The AI ARR Mirage🤖, Sam Altman on Where AI Is Actually Going🧠, Top Universities for Unicorn Founders🎓

If you're building, investing, or just trying to stay ahead of the curve, you're in the right place. Every week, we break down the latest insights, funding news, and founder-friendly gems. Just what matters. Plus, we track the freshest VC funds deploying capital so you know where the money’s moving.

Let’s get into it 👇

In-Depth Insights 🔍

The AI ARR Mirage 🤖

AI startups are posting massive ARR numbers, but many of those dollars are passthrough cost, not durable revenue. Founders who separate volume from value and control from dependency are the ones building companies that actually last. [Chris Tottman]

How Creandum Won by Betting Early 📈

Conviction at 80 percent certainty beat waiting for comfort as Creandum backed Spotify, Trade Republic, and Lovable before they looked inevitable.

The real edge was doing the hard work others avoided and staying paranoid even after winning big. [Guillermo Flor & Ruben Dominguez]

Sam Altman on Where AI Is Actually Going 🧠

AI is already outperforming experts, but most teams are only using a fraction of what’s available. The real edge is memory, deployment, and rebuilding workflows around agents instead of adding features.

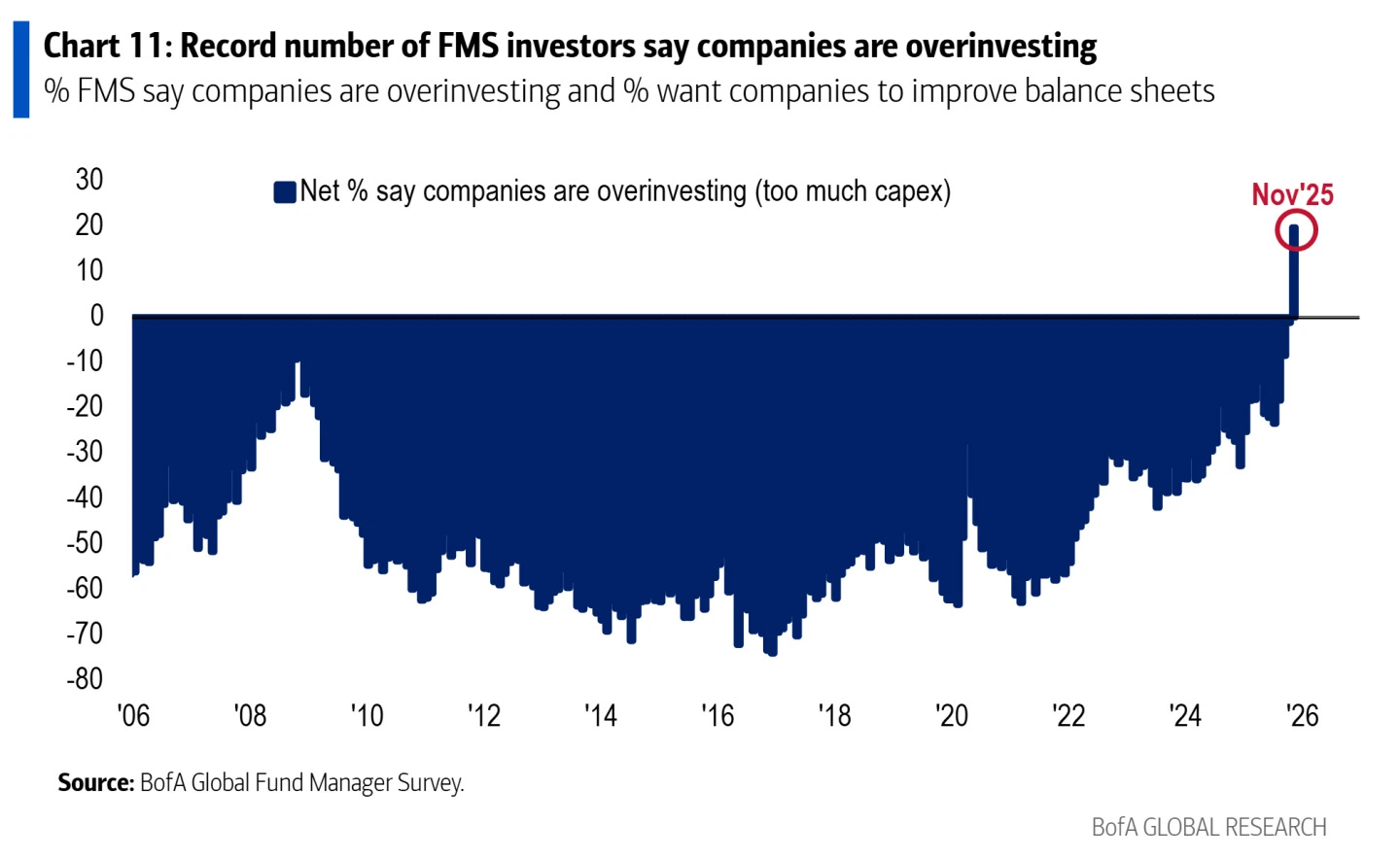

5 Charts Framing the AI Spending Boom 💰

Capital spending on AI is accelerating fast, and fund managers are starting to question whether returns will justify the scale. Public markets are getting cautious while private investors keep paying peak valuations, setting up a real tension worth watching closely. [PitchBook]

Luminar Collapses After Losing Volvo 💥

Luminar bet everything on Volvo and when the automaker walked, the company went from a $3 billion valuation to bankruptcy. Massive upfront investment, hardware risk, and leadership upheaval left no buffer to survive. [Failory Newsletter]

Google’s success comes from picking the hardest problems and empowering teams to solve them. Strategy, discovery, and delivery all run on data, experimentation, and expert-led leadership to build products used by billions. [svpg]

$1–10M ARR Is the Hardest Climb 🛠️

Hitting $1M ARR proves product-market fit, but $1M–$10M stretches focus, structure, and execution. Scaling sales means narrowing ICPs, building repeatable motions, and turning early customers into compounding assets. [Euclid Insights]

Business Has Floods Not Reps 🌊

