The Most Dangerous Document a Founder Will Ever Sign

Not because it is complex, but because it looks harmless.

An investor says yes.

A short document lands in your inbox. Three to five pages. A valuation that feels like a finish line after months of pitching, rewrites, and quiet doubt.

Most founders do the same thing next. They scroll straight to the number, feel the rush, and assume the hard part is over.

It is not.

Because your pitch deck gets you the meeting.

Your term sheet decides who controls the company, who gets paid first, and how much of that headline number actually ends up in your pocket when it all ends.

Brought to you by Lindy: Build AI that works, not AI that chats

Most AI tools talk about productivity.

They draft, suggest, and summarise.

Then they wait.

Lindy turns intent into action.

With Lindy, you create AI employees that run work end to end across email, calendar, CRM, Slack, and internal tools. You define the role. Lindy does the work. Meetings get booked. Follow ups get sent. Inboxes get triaged. Systems stay updated automatically.

This is not prompt and wait.

It is execution with triggers, logic, and optional human approval when judgment matters.

Lindy also includes ready made agents, so teams start from proven workflows instead of building from scratch.

For founders and operators who want real output without adding headcount.

Table of Contents

What A Term Sheet Actually Is (In Plain English)

How To Read Any Term Sheet Without Getting Lost

Where Outcomes Quietly Diverge

The Term Sheet Walkthrough

The Top Box (Price, Size, And The Cap Table You Must Demand)

Liquidation Preference (The Line That Decides Who Gets Paid First)

Dividends (Often Ignored, Sometimes Meaningful)

Conversion to Common (What Preferred Really Means)

Anti Dilution (What Happens In A Down Round)

Voting rights, Protective Provisions, And Vetoes

Board Composition (How Control Shows Up In Real Life)

Drag Along Rights (How Exits Can Be Forced)

Founder And Employee Vesting (The Personal Economics)

No Shop Exclusivity (The Leverage Killer)

Common Pitfalls Founders Repeat (Even Smart Ones)

The Founders Corner Framework: The Ten Minute Term Sheet Test

Closing Thought

What A Term Sheet Actually Is (In Plain English)

A venture term sheet is a short document that sets out the major commercial terms under which an investor proposes to fund your company, usually through the purchase of preferred shares rather than ordinary shares.

In the startup ecosystem, your pitch deck is the sales brochure. The term sheet is the structural engineering report. It is where an abstract valuation turns into a legal and economic reality.

It is not the final contract. It is the blueprint the final contracts will be built from.

Most of it is described as non binding. In legal terms, neither side is yet forced to close. In practice, once a term sheet is signed, the deal becomes socially binding. Backing out without a serious reason can damage a founder or investor reputation for years.

A small number of clauses are usually binding immediately. Confidentiality and exclusivity are the most common. That exclusivity clause, often called no shop, is one of the few lines that can change your leverage overnight.

Treat the term sheet for what it really is.

The skeleton of your deal.

How To Read Any Term Sheet Without Getting Lost

Most founders try to read a term sheet top to bottom like a story.

That is a mistake.

Term sheets are not stories. They are systems.

Instead, read it in three passes.

Pass 1: Economics

How money flows on the way in through dilution and on the way out through preferences and conversion.

Pass 2: Control

How decisions get made through board seats, voting rights, and vetoes.

Pass 3: Behaviour

How you and your investors agree to behave over time through vesting, information rights, and exclusivity.

If a clause changes economics, control, or behaviour, it matters. If it does not, it is usually plumbing.

Where Outcomes Quietly Diverge

Here is the part most founders do not anticipate.

You can negotiate a strong valuation and still end up with a weak outcome.

That is because exits do not pay out like a cap table.

They pay out like a waterfall.

And waterfalls are shaped by:

• liquidation preference and whether it participates

• anti dilution mechanics in down rounds

• stacked investor protections across multiple rounds

• conversion rules that decide when preferred becomes ordinary

None of these lines feel dramatic when you first read them. Most look technical. Some feel standard.

But together, they determine whether an exit feels like success or confusion.

Once you understand how these pieces interact, term sheets stop feeling opaque. You can see exactly where leverage lives, where risk accumulates, and where founders quietly give ground without realising it.

That understanding starts with the economics.

The Term Sheet Walkthrough

Section A: The Top Box (Price, Size, And The Cap Table You Must Demand)

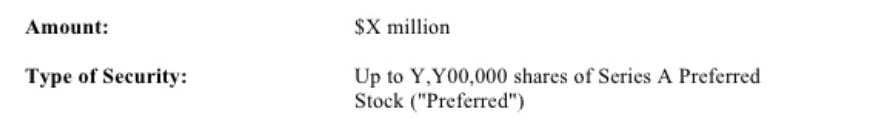

1) Amount Raised / “Purchase Price”

You will see something like:

“The Investors will purchase £X of Series A Preferred Stock.”

This is the cheque size. It is also the size of the new senior claim you are adding to the exit waterfall.

Big rounds are not just dilution. They are heavier preference stacks.

Founder pitfall: optimising for dilution alone and forgetting that every new pound raised usually sits ahead of common shareholders on exit.

2) Valuation (Pre money vs Post money)

Keep reading with a 7-day free trial

Subscribe to The Founders Corner® to keep reading this post and get 7 days of free access to the full post archives.