Stop Pitching the Wrong Investors⚡️; Why Series A Takes Longer🌱; It’s Easy to Criticize, Hard to Create 🎨

If you're building, investing, or just trying to stay ahead of the curve, you're in the right place. Every week, we break down the latest insights, funding news, and founder-friendly gems. Just what matters. Plus, we track the freshest VC funds deploying capital so you know where the money’s moving.

Let’s get into it 👇

In-Depth Insights 🔍

How Growth Hacking Evolved into Product-Led Growth 📈

The scrappy tactics of early viral loops matured into disciplined systems powered by data, experimentation, and embedded distribution. Today’s growth engines prioritize loops, North Star metrics, and product-led activation over channel arbitrage and gimmicks.Stop Pitching the Wrong Investors: Try Family Offices ⚡️

Many founders spin their wheels courting slow committees instead of decision-makers who can move on conviction. Family offices often decide faster and think longer-term, making them a fit for focused outreach during a raise.The Fundraising Shortcut Nobody Talks About 🧭

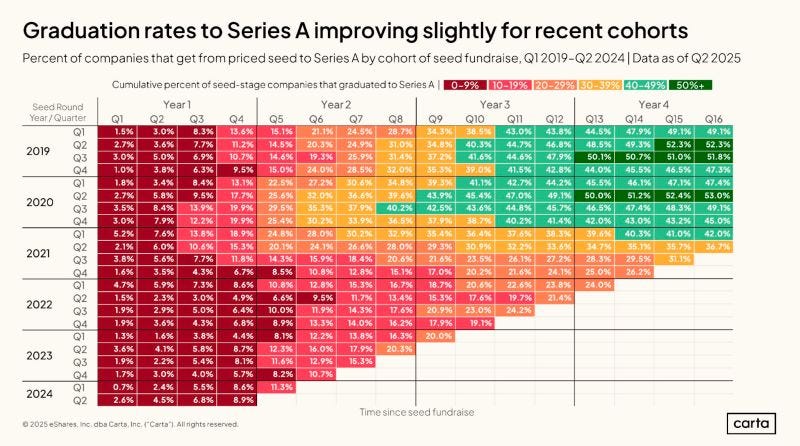

Rounds accelerate when a company shows compounding signals inside a focused segment, making the future feel present. Narrative clarity ties evidence to trajectory, so investors feel inevitability rather than being asked to imagine outcomes. [Chris Tottman]Seed Is Just the Start: Why Series A Takes Longer 🌱

