The $100B SaaS Question🧮, 72‑hour workweek🏃♂️, Sam Altman's $1.4T Commitment💸

If you're building, investing, or just trying to stay ahead of the curve, you're in the right place. Every week, we break down the latest insights, funding news, and founder-friendly gems. Just what matters. Plus, we track the freshest VC funds deploying capital so you know where the money’s moving.

Let’s get into it 👇

Brought to you by deel, the All-in-One HR Tool

Simplify global hiring, payroll, and compliance with Deel — the all-in-one platform trusted by 25,000+ companies.

Hire anyone, anywhere, in minutes while Deel handles contracts, taxes, and payments in 150+ countries. Save time, stay compliant, and scale your team globally with confidence.

Book a free 30-minute product demo to see how Deel can transform your global operations 👇

In-Depth Insights 🔍

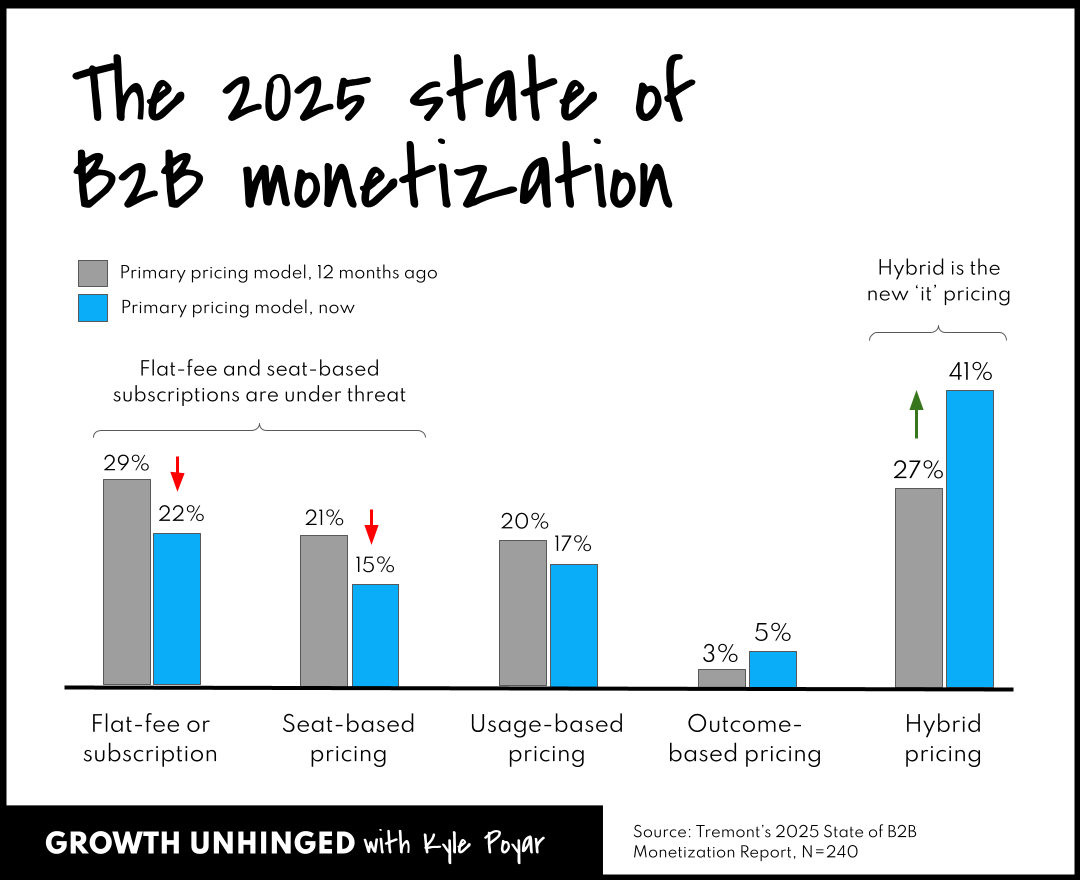

The $100B Question: How SaaS Giants Are Rewriting the Rules of Value with AI in 2025 🧮

AI-heavy workloads are breaking seat-based and flat pricing, pushing leaders toward hybrid metered models and outcome-linked contracts. The piece lays out when to use usage, hybrid, or results-based pricing to align revenue with compute costs and the business impact delivered.

