📖 The Founder’s Guide to Understanding Investors

Why the right investor is more than money—and the wrong one can sink your startup.

👋 Hey, Chris here! Welcome to BrainDumps—a weekly series from The Founders Corner. If you’ve been reading along, you know this series is a preview of a bigger project. Well, it’s finally here: The Big Book of BrainDumps is out now!

It isn’t a theory book—it’s the founder’s field manual. Inside, you’ll find 70 powerful frameworks distilled from 30+ years scaling software companies to hundreds of millions in ARR, 20+ years investing in 500+ B2B tech startups, and over $1B of shareholder value created. From raising capital to hiring your first VP of Sales, this book turns scars and successes into practical playbooks you’ll return to again and again. I expect most copies will become well-worn, scribbled on, and dog-eared—because it works.

Table of Contents

The 4 Investor Archetypes That Kill Startups (Slowly)

So… What Makes a Great Investor?

How to Vet Investors Before They’re on Your Cap Table

Setting the Right Investor Relationship from Day One

Why This All Matters (More Than You Think)

Final Thoughts: Pick Your Investors Like You Pick Cofounders

You can raise the perfect round and still lose.

You can close the biggest VC in your space, get your deck retweeted a hundred times, and still end up building a business you don’t recognise, chasing goals you don’t believe in.

How?

Because you picked the wrong investor.

And in my experience—both as a founder and an investor—this happens far more often than anyone admits.

We spend months obsessing over cap tables, equity dilution, and valuations. But the most important question is usually the one we ask too late:

“Are we actually aligned?”

This BrainDump—The Founder’s Guide to Understanding Investors—is the guide I wish I’d had when I was first raising. It’s not about pitch decks or term sheets. It’s about people. And understanding which investors accelerate your vision… and which slowly poison it.

Let’s start with the ones to avoid.

