🧨 The Hidden Red Flags Investors Catch That Founders Never See Coming

The hard truths every founder must confront before stepping into due diligence.

👋 Hey, Chris here! Welcome to BrainDumps—a weekly series from The Founders Corner. If you’ve been reading along, you know this series is a preview of a bigger project. Well, it’s finally here: The Big Book of BrainDumps is out now!

It isn’t a theory book—it’s the founder’s field manual. Inside, you’ll find 70 powerful frameworks distilled from 30+ years scaling software companies to hundreds of millions in ARR, 20+ years investing in 500+ B2B tech startups, and over $1B of shareholder value created. From raising capital to hiring your first VP of Sales, this book turns scars and successes into practical playbooks you’ll return to again and again. I expect most copies will become well-worn, scribbled on, and dog-eared—because it works.

Founders think fundraising is won in the pitch room.

Investors know fundraising is won — or lost — in due diligence.

This is the moment where every claim, every number, every milestone, and every assumption gets pulled apart. Your deck gets put on ice, your enthusiasm gets filtered through spreadsheets, and your business is examined under a forensic lens.

And here’s the truth almost no founder realises until it’s too late:

Most rounds don’t fall apart because investors lose interest.

They fall apart because founders weren’t prepared for due diligence.

This BrainDump spells out the six most common mistakes that derail deals — and exactly how to avoid them. Let’s break down each one.

Table of Contents

Ignoring Market Validation

Neglecting Founder Background Checks

Overreliance on Financial Projections

Overlooking Intellectual Property

Overlooking Regulatory Compliance

Ignoring Cap Table Complexities

The Founder’s Survival Playbook

Final Thought

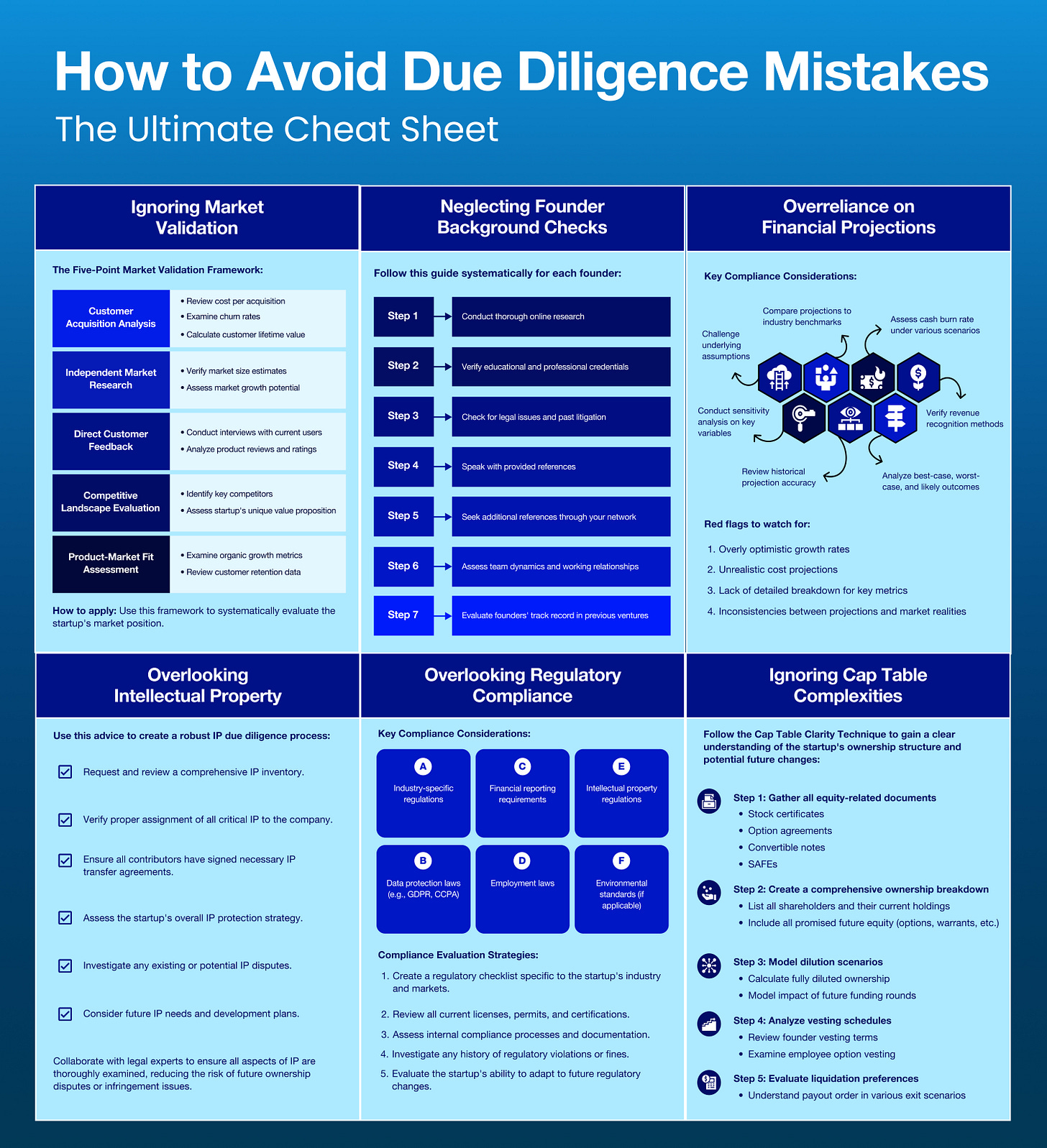

1. Ignoring Market Validation

The fastest way to shatter investor confidence is to show up with a product that isn’t validated by customers.