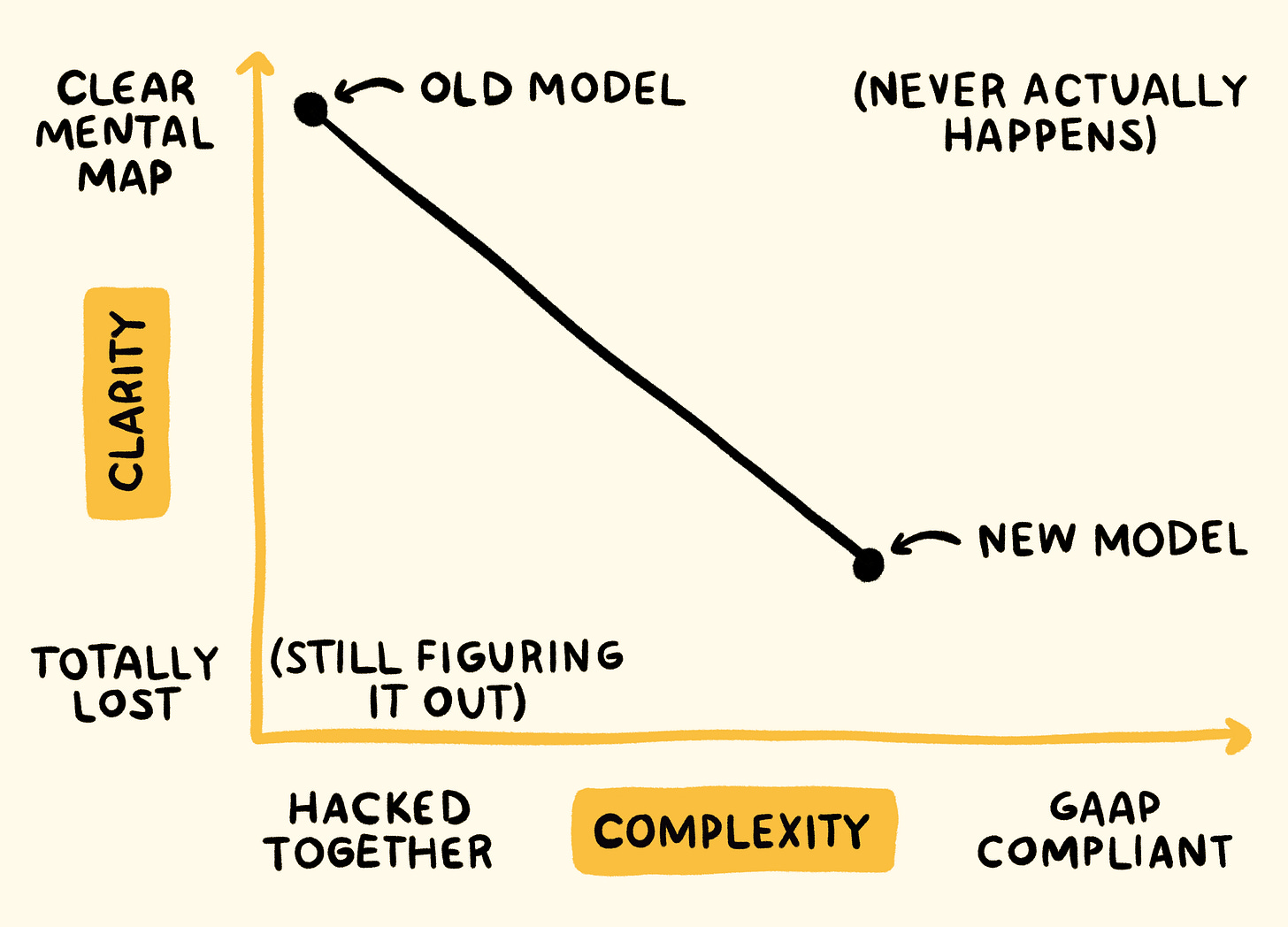

The hidden cost of a “better” model 🧭

Over‑engineered financial models can become rigid “gatekept” artifacts that slow questioning, degrade intuition, and hinder fast scenario exploration. The argument: keep an auditable view for reporting while preserving a simulation you can actively “play” to see cause-and-effect in real time. [Siqi Chen]

How Two Teen Founders Built One of YC’s Hottest Startups: Novoflow 🏥

Novoflow’s teenage co-founders raised $3.1M to deploy multilingual AI agents that handle calls and scheduling directly inside major EHRs, reclaiming lost clinic revenue. Their YC journey spotlights “AI employees” as an operating layer for healthcare back offices rather than another point solution.