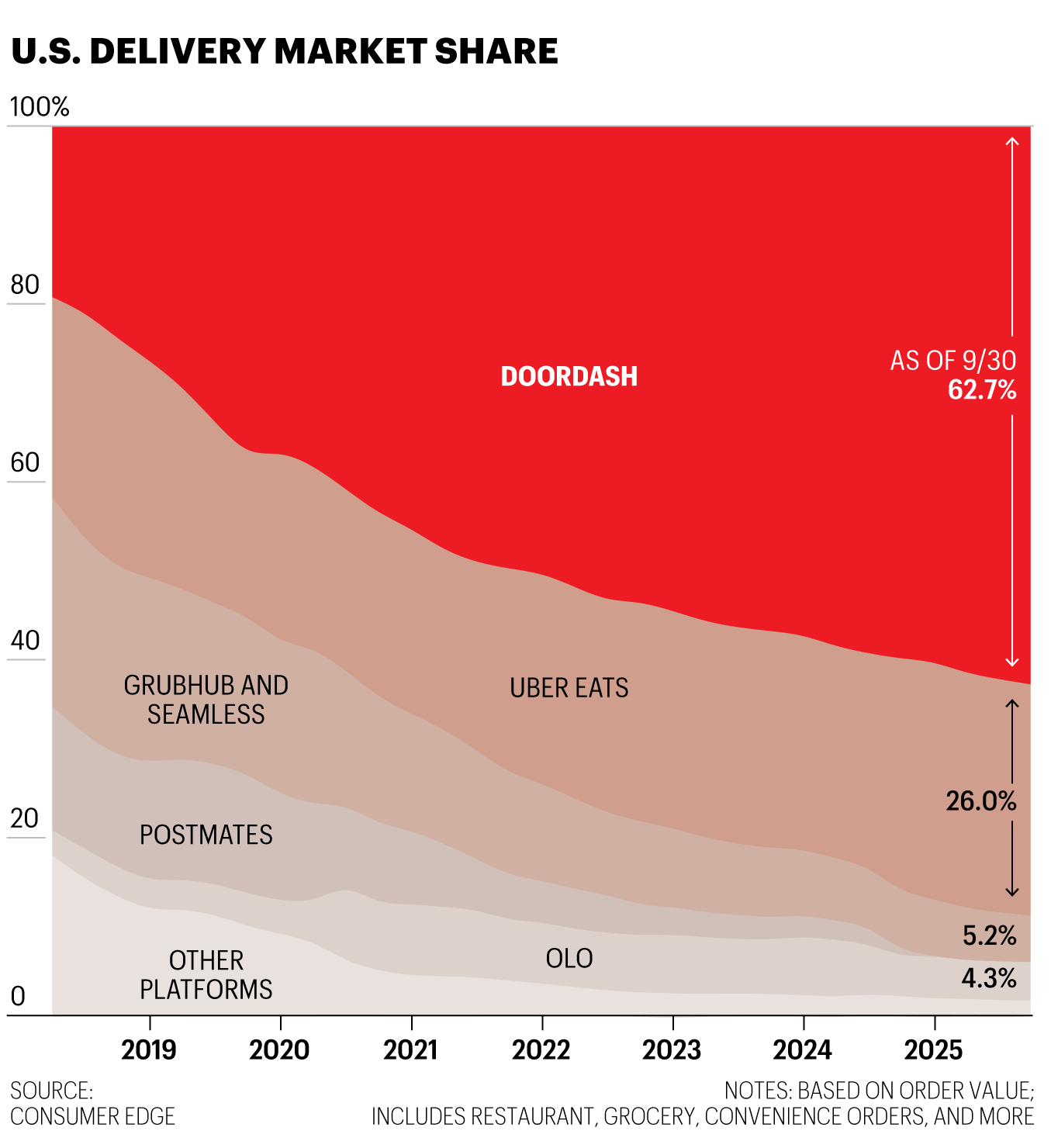

Recent cohorts show a tougher path to the next milestone, with longer timelines and lower graduation rates. Investors now expect tangible usage, durable retention, and a repeatable GTM before advancing.How DoorDash Won the Delivery Wars 📦

Relentless optimization, from route guidance to micro UX for drivers, compounded into category leadership as the market shifted. A suburb-first bet and disciplined execution turned operational edges into dominant share across food and new retail verticals. [Fortune]It’s Easy to Criticize, Hard to Create 🎨

Armchair skepticism is effortless, but progress comes from testing, learning, and iterating until insights hold. Great builders balance conviction with instrumentation, embracing feedback without letting it derail momentum. [Jason Cohen]You Can’t Hide From Burn Rate ⏳

Runway math is unforgiving; wishful forecasts won’t bridge the gap without decisive changes to the cost structure. Cut early and deeply if needed, anchor on an honest L4M model, and choose a path that makes the company default alive. [SaaStr]

Trending News ⚡

Trump to issue order creating national AI rule 📜

A White House executive order will seek one federal standard for AI, preempting the current patchwork of state regulations. The move promises faster deployment for industry but is likely to face resistance from state leaders concerned about consumer protections. [Reuters]

Trump gives Nvidia the green light to sell its H200 chips in China 💻

Washington will allow sales of H200 processors to vetted buyers across the border, while proposing that the U.S. take a percentage of those transactions. Markets responded positively, reflecting expectations of near‑term revenue upside for the chipmaker. [Business Insider]

Google DeepMind CEO: AI scaling ‘must be pushed to the maximum’🚀

Demis Hassabis argues that bigger models with more data and compute remain central to reaching general‑purpose reasoning. He also notes that additional breakthroughs will likely be needed as data constraints, costs, and environmental impacts mount. [Business Insider]Surge AI CEO worries companies are optimizing for ‘AI slop’ instead of hard problems 🎯

Edwin Chen says leaderboard‑driven incentives reward flashy outputs over accuracy and real‑world utility. He urges a shift toward rigorous evaluation that prioritizes truthfulness and measurable impact on difficult tasks. [Business Insider]Accenture, Anthropic strike multi‑year partnership to boost AI adoption Accenture will train about 30,000 employees on Claude and roll out packaged offerings for regulated sectors. The deal expands enterprise focus beyond chat to coding assistants, automated workflows, and multi‑step task systems. [Reuters]

