The Story No One Is Telling About AI’s Explosive ARR

What happens when the metric everyone celebrates turns out to be the least understood?

Founders don’t like admitting it, but most of us have had the same reaction recently: some of the AI numbers doing the rounds just don’t pass the sniff test. You open a deck claiming $200M of ARR in eighteen months and that familiar feeling kicks in — a mix of curiosity and mild panic — what on earth did I miss?

Then the quieter thought follows: is any of this actually real?

That second question is the one worth paying attention to. Because beneath the excitement, there’s a pattern emerging — companies that look unstoppable at the surface, but far less stable once you examine what’s driving the top line.

And if you’re building in this moment, understanding that difference isn’t optional. It’s the difference between chasing a story… and building something that lasts.

Brought to you by TheCarCrowd – The Investment World’s Best-Kept Secret

Most investment newsletters talk about equities, VC rounds, real estate…

But very few mention the asset class quietly delivering strong long-term returns: collectible cars.

Until now.

TheCarCrowd curates rare vehicles, fractionalises them, and manages everything end-to-end - so you can invest like a collector without needing to become one.

And the tax treatment? Let’s just say some investors are pleasantly surprised.

👉 See the cars currently under consideration.

👉 Learn in 60 seconds how fractional ownership works.

👉 Start building a “passion portfolio” alongside your traditional one.

🧭 Table of Contents

🚨 The AI ARR Mirage

📉 The Problem Isn’t Growth — It’s the Definition of It

⚠️ Why This Distortion Matters

🔍 The Difference Between Volume and Value

🌪️ The Mirage of Momentum

💡 Founders OS: The Control Line

🧩 Where the Strategic Risk Creeps In

🧠 Founders Wisdom

🔚 A Closing Thought

🚨 The AI ARR Mirage

There’s a line founders don’t like hearing but eventually realise is true:

Not all growth is real. And not all metrics mean what you think they mean.

Over the past year, the ecosystem has been flooded with AI startups posting explosive ARR:

$1M to $100M.

$20M to $300M.

$500M in “ARR” in under two years.

It pulls you in.

It makes you question your own velocity.

It makes you wonder whether someone else has discovered a secret channel you missed.

But peel back the layers and a different reality emerges — one that says far more about how AI businesses are being measured than how quickly they’re truly growing.

And it’s this gap — between what’s reported and what’s real — that quietly puts founders at risk.

📉 The Problem Isn’t Growth — It’s the Definition of It

ARR used to mean something very specific.

It meant predictable, contracted revenue that renews because customers can’t live without the product.

It meant the economics of the business were largely under your control.

It meant durability.

But AI has stretched this definition into something almost unrecognisable.

Much of today’s so-called “AI ARR” isn’t recurring software revenue at all — it’s passthrough compute, API volume, human-in-the-loop labour, and operational throughput that happens to sit inside the contract value.

We’ve gone from treating ARR as the gold standard…

to treating it as a flexible container you can pour anything into.

And once the definition bends, the business built on top of it bends too.

⚠️ Why This Distortion Matters

This isn’t a semantic debate. It’s a structural one.

When founders mistake passthrough for true ARR, they start making decisions based on a number that doesn’t actually belong to them.

They hire ahead of their real margin.

They scale GTM on a phantom revenue base.

They price to win volume instead of value.

They raise on a number that can evaporate with a single pricing update from a provider.

Revenue you don’t control is not revenue you can plan around.

And when the compute bill jumps, or a model pricing change lands, or an API rate limit shifts, that reality shows up not in theory but in the P&L.

🔍 The Difference Between Volume and Value

This is the part most founders underestimate.

Volume is activity.

Value is ownership.

AI makes it incredibly easy for those two to look similar — a clean dashboard chart, an impressive topline, a case study built on throughput.

But the economics couldn’t be more different.