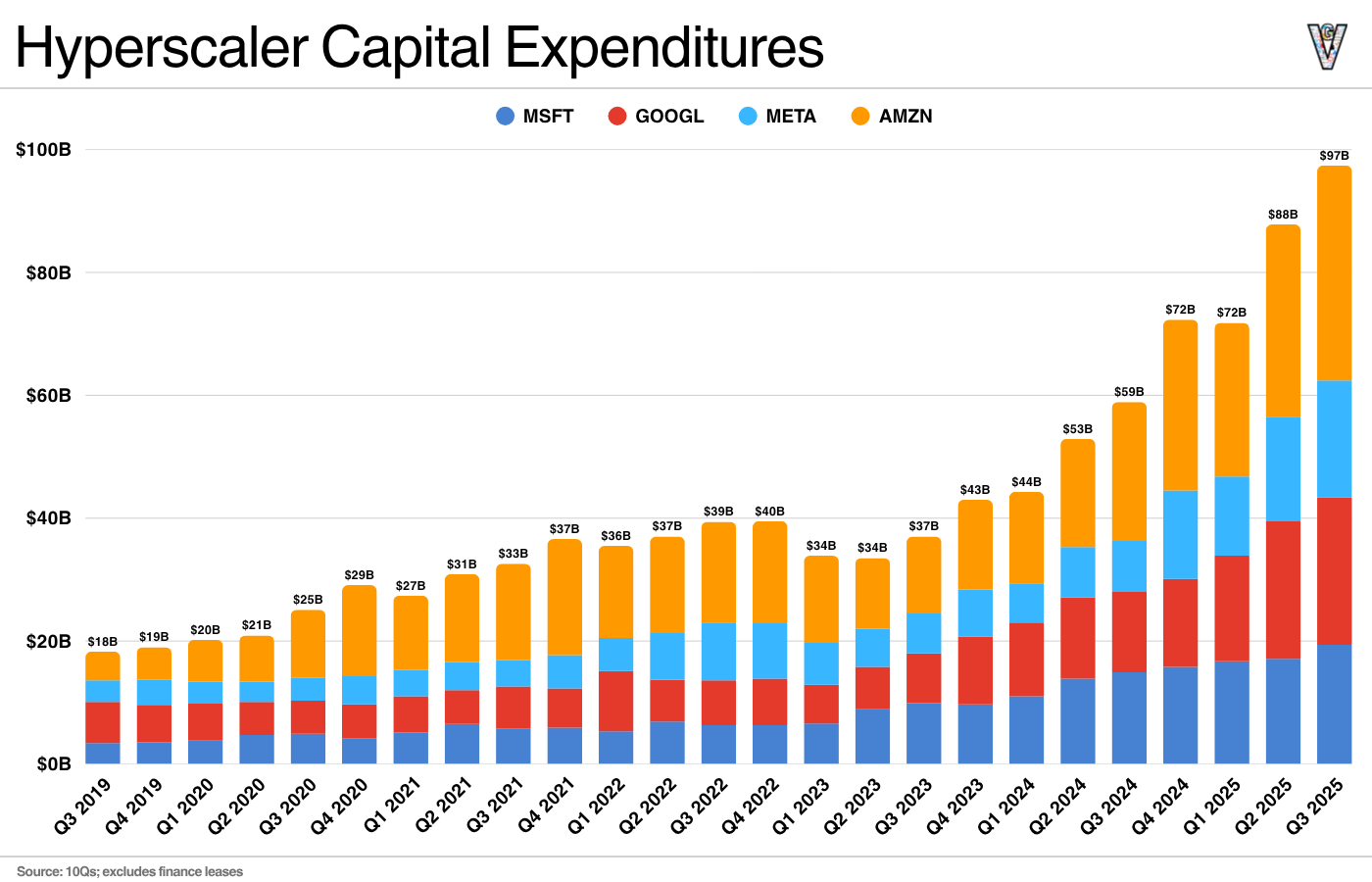

Thoughts on the Hyperscalers (Q3 ’25 Update) 🏗️

Foundation model labs have become the cloud’s most pivotal customers, catalyzing record CapEx and shifting market share via multi‑billion compute partnerships. The analysis weighs backlog, capacity