Databricks CEO Ali Ghodsi lays out path to a $1 trillion valuation 🚀

Ghodsi’s “trifecta” bets span transactional databases, agentic systems working over proprietary data, and apps built atop Lakehouse. He says agents are already auto‑provisioning most new databases on the platform, hinting at accelerating usage. [Fortune]Amazon to invest over $35 billion in India by 2030 to expand operations and boost AI ☁️

The company plans to scale cloud and artificial intelligence capabilities while growing exports and logistics capacity. Commitments include job creation and support for local sellers as India’s digital infrastructure accelerates. [Reuters]Google could net $111 billion if SpaceX IPOs at $1.5 trillion 💰

Alphabet’s early investment stands to deliver one of the most lucrative venture outcomes ever if the listing proceeds as reported. Beyond financial gains, the relationship has strategic depth through cloud services tied to Starlink’s network. [Business Insider]

Fundraising?

If you’re raising a round, Luis Llorens and The Founders Corner can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

Social Media Gems 💎

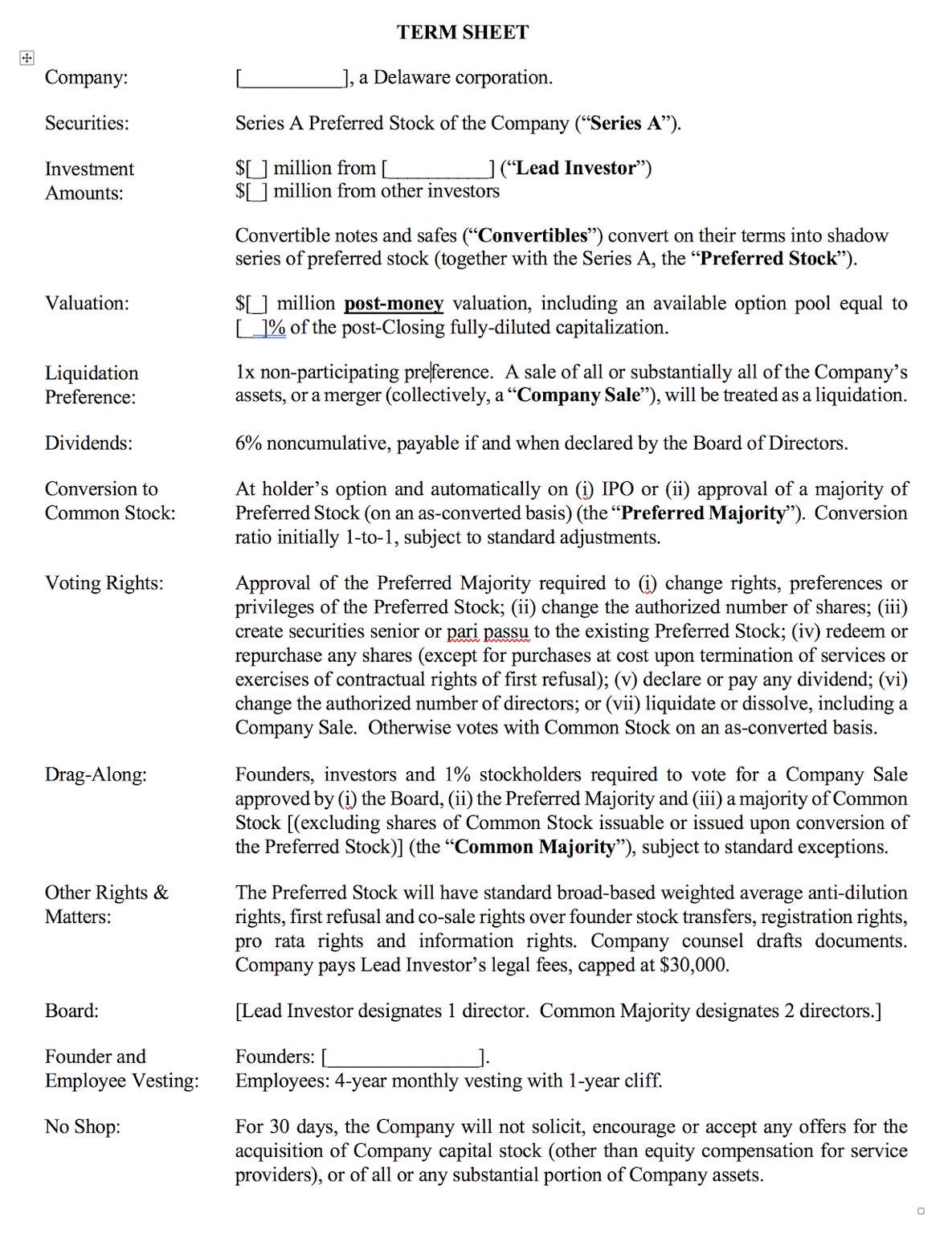

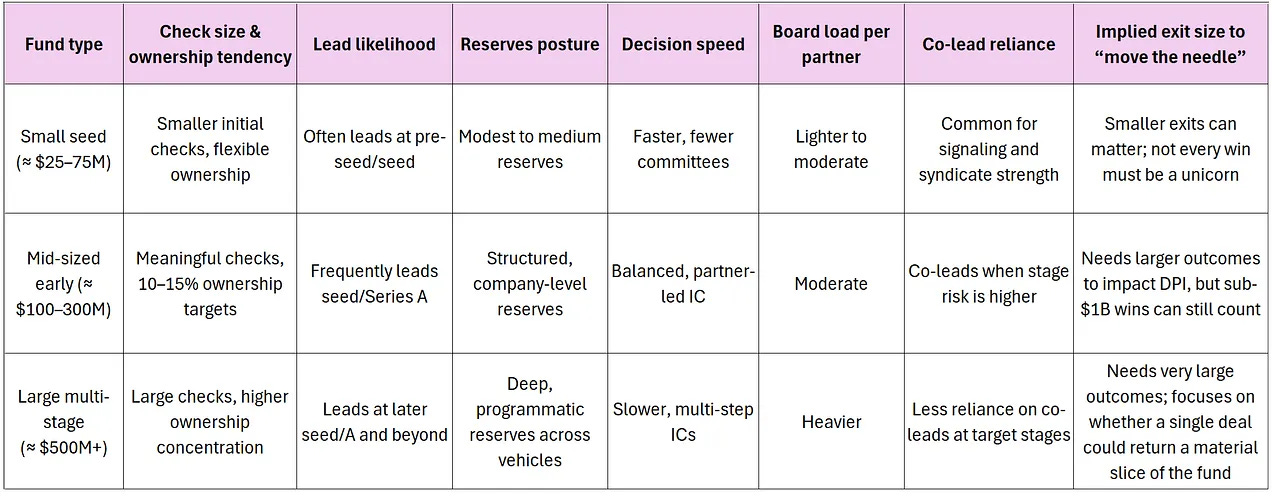

Founders: Read the Fund, Not Just the Term Sheet 🧩

Understanding reserves, vehicle size, carry, and partner bandwidth helps you anticipate how investors will behave after the check clears. A concise guide demystifies fund mechanics so you can predict follow-ons, support, and real decision power on your cap table.

