🔑 Stop Losing the Room: The Pitch Deck Investors Can’t Ignore

A founder’s step-by-step guide to turning investor curiosity into conviction—slides to include, what to skip, and how to tell a story that wins meetings.

👋 Hey, Chris here! Welcome to BrainDumps—a weekly series from The Founders Corner. If you’ve been reading along, you know this series is a preview of a bigger project. Well, it’s finally here: The Big Book of BrainDumps is out now!

It isn’t a theory book—it’s the founder’s field manual. Inside, you’ll find 70 powerful frameworks distilled from 30+ years scaling software companies to hundreds of millions in ARR, 20+ years investing in 500+ B2B tech startups, and over $1B of shareholder value created. From raising capital to hiring your first VP of Sales, this book turns scars and successes into practical playbooks you’ll return to again and again. I expect most copies will become well-worn, scribbled on, and dog-eared—because it works.

📑 Table of Contents

The Purpose of a Pitch Deck (That No One Tells You)

Tell a Story That Starts with Urgency

Your Solution Slide Is Not a Feature List

Show the Market—and Why It’s Moving

Prove People Want It (With Real Evidence)

Explain How You Make Money (Clearly)

Articulate Your Moat

Know Your Competitors—Then Differentiate

Show Your GTM Plan (Not Just a Growth Chart)

Introduce the Team—But Make It Sharp

Your Roadmap Slide Is About Milestones, Not Dates

The Ask: Be Precise

Bonus: How to Engage a VC (Beyond the Deck)

Pitch Deck Best Practices (That No One Prints on a Slide)

Final Thoughts: A Great Deck Isn’t a Silver Bullet

Your pitch deck is not a product demo.

It’s not a datasheet. It’s not a wall of charts. And it’s definitely not your business plan in slide format.

Your pitch deck is a belief system.

A short, sharp, emotionally charged narrative designed to make an investor think, “If I don’t back this, someone else will—and I’ll regret it.”

And yet, I still see Founders turn up with decks that are either:

So dull they put you to sleep before Slide 4

So fluffy they belong in a creative writing class

Or so crammed with data that the actual story is lost in a forest of bar charts

So let’s fix that.