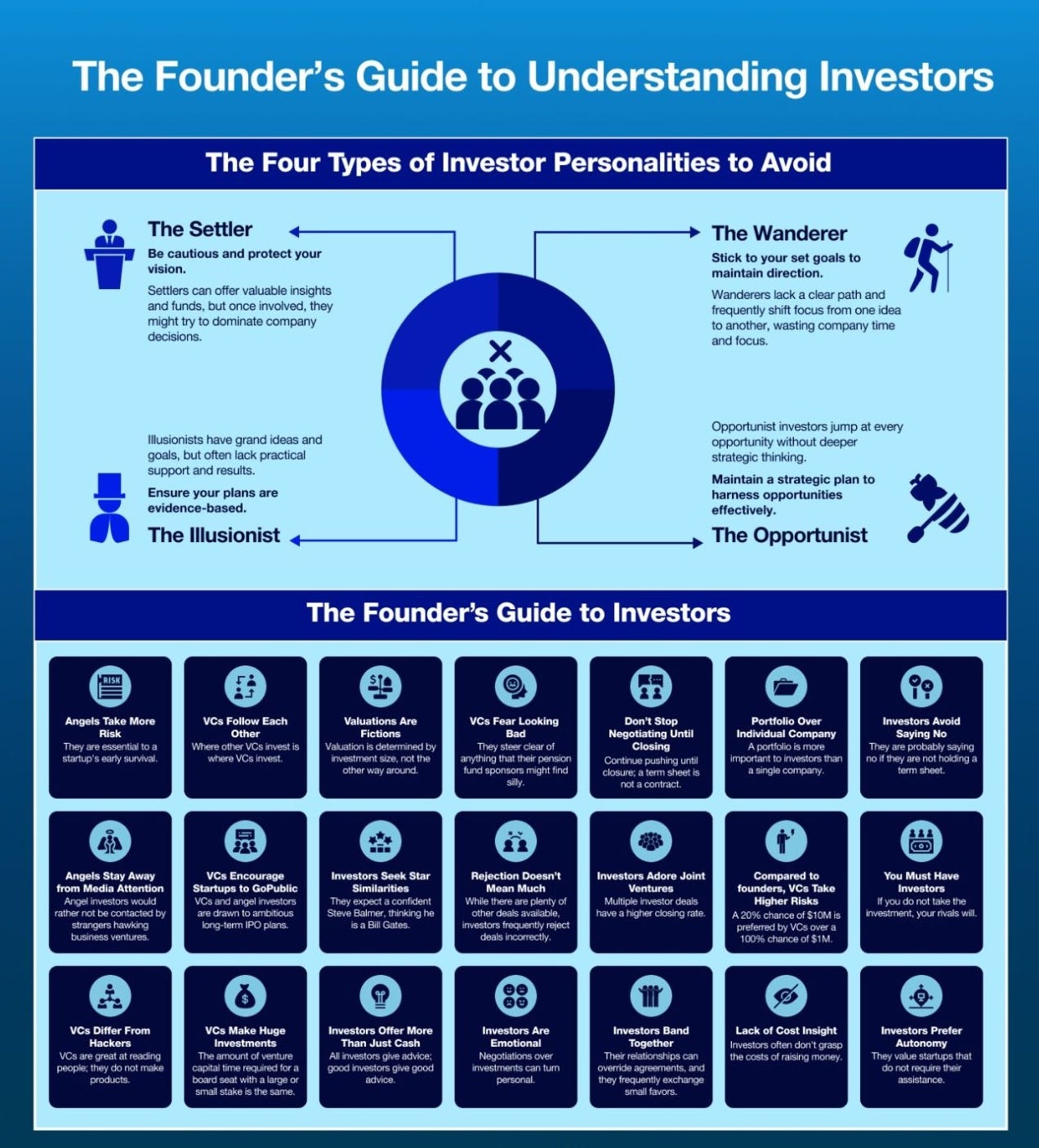

The 4 Investor Archetypes That Kill Startups (Slowly)

Not every bad investor is toxic. Some are just… misaligned. But misalignment can be just as deadly.

1. The Settler

At first glance, the Settler seems perfect.

They’re reasonable. Steady. Conservative. They’ve “seen it all before.”

But here’s the problem: they’re optimised for wealth preservation, not growth.

They’re used to betting on blue-chip companies. Not zero-to-one chaos.

The Settler asks:

“What could go wrong?”

You need someone asking:

“What will it take to win?”

In a fast-moving market—where you have to out-build, out-hire, and out-learn your competitors—a Settler will slow you down. They’ll question every bold move. Vote against aggressive hires. Second-guess pricing changes. And when you most need courage, they’ll advocate for caution.

Founder's Story:

One founder I backed told me their Seed investor blocked their Series A because they thought the valuation was “too aggressive.” The business doubled the next year. The founder exited. The investor missed out. That’s what Settlers do.

2. The Illusionist

This investor feels like a dream.

They’re well connected. Smooth in meetings. “Big believers in your vision.” They promise intros to major clients. They name-drop every VC in the Valley.

But here’s what you learn the hard way:

Nothing lands.

The intros don’t happen. The “help” never materialises. When you hit a rough patch, they vanish.

Illusionists want the vibe of being involved in cool startups. But they don’t do the work. And when it matters most—when you're pitching Series A or dealing with churn—they’re nowhere.

My Rule:

If someone offers the world but doesn’t ask deep questions about your business model, run. The best investors ask the hardest questions. Because they’re actually thinking.

3. The Wanderer

The Wanderer means well.

They show up at the first board meeting. They’re friendly. Maybe even write a nice tweet after your launch.

And then?

Silence.

No follow-up. No strategic input. No questions. No hard truths. Just passive presence.

They’re not hostile. They’re just checked out.

Now look—some founders love Wanderers. “They don’t get in the way,” you’ll hear.

But here’s the risk: when you hit a real wall—and you will—you’ll want someone who can help. Who knows the terrain. Who’s walked this road.

Founder's Story:

I’ve sat on cap tables with 12 investors. Guess who made a difference? The two who actually gave a damn.

4. The Opportunist

Ah yes—the most dangerous of the four.

The Opportunist is always in deal mode. They chase hot trends. Invest in 40 startups a year. They move fast, talk big, and push for “traction at all costs.”

They’ll pressure you to pivot to AI when you’ve just found PMF. They’ll encourage growth hacks that juice short-term numbers but destroy LTV.