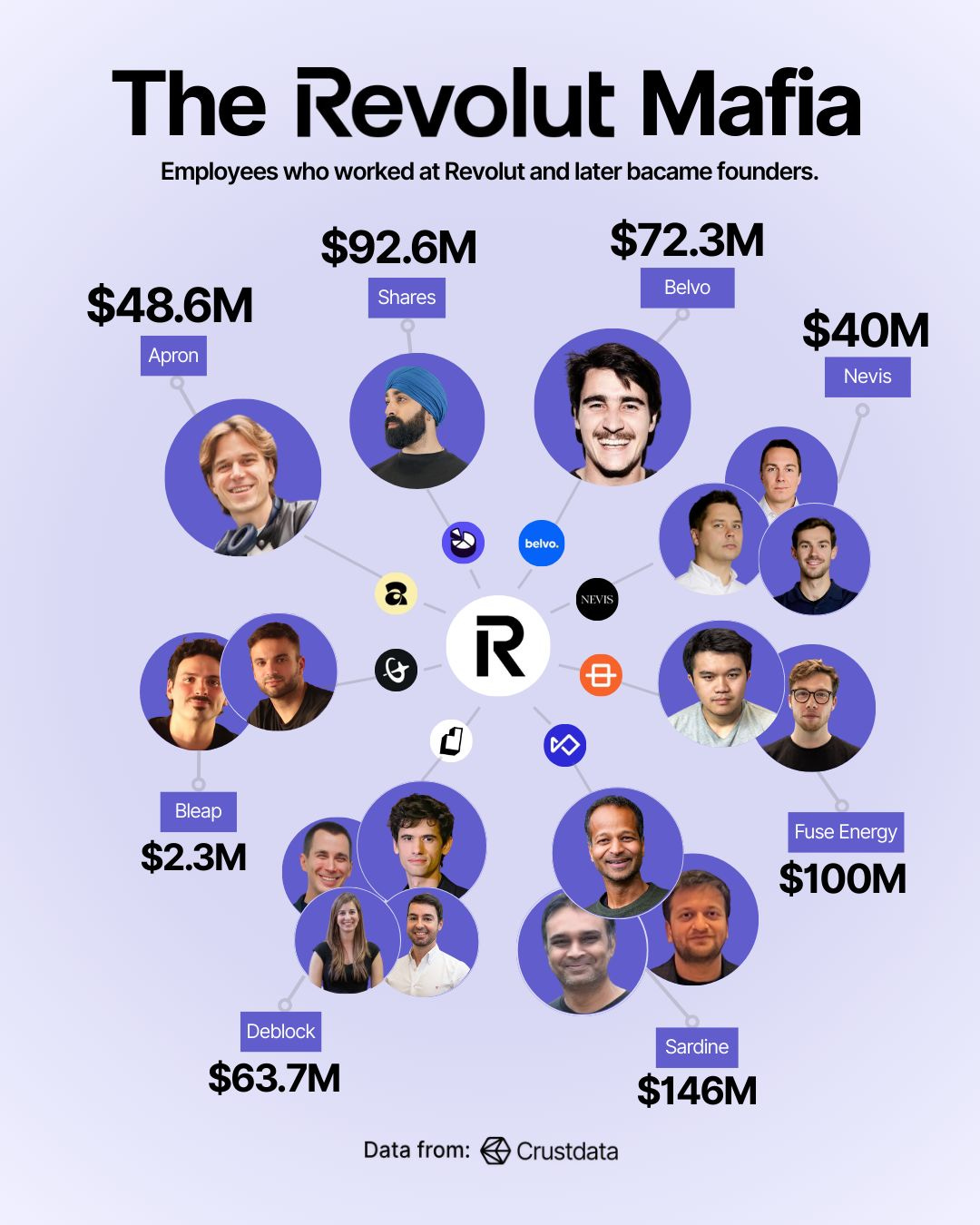

Revolut Alumni Founders Have Raised $565M 💸

A data pull using people and funding APIs highlights the most capitalized ventures started by former team members, spanning fraud infrastructure to energy. The list underscores how an execution-first operating culture travels with builders into their new companies. [Crustdata]The Hidden Side of Venture Capital Funds Every Founder Should Know 🔎

Fund scale quietly drives investor incentives, pacing, and the likelihood of continued backing long before your next round. This quick breakdown shows how structure shapes behavior so you can qualify partners as rigorously as they qualify you.