constraints, and unit economics to explain why durable revenue quality now matters as much as raw growth. [Eric Flaningam]

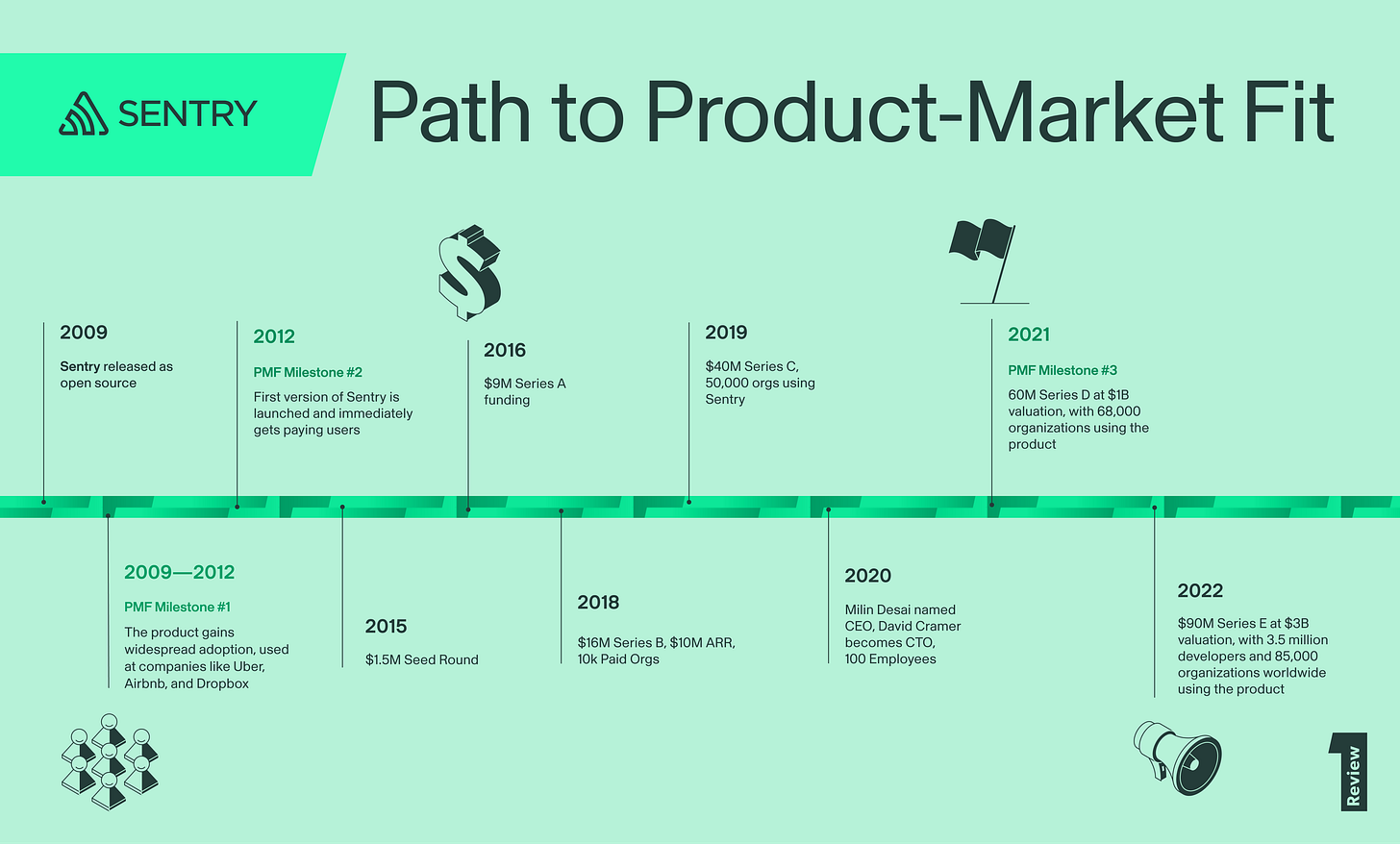

Sentry’s Path to Product‑Market Fit - A High School Dropout Turned an Open‑Source Project into a $3B Company 🧑💻

