most AI Teams Talk More Than They Ship 🤖

Companies stack titles, committees, and frameworks while actual product progress stalls. The teams that win let builders move fast, keep ownership clear, and turn AI from strategy slides into shipped work.When Rage Becomes the Business Model 😡

Modern platforms optimize for outrage because fear and anger drive engagement and profits. When algorithms shape attention at scale, founders and investors are making choices that influence behavior and society. [Chris Tottman]

New Funds 💰

Lightspeed Venture Partners closed over $9B in new capital, doubling down on backing the next wave of category-defining companies.

S3 Ventures launched a $250M Fund VIII to keep backing early-stage companies across tech, healthcare, and consumer.

Viola Ventures raised $250M across two funds to support early-stage software and tech startups from Israel and beyond.

MBX Capital raised $100M to invest in biotech startups turning deep science into real products.

FemHealth Ventures closed Fund II at $65M to invest in women’s health startups fixing long-overlooked problems.

Cloudberry Capital first €30M close of its debut fund, backing European startups that start niche and scale globally.

That’s a wrap for this week.

If you want to stay ahead of the curve, make sure you're subscribed. No fluff, just real startup insights delivered straight to your inbox.

See you next time 🚀

It's the kind of thing that makes people move faster from idea to execution. The Notion/investor database combo is a massive accelerator

Cutting through the noise and giving builders practical tools is what actually helps people move forward.