Experience alone does not prepare you for capital cycles that reset incentives and wipe out fragile strategies. Studying past regimes builds pattern recognition so you can adapt when the rules change and the music stops. [Commoncog]

Trending News ⚡

AI Security Gaps Exposed 🔒

A new report shows that most companies are leaving AI systems wide open to vulnerabilities. Firms are urged to tighten policies and monitoring before small gaps become catastrophic failures. [Business Insider]Apple Fined by Italy ⚖️

Italy slapped Apple with an antitrust fine for allegedly abusing App Store dominance. This marks another push by regulators to hold tech giants accountable in Europe. [Reuters]Big AI Funds Are Shaping Venture Capital 🚀

Venture capital is flowing heavily into AI startups, reshaping funding priorities. Investors now expect founders to deliver AI-driven results faster and at scale. [New York Times]Shield AI Powers Ukraine Defense 🛡️

US startup Shield AI is providing autonomous defense tech to Ukraine. Their AI-driven tools amplify operational capabilities on the battlefield in real time. [Fortune]ChatGPT Wrapped: Your Year in AI 📅

OpenAI launched a 2025 recap showing how users engaged with ChatGPT across platforms. The insights reveal which prompts, features, and trends dominated the AI landscape. [Business Insider]AI Browsers Vulnerable to Prompt Injection ⚠️

OpenAI warns that AI-powered browsers remain susceptible to prompt injection attacks. Security measures and careful usage are essential to prevent malicious manipulation. [TechCrunch]ByteDance to Spend $23B on AI Infrastructure 💰

ByteDance is investing heavily in AI data centers and compute hardware. The move signals China’s ambitions to accelerate AI development and compete globally. [Reuters]Nvidia Targets China with H200 Chip 💻

Nvidia plans to ship its H200 AI chips to China by mid-February. This expands AI compute capacity and strengthens Nvidia’s footprint in the world’s largest tech market. [Reuters]NYT Reporter Sues Google, OpenAI, XAI 📰

A journalist is suing tech giants over the use of his content to train AI models. The case highlights ongoing debates around copyright, consent, and AI data usage. [Reuters]

Fundraising?

If you’re raising a round, Luis Llorens and The Founders Corner can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

Social Media Gems 💎

Google’s Investments That Became Giants 💸

Google has a record of turning early bets into massive wins. From Android to YouTube to DeepMind, its strategic early-stage plays created hundreds of billions in value, showing that disciplined investing beats luck every time.

