Part 1: When 89% NRR & A Churn Issue Still Wins

Why distribution sometimes beats retention

Revenue up 400% YoY. Glowing press. Growth exploding. And yet… the board is staring at one ugly number: 89% NRR.

A founder showed me their dashboard last week. Churn was creeping up, and the board asked the dreaded question:

“Are we screwing this up?”

I’ve seen it too many times — boards obsess over the wrong numbers, while the real path forward is in your hands.

Most SaaS advice is backwards. Everyone chases 120%+ NRR while missing massive distribution plays. But Zoom, Slack, Notion, Canva — and now Lovable — all scaled early with mediocre retention. They went wide before they went deep.

Sometimes distribution > retention. The trick is knowing when.

📑 Table of Contents

The NRR Trap

Case Study: Lovable — Scaling Fast Before Retention

When Distribution Wins

The Math That Actually Works

Founder OS: The Distribution Mindset

1. The NRR Trap

This is the most common early-stage founder mistake: letting retention metrics dictate your entire growth strategy.

The logic seems sound: if your customers stick, revenue compounds. If they don’t, you’ve got a leaky bucket. That’s true later in the game — but in the early innings, it can lead to paralysis.

Why it happens:

Benchmarking against enterprise SaaS. You read that Salesforce or ServiceNow run at 120%+ NRR and think you’re failing at 89%. But those businesses have entrenched lock-in, multi-year contracts, and thousands of expansion levers. Comparing your seed-stage SaaS to them is like comparing a sprint to a marathon.

Obsessing over the “perfect” customer. Teams spend months over-engineering onboarding flows to filter for customers who’ll stay forever. Meanwhile, competitors scoop up thousands of imperfect but vocal users, build community, and dominate mindshare.

Over-investing in customer success. It feels good to hand-hold every user. But if your team is burning cycles on custom support instead of building acquisition channels, you’re sacrificing long-term category leadership for short-term NRR optics.

Missing the window. This is the killer. In an emerging category, speed compounds. Every month you delay chasing distribution is a month your competitors are racing ahead. By the time you “fix” churn, the market has already crowned its winner.

I’ve written about this tradeoff in one of my BrainDumps that focuses specifically on acquisition vs retention — you can read it here. The theme is simple: retention is almost always cheaper than acquisition, but fast-growing teams rarely have the bandwidth to invest in it early. The real skill isn’t choosing acquisition or retention — it’s sequencing them: win the land grab when the window’s open, then lock in value.

👉 For those who want all my BrainDumps in one place, you can check out the full collection in The Big Book of BrainDumps here.

2. 📦 Case Study: Lovable — Scaling Fast Before Retention

No company has embodied distribution-first growth this year quite like Lovable.

The AI design tool burst onto the scene with immediate buzz. Their early retention numbers were messy — many users built one or two projects and never came back. On paper, that looks like a problem. But Lovable ignored the conventional wisdom and doubled down on distribution velocity.

Here’s how they pulled it off:

Frictionless onboarding: Users hit the homepage, dropped in a prompt, and had a design in seconds. No training, no hurdles, just instant value.

Viral mechanics baked in: Every creation was polished and instantly shareable. Lovable outputs flooded LinkedIn and X feeds — free advertising at scale.

Content-driven discovery: Instead of thought-leadership blogs, they shipped templates and demos. These ranked for “AI design” keywords and got bookmarked and shared.

Press and social proof: Within weeks, journalists were writing about the “design tool that makes Figma look old.” Screenshots of outputs spread organically across communities.

The result? A user base that scaled faster than almost anyone in SaaS history — with retention that lagged behind. And it didn’t matter. Because in an emerging category, distribution velocity > NRR.

The lesson: Like Zoom, Slack, Canva before it, Lovable understood the sequencing. Distribution wins first. Retention comes later.

3. When Distribution Wins

Here’s the filter I use with founders: if your product sits in an emerging, competitive category, you’re in a distribution race, not a retention race.

Distribution-first growth wins when:

Customer use cases are project-based or seasonal. Think event tools, campaign builders, even design apps. Customers come in bursts. Don’t over-engineer to keep them forever.

The market is winner-take-most. With network effects or heavy integrations, there’s only room for one or two leaders. If you don’t flood the market first, someone else will.

You’re building in an emerging category. The first phase of growth is education. That means reach and awareness matter more than expansion metrics.

Switching costs are low, but virality is high. If customers can move easily, you need to win by sheer ubiquity. If they naturally share your product (think Notion docs, Slack invites, Lovable outputs), you should lean all the way in.