By weaponizing open source distribution and obsessing over developer pain, Sentry grew from a community tool into a category leader without chasing on‑prem detours. The founder’s playbook emphasizes narrow focus, brand‑forward marketing, and founder‑led sales as trust building rather than feature pitching. [Review - FirstRound]

Why these companies insist on a 72‑hour workweek 🏃♂️

As competition in AI intensifies, some startups are normalizing extreme “996‑style” expectations and hacker‑house routines to accelerate iteration. The story examines tradeoffs in productivity, culture, and sustainability as founders push pace in pursuit of an edge. [The Washington Post]Most Founders Fail Their Pitch in the First 5 Minutes - Here’s Why 🔍

Investors look past polished slides to what sits “below the surface”: customer insight, repeatable go‑to‑market, defensibility, unit economics, and team dynamics. The checklist urges substance over show, with evidence, learning velocity, and candid assumptions turning interest into conviction. [Chris Tottman]

Trending News ⚡

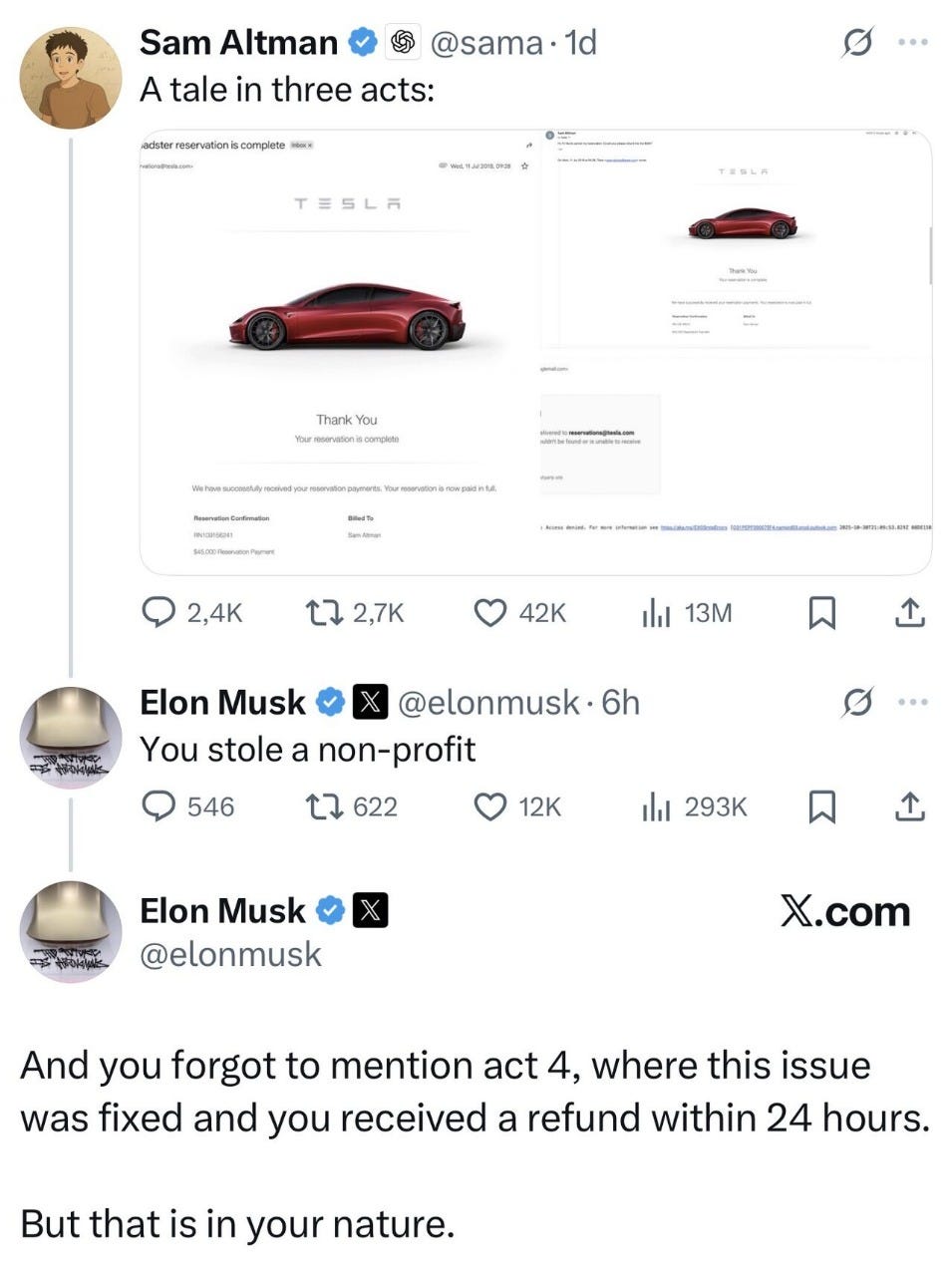

Elon Musk and Sam Altman are still trading jabs over OpenAI 🤖

The latest exchange on X highlights deep rifts over OpenAI’s structure and who deserves credit for its trajectory. Public sparring is shaping narratives for rival AI ambitions and could influence investor and partner perceptions across the ecosystem. [Business Insider]‘Big Short’ investor Michael Burry is back with a bubble warning after 2 years of silence 🐻

Burry returned to X to caution that sitting out euphoric trades can be the best move when speculation runs hot. His stance underscores mounting anxiety around momentum pockets and highlights positioning risks if sentiment turns.IBM cutting thousands of jobs in the fourth quarter 🧑💼