Jake Paul as a Venture Investor 📈

Jake Paul has quietly delivered one of the best VC hit rates of the last decade. Early access, bold bets, and power-law thinking turned small seed checks into multi-billion dollar outcomes.

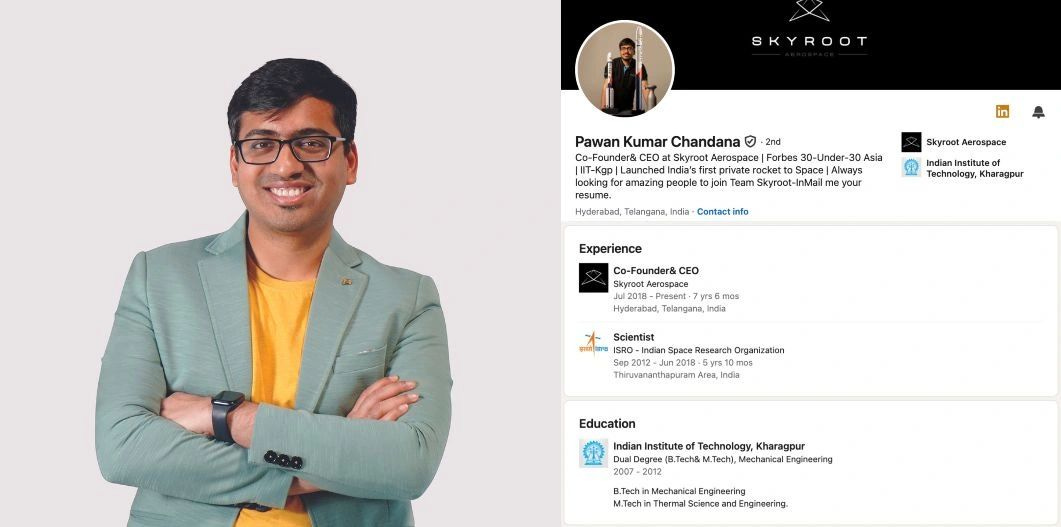

Pawan Chandana’s Space Startup Journey 🌏

From middle-class India to leading the nation’s first private orbital rocket company, Pawan Chandana built a $527M space venture without pedigree or deep capital. Persistence, bold networking, and timing with India’s space reforms turned early struggles into historic milestones.

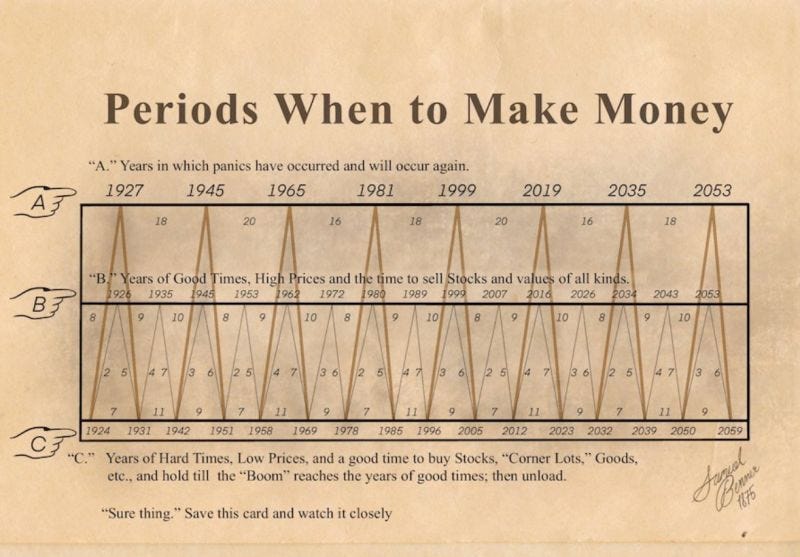

Lessons from a 150-Year-Old Market Chart 📊

This 150-year-old chart by Samuel Benner maps Panic Years, Good Times, and Hard Times, highlighting recurring market cycles. While not perfectly accurate, it offers insights into human behavior and the patterns that drive markets over time.

