Side Projects That Win🛠️, Founder-Led Content✍️, Seeing the Exit Early👀

If you're building, investing, or just trying to stay ahead of the curve, you're in the right place. Every week, we break down the latest insights, funding news, and founder-friendly gems. Just what matters. Plus, we track the freshest VC funds deploying capital so you know where the money’s moving.

Let’s get into it 👇

In-Depth Insights 🔍

9 Side Projects Worth Building 🛠️

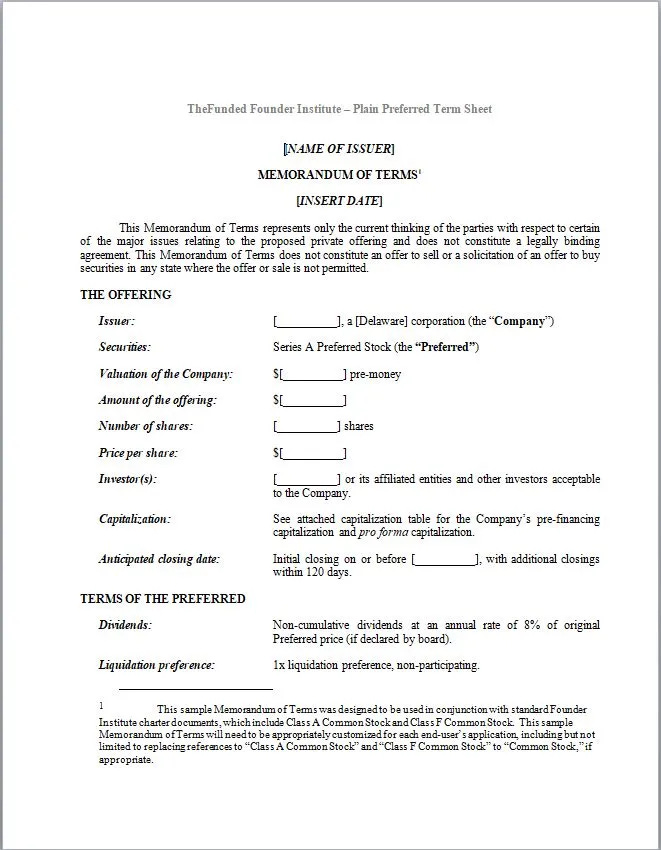

A practical list of business ideas designed for smart builders who feel stuck choosing what to work on next. Each concept favors execution over complexity with clear paths to monetization through focus, consistency, and taste. [Ben Lang]The Most Dangerous Document a Founder Signs ⚠️

Term sheets define control, payouts, and leverage long after the valuation glow fades. This breakdown shows how small clauses shape exit economics, power dynamics, and the ultimate outcomes for founders. [Chris Tottman]