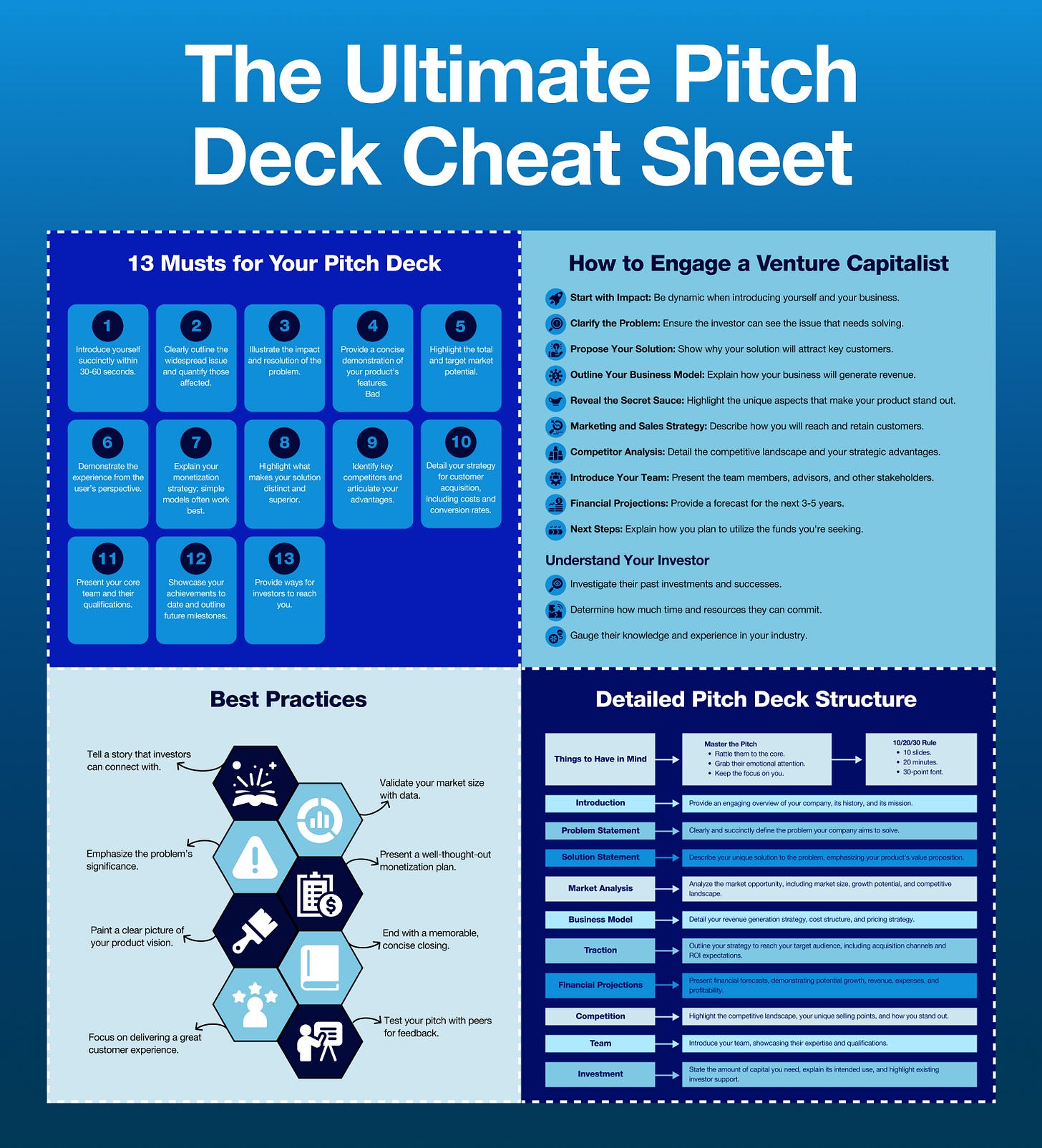

This Ultimate Pitch Deck Cheat Sheet, based on years of YC wisdom and founder battle scars, breaks down the how and why of pitch construction.

But more than that, it gives you a structure you can actually use—not just to impress investors, but to align your entire business around a sharp, compelling story.

Let’s break it down.

1. The Purpose of a Pitch Deck (That No One Tells You)

Your deck has one job:

To get you a second meeting.

That’s it.

Not to raise money on the spot.

Not to teach an investor your entire business model.

Not to list every possible use case or pricing variant.

It’s to make them want to know more.

Think of it like a movie trailer. It doesn’t tell you the whole plot—it makes you want to buy a ticket.

So every slide should answer one question:

Why is this company inevitable—and why now?

If you do that, the money conversation becomes much easier.

2. Tell a Story That Starts with Urgency

Most decks start with “Our Team” or “Our Vision.”

Wrong.

Start with the problem.

The best decks create emotional tension right away:

“This is broken.”

“People are frustrated.”

“Money is being wasted.”

“No one’s solved this yet.”

Make the problem feel painful, urgent, and massive.

If investors don’t feel it in Slide 2, they’re already checking their emails.

My Tip:

If you can’t explain the problem in 3 bullet points or a single sentence, you haven’t earned the right to talk about your solution yet.

3. Your Solution Slide is Not a Feature List

The worst pitch decks sound like product manuals.

“Our solution offers:

AI-powered integration

End-to-end automation

Scalable microservices”

Cool. But… what does it do for people?

The solution slide should visually show how your product solves the problem.

Use a diagram.

Show a workflow.

Use a before/after story.

Show a customer quote if you have one.

Make it obvious how your product creates transformation.

4. Show the Market—and Why It’s Moving

Every investor asks: Is this a big enough opportunity?

So your market slide has to nail three things:

The size of the market

The urgency of the shift

The reason you can win

Don’t just throw a TAM slide with “$87B market” on it.

Show:

Why this market is growing now

What trends are pushing adoption

What’s wrong with incumbents

Why new buyer behaviour helps you

Best decks don’t just quantify the market—they contextualise it.

5. Prove People Want It (With Real Evidence)

Investors don’t need you to be profitable at Seed.

But they do need proof that:

People use it

People love it

People will pay for it

So if you’ve got it, show:

MRR or ARR growth

Retention curves

Testimonials

Activation metrics

Waitlist numbers

Sales cycle length

Paid conversion rates

My Tip:

If you’ve only got 100 users, show how deeply they’re engaged. Usage tells a better story than vanity numbers.

6. Explain How You Make Money (Clearly)

Don’t get cute here. Don’t write:

“We’re exploring multiple monetisation strategies.”

Nope. Tell them:

Who pays you

How much they pay

How often they pay

How that scales over time

Break down pricing models:

Subscription? Freemium? Usage-based?

Tiered by user, seat, usage, or feature set?

Land-and-expand or upfront enterprise deals?

Investors want to know if your revenue model is predictable, scalable, and sensible.

7. Articulate Your Moat

A good product is not enough.