IBM plans a low single‑digit percentage headcount reduction as it prioritizes productivity and reallocates roles toward growth areas. The move tracks broader tech belt‑tightening while automation shifts staffing toward sales and software. [CNBC]Anthropic projects $70B in revenue by 2028: Report 🤖

Aggressive B2B adoption, enterprise partnerships, and cost‑efficient model tiers are driving long‑range revenue and cash‑flow targets. The company is leaning on enterprise integrations and verticalized offerings to deepen usage and margins. [TechCrunch]Global markets snapshot (Reuters link via Google redirect) ⚠️

A pause in the AI rally and profit‑taking across growth names triggered a risk‑off ripple through Asia and U.S. futures. Currency moves and a crypto drawdown added to cross‑asset volatility as traders trimmed crowded bets. [Reuters]Elon Musk’s $878 billion Tesla pay plan wins shareholder approval 💰

Investors endorsed a massive long‑term package tied to ambitious goals spanning autonomy, robotaxis, and robotics. The vote signals confidence in execution while intensifying scrutiny on milestones that must justify the award. [Rubén Domínguez Ibar]

Sam Altman Reveals OpenAI $20B ARR and $1.4T Data Center Commitment Locking AI Scaling Bottleneck 💸

OpenAI’s revenue scale and multitrillion infrastructure plan aim to secure compute availability and reduce unit costs for future products. Vertical integration targets speed and pricing leverage as competition faces capacity constraints. [Rubén Domínguez Ibar]

Fundraising?

If you’re raising a round, Luis Llorens and The Founders Corner can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