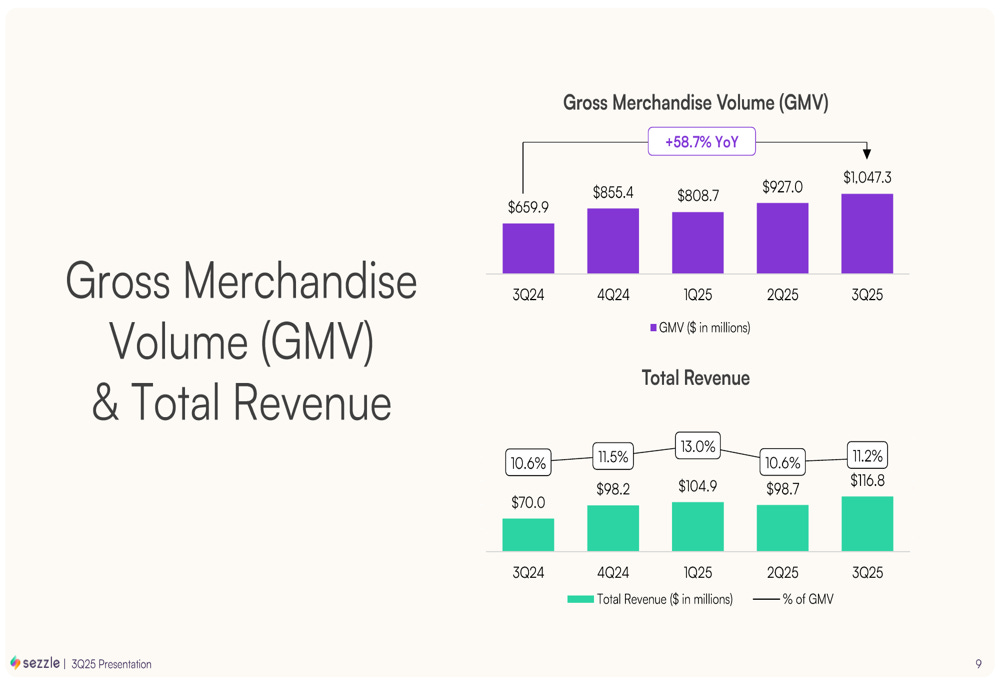

Today’s AI boom looks remarkably similar to the Gross Merchandise Value (GMV) era of marketplaces:

Huge graphs.

Huge hype.

Tiny capture.

If your “ARR” is mostly someone else’s cost structure flowing through your system, then beneath the surface your business is far more fragile than the headline suggests.

🌪️ The Mirage of Momentum

Momentum is intoxicating.

Usage climbs.

Inference explodes.

The revenue graph looks like it’s on performance-enhancing drugs.

But if the bulk of that spike is passthrough, the momentum isn’t yours.

It belongs to the model provider.

To the contractors.

To the infrastructure beneath you.

Founders who lived through the “GMV wars” know this story well.

The metric that looked strongest was often the least predictive of longevity.

We’re replaying a familiar script — only the numbers are bigger and the cycles are faster.

💡 Founders OS: The Control Line

There’s a simple mental model I use constantly: The Control Line.

Above the line is what you own:

your margin, your pricing power, your renewal base, your product’s true defensibility.

Below the line is what you rent:

compute, model access, third-party infrastructure, contractors, and anything that disappears if someone else changes the rules.

The key question:

How much of your ARR sits above the line, not below it?

The less you own, the more volatile your “ARR” becomes.

AI makes growth easy.

It’s control that’s scarce.

And it’s control — not velocity — that determines whether the business survives its own hype cycle.

🧩 Where the Strategic Risk Creeps In

The danger of inflated ARR rarely appears immediately.

It shows up slowly, in the blind spots founders don’t monitor closely enough.

1. Investors Dig Below the Line

Investors have already updated their filters.

They’re no longer asking: How big is the number?

They’re asking: How much of it returns?

How much of it survives provider pricing changes?

How much of it is actually yours to keep?

When a founder can’t answer those questions with clarity, the investor assumes the founder doesn’t understand their own business mechanics.

And that’s a far bigger concern than a smaller ARR figure.