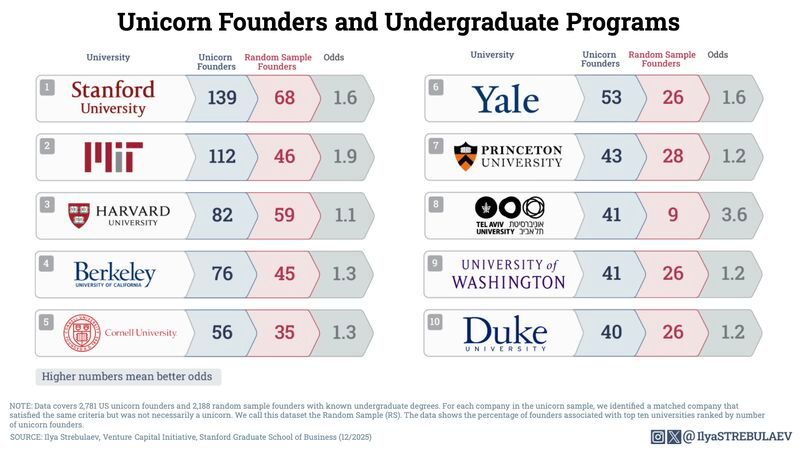

Top Universities for Unicorn Founders 🎓

Undergraduate degrees at Tel Aviv University, MIT, and Stanford significantly boost your odds of founding a unicorn. Data shows Tel Aviv increases chances by 260%, MIT by 90%, and Stanford by 60% compared to typical VC-backed founders. [Ilya Strebulaev]

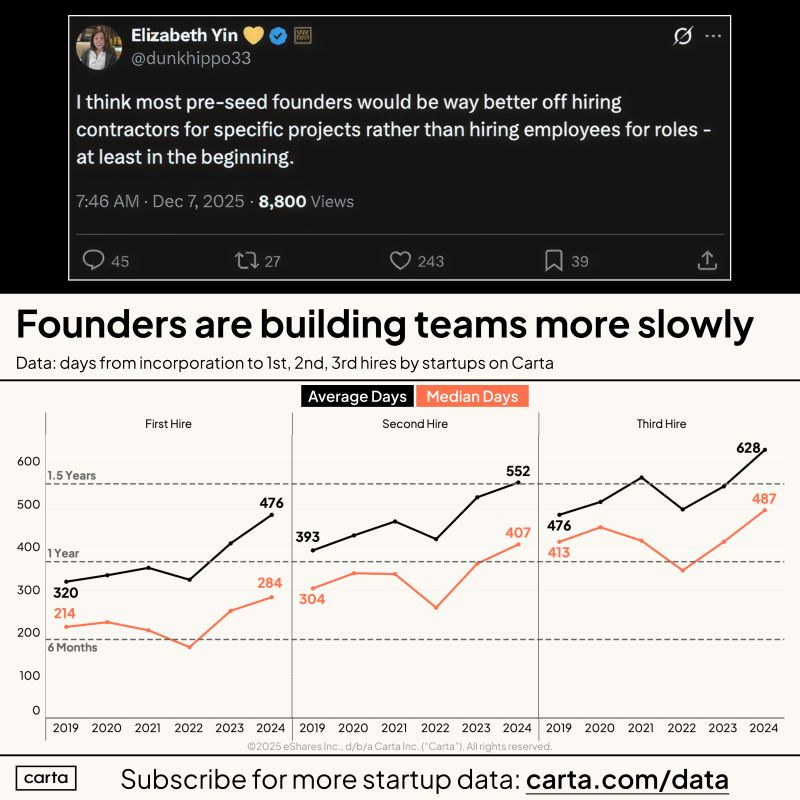

Startup Teams Are Shrinking, Contractors Rising 👥

Startups are hiring fewer full-time employees and leaning on contractors for non-core roles. Engineers remain the first hires as companies focus on lean, flexible teams that move fast in a changing market. [Peter Walker]