Social Media Gems 💎

Andreessen and Sacks on AI ‘leadership’ and EU rules 🏛️

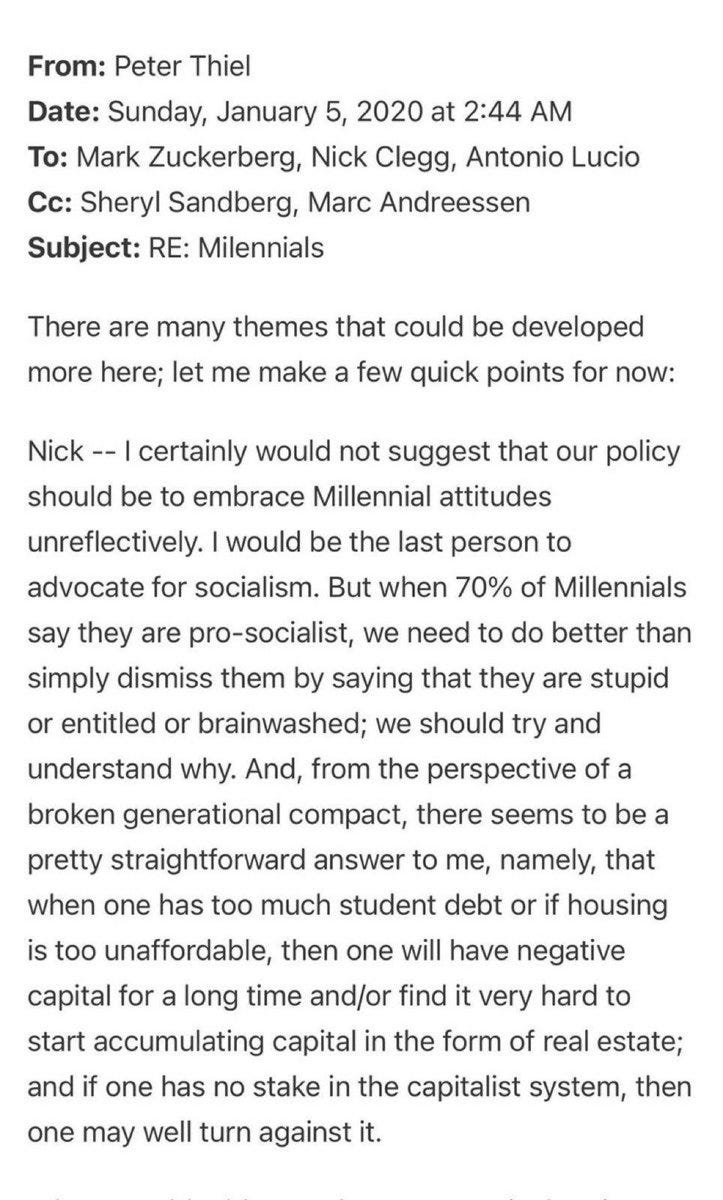

The clip contrasts a compliance-first policy model with a speed-to-innovation mindset for emerging technologies. It argues that over-prescriptive frameworks can blunt competitiveness versus environments that prioritize rapid iteration. [a16z]Chamath shares Peter Thiel’s 2020 email on socialism risk 🎓

The note warns that heavy student liabilities and housing scarcity can keep a generation underwater financially, shifting their political incentives. It suggests that without ownership participation, disillusionment with markets intensifies over time. [Chamath Palihapitiya]

a16z Note: Marc on intelligence and expertise 💬

Marc argues society both undervalues cognitive ability broadly and overweights it within fields that already prize it, missing other drivers of achievement. The takeaway is to treat raw aptitude as one input while elevating execution, judgment, and team dynamics. [a16z]Chart: Google’s vertical AI stack vs peers 📊

The visual maps integration from chips through inference to applications, highlighting one vendor’s breadth across the pipeline. It implies strategic control, distribution advantages, and potential customer lock-in as ecosystems consolidate. [we have the data]

