The Fundraising Shortcut Nobody Talks About

A practical breakdown of the narrative patterns top founders use to convert investor interest into allocation pressure.

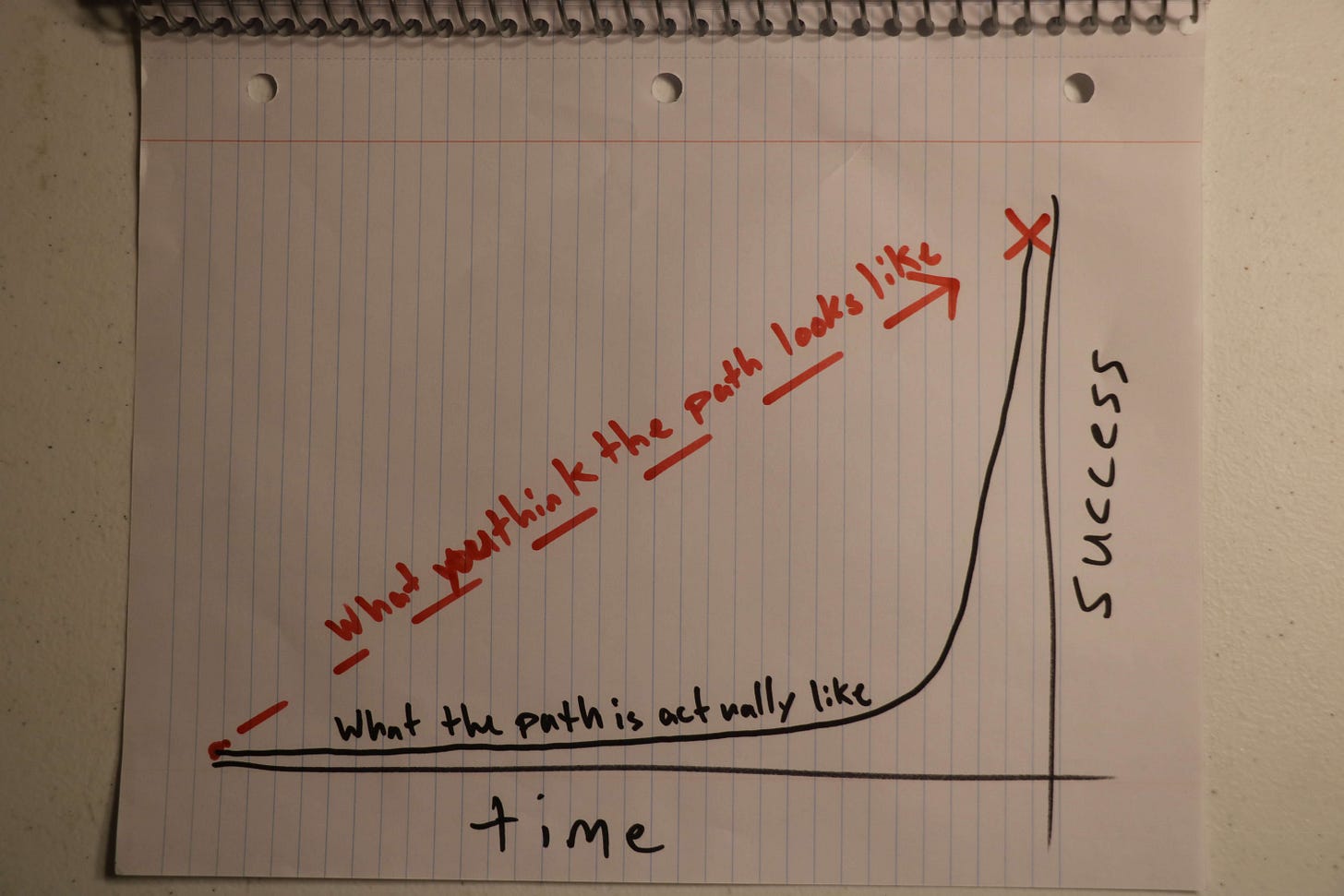

If you have ever wondered why some founders raise in weeks while others spend a quarter circulating the same deck, the difference is rarely the product or the metric. It is the narrative. Not the words, the arc. The feeling that the future is already unfolding and the round is simply the next logical frame.

Because investors do not fund need. They fund conviction.

And conviction is constructed long before the pitch begins.

Punchline: Great founders do not persuade. They reveal.

Brought to you by TheCarCrowd – The Investment World’s Best-Kept Secret

Most investment newsletters talk about equities, VC rounds, real estate…

But very few mention the asset class quietly delivering strong long-term returns: collectible cars.

Until now.

