How Soon Do Startups Become Unicorns 🦄, The AI Risk-Reward Model 🤖, Google Ordered to Sell Chrome ⚖️

If you're ready for practical, no-nonsense guidance, The Founders Corner is the newsletter you’ve been waiting for…

In-Depth Insights 🔍

How Soon Do Startups Become Unicorns 🦄

Most startups become unicorns between years 2-7 after their first funding round. There's a surprising number achieving it quickly: 78 companies in under a year and another 84 in their first full year.

The AI Risk-Reward Model 🤖

An essential framework by Damien Kopp for evaluating AI investments, balancing potential risks with groundbreaking rewards.

Why Candidate Assignments Are the Hidden Key to Better Hiring 🔑

Want to increase your odds of hiring the right person? Use assignments.

The Verticalization of Everything 📂

NFX explores how startups are increasingly dominating niche verticals, creating opportunities for hyper-focused innovation.

Explore the challenges of scaling AI and how startups can adapt to this new reality.

Defensibility in Hardware, Hosting Models & Infrastructure 💼

A deep dive into how startups can create defensible moats in the realms of hardware, hosting models, and infrastructure. [Kevin Mahaffey]

Trending News ⚡

N26 Hits Profitability 🏦. European digital bank N26 reports its first profitable quarter, signaling a significant milestone in the competitive fintech landscape.

Google Ordered to Sell Chrome ⚖️. The DOJ mandates Google to divest its Chrome browser as part of its ongoing antitrust battle, potentially reshaping the web browser market.

Northvolt Faces Bankruptcy in the US ⚡. Swedish battery giant Northvolt navigates financial challenges in the US, sparking concerns about the green energy supply chain.

Odoo Valuation Soars 🛠️. Open-source ERP leader Odoo raises $527M via secondary transactions, boosting its valuation to $5.26 billion.

Lighthouse Becomes a Unicorn 🚀. With a $370M funding round, Lighthouse secures unicorn status, positioning itself as a key player in the enterprise tech space.

NATO Innovation Fund Sees Partner Exit . A surprising leadership shift as a key partner exits the NATO Innovation Fund, raising questions about its strategic direction.

Social Media Gems 💎

Why Startups Shouldn't Have Growth Teams 📉

Misho challenges the necessity of growth teams in early-stage startups, emphasizing focus and lean execution.

Valuations are even crazier today than in 2021 🤯

But…not for everyone.

Early stage valuations are up, but number of deals are still WAY down.

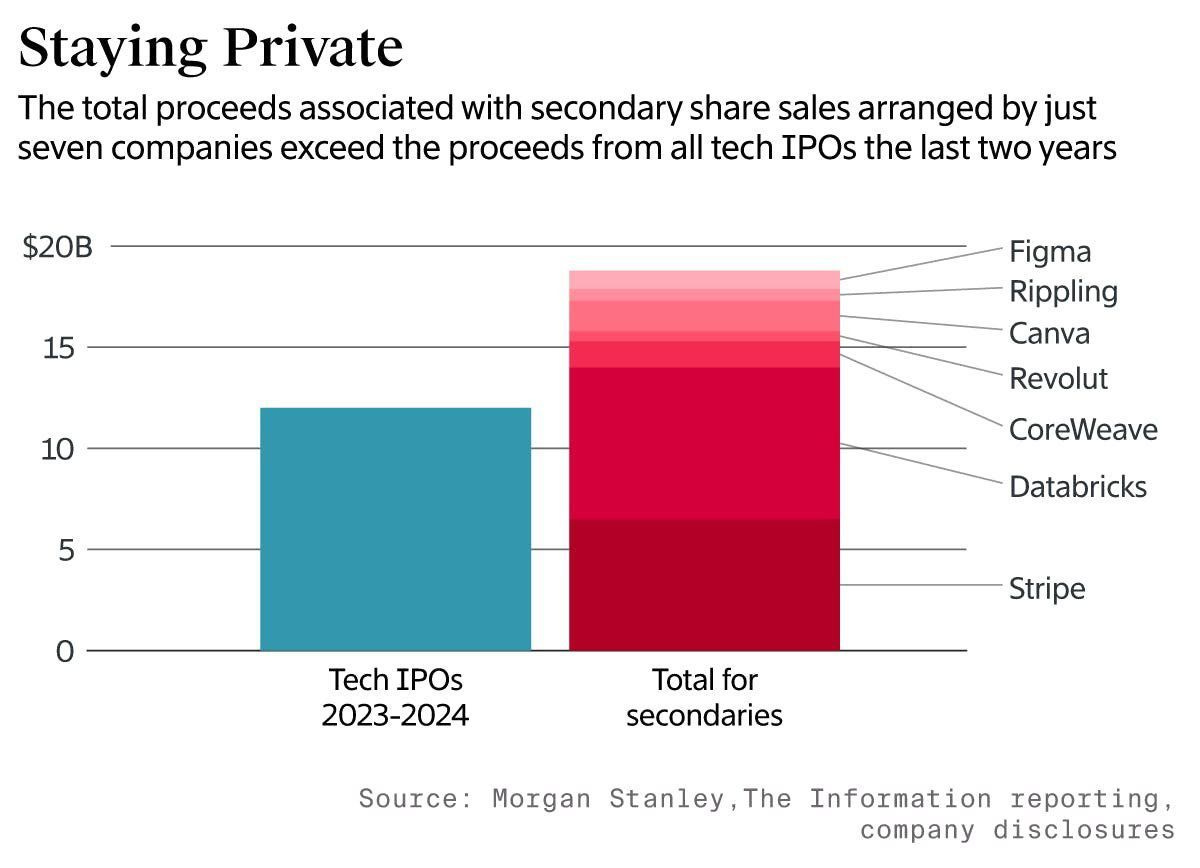

Staying private is the new IPO 💸

Secondary share sales from just seven companies—including Stripe, Canva, and Databricks—have outpaced proceeds from all tech IPOs in the past two years.

New Funds 💰

Frumtak Ventures has raised €87M in its fourth fund to back Icelandic tech startups.

Connexa Capital closed its debut $20M fund, investing in early-stage technology companies.

Berlin-based Extantia Capital closes €204 million flagship fund

Chemistry Capital: Founded by former Index Ventures, Bessemer, and a16z investors, this $350M fund targets chemistry-based solutions in sustainability, agriculture, and energy.

Thrive Capital: A $5B fund led by OpenAI’s backer Thrive Capital, focused on tech infrastructure, AI, and companies pushing the boundaries of digital transformation.

XGen Venture Fund: XGen announces a $160M first close, with a focus on early-stage investments in transformative tech across the U.S. and Europe.

Dawn Capital V: Launches its fifth fund at €400M, dedicated to scaling B2B software across Europe.

Startups chasing unicorn status often face a tightrope walk between rapid scaling and sustainable growth. Your breakdown of the AI risk-reward model and the timeline for unicorn milestones sheds much-needed clarity. It’s intriguing how verticalization is reshaping the market, enabling hyper-niche innovation while reinforcing defensibility.

Given the current investment climate, how can early-stage founders balance the push for fast-track valuation with building a long-term, resilient business?

That meme was crazy work