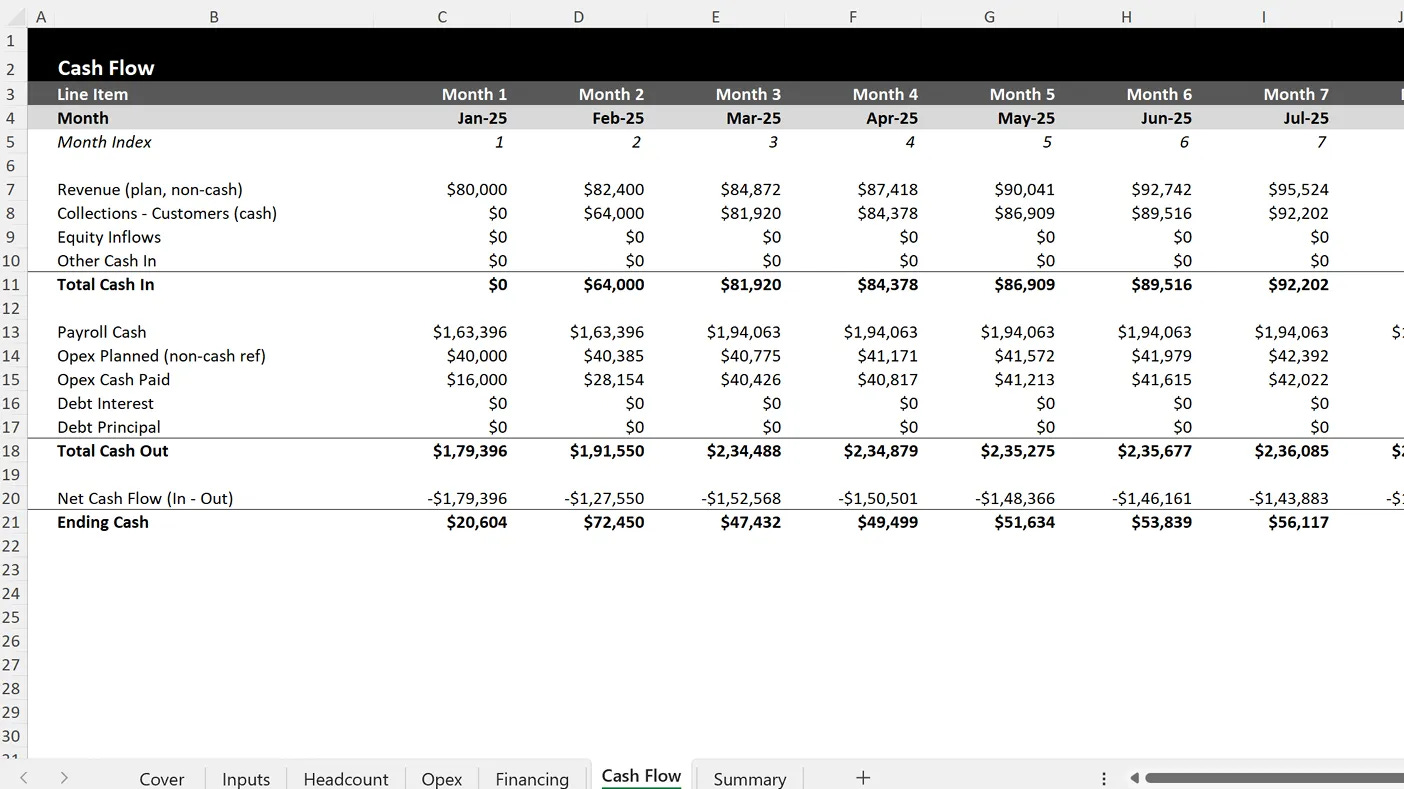

The Cash Runway Model Every Founder Needs 💰

A practical, scenario-ready financial model shows exactly how long cash will last and which levers extend it. It translates hiring plans, burn, and fundraising into one clear source of truth for better decision making.

Founder Led Content Wins in 2026 ✍️

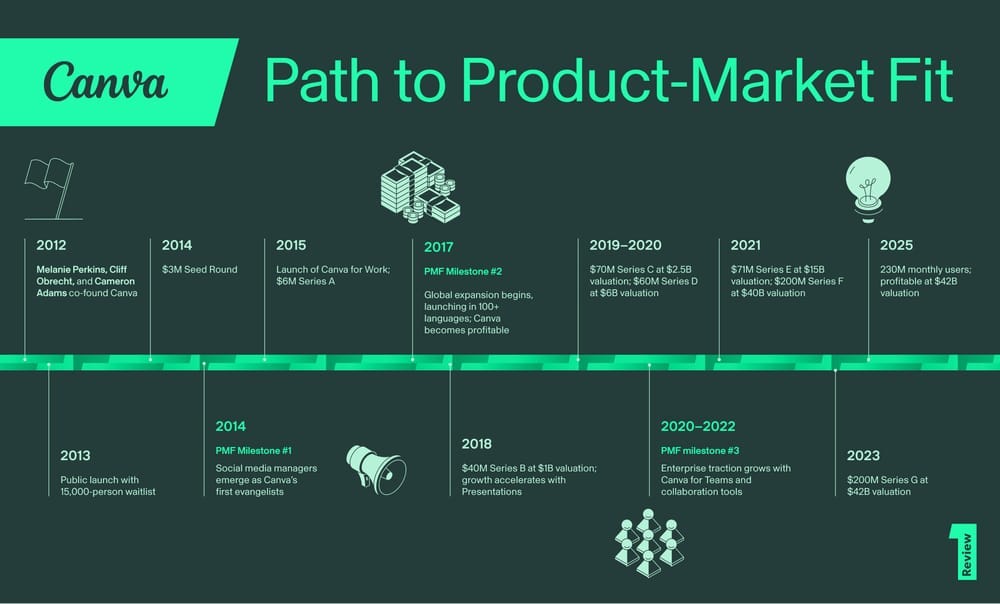

Consistent, opinionated posts from founders now outperform company pages for reach, trust, and pipeline. This guide explains how to write with insight, build repeatable systems, and turn content into long-term leverage. [Peter Wong]How Canva Found Product Market Fit Early 🎨