Investors want to know:

Have you tested demand?

Do customers actually want this?

Is the problem real, painful, and urgent?

Do you have proof, not assumptions?

What founders get wrong:

They confuse interest with intent.

They mistake conversations for commitments.

They rely on anecdotal enthusiasm instead of real data.

What investors expect:

✔ Evidence of active customer problems

✔ Real user feedback

✔ Signals of willingness to pay

✔ Pilot outcomes or prototypes in the hands of real users

✔ Early revenue or contracted commitments

Market validation isn’t about having a perfect product — it’s about proving you’re not guessing.

2. Neglecting Founder Background Checks

Founders assume this part is quick and simple.

Investors know it’s one of the biggest risk filters in the entire process.

The cheat sheet breaks it into a clear due diligence stack:

Investors look for:

Step 1: Coherence — does your story check out?

Step 2: Capability — does your background align with the execution plan?

Step 3: Character — do references back you?

Step 4: Credibility — have you behaved with integrity?

Step 5: Chemistry — are you someone they want to work with?

Step 6: Consistency — do your actions match your claims?

A founder’s personal reputation is weighted heavily because investors are backing you long before they’re backing revenue.

The biggest red flags:

❌ CV inconsistencies

❌ Overstated achievements

❌ Unexplained gaps

❌ Poor references

❌ Personality friction

Background checks don’t kill good founders — they expose careless ones.

3. Overreliance on Financial Projections

Every founder wants to show the hockey stick.

Every investor has seen thousands of them break.

Projections aren’t a prediction — they’re a test of your reasoning. Investors don’t care about the numbers themselves; they care about the logic behind them.

What investors look for:

✔ Assumptions that are grounded in evidence

✔ Transparent unit economics

✔ Sensitivity to real-world variables

✔ Measured, credible revenue paths

✔ Costs that scale realistically

✔ CAC and LTV supported by actual behaviour

If your entire financial model depends on perfection, you don’t have a financial model — you have a fantasy.

What founders get wrong:

Overestimating growth

Underestimating churn

Minimising cost of sales

Ignoring operational drag

Proposing margins that defy physics

Your projections should show ambition — not delusion.

4. Overlooking Intellectual Property

This is one of the most overlooked deal-breakers.

Investors want to know whether:

You actually own what you’ve built

Contractors have assigned rights

There are no lurking patent disputes

Core technology is protected

You’re not infringing on anyone else’s IP

Founders lose deals because:

❌ A previous employer claims ownership

❌ A contractor never signed assignment agreements

❌ A competitor filed earlier

❌ Trademarks weren’t secured

IP doesn’t matter — until suddenly it matters more than anything else.

5. Overlooking Regulatory Compliance

In regulated markets, investors need proof that you’re not building on legal quicksand.

Key areas they check:

✔ Data protection & privacy

✔ Industry-specific regulation (FinTech, MedTech, EdTech)

✔ Security standards

✔ Geographic compliance

✔ Licensing requirements

A brilliant product can be worthless if it’s illegal to sell, scale, or operate.

Regulatory slip-ups don’t just hurt valuation — they kill deals outright.

6. Ignoring Cap Table Complexities

Few things scare investors more than a messy cap table.

If your equity structure is unclear, misallocated, or overloaded with early parties who shouldn’t be there, investors hesitate — because complexity equals risk.

Common cap table killers:

❌ Too many small early investors

❌ Unclear founder vesting

❌ Overly diluted founders

❌ Excessive advisory shares

❌ Unallocated ESOP

❌ Legal disputes over ownership

Investors don’t just fund companies — they fund clean structures. A messy cap table signals poor judgment and makes future rounds harder.

The Founder’s Survival Playbook

Before you enter due diligence, ask yourself:

Market:

Do I have real proof that customers want this?

Founder:

Would I pass my own background check?

Financials:

Are my projections ambitious but believable?

IP:

Do we own everything we claim to own?

Regulation:

Are we compliant in every market we operate?

Cap Table:

Is it clean, simple, and defensible?

If any of these answers make you wince, fix them before an investor finds them — because they will find them.

Final Thought

Due diligence isn’t a box-ticking exercise.

It’s a reflection of how seriously you treat your business.

The founders who breeze through it aren’t the ones with perfect companies — they’re the ones who prepare relentlessly, document rigorously, and treat governance like an advantage, not an afterthought.

Master due diligence and you remove one of the biggest silent killers in fundraising. Ignore it, and the deal collapses long before the term sheet is signed.

-Chris Tottman

Preparation is the quiet advantage most founders skip.

Great list. Bypassing market validation is, IMHO, by far the biggest mistake. Building products and services for a problem that doesn't exist is a killer.