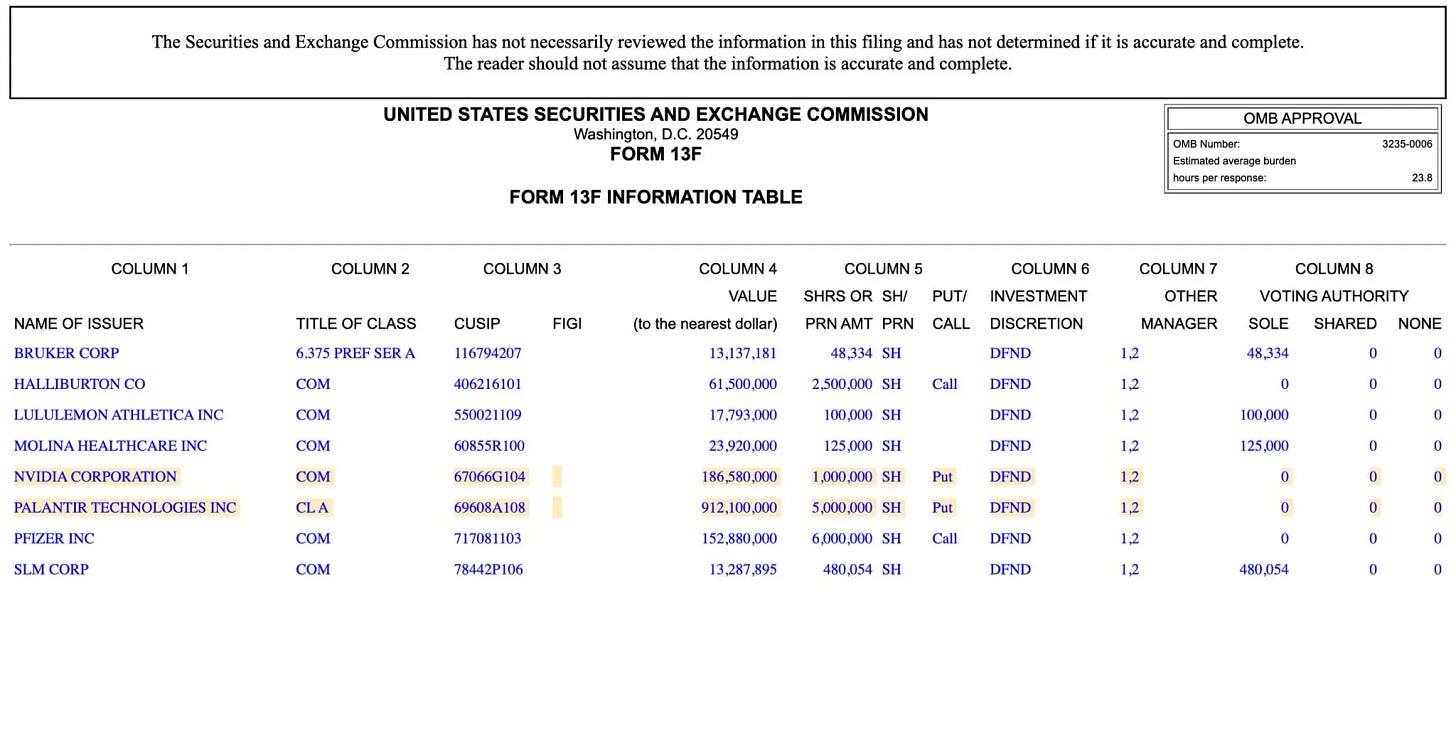

Michael Burry’s big bearish bet on AI bellwethers 📉

A viral thread cites 13F disclosures showing sizable protective positions tied to semiconductor and defense-software names, stoking bubble debates. Commenters question timing, strikes, and notional versus risk, reminding that being early can still be costly. [gorillaalerts]

New Funds 💰

Section Partners closed two new funds totaling $189M, doubling down on growth-stage tech with a sharp operator-first focus.

United Founders launched a pre-seed and seed fund to back emerging European founders before the crowd catches on.

Rubio Impact Ventures raised €70M for its third fund to scale purpose-driven startups tackling climate and social challenges.

Forbion closed the €200M BioEconomy Fund I, targeting biotech and sustainability plays that merge science with market potential.

MVP Ventures reported top 5% TVPI for its $125M Fund II, a strong signal that steady capital and deep diligence still win.

CMT Digital closed $136M Fund IV to invest in crypto infrastructure and digital asset innovation.

UKG Ventures launched UKG Ventures, the new corporate venture arm from HR leader UKG focused on early-stage worktech startups.

That’s a wrap for this week.

If you want to stay ahead of the curve, make sure you're subscribed. No fluff, just real startup insights delivered straight to your inbox.

See you next time 🚀

Given OpenAI's struggles with API and developer market share hard to justify their AI infrastructure debt and plans. You almost have to feel sorry for Oracle and SoftBank at this point because you don't need to read the tea leaves to see what's going to happen. Unless they replace the CEO soon with a professional CEO I predict mighty struggles ahead.

Súper excited to see how Burry’s new big shorts playout. $1.1B

I agree with him but not sure I would bet 80% of my portfolio on a specific timeframe 🤣