🚀 Before You Pitch: The Negotiation Secrets Investors Don’t Want You to Know

Avoid the traps investors never mention — and keep control of your company as you scale.

👋 Hey, Chris here! Welcome to BrainDumps—a weekly series from The Founders Corner. If you’ve been reading along, you know this series is a preview of a bigger project. Well, it’s finally here: The Big Book of BrainDumps is out now!

It isn’t a theory book—it’s the founder’s field manual. Inside, you’ll find 70 powerful frameworks distilled from 30+ years scaling software companies to hundreds of millions in ARR, 20+ years investing in 500+ B2B tech startups, and over $1B of shareholder value created. From raising capital to hiring your first VP of Sales, this book turns scars and successes into practical playbooks you’ll return to again and again. I expect most copies will become well-worn, scribbled on, and dog-eared—because it works.

Raising capital isn’t just about convincing someone to back your idea — it’s about negotiating the kind of partnership that shapes your company’s next five years.

And while most founders focus on valuation, the truth is, the way you negotiate matters more than the number you land on.

Fundraising is about balance — ambition with realism, confidence with curiosity, and persistence with patience. Negotiation sits right at that intersection. Get it wrong, and you risk giving up too much control too early. Get it right, and you set the foundation for sustainable growth and aligned investors who’ll stand beside you when things get tough.

Let’s unpack the key skills and mental models that separate great negotiators from desperate ones.

