🔍 Your CV Isn’t Worth What You Think: The Data Behind How Investors Judge Founders

Founders overestimate the value of experience — investors don’t. Here’s how early-stage valuation actually works, and why adaptability beats pedigree every time.

👋 Hey, Chris here! Welcome to BrainDumps—a weekly series from The Founders Corner. If you’ve been reading along, you know this series is a preview of a bigger project. Well, it’s finally here: The Big Book of BrainDumps is out now!

It isn’t a theory book—it’s the founder’s field manual. Inside, you’ll find 70 powerful frameworks distilled from 30+ years scaling software companies to hundreds of millions in ARR, 20+ years investing in 500+ B2B tech startups, and over $1B of shareholder value created. From raising capital to hiring your first VP of Sales, this book turns scars and successes into practical playbooks you’ll return to again and again. I expect most copies will become well-worn, scribbled on, and dog-eared—because it works.

There’s a quiet mistake that shows up in early-stage fundraising conversations more often than any founder realises — and it can inflate expectations, distort valuations, and derail otherwise promising rounds:

Investors and founders dramatically overvalue founder experience.

Surprising? Maybe.

Common? Absolutely.

In fact, it’s one of the most frequent reasons founders and investors end up misaligned on valuation. A founder with a stellar CV assumes it raises the value of the company. An investor agrees — but only up to a point. And somewhere between those assumptions, the deal starts falling apart.

This BrainDump breaks the issue down with painful clarity. Let’s unpack what’s really going on — and how to keep yourself out of the founder-experience valuation trap.

Table of Contents

The Berkus Method: Why Experience Isn’t Worth What You Think

The Founder’s Dilemma: Why Experience Isn’t Linear

The Biggest Misconceptions About Founder Experience

The Founder Experience Matrix: What Actually Matters

The Founder Experience Discount Model: Harsh But True

Best Practices: How to Talk About Your Experience the Right Way

Red Flags Investors Watch For

Balanced Founder Experience Valuation: What Actually Works

The Takeaway

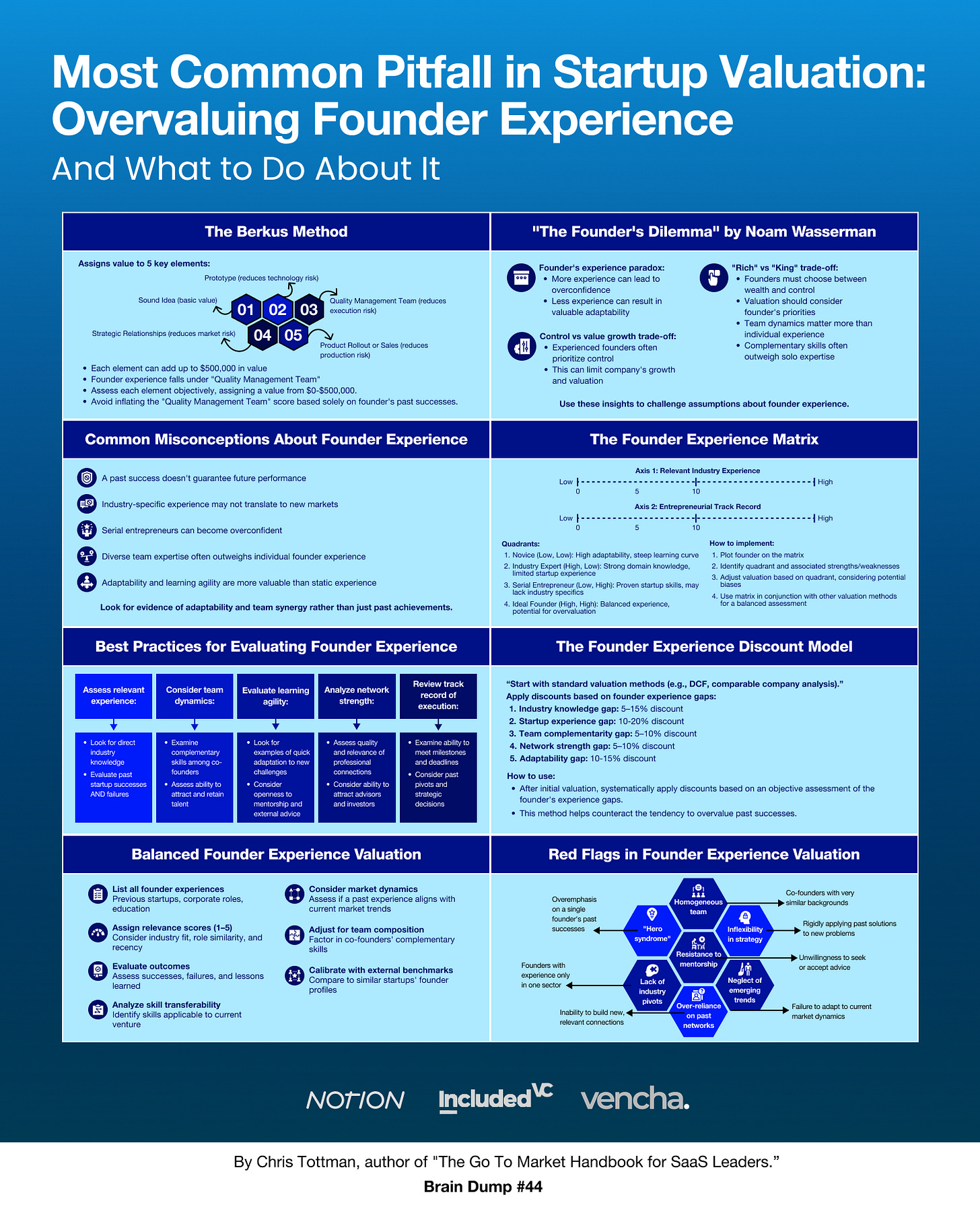

1. The Berkus Method: Why Experience Isn’t Worth What You Think

The Berkus Method is one of the most widely referenced early-stage valuation approaches — and even in this model, founder experience is only one of five inputs.