A fast founder bet, relentless prototyping, and early evangelists turned a simple idea into a global platform. This case study highlights how intuition, community, and execution unlocked scale long before the $42B valuation. [review]

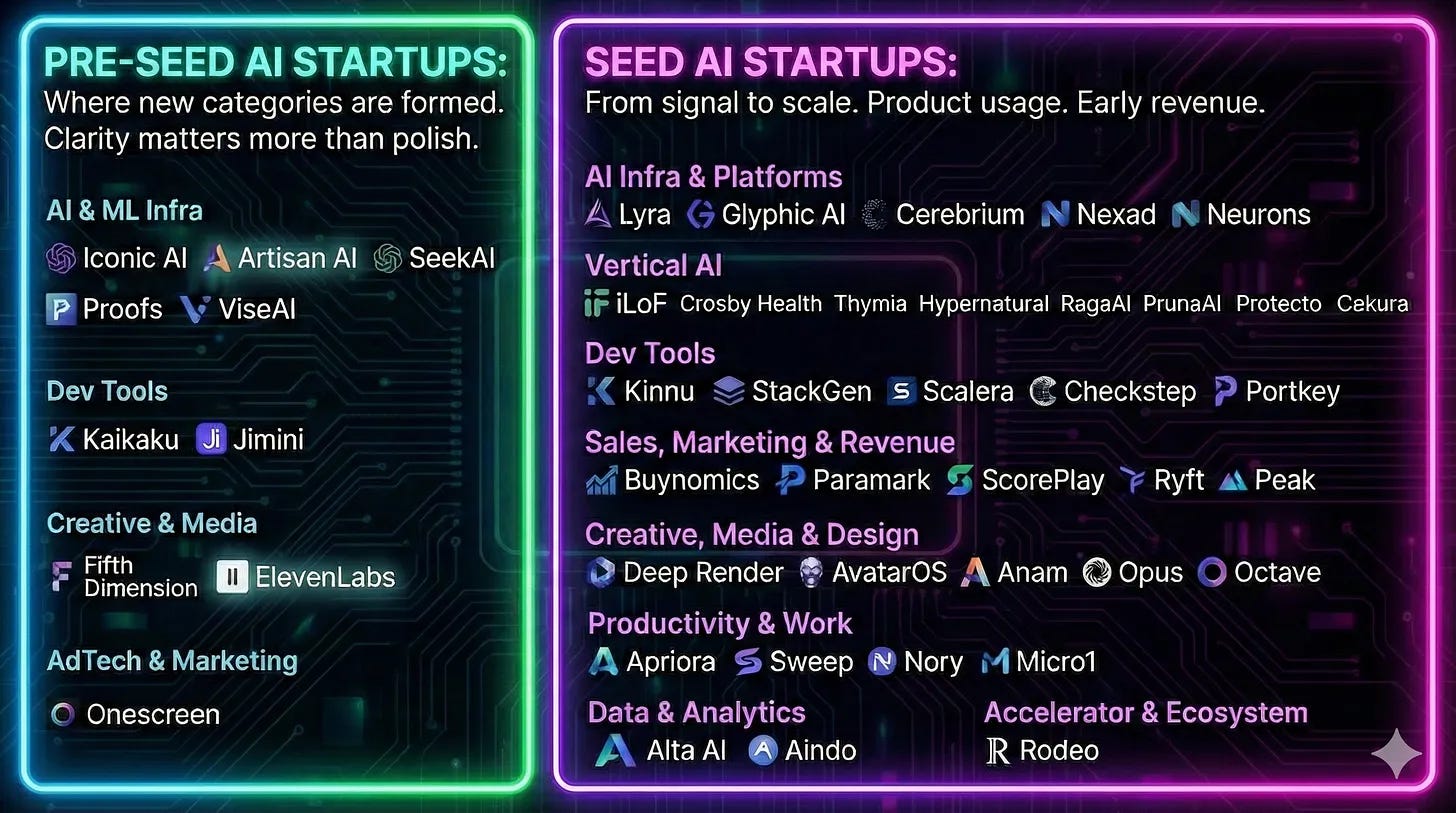

AI Startup Decks Worth Studying Right Now 🤖

A curated library of real Pre Seed and Seed AI pitch decks shows how founders explain moats, data, and distribution. These examples provide insight into how top teams communicate value before outcomes are obvious and capital is easy.