A 5-Step Template to Nail Your Investor Pitch 🗣️

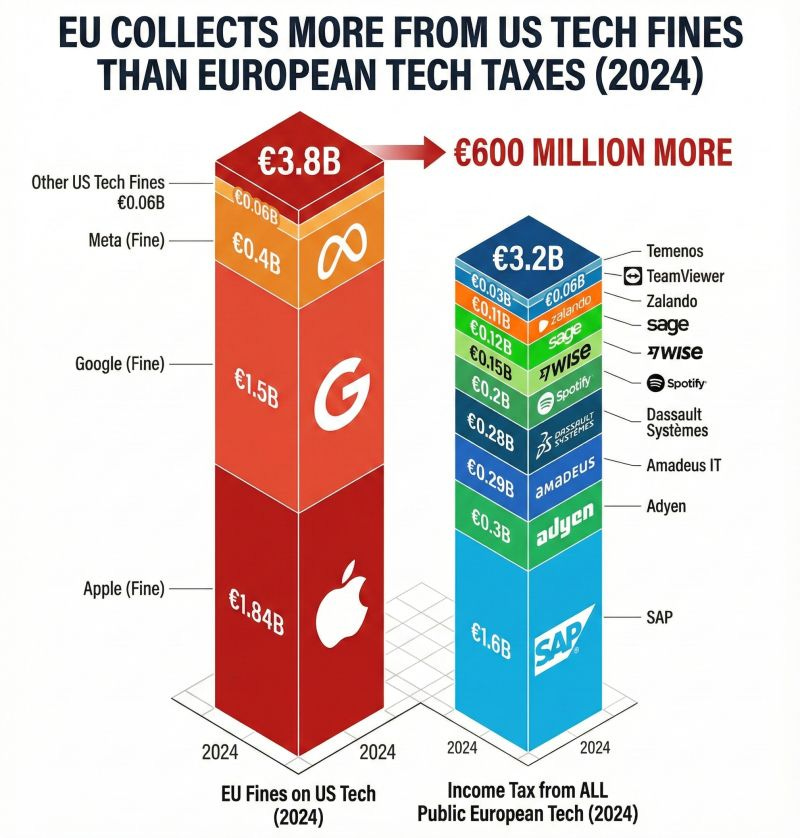

A tight intro covering offer, market, competition, traction, and ask keeps meetings focused and signals clarity. Use it as a rehearsal frame, then prepare depth on product and GTM where the toughest questions land. [Chris Tottman]EU Fines on US Tech Surpass European Tech Taxes in 2024 ⚖️

Enforcement windfalls outpaced corporate income receipts from listed players across the continent, fueling debate on incentives versus oversight. The comparison raises a policy question: are we optimizing for policing outcomes or industrial growth. [David Villalon]