The method assigns equal weight to:

Sound idea

Prototype

Quality management team

Strategic relationships

Product rollout

The lesson?

Experience is only 20% of the equation at best — and that’s before traction even enters the picture.

Founders who lean too heavily on their backgrounds often forget that investors are ultimately buying future outcomes, not past accomplishments.

2. “The Founder’s Dilemma”: Why Experience Isn’t Linear

Noam Wasserman’s seminal research points out something uncomfortable:

Founders with more experience sometimes outperform, sometimes underperform —

and past success doesn’t reliably predict future returns.

Why?

Because different stages require different skills. A founder who excelled in a corporate environment may struggle in the chaos of zero-to-one execution. Likewise, a founder who thrives in early-stage scrappiness may hit a ceiling at scale.

Experience is helpful — but not if it’s the wrong kind of experience for the current stage of your company.

3. The Biggest Misconceptions About Founder Experience

Most valuation friction comes from these false assumptions:

❌ “Senior experience = strong early-stage leadership.”

❌ “A big-brand CV warrants a big valuation.”

❌ “Past success guarantees future investor returns.”

❌ “Industry experience automatically means fast execution.”

❌ “Experienced founders always outperform first-time founders.”

Here’s the reality:

Investors care less about where you’ve been and more about how you operate today.

Execution > pedigree.

Velocity > history.

Learning speed > CV logos.

4. The Founder Experience Matrix: The Only Part That Actually Matters

This matrix offers the most useful lens I’ve seen:

Investors evaluate:

(A) Experience relevant to the current stage

(B) Ability to adapt to rapid change

(C) Evidence of learning velocity

(D) Practical experience overcoming similar obstacles

Notice what’s missing?

“Impressive job titles.”

“Big company names.”

“Fancy credentials.”

Investors don’t care who you were.

They care whether your experience accelerates the next 12–18 months.

5. The Founder Experience Discount Model: Harsh But True

This is where the BrainDump gets blunt:

Even when a founder has exceptional experience, investors often discount it.

Why?

Because:

Experience rarely correlates directly to outcomes.

Market factors often matter more than founder background.

Execution is contextual, not transferable.

Overconfidence can distort planning and hiring.

Experienced founders sometimes resist learning new patterns.

So investors build their own discount factor into valuation — consciously or unconsciously.

6. Best Practices: How to Talk About Your Experience the Right Way

Here’s how to position Founder Experience without overplaying it:

✔ Anchor your experience to your current milestone

(“…and that’s why I can execute the next stage faster.”)

✔ Show humility and learning velocity

Investors love founders who adapt quickly.

✔ Connect past roles to specific capabilities

Not “I led a team of 80,” but

“Managing an 80-person team taught me X skill, which we use here to achieve Y.”

✔ Demonstrate relevant expertise

Domain knowledge beats prestige every time.

✔ Use your experience to derisk the business

Show how your background reduces execution uncertainty.

7. Red Flags Investors Watch For

Investors are trained to look for warning signs linked to overvaluing experience:

⚠️ Founder arrogance (“I’ve done this before — I know better”)

⚠️ Refusal to test assumptions

⚠️ Overconfidence in execution ability

⚠️ Reliance on past playbooks that no longer fit

⚠️ Ignoring market feedback

⚠️ Overshooting valuation expectations

If you’re hitting one or more of these, investors will quietly step back — or discount your valuation even further.

8. Balanced Founder Experience Valuation: What Actually Works

The best founders strike this balance:

Confidence without ego

Expertise without rigidity

Experience without entitlement

Humility without insecurity

The real signal investors look for is adaptability — not achievements.

If your experience accelerates execution, removes risk, and sharpens strategy, it’s valuable.

If it’s used as a shield, a shortcut, or a justification for unrealistic valuation — it becomes a liability.

The Takeaway:

🚀 Experience doesn’t raise your valuation.

Execution does.

Learning speed does.

Evidence does.

The founders who win aren’t the most decorated — they’re the most adaptable, the most self-aware, and the quickest to turn insight into traction.

Your experience is an asset, but only if you use it as a foundation, not a forecast.

-Chris Tottman

I’m coming from the legal world, where I agree educational pedigree is overvalued, but experience? With all the talk about how our brains are pattern-matching and prediction-making machines? Someone who’s encountered more patterns and evaluated more predictions isn’t more valuable? Y’all are wild in the tech world!

Founders often overweight experience over market validation and traction - I hear this a lot. It’s far easier to talk about yourself than do 200 validation calls. Or even 20.

Often - founder market misfit is a strategic advantage