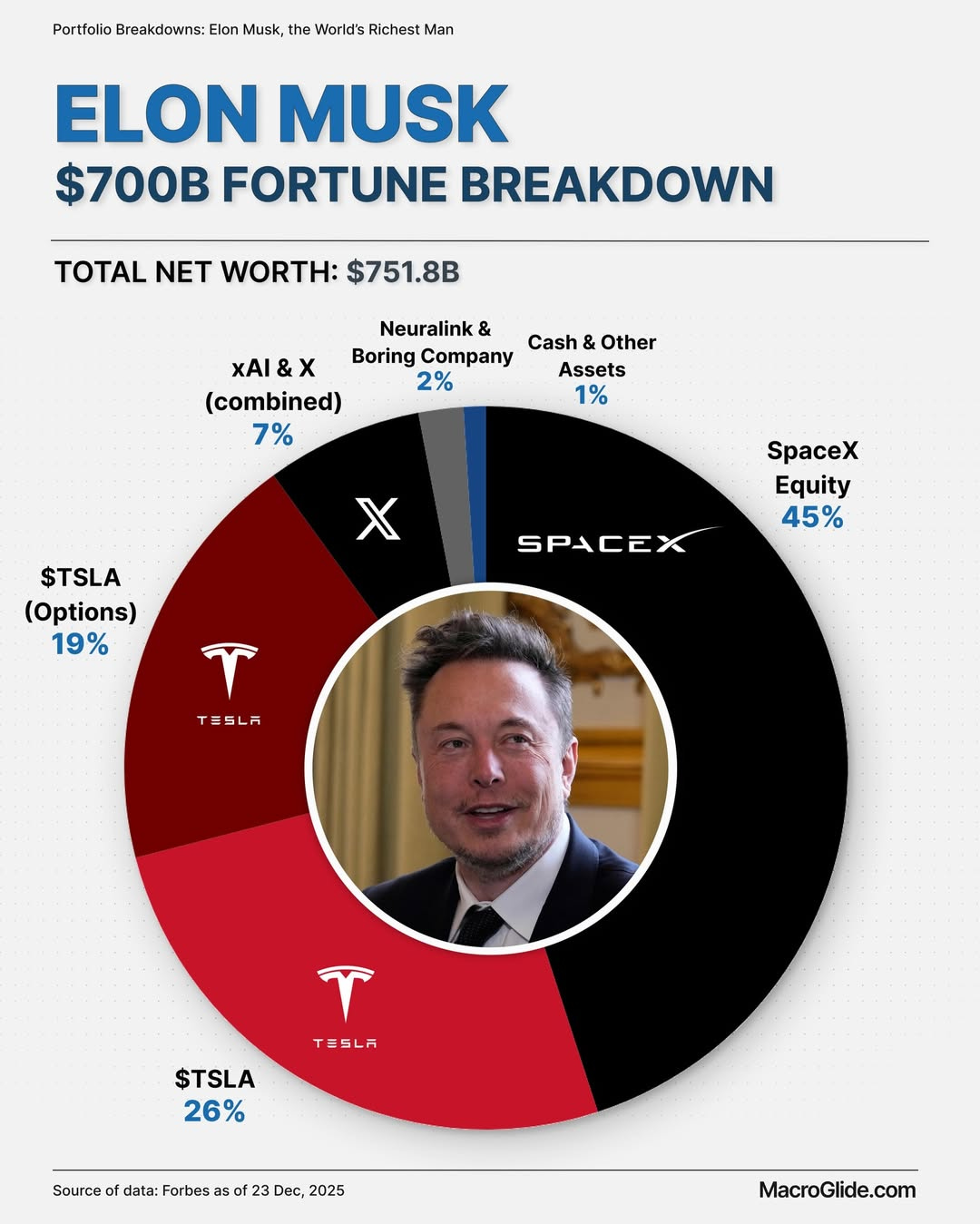

Elon Musk became the first person to reach roughly $751.8 billion in net worth, driven mostly by SpaceX, Tesla, and stakes in xAI and X. This milestone highlights the power of concentrated, long-term bets on frontier technologies. [MarcoGlide]

