The Pitch Deck Test Investors Use in 30 Seconds — Now You Can Too

Fix weak signals, avoid silent no’s, and walk into every meeting knowing how your deck really lands.

Most founders only ever get one version of feedback on their pitch deck.

The polite, surface level commentary that never tells you what an investor actually thought.

That is dangerous.

Because investors decide whether to lean in or quietly pass long before they ever say a word, and once that first impression is set, you rarely get a second chance to change it.

After 25+ years of building companies, backing founders, reviewing more than 20,000 decks, and sitting through every version of a partner meeting imaginable, I wanted to give founders something I never had when I was raising.

A way to see your deck exactly as investors see it.

Not guesswork, not generic advice, but the real pattern recognition that shapes early decisions.

That is why I built this tool.

Below is how to use it.

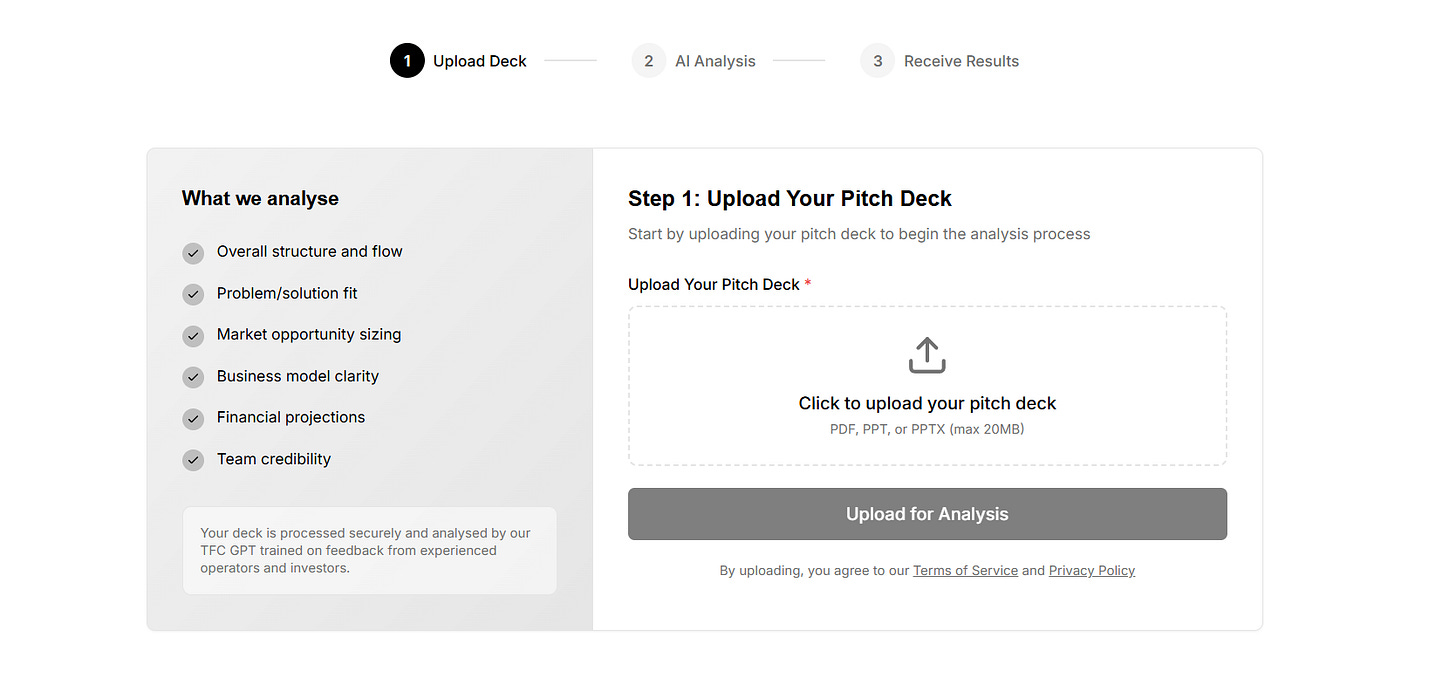

📤 1. Upload Your Deck

You begin by uploading your deck, PDF, PPT or similar.

The tool analyses it in under a minute across the exact filters investors use during an initial assessment:

Structure and narrative flow

Clarity of the problem and solution

Market depth and credibility

Business model logic

Financial signals

Team strength and execution signals

This is the first impression layer that sets the tone for the entire process.

A calibrated first look can shift your odds dramatically.

