What 2,000+ Early Rounds Reveal About Venture🤔, 9 Ways Growth is Different in AI Companies✨, EU Leaders Back Pan-European Startup Entity 📑

If you're building, investing, or just trying to stay ahead of the curve, you're in the right place. Every week, we break down the latest insights, funding news, and founder-friendly gems. Just what matters. Plus, we track the freshest VC funds deploying capital so you know where the money’s moving.

Let’s get into it 👇

In-Depth Insights 🔍

9 Ways Growth is Different in AI Companies ✨

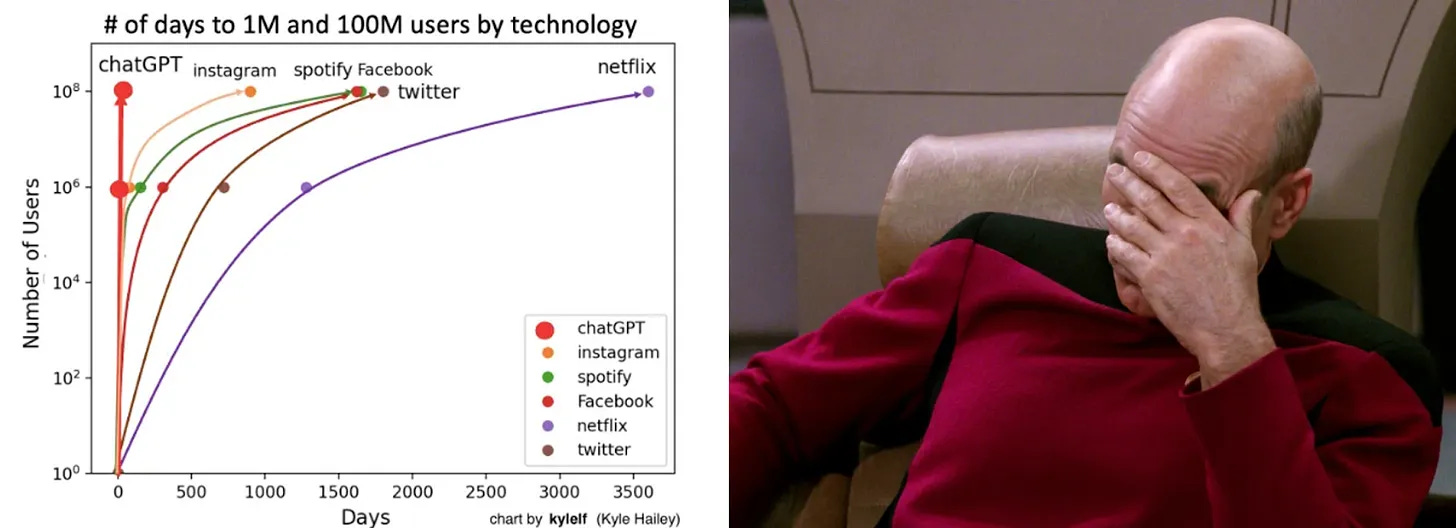

AI startups re-earn PMF repeatedly, with activation often just a prompt box. Growth comes from founder-led social, brand strength, and product loops instead of traditional playbooks. [Elena Verna]Distribution Is the Final Moat 🏰

The best founders pick one channel early, master it, and scale it relentlessly. Distribution is treated as a core product function from the first day. [GTMnow]The Great Unlock of Time and Brand 🔥

AI is making every minute more productive, changing how people work and spend attention. Brand continues to shape meaning, trust, and consumer choices in this new environment. [Scott Belsky]What 2,000+ Early Rounds Reveal About Venture 🤔