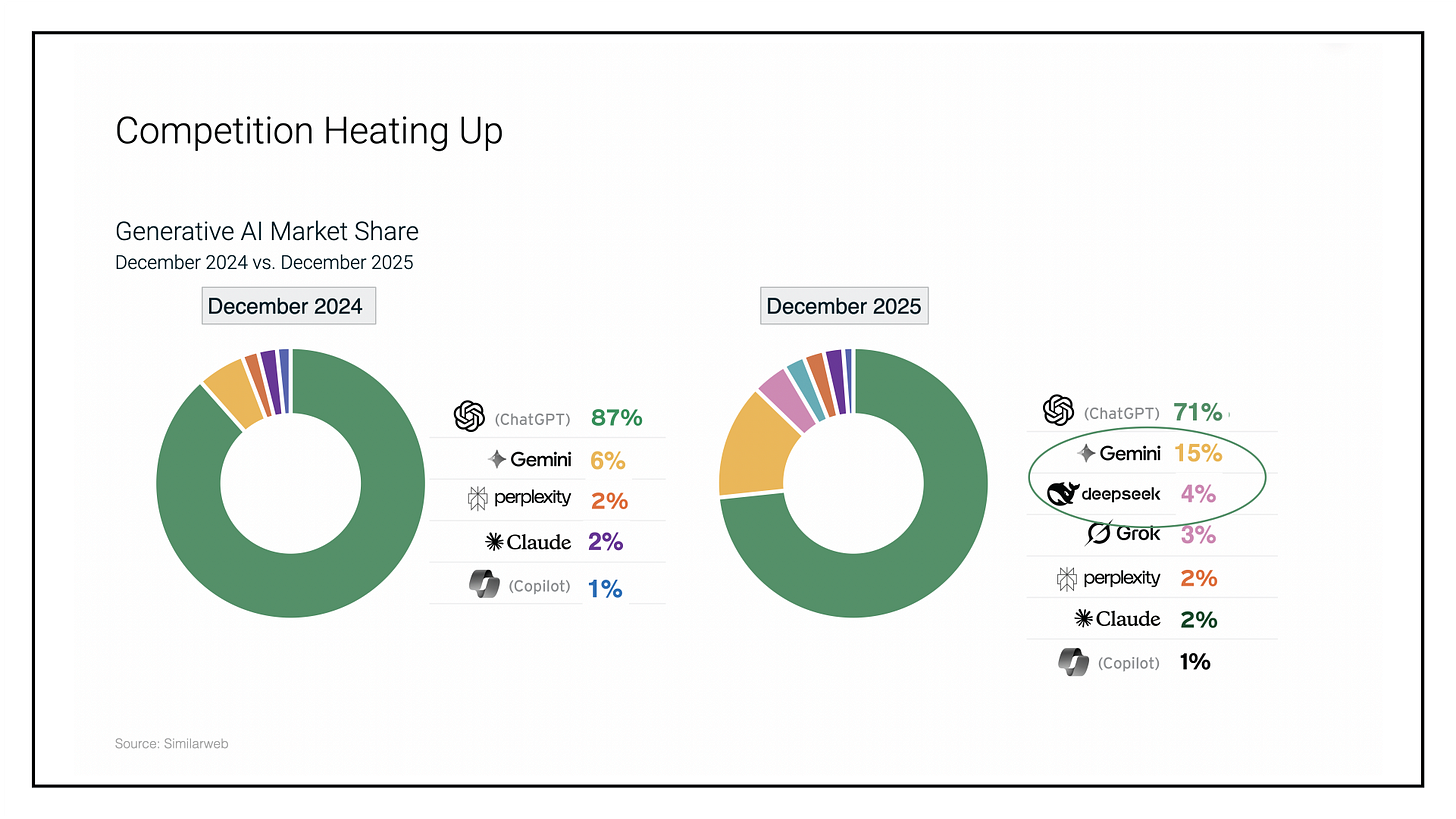

AI Search Market Tightens Fast ⚔️

ChatGPT still leads in generative AI usage, but its share dropped sharply over the past year as rivals gain traction. Google Gemini and emerging players like Grok and Deepseek are accelerating, signaling a shift from monopoly to true platform competition. [Davide Ritorto]

New Funds 💰

Picus Capital Raised €150M from Carlyle AlpInvest to scale global investments across fintech, SaaS, and digital consumer platforms.

Hanoi Venture Capital Fund Hanoi is launching a government-backed VC fund to support technology startups and strengthen Vietnam’s innovation ecosystem.

That’s a wrap for this week.

If you want to stay ahead of the curve, make sure you're subscribed. No fluff, just real startup insights delivered straight to your inbox.

See you next time 🚀