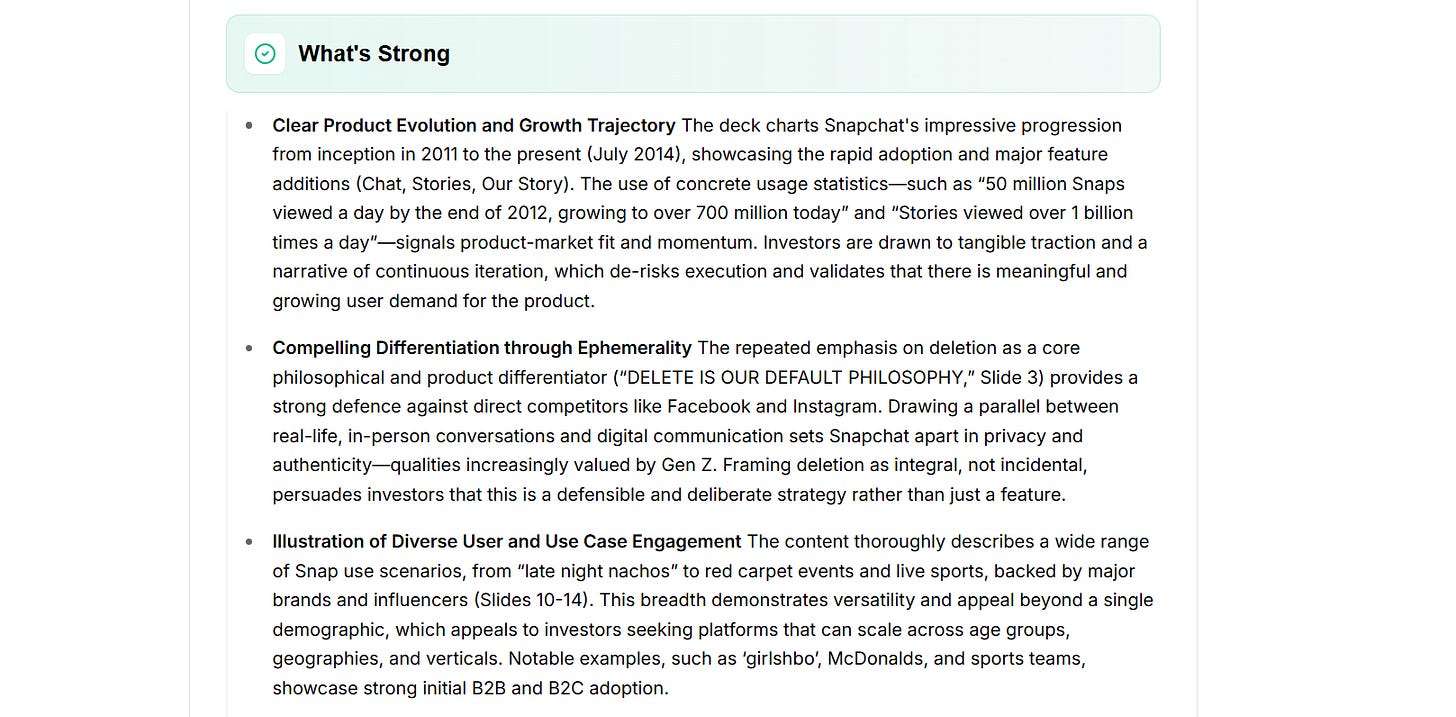

📊 2. My Feedback – What’s Strong

The first section highlights the parts of your pitch that already work.

This matters more than founders realise.

You normally only hear what needs work, which can make the entire deck feel weaker than it is.

Strength creates conviction.

When an investor sees strong signals early, the rest of your story lands more powerfully.

This section shows you exactly which signals are resonating so you can lean into them deliberately.

Founders who understand their strengths communicate with far more authority.

