🎯 Why Investors Back Certain Founders: Paul Graham’s Breakdown of What Really Matters

How today’s top founders think, speak, and execute when raising capital.

👋 Hey, Chris here! Welcome to BrainDumps—a weekly series from The Founders Corner. If you’ve been reading along, you know this series is a preview of a bigger project. Well, it’s finally here: The Big Book of BrainDumps is out now!

It isn’t a theory book—it’s the founder’s field manual. Inside, you’ll find 70 powerful frameworks distilled from 30+ years scaling software companies to hundreds of millions in ARR, 20+ years investing in 500+ B2B tech startups, and over $1B of shareholder value created. From raising capital to hiring your first VP of Sales, this book turns scars and successes into practical playbooks you’ll return to again and again. I expect most copies will become well-worn, scribbled on, and dog-eared—because it works.

Every founder dreams of the moment an investor leans forward and says, “We’re in.”

But getting there is never just about your product, traction, or deck — it’s about how you make investors feel about you as a founder.

Paul Graham, the legendary co-founder of Y Combinator, has seen thousands of pitches and backed hundreds of successful startups. His advice on convincing investors is timeless: clear, practical, and deeply human.

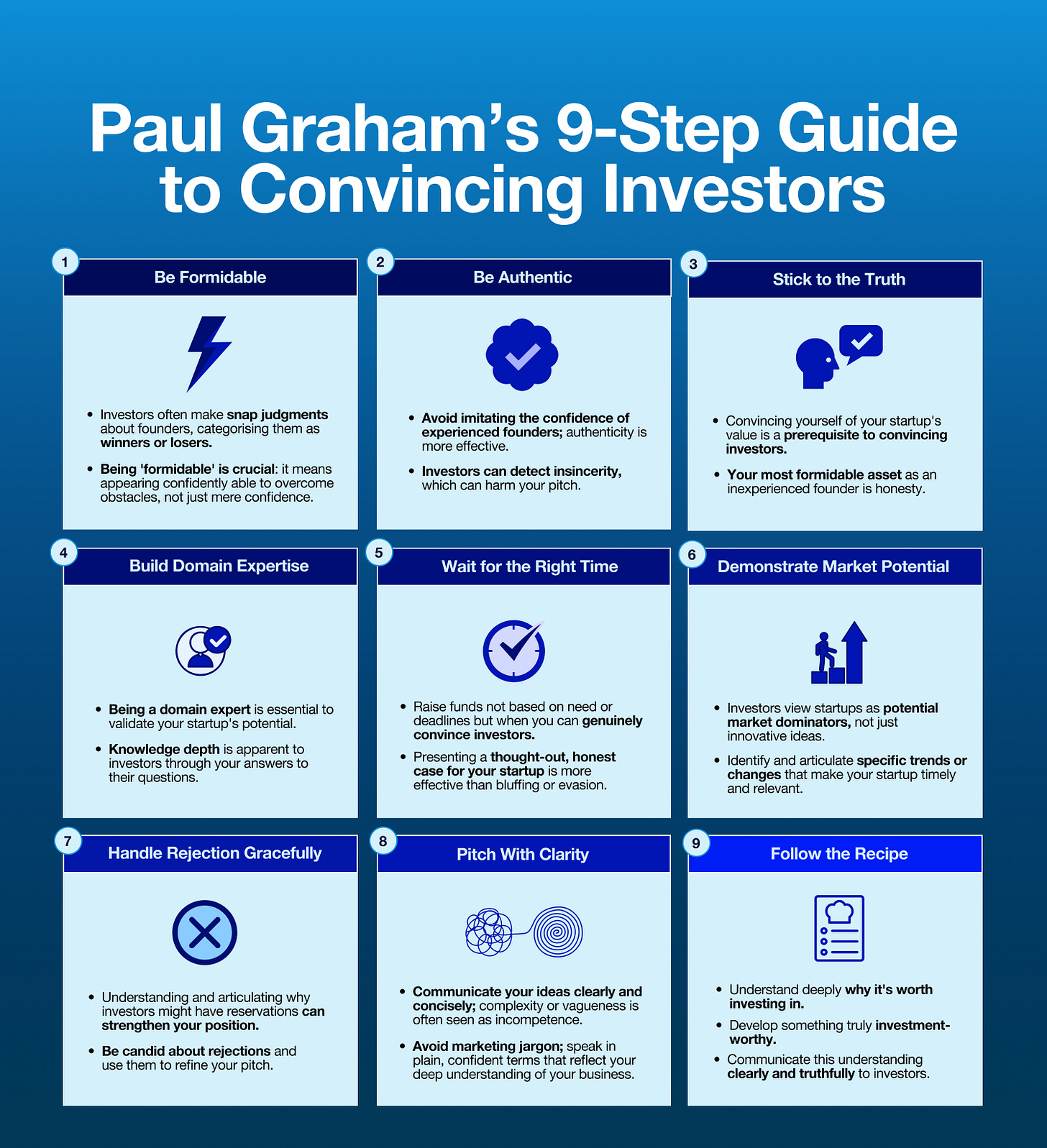

This 9-step framework isn’t just about what to say — it’s about who to be when you’re pitching.