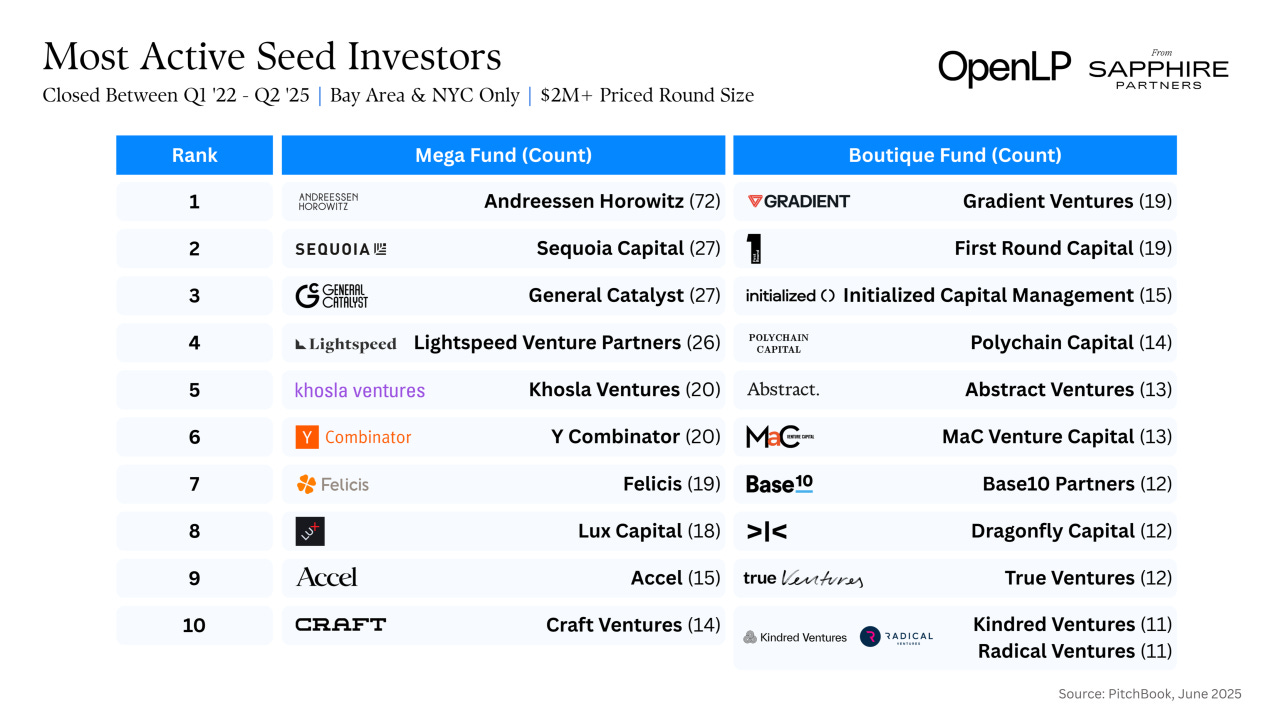

Mega-funds are leading larger Seed and Series A checks while boutiques dominate mid-sized deals. LP capital is concentrated, competition is higher, and selection standards are rising. [Elizabeth "Beezer" Clarkson]The Economics of Chips and GenAI ⚡

Surging demand is driving semiconductor growth cycles across the industry. Adoption speed, inference costs, and production efficiency will define long-term market stability. [Gauthier Roussilhe]AI as Normal Technology: A Guide 🔍

AI follows the same path as other transformative technologies shaped by institutions and choices. Outcomes depend on how it is deployed, governed, and integrated into society. [Arvind Narayanan and Sayash Kapoor]

Trending News ⚡

Klarna’s IPO to Create 40+ Employee Millionaires 💰

Shares priced at $40 will mint dozens of new millionaires among staff and execs. CEO Sebastian Siemiatkowski is holding his full $1B stake as Klarna goes public. [Swift]Speedinvest Raises €30M for Continuation Fund 🔄

The first in a planned series of continuation vehicles gives LPs liquidity in a slow exit market. Secondary structures are becoming central to how VCs return capital. [Swift]ASML Invests $1.5B in Mistral at $11B Valuation 🇪🇺

The chipmaker will become Mistral’s largest shareholder, anchoring a $2B Series C. The deal positions Mistral as Europe’s most valuable AI startup and sovereignty bet. [CTECH]ElevenLabs Eyes $6B Valuation in Employee Secondary 🗣️

The voice AI company is nearly doubling its valuation while offering early liquidity. With $90M ARR and major media clients, it is laying groundwork for a future IPO. [TechFundingNews]OpenAI and Oracle Strike $300B Cloud Deal 🤖

Starting in 2027, OpenAI will buy $300B in compute from Oracle, one of the largest contracts ever. The agreement ties into the $500B Stargate data center project. [TechCrunch]Replit Raises $250M at $3B Valuation 💰

The coding platform tripled its valuation while launching Agent 3, its newest autonomous system. With $150M ARR and 40M users, Replit is scaling toward enterprise adoption. [replit]ByteDance Launches Seedream 4.0 Image Model 🖼️

The new release combines text-to-image and editing while outperforming DeepMind benchmarks. ByteDance is positioning itself as a direct challenger in AI image generation. [SCMP]Judge Pauses Anthropic’s $1.5B Book Settlement ⚖️

A federal judge halted approval, questioning the $3,000-per-book payout to authors. The case covers ~465K works and will be revisited in late September. [The Verge]

Fundraising?

If you're raising a round, Luis Llorens and Ruben Dominguez Ibar can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form, and they’ll do their best to connect you with the right investors! 🚀

Social Media Gems 💎

Your Pitch Deck is Worth $0 if it Raises $0 🚫

Most founders lose investors before slide two because decks are graded like exams. The six investor tests are Hook, Pain, Clarity, Math, Evidence, and Use of Funds. [Burak Buyukdemir]EU Leaders Back Pan-European Startup Entity 📑

Macron and Scholz support a unified EU legal structure to streamline startup operations. The EU INC proposal is designed to cut friction for founders and speed cross-border growth. [EU–INC]

New Funds 💰

Yachad Capital Partners held the initial close of its inaugural fund to back early-stage ventures.

CoreWeave Ventures launched a corporate venture capital arm to invest in cloud and AI-focused startups.

Vireo Ventures closed €50M Electrification Fund I to support energy transition and electrification solutions.

TVM Capital Healthcare reached first closing of its $150M Southeast Asia-focused healthcare fund.

Sora Ventures introduced a Bitcoin Treasury Fund to support blockchain projects and digital assets.

Legion VC launched to back breakout startups across multiple industries.

JVP closed a $290M continuation vehicle with TPG to support portfolio company Earnix.

Solaire Partners set to manage a $28M IPTV-focused investment fund.

Corenest Capital launched a global accelerator in El Salvador with a $25M tokenized VC fund.

VCUK rolled out a new private equity and VC initiative with a Europe-focused strategy.

Accion Venture Lab closed its $61.6M second fund to back inclusive fintech innovations.

That’s a wrap for this week.

If you want to stay ahead of the curve, make sure you're subscribed. No fluff, just real startup insights delivered straight to your inbox.

See you next time 🚀

Really sharp roundup.....appreciate how you cut through the noise and keep it focused on what actually matters.

"Mega-funds are leading larger Seed and Series A checks while boutiques dominate mid-sized deals."

It's just the basic step on the path toward rising market concentration and thus, one step closer to oligopoly.

I don't expect the appetites of a16zs and such to be sated like ever, so being a small fish in the VC pond will increasingly become less and less attractive. And with less competition on the investment end, it will suck to be a startup in need of money even more.