TheCarCrowd curates rare vehicles, fractionalises them, and manages everything end-to-end - so you can invest like a collector without needing to become one.

And the tax treatment? Let’s just say some investors are pleasantly surprised.

👉 See the cars currently under consideration.

👉 Learn in 60 seconds how fractional ownership works.

👉 Start building a “passion portfolio” alongside your traditional one.

Table of Contents

⚡ Why Most Fundraising Stories Fall Flat

🌀 The Structure of a Conviction Story

🔨 Building the Case Before You Ask

📈 The Series A Story Shape

💬 The Pull Quote Test

🔍 Narrative versus Numbers

🧩 Three Real Series A Arcs

💡 Founder OS: How Great Founders Build Narrative Gravity

🎛️ The Levers That Signal Inevitability

🧠 Founder Wisdom: A Braindump on Focus, Story and Momentum

📣 The Investor View

🚀 Closing Thought: Do Not Sell the Trajectory

⚡ Why Most Fundraising Stories Fall Flat

Most founders pitch as if they are trying to earn approval. They walk into the room explaining themselves instead of showing what is already working.

When a story is shaped around need, investors shift into risk detection. They look for gaps, not momentum. The meeting becomes defensive before the pitch has even begun.

The founders who raise quickly take a different approach. They speak from motion. They highlight the parts of the engine that are already compounding. The conversation becomes about trajectory, not justification.

The story gains clarity. It becomes easier to follow and harder to ignore. It feels less like theory and more like something that is already unfolding.

A fundraising narrative lands when investors sense progress without being asked to imagine it.