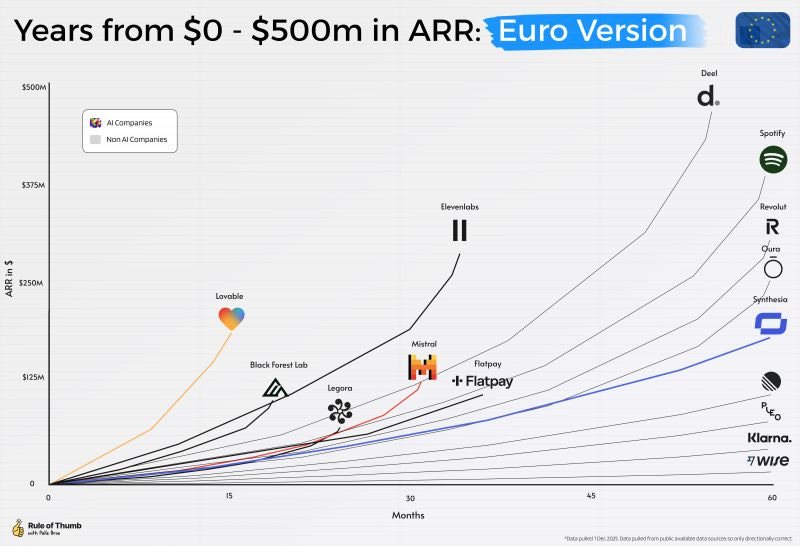

Europe’s New AI-Native Champions Are Scaling Globally 🤖

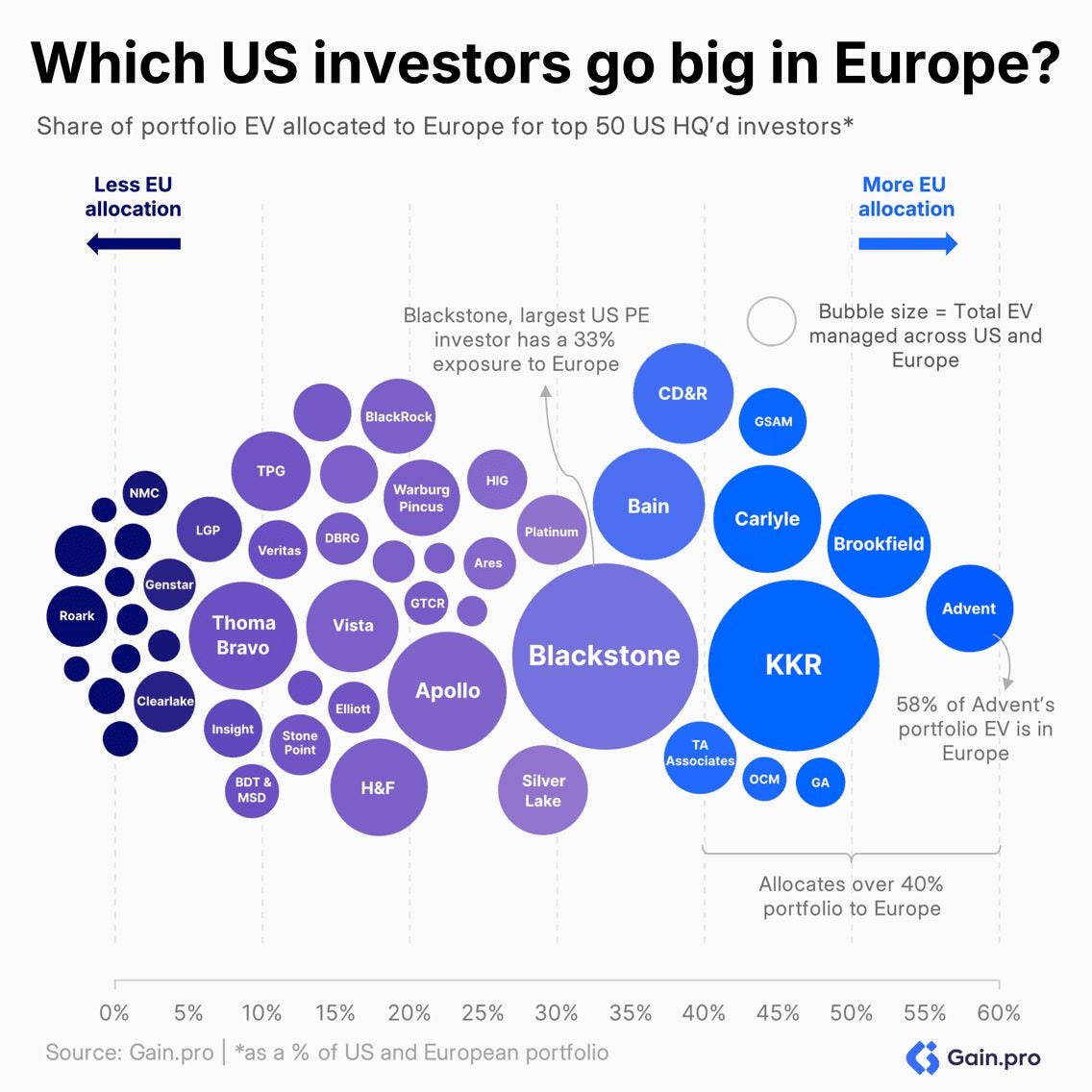

A fresh cohort is posting eye-popping revenue run rates and valuations, following the path blazed by earlier winners. Ambition, faster cycles, and cross-border DNA are turning young teams into global contenders from day one. [Palle Broe]How US Private Equity Is Reweighting Toward Europe 🏦🌍📉🔍

Large diversified buyers are allocating meaningful enterprise value to the region, while tech-leaning funds are increasing exposure from a smaller base. Lower entry prices, stronger cash flows, and under-penetration are pulling capital into familiar playbooks. [Nicola Ebmeyer]

New Funds 💰

Integrity Growth Partners just closed a $220M fund to back high-growth software and tech-enabled companies.

ALM Ventures is going all in on humanoid robots with a $100M fund focused on embodied AI and spatial intelligence.

6 Degrees Capital wrapped a €154M third fund to go deep on deep tech across Europe.

Brainworks Ventures launched a $50M AI-native fund for startups where AI isn’t a feature, it’s the foundation.

Hiro Capital is back with Hiro III to fund European scaleups and brought on Sir Nick Clegg as general partner.

Holly Ventures dropped a $33M fund to guard the digital gates with early cybersecurity plays.

Factorial Capital just raised $25M for Fund II to back early-stage deep tech builders.

Castle Fund is kicking things off with plans to raise $20M for its first fund focused on early consumer tech.

Page One Ventures is turning the page with plans for a second fund backing women-led startups.

Fitz Gate Ventures closed its third fund to keep backing Princeton-linked founders building the future.

That’s a wrap for this week.

If you want to stay ahead of the curve, make sure you're subscribed. No fluff, just real startup insights delivered straight to your inbox.

See you next time 🚀

Nice one!

Angel investor here.

A lot of this advice assumes Series A is slow because founders are doing the wrong things. In reality, it’s slow because the bar moved and capital became far more consensus-driven.

You can pitch the “right” investors, have clean growth loops, solid GTM, and still stall if your category lacks momentum or if no fund wants to stick their neck out first. Series A today is less about craft and more about timing, herd behaviour, and who is willing to lead without cover.

Founders often blame execution when the real blocker is that the market hasn’t decided it cares yet.