Table of Contents

Know Your Valuation Language: Pre-Money vs Post-Money

Profile Your Investors Before You Pitch

Master Your ESOP Strategy

The Lowball Response Strategy

Build Trust Through Transparency

Don’t Let the Clock Dictate the Deal

The Term Sheet: Where Real Control Lives

Prepare Like It’s a Final

The Ladder of Proof: How Investors Justify Value

Confidence Without Arrogance

Closing Thought

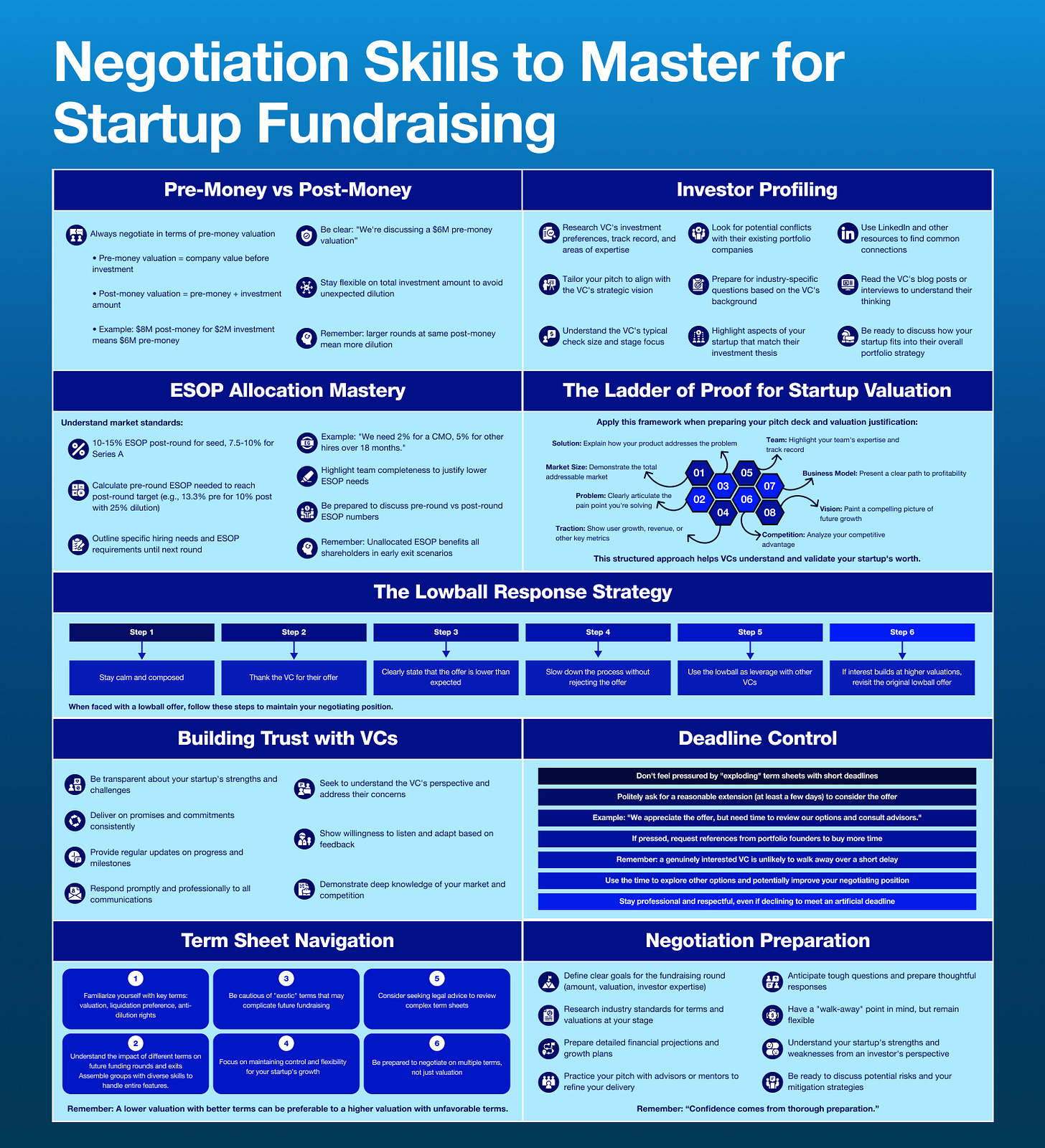

1. Know Your Valuation Language: Pre-Money vs Post-Money

One of the easiest ways to lose control of your equity is through simple misunderstanding.

Pre-money valuation is your company’s value before investment. Post-money valuation is after. If your pre-money is £4M and you raise £2M, your post-money valuation is £6M — meaning investors now own 33%.

Always frame your negotiations in pre-money terms. It keeps the conversation clean and avoids dilution confusion.

The valuation math may be simple, but the implications are huge. It determines how much of your company you’re giving away — and how much leverage you’ll retain in the next round.

2. Profile Your Investors Before You Pitch

Not all money is equal.

Every investor has a pattern — the kind of companies they back, cheque sizes they prefer, sectors they understand, and timelines they expect for returns. The best founders research these patterns before ever sitting down at the table.

If you understand what drives an investor’s decision-making — their thesis, portfolio gaps, and internal politics — you can position your pitch as the solution they’re looking for, not just another opportunity.

Use LinkedIn, Crunchbase, and industry networks. Talk to other founders they’ve funded. Find out how they behave post-investment.

You’ll enter the negotiation with insight instead of guesswork. And when you understand their agenda, you can align it with yours.

3. Master Your ESOP Strategy

Your Employee Stock Ownership Plan (ESOP) isn’t just an HR tool — it’s a negotiation lever.

Investors expect you to have one. It shows you’re thinking about talent retention and long-term culture. But here’s the trick: investors often want the ESOP pool created before their investment — meaning it dilutes you, not them.

Plan for it early. Market norms suggest a 10–15% pool. Make sure you’re clear on:

The size of the pool pre- and post-round.

Who it’s meant for (senior hires or future team growth).

How it impacts the cap table after the round.

Walk into every funding meeting with a clear ESOP plan. It shows you’re professional, prepared, and thinking about building a company — not just a product.

4. The Lowball Response Strategy

Every founder faces it sooner or later — the lowball offer.

It’s deflating, sometimes insulting. But it’s also a test.

Your reaction tells the investor more about you than your deck ever could.