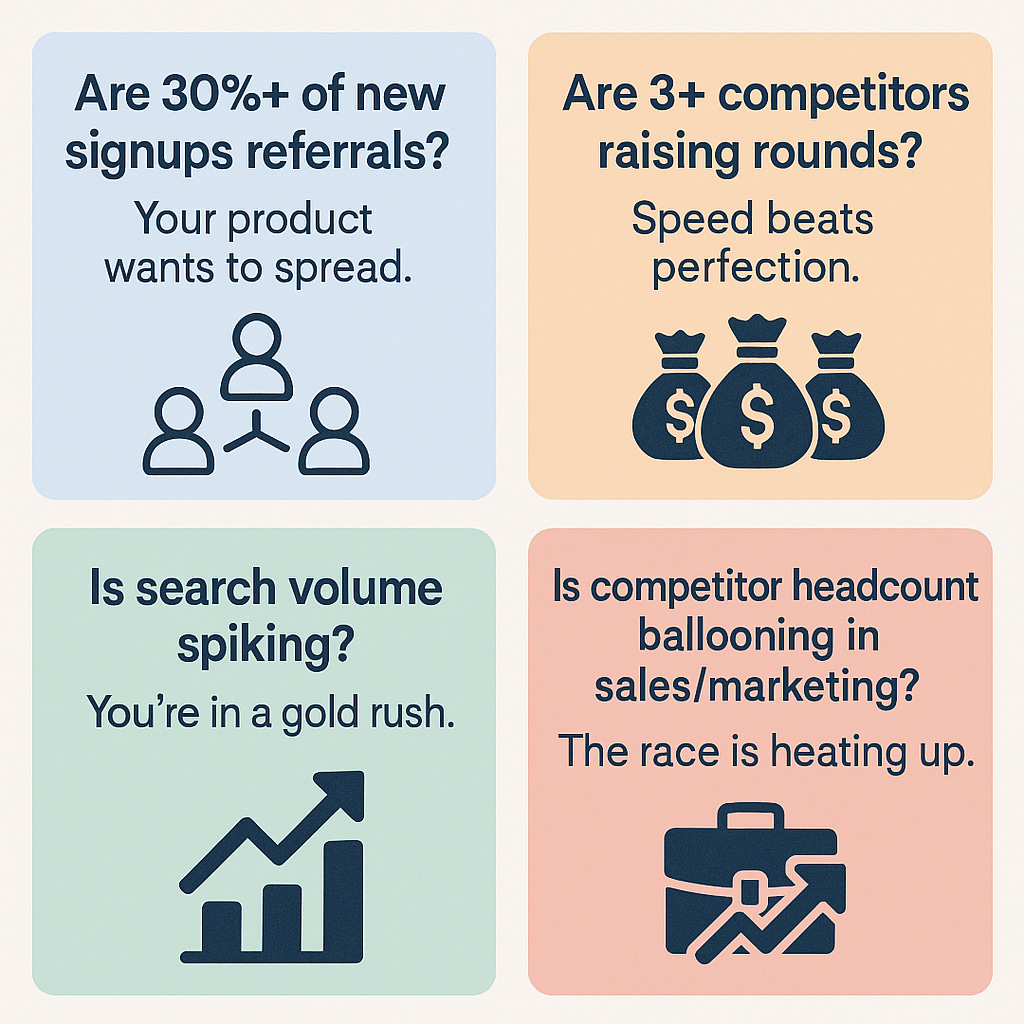

Quick checks for founders:

Are 30%+ of new signups referrals? Your product wants to spread.

Are 3+ competitors raising rounds? Speed beats perfection.

Is search volume spiking? You’re in a gold rush.

Is competitor headcount ballooning in sales/marketing? The race is heating up.

In these cases, perfecting retention is like rearranging deck chairs on the Titanic. The only question is: are you growing fast enough to own the market?

4. The Math That Actually Works

Most investors push founders to chase a “healthy” LTV:CAC ratio of 3:1. That works in steady, mature markets. But in an emerging category, you’re playing a different game.