How Serious Builders Work With Claude 🧠

A practical guide demonstrates how founders and operators use Claude for sustained thinking, iteration, and real decision making. Learn the workflows, prompts, and systems that turn Claude from a chatbot into a daily co-worker that compounds value over time.

Seeing Your Exit Before It Happens 👀

Ownership, dilution, and fundraising decisions quietly shape what founders actually take home. This guide breaks down exit math, investor incentives, and paths that preserve meaningful ownership for founders. [Chris Tottman]

Trending News ⚡

AI Agents Scale Up 📞

Parloa’s $350M Series D signals a major acceleration in enterprise adoption of AI for customer service workflows. As capital concentrates around fewer winners, the focus shifts from pilots to deeply contextual, multi-channel agent systems at global scale. [TechCrunch]BlackRock’s Scale Keeps Expanding 📈

BlackRock has surpassed $14T in assets under management, driven by record inflows and resilient revenue growth. Demand for ETFs, private markets, and infrastructure shows how capital keeps consolidating around global platforms with unmatched reach. [Eddie Donmez]Compute at Industrial Scale 🧠

OpenAI’s $10B multi-year deal with Cerebras highlights how raw compute is now a defining constraint in AI leadership. With 750 megawatts coming online by 2028, the race is shifting toward faster inference and infrastructure built specifically for AI workloads. [TechCrunch]Google Is the Operating System of the Internet ⚙️

Google no longer just competes on the internet, it underpins nearly every layer that allows it to function. From models and compute to search, devices, maps, ads, and commerce, Google controls the rails of digital life. [Linas Beliūnas]Claude for Everyone ✨

Anthropic’s Cowork tool brings Claude Code capabilities to non-technical users through a simple desktop experience. By safely reading and editing files inside a defined folder, Claude becomes an everyday productivity partner without command-line skills. [TechCrunch]Musk vs Altman Heads to Trial ⚔️

A federal judge has scheduled an April trial for Elon Musk’s fraud case against Sam Altman and OpenAI. The dispute centers on OpenAI’s shift toward profit, with Musk alleging mission drift and Altman defending governance decisions. [Business Insider]Meta Builds Its Own AI Backbone ⚡

Meta is aggressively moving to control the infrastructure layer behind its long-term AI ambitions. With Meta Compute, Zuckerberg is betting that energy scale, custom silicon, and owned data centers create durable advantage. [TechCrunch]McKinsey’s Agent Workforce Goes Mainstream 🧠

McKinsey has added 25,000 AI agents alongside 40,000 humans in under two years, redefining headcount itself. Consulting is becoming a hybrid human and machine operation, reshaping delivery models, talent needs, and competitive dynamics. [Business Insider]Controversy as Strategy 🔥

Marc Andreessen argues that being outspoken and polarizing creates a powerful edge in venture capital. Clear public convictions attract founders who value bold thinking, clarity, and decisiveness over quiet capital. [Business Insider]Apple Bets on Gemini for Siri’s AI Future 📱

Apple is integrating Google’s Gemini models into a rebuilt Siri, deepening a multi-year alliance between rivals. The deal expands Gemini’s reach across Apple devices while pushing OpenAI into a secondary, opt-in role. [Reuters]

Fundraising?