🌀 The Structure of a Conviction Story

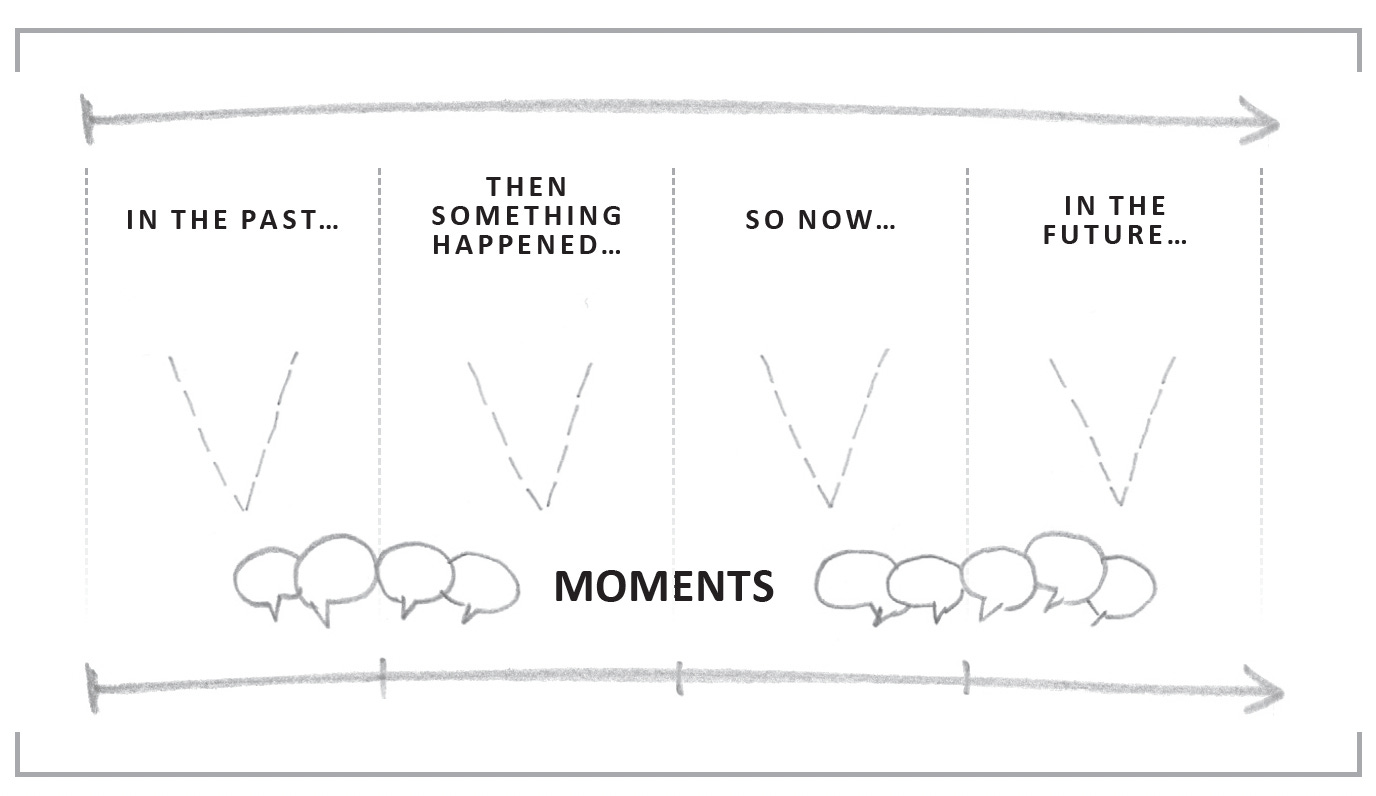

The most compelling fundraising stories share a similar structure. It is not a template, it is a pattern of clarity.

One. Something in the world has changed.

A shift in behaviour. A change in cost curves. A new pain point. This is the opening act.

Two. You have built the system that fits the new world.

The founder had the insight early and built an engine that now feels obvious in hindsight. The logic fits the moment perfectly.

Three. The proof is already visible.

The story does not ask investors to imagine a future. It shows that the future has already begun inside a narrow segment.

When these three layers align, the pitch moves from conceptual to documentary.

You are not telling investors what might be.

You are showing them what already is.

🔨 Building the Case Before You Ask

Narrative power comes from the sequence of choices made before the raise.

The narrowing of focus.

The removal of distraction.

The decision to find the one segment where the product lands with force.

Great founders build the story through repeated moments of precision.

They sharpen the use case.

They identify a learning loop that strengthens each cycle.

They find the customers who activate quickly and return often.

They watch where the system naturally compounds and protect that slope.

By the time the deck is created, the story feels inevitable because it has already been earned in the field.

The deck becomes a summary, not a performance.

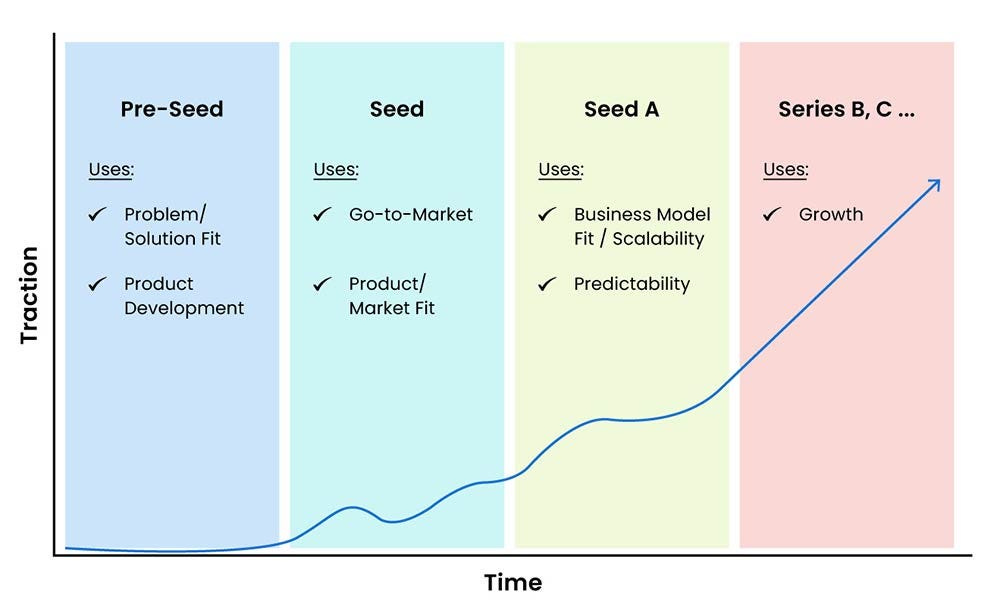

📈 The Series A Story Shape

A strong Series A narrative has a recognisable flow.

Act One — The World Moved

You saw something early. You acted before others believed it mattered.

Act Two — The Engine Emerged

Patterns appeared. Retention stabilised. Conversion improved. A system started to behave predictably.

Act Three — The Proof Arrived

Momentum surfaced in measurable ways. Not huge in scale, but undeniable in direction.

This is the point where investors stop squinting at the numbers and start seeing the shape of the future.

Series A is not about size. It is about slope.

💬 The Pull Quote Test

Here is a simple test for a fundraising story:

If an investor had to describe your company in one sentence after your meeting, what would they say?

Weak stories produce vague summaries.

Clear stories produce conviction.

Great stories produce inevitability.

The best pitches compress into a single compelling line:

The engine is working and the round accelerates what is already unfolding.

If your narrative cannot compress, it cannot spread.