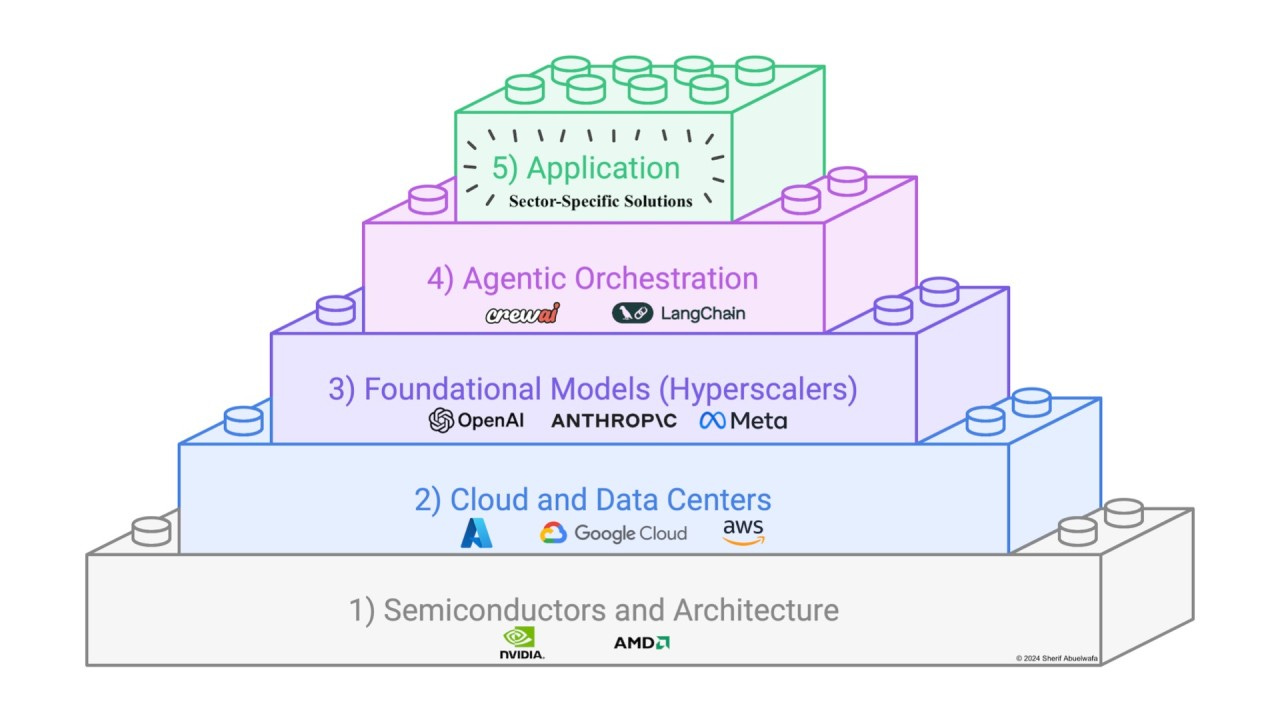

2. Stack Dependency Becomes Fragility

AI businesses are built on layers — many of which don’t belong to you.

Models.

Inference engines.

Vector databases.

Orchestrators.

Human augmentation.

The greater the dependency, the weaker the control.

The weaker the control, the thinner the defensibility.

Dependency is just fragility dressed up as acceleration.

3. Big Numbers Create False Safety

A large top line makes founders feel insulated.

But it’s an illusion.

Customers don’t renew passthrough spend.

They renew value — and only value.

If the basis of your revenue shifts with someone else’s roadmap, you’re not building a business.

You’re renting one.

🧠 Founders Wisdom

One of the Braindumps I wrote a while back — BrainDump #99: The Pitch Iceberg — keeps coming back to me as I’ve watched the AI ARR frenzy unfold.

👉 The Pitch Iceberg

The metaphor is simple: founders obsess over the part of the iceberg everyone can see — the deck, the story, the curve — while ignoring the mass beneath the waterline.

The part that actually keeps the whole thing afloat.

The same pattern is emerging with AI ARR.

The visible number looks spectacular.

But the invisible truth — margin structure, dependency, defensibility, value capture — matters infinitely more.

Eventually, someone looks below the surface.

It might be an investor.

It might be a customer.

It might be the economics of the business itself.

And when that moment arrives, the story only holds if the iceberg is real.

🔚 A Closing Thought

Every hype cycle produces two kinds of founders.

Those who chase the metric.

And those who chase the mechanism behind the metric.

Those who optimise for optics.

And those who optimise for economics.

Those who talk about ARR.

And those who understand what ARR truly represents.

If AI fulfils even a fraction of its promise, the companies being built today will define the decade ahead.

But only if their foundations are real.

Your job isn’t to match someone else’s number.

It’s to build a company that survives long enough for the number to matter.

And that begins with knowing — truly knowing — what your revenue actually is, and what it absolutely isn’t.

Want the full BrainDumps collection?

I’ve compiled all 70+ LinkedIn BrainDumps into The Big Book of BrainDumps. It’s the complete playbook for founders who want repeatable, actionable growth frameworks. Check it out here.

Agree with this post.

My only pushback is that velocity isn’t the enemy, confusion is. Fast growth is fine as long as founders are honest about what they control and what they’re renting. The danger starts when those two blur.

Thanks, Chris, this is an excellent reminder as to why ARR is a poor indicator for real growth in the AI sector. How long do you think the market will continue to ignore the disconnect between revenue growth and actual profitability?