Start by staying calm. Thank them for the offer. Then, anchor your response around data and conviction:

“We appreciate the offer. Based on comparable SaaS valuations and our traction — £600K ARR, 10% month-on-month growth — we believe a pre-money closer to £5M better reflects our position.”

Avoid defensiveness. Avoid desperation. Low offers are often used to gauge your confidence and discipline.

And remember: sometimes the offer isn’t bad — it’s feedback. If multiple investors land in the same valuation range, use that signal to reassess your expectations.

Negotiation isn’t about pride. It’s about alignment.

5. Build Trust Through Transparency

Founders who negotiate best don’t rely on tricks — they rely on trust.

Investors back people they believe will be open when things get messy. Transparency builds that belief.

Be honest about challenges and vulnerabilities. Deliver on small promises — send the follow-up, hit the milestones, communicate updates promptly. These small signals compound into credibility.

When trust builds, investors become allies, not adversaries. And when you have allies, terms get better naturally.

6. Don’t Let the Clock Dictate the Deal

Deadlines are one of the oldest power plays in venture capital. “We’re closing this week.” “Term sheet expires in 48 hours.”

Don’t bite.

Time pressure is designed to make you emotional. A rushed founder makes mistakes.

If you need more time, ask for it professionally — and use that breathing room strategically. Strengthen your position by continuing parallel conversations with other investors.

Remember: the investor already wants in. If they didn’t, they wouldn’t be negotiating.

Calm beats speed every time.

7. The Term Sheet: Where Real Control Lives

Valuation headlines look impressive. But the terms determine your future.

Watch out for clauses like:

Liquidation preferences – who gets paid first if things go wrong.

Anti-dilution rights – protection mechanisms for investors in down rounds.

Board control – how much say investors have in your decisions.

A slightly lower valuation with fair terms can be far healthier than a high one tied to restrictive governance.

If you’re unsure, get advice. A few hours with a good startup lawyer can save you years of regret.

8. Prepare Like It’s a Final

Negotiation is 80% preparation, 20% conversation.

Before entering the room, know your numbers cold:

Target raise

Minimum acceptable valuation

Equity to give up

Non-financial goals (e.g., network, expertise, intros)

Anticipate hard questions. Rehearse objections. Align with your co-founders on non-negotiables.

Because when you’re clear on what you want — and what you’ll walk away from — the power balance shifts instantly.

9. The Ladder of Proof: How Investors Justify Value

Investors climb a mental ladder when valuing your company:

Idea

Product

Traction

Revenue

Profitability

Scalability

Defensibility

Each rung represents proof. The higher you are on the ladder, the stronger your negotiating position.

So, when in doubt, move one rung higher. Show evidence — not hope. Data is the ultimate leverage.

10. Confidence Without Arrogance

Finally, remember that negotiation isn’t confrontation. It’s collaboration.

Investors are not enemies — they’re future partners. The goal isn’t to win; it’s to align.

Be confident, but not combative. Firm, but flexible. Visionary, but grounded.

A negotiation done right ends with both sides feeling they got a fair deal — and excited to build something together.

Closing Thought

Fundraising isn’t just a financial transaction — it’s a reflection of how you lead.

Every conversation, every term, every clause tells a story about how you think, plan, and protect your company’s future.

If you can master the art of negotiation — balancing clarity with conviction, empathy with assertiveness — you’ll do more than raise money. You’ll earn respect.

And in this world, respect compounds faster than capital.

—Chris Tottman

So much value packed in here, Chris.

"6. Don’t Let the Clock Dictate the Deal" - it's applicable in any business context, they should really teach this in business schools

This reminded me of watching a team build a campfire, each person convinced their spark is the one that will catch.

Everyone means well, but without rhythm and a shared plan, the flame never quite takes.

In my world with the 5 Voices, most of these mistakes show up when stress hits.

Pioneers push harder.

Guardians over-question.

Connectors over-promise.

Creatives retreat into ideas.

Nurturers carry the emotional weight of the team.

When a founder understands their voice pattern under pressure, it changes the way they fundraise and the way they show up in those high-stakes rooms.