If it cannot spread, it cannot raise.

🔍 Narrative versus Numbers

Metrics matter, but only when they reinforce a coherent story.

Investors do not respond to numbers in isolation.

They respond to numbers that match the narrative you have already articulated.

If you say your onboarding is frictionless, activation should improve.

If you say you have found your segment, payback should shorten.

If you say the engine compounds, usage intensity should rise.

Narrative and numbers must form an echo chamber.

Each strengthens the other.

A pitch succeeds when the story explains the data and the data validates the story.

Trajectory over snapshot.

Clarity over complexity.

Direction over detail.

🧩 Three Real Series A Arcs

Example One: The Vertical Workflow Takeover

A founder targeted a neglected workflow inside a niche market.

Because competitors ignored it, conversion soared and expansion became automatic.

The narrative became one of precision creating inevitability.

Example Two: The Delayed Monetisation Masterstroke

A marketplace chose to delay revenue for twelve months and focused only on liquidity.

When monetisation arrived, it looked instant.

But the real story was patience.

They had spent a year creating inevitability and now they were revealing it.

Example Three: The Activation Driven Flywheel

A B2B founder radically redesigned onboarding.

Time to first value collapsed.

Activation surged.

Expansion tightened.

The fundraising story centred on system behaviour, not ambition.

The internal mechanics were already compounding.

Investors chase when they see compounding that does not require persuasion.

💡 Founder OS: How Great Founders Build Narrative Gravity

Founder OS is the mindset beneath every compelling fundraising story.

It is not a set of meetings or a reporting rhythm.

It is the mental model that shapes how momentum forms.

Great founders anchor on three principles.

The story must reflect reality, not aspiration.

Clarity beats optimism.

Patterns matter more than possibilities.

Momentum is the organising principle.

Every decision either accelerates or dilutes momentum.

Great founders remove anything that slows the slope.

The narrative must travel without them.

A story that cannot be retold cannot raise.

Investors must be able to articulate your engine better than you can.

Founder OS is narrative gravity.

It makes the story heavy enough that it begins to pull investors toward it.

🎛️ The Levers That Signal Inevitability

Investors pay attention when certain signals begin to show themselves.

A segment that behaves consistently

Reliable patterns create confidence.

Time to value moving down

The faster customers reach impact, the faster revenue compounds.

Engagement rising without extra spend

When usage deepens on its own, the engine is working.

When these signals surface together, the story gains a clarity that does not need embellishment.

🧠 Founder Wisdom: A Braindump on Focus, Story and Momentum

I wrote about this in one of my BrainDumps, the piece on the TAM SOM Paradox, which you can find here:

The theme is simple. Founders often feel pressure to anchor their pitch in the scale of the market because it feels impressive. But when you study companies that genuinely compound, the story rarely starts with a broad horizon. It begins with a very specific segment where the product lands with authority and the engine learns quickly.

That paradox explains why so many early stage pitches fall flat.

Breadth without depth creates abstraction.

Depth without breadth creates traction.

And traction is what creates inevitability.

A founder who knows exactly where the engine is already working tells a story that is sharper, cleaner and far easier to retell. That clarity signals control and control signals momentum. Once the momentum is visible inside one well chosen segment, the expansion path becomes self evident.

This is why the strongest fundraising stories do not begin with the size of the opportunity.

They begin with the part of the market the company already owns.

Momentum first. Scale later.

That is how inevitability is built.

📣 The Investor View

Investors do not chase founders because the deck is attractive.

They chase because the story feels alive.

A living story has three qualities.

• The founder can explain exactly why the engine works

• The founder knows where the engine compounds fastest

• The business shows motion that does not rely on optimism

Once these signals appear, investor psychology flips.

The question is no longer whether to join the round.

It is how to secure allocation.

🚀 Closing Thought: Do Not Sell the Round, Sell the Trajectory

The moment you stop trying to sell the round and start revealing the trajectory, fundraising changes.

Show the slope.

Show the compounding.

Show the decisions that created inevitability.

Investors do not chase founders who need capital.

They chase founders whose engines are already moving.

Make the trajectory unmistakable.

Make the story retellable.

Make the momentum visible.

And the round begins to close itself.

Want the full BrainDumps collection?

I’ve compiled all 70+ LinkedIn BrainDumps into The Big Book of BrainDumps. It’s the complete playbook for founders who want repeatable, actionable growth frameworks. Check it out here.

Great writeup Chris. Is “revealing what’s already true” possible without traction, or is traction itself the real truth investors respond to?

The founders who raise the fastest aren’t better storytellers; they’re better at revealing what’s already true.