Table of Contents

Be Formidable

Be Authentic

Stick to the Truth

Build Domain Expertise

Wait for the Right Time

Demonstrate Market Potential

Handle Rejection Gracefully

Pitch with Clarity

Follow the Recipe

The Real Message

1. Be Formidable

Investors make snap judgments. Within minutes, they decide whether you’re the kind of founder who can survive the chaos of startup life.

To them, being formidable isn’t about bravado or aggression — it’s quiet strength. It’s the ability to project confidence through clarity, calm, and command of your facts.

When you speak, they’re asking: Can this person hold the line when things get hard?

Being formidable means you don’t fold under pressure — you focus. You answer tough questions with logic, not defensiveness. And when investors sense that calm conviction, they start to believe you might just be unstoppable.

2. Be Authentic

Investors are professional human lie detectors. They meet hundreds of founders, and they can spot insincerity in seconds.

Authenticity doesn’t mean being unpolished — it means being real.

Be honest about what you’ve achieved and where you’re still learning. If something isn’t working, say so and explain what you’re doing about it. Investors don’t expect perfection; they expect honesty.

Authenticity builds trust — and trust is the foundation of every investor relationship.

3. Stick to the Truth

It’s tempting to oversell, to exaggerate traction, to make the future sound closer than it is. Don’t.

Paul Graham’s advice is simple: tell the truth, and tell it well.

Investors are trained to test every claim. They’ll call your customers, check your numbers, and talk to your competitors. One overstatement can unravel everything.

Instead, focus on clarity. If you’ve only just found early traction, say so. Frame your truth with context and momentum:

“We’ve signed five design partners — and each one represents a segment of our go-to-market strategy.”

Realism, delivered confidently, is more compelling than hype every time.

4. Build Domain Expertise

You can’t fake expertise.

When you talk about your market, investors should feel like they’re learning something new. That’s how they know you’re the real deal.

It’s not about jargon — it’s about insight. What do you understand about this industry that others don’t? What unique pattern have you spotted?

The most convincing founders don’t just build in their market — they belong to it. They understand its problems so deeply that their solution feels inevitable.

5. Wait for the Right Time

The best time to raise money isn’t when you need it — it’s when you’ve earned it.

Paul Graham’s rule of thumb: raise when you’ve hit a milestone that proves momentum. That could be revenue growth, customer adoption, or early market validation.

When you raise from a position of strength, you negotiate on your terms. When you raise from need, you give away leverage.

The right timing shows discipline — and discipline signals investability.

6. Demonstrate Market Potential

Investors are in the business of scale. They’re not funding what you are — they’re funding what you could become.

That means showing not just how big the market is, but how you’ll win your share of it.

Don’t just drop a TAM figure. Walk them through the system — your customer funnel, expansion strategy, and compounding advantage.

Help them see your growth story play out like a movie. By the time you finish, they should already be imagining the sequel.

7. Handle Rejection Gracefully

Every founder faces rejection. Sometimes dozens. Sometimes hundreds.

What investors notice isn’t that you got rejected — it’s how you handle it.

The most respected founders take feedback without defensiveness, follow up with progress later, and maintain relationships. Rejection is rarely final — it’s often “not yet.”

A calm, professional response to “no” can turn into a “yes” 12 months later.

Resilience isn’t just a startup virtue — it’s a fundraising asset.

8. Pitch with Clarity

Clarity is the single greatest gift you can give an investor.

A confused pitch is a red flag. If you can’t explain your business clearly, they’ll assume you don’t understand it deeply enough.

Structure your story: problem → insight → solution → traction → opportunity.

Use simple, specific language. Replace buzzwords with examples. Paint the picture, then fill in the numbers.

Clarity doesn’t mean simplicity — it means understanding your business so well you can explain it to anyone.

9. Follow the Recipe

Paul Graham often says that great founders follow a kind of recipe — not because they’re unoriginal, but because the fundamentals work.

Know your metrics. Understand your customers. Build something people actually want. Communicate that clearly.

Fundraising isn’t about inventing a new playbook — it’s about executing the old one brilliantly.

Following the recipe doesn’t make you predictable; it makes you trustworthy.

The Real Message

Paul Graham’s nine-step guide isn’t really about tactics — it’s about presence.

Investors don’t just invest in the business model; they invest in how you think, act, and communicate under pressure.

If you can project confidence without arrogance, speak truth without fear, and lead with both data and conviction — you’re already halfway there.

The rest is just execution.

-Chris Tottman

This is a sharp breakdown of something most founders underestimate. The nine traits Paul Graham outlines are pattern recognition. Investors like me are constantly deciding whether a founder will still be standing when the glamor wears off and the hard yards begin.

From my side of the table, the two qualities that separate the fundable from the forgettable are clarity and calm under pressure. When a founder can explain their business without theatrics, defend their decisions with evidence, and stay steady when the numbers or the questions turn awkward, you start to believe they can survive the parts of the journey no deck ever captures.

One thing I wish more early founders understood is that authenticity is not a style choice. It is the only reliable way to build trust with people who check everything you say. The founders I have backed over the years have all demonstrated the same thing. They told me the truth early, even when it made them look less shiny.

This piece captures that mindset well. Worth reading twice.

The missing key here Chris Tottman shares is investors don't back products– they back founders, and a very certain kind of founder with a very specific set of traits.

Can you be that person?