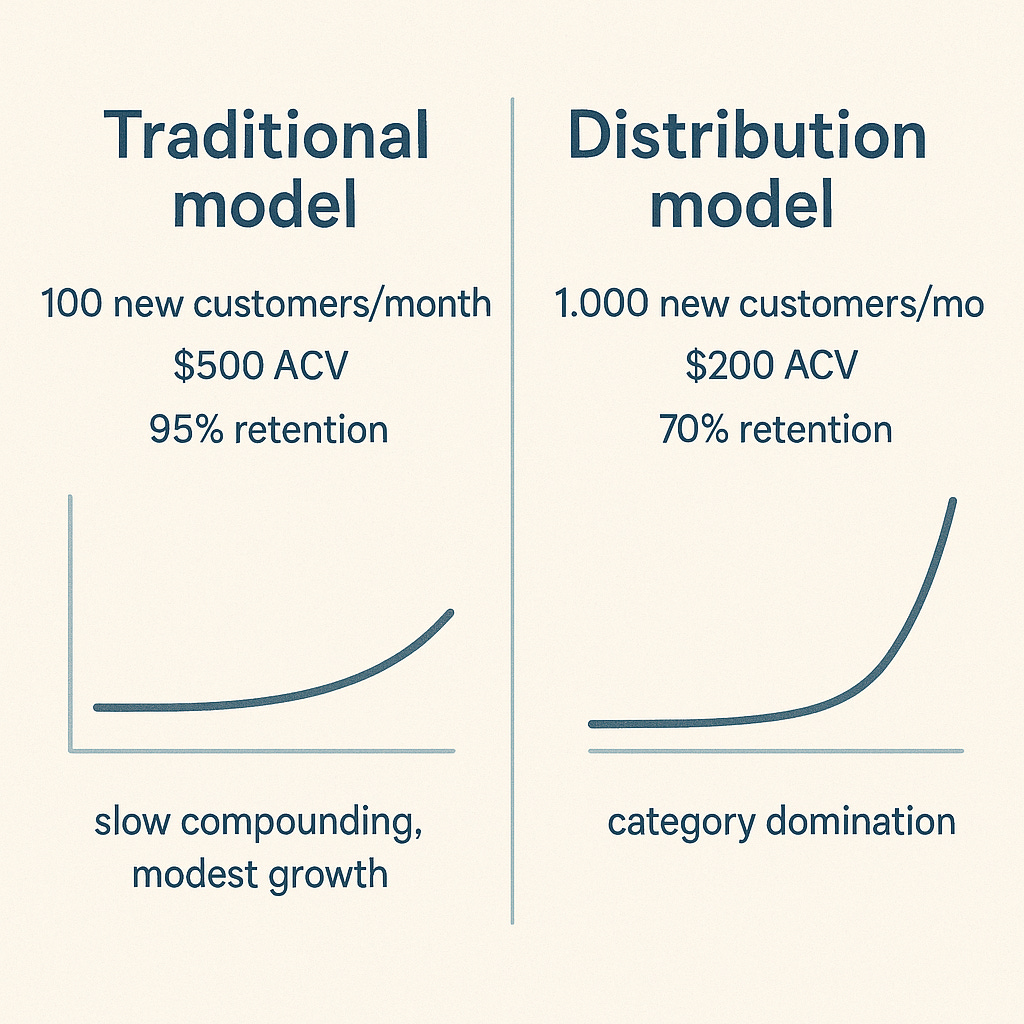

Let’s compare two models:

Traditional model:

100 new customers/month · $500 ACV · 95% retention = slow compounding, modest growth.Distribution model:

1,000 new customers/month · $200 ACV · 70% retention = category domination.

Which one wins? The latter. Because volume compounds into:

More data → better product insights.

More virality → users recruit more users.

More mindshare → you become the default choice before competitors catch up.

This is why unicorns often look “messy” in their early dashboards. High churn, sub-100% NRR — but unstoppable acquisition velocity.

5. 💡 Founder OS: The Distribution Mindset

Here’s the mindset shift I want founders to make:

When your market is emerging, your job is not to run a perfect machine. Your job is to win the land grab.

That means:

Prioritise acquisition velocity. Ask: “Are we adding enough users, fast enough, to be the default?”

Exploit virality. Bake in sharing moments so users can’t help but spread your product.

Check category timing. If you’re in a gold rush, perfection kills you. Speed wins.

Consider option value. Ten times more users today unlock monetisation and retention levers tomorrow.

Sometimes 89% NRR with 10x growth beats 120% NRR with 2x growth. Play the right game at the right time.

👉 Next week: Part 2 — The 90-Day Distribution Sprint: the repeatable playbook for scaling wide when retention is messy.

Love the framing on sequencing, but I think there’s a middle path worth highlighting. A solid onboarding flow doesn’t have to be months of over-engineering. It can be simple, fast, and still deliver an early win that locks in value. That first moment of success isn’t a distraction from distribution velocity; it can actually amplify it, because people share and stick with products that click quickly. Speed matters, but so does making sure the speed leads somewhere sticky.

Sometimes, flooding the market matters more than keeping every customer. Winning the land grab now creates the scale to fix retention later. Distribution in emerging categories has always been about survival.