Why?

Because they’re optimising for optics, not outcomes.

They want you to look good in their portfolio dashboard. They want to show activity to their own LPs. But they don’t care about your mission. Your culture. Your 10-year plan.

Founder's Story:

One founder I know was forced to cut R&D by 60% to hit short-term MRR goals. They made their numbers. They lost their edge. They were acquired for peanuts.

So… What Makes a Great Investor?

Now that we’ve cleared out the ghosts, let’s talk about the good ones.

The ones who change your business—not just with money, but with clarity, connection, and conviction.

🔍 1. They Ask Hard Questions Early

The best investors aren’t cheerleaders. They’re truth-seekers.

They want to know:

How do you acquire customers?

What happens to retention in month 3?

Why is your CAC rising?

What’s stopping you from doubling next year?

They push. Not to criticise—but to calibrate.

🤝 2. They Align With Your Vision (Not Just Your Valuation)

Great investors back you for where you’re going—not just where you are.

They don’t flinch when your roadmap takes longer. They don’t force exits. They see what you see, and they commit.

🧠 3. They Bring Something Beyond the Cheque

Capital is table stakes.

What else can they offer?

GTM experience

Follow-on investor intros

Early customer access

Hiring support

Emotional resilience

Founder’s Story:

When I was scaling my second startup, our investor helped us land a partnership that 3x’d our ARR. That intro was worth more than their entire investment.

📈 4. They Understand Software Metrics

This one matters.

You want someone who gets:

ARR vs MRR

CAC vs LTV

Net Revenue Retention

Payback periods

Churn drivers

If they ask about “EBITDA” at £20k MRR… you’re in trouble.

How to Vet Investors Before They’re on Your Cap Table

Here’s how founders I respect run diligence on their investors.

✅ Ask for founder references. And not just the successes. Ask to speak to companies that missed their targets. You’ll learn way more.

✅ Watch how they behave in a downturn. Do they support bridge rounds? Help with runway extensions? Or do they go dark?

✅ Gauge their involvement. Ask: “What’s your ideal founder/investor relationship look like?” Their answer tells you everything.

✅ Study their decision-making process. If they ghost for 3 weeks, expect them to ghost when you’re raising Series B.

✅ Look at portfolio concentration. If you’re investment #47 this year… how much mindshare will you really get?

Setting the Right Investor Relationship from Day One

Once you’ve found a good investor, protect the relationship.

Here’s how:

🎯 1. Set Expectations Early

Be clear on what you’ll report, how often, and what support you want. Investors don’t read minds.

📢 2. Communicate With Intent

Don’t just “keep them in the loop.” Bring them into your thought process. Ask for help. Share what’s really going on.

🧩 3. Don’t Hide Bad News

This is a test. If you share the hard stuff and they lean in—not out—you’ve got a real partner.

⏳ 4. Respect Their Time, But Use It

The best investors want to help. Don’t wait until your board deck is perfect. Ask the hard questions when they’re messy.

Why This All Matters (More Than You Think)

In the software world, the stakes are high.

You’re building in a market that moves fast, burns cash, and punishes mistakes. You’re balancing:

PMF

GTM strategy

Pricing evolution

Expansion plans

Talent management

Fundraising cycles

You need capital, yes. But more than that—you need clarity.

And clarity comes from alignment.

The right investor sharpens your focus. Expands your vision. Helps you hold the line when things get noisy.

The wrong one? They’ll distract you. Derail you. Drain you.

Final Thoughts: Pick Your Investors Like You Pick Cofounders

We spend so much time choosing cofounders carefully. But we forget investors are also on the journey.

So ask yourself:

Can I build with them?

Will they challenge me in the right ways?

Do they believe in my mission—or just my market?

Because once they’re on your cap table, you’re tied together for years.

Don’t just take the cheque.

Take the time.

—Chris Tottman

This is such great advice, and perfectly timed for us. We are raising now and looks like we are going to be oversubscribed. Any advice Chris on how to say no to investors that might not be right without making future enemies? They might not be right for the reasons you mention, or just because they don't bring the experience, connections, or future round potential that others might.

Pick your investors like you pick your cofounders, genius line!