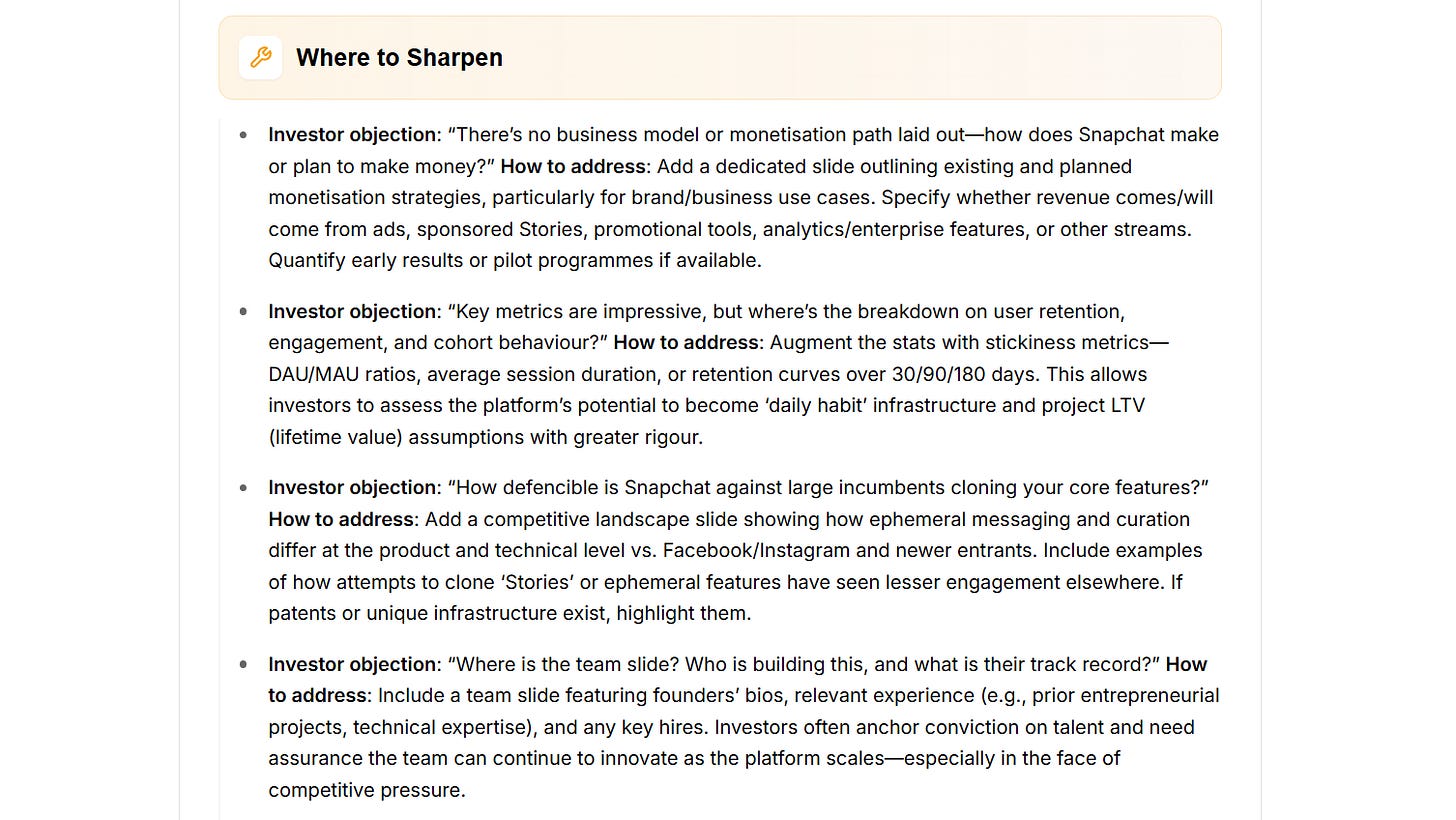

🔧 3. My Feedback – What’s Weak

This is where the real investor objections appear.

Not the polite questions on a call, but the internal questions that decide whether a firm engages:

How solid is the model

Is the traction repeatable

Where are the retention or engagement signals

What protects this from competition

Why this team for this problem

For each one, the tool explains:

what the concern actually is

why it matters to investors

how to fix it clearly and fast

This is the kind of clarity founders usually get only after dozens of no’s.

Fixing these early turns weak signals into reasons to lean in.

🚩 4. Investor Red Flags? Identified

Flags are what quietly slow a process or stop momentum altogether.

This section surfaces the risk areas investors notice first:

Unclear narrative between problem and solution

Competitive framing that lacks depth

Traction that is anecdotal

Limited team signals

Market logic that needs clarity

Weak evidence behind the model

Knowing these early lets you tighten them before your raise.

Avoiding these red flags alone can shift an 80% no rate into an 80% yes rate over a fundraise.

🧠 5. Apply Tactical Recommendations

This is where insight becomes execution.

You get immediately actionable improvements:

slide rewrites

missing slides to add

cleaner sequencing

sharper storytelling and model logic

These are the same practical fixes I give portfolio founders when they are preparing for investor conversations.

They are small upgrades that materially improve the win rate of every meeting that follows.

🚀 6. Your Next Actions

With the deck improved, the tool takes you deeper.

The VC Scorecard is a self assessment built from the exact questions I use when evaluating early stage teams.

It gives you a sharper view on:

founder market fit

traction strength

quality of GTM thinking

investor momentum

your readiness to raise

This shifts your focus from slides to substance.

Founders who score themselves honestly almost always fundraise faster.

📈 7. Take the 18 Question Startup Assessment

You then complete an eighteen question assessment.

Your results appear instantly and are also emailed to you.

You receive:

a personalised score

a breakdown of strengths and gaps

a narrative explaining why each part matters

a permanent reference for your next raise

This gives you clarity long before speaking to investors — the kind of clarity that compounds with every outreach, meeting and follow up.

🧩 Why I Built This

Founders deserve clarity, not noise.

Most fundraising friction comes from the fact that founders and investors are not looking at the same picture.

When you can see your company through the investor lens, everything becomes more predictable.

A calibrated pitch removes avoidable no’s, accelerates momentum, and opens doors that would’ve stayed closed.

This tool gives you that clarity.

🔐 Get Access to the Full Deck Hack Tool

If you want to run your own deck through the same framework I have relied on for decades, you can access it below.

Keep reading with a 7-day free trial

Subscribe to The Founders Corner® to keep reading this post and get 7 days of free access to the full post archives.