You need to show why no one else can easily do what you’re doing.

This could be:

Proprietary data

Distribution partnerships

Switching costs

Embedded use cases

Network effects

Brand trust

Patents (less important than people think)

Your unfair advantage is not what you build. It’s what makes it hard for others to catch up.

8. Know Your Competitors—Then Differentiate

Every deck needs a competitive landscape slide. And it should be realistic.

Don’t do the thing where every competitor is in the “bad” quadrant and you’re the only one in the “top-right.”

Instead:

Show you’ve studied the space

Acknowledge strengths of others

Highlight where you’re different (not just better)

My Tip:

Great founders say:

“Here’s where we overlap, and here’s where we’re betting the world’s changing.”

That’s strategy.

9. Show Your GTM Plan (Not Just a Growth Chart)

This is where most decks go vague.

“We’ll acquire customers through organic, paid, partnerships and virality.”

…Great. So will everyone else.

Break it down:

Who are your ICPs?

How will you reach them?

What channels have shown early traction?

What’s your CAC so far?

What’s your sales motion? PLG? SDR? Founder-led?

Even a basic funnel is better than hand-waving.

Investors don’t need it to be perfect—they need to see you’re thinking like a business builder.

10. Introduce the Team—But Make It Sharp

Don’t spend 4 slides here.

Just show:

Who’s building what

Why they’re credible

What experience they bring

Where the gaps are (be honest)

If you’ve got relevant domain experience, say it loud.

My Tip:

Slides with smiling team photos and job titles don’t cut it. Show why this team has an unfair edge.

11. Your Roadmap Slide Is About Milestones, Not Dates

Investors know your timeline will slip. What they want to know is:

What are the key milestones?

What does success look like in 12–18 months?

What does the next raise unlock?

This slide should connect the use of funds to the traction you plan to create.

Tie this to:

Team hiring

GTM channels

Product evolution

ARR or usage goals

Make it easy to see what progress looks like—and what you’re optimising for.

12. The Ask: Be Precise

Too many decks end with:

“We’re raising money to scale.”

That’s a non-starter.

Say:

How much you’re raising

What % of equity that represents (if priced)

How long it gives you

Where the money will go

What you expect to achieve with it

Confidence + clarity = conviction.

13. Bonus: How to Engage a VC (Beyond the Deck)

This part of the cheat sheet is pure gold, and founders often forget it.

Pitching isn’t just what you say—it’s how you engage.

Here’s what works:

🧠 Know Your Audience

Do your homework. Who have they backed? What stage do they like? What themes do they talk about? Personalise the intro.

📬 Craft a Killer Intro Email

Short. Direct. Confident. Include traction in the first 2 lines.

🗣️ Own the Narrative

Control the tempo. Lead the conversation. Don’t just walk through slides—tell a story.

📊 Answer Questions with Precision

VCs love clarity. If you don’t know the answer, say so—and tell them how you’ll find out.

🔁 Follow Up Like a Pro

Recap what you heard. Send additional info fast. Keep momentum high.

🧭 Always Have a Next Step

Don’t leave the room without knowing what’s next—call, IC meeting, partner intro.

Pitch Deck Best Practices (That No One Prints on a Slide)

📽️ Tell a Story

Make it emotional. Urgent. Visionary. The best decks are mini-films, not PDF brochures.

🧱 Build Logic Step-by-Step

Don’t jump around. Walk the investor from problem → solution → market → traction → moat → business model → team → roadmap → ask.

🎯 Stay Focused

No more than 12–15 slides. Every word earns its place. Less is more.

🎨 Use Visuals to do the Heavy Lifting

People remember images, diagrams, and charts. A clear chart beats a paragraph.

💥 End with Conviction

You want the last slide to stick. This is where you say: “This is the company you want to back.”

Final Thoughts: A Great Deck Isn’t a Silver Bullet—But a Bad One Will Kill the Conversation

You don’t need the “perfect” deck to raise money.

You need a deck that tells your story with clarity, emotion, and credibility.

One that shows:

There’s a real problem

You’ve got a better solution

The market is pulling you forward

Your team is the one to build it

You know how to get there

And you know exactly what you need to do it

And here’s the thing most founders miss:

The process of building a great deck forces you to build a better business.

The questions you answer in that pitch?

They’re the same ones you’ll face every week for the next 3 years.

So take the time. Get it right.

Your future self—and your investors—will thank you.

—Chris Tottman

Amazing resource for getting investors on our side!

I especially love the first one... it is not to get money right away, but to peak curiousity and get a second meeting.

Thanks for this!! It's really helpful :))