If you’re raising a round, Luis Llorens and The Founders Corner can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

Social Media Gems 💎

Founder Confidence on Full Display 💰

Airwallex CEO Jack Zhang is taking $70M in personal debt to buy shares in his own $8B company. Co-founders are doing the same, showing confidence backed by personal financial exposure. [Founder Mode]Bezos’ Morning Blueprint for Smart Decisions ☕

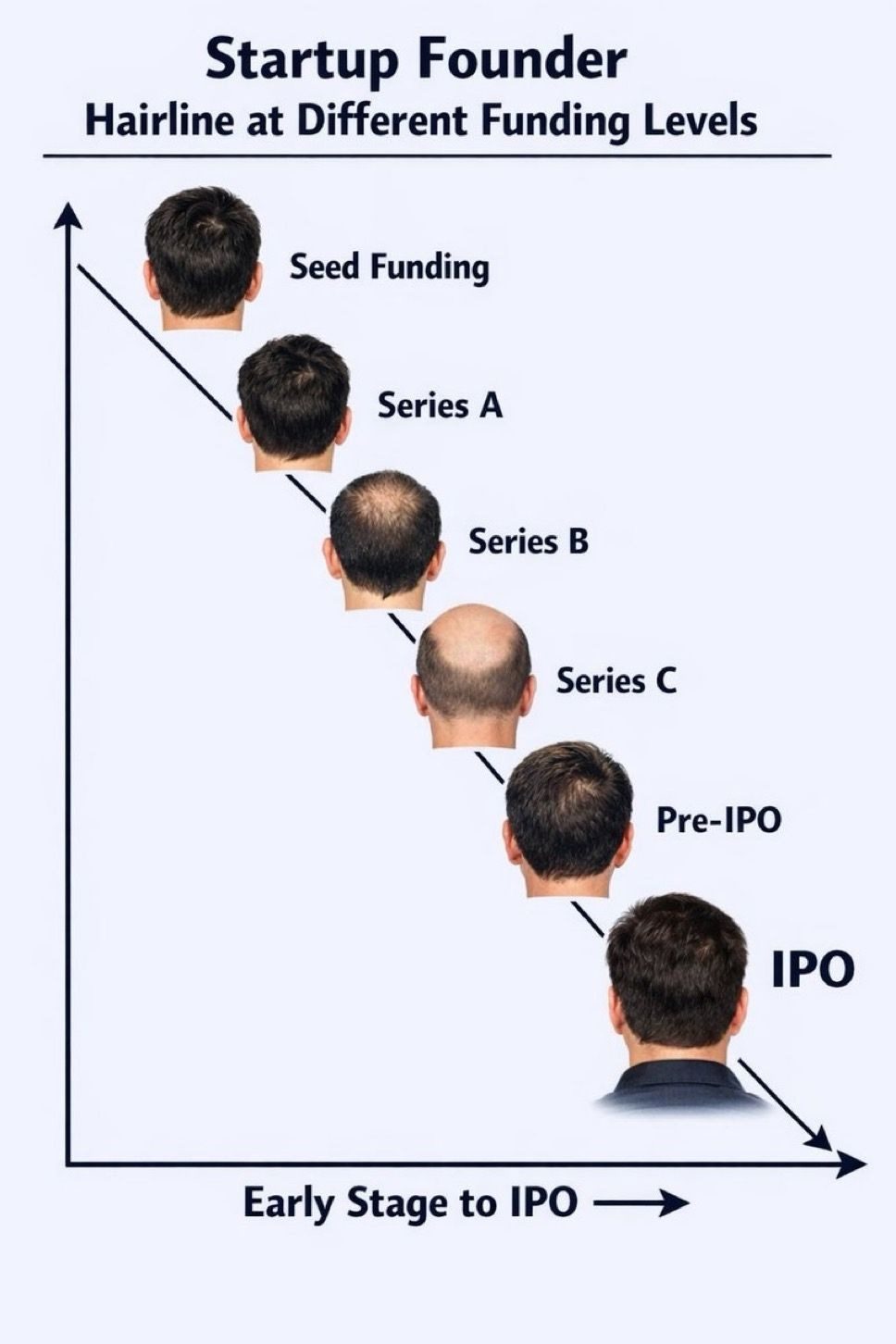

Jeff Bezos structures his mornings to protect energy for the day’s most critical decisions and preserve focus. By limiting choices early, he ensures that his attention remains on a few high impact actions that define leadership effectiveness. [Marcus Köhnlein]The Startup Stress Curve 😰

As funding rounds grow, stress compounds quietly even when metrics like revenue and growth are strong. By the time companies reach IPO, performance is high but founders often pay a heavy price in peace of mind. [Michael Jackson]LLMs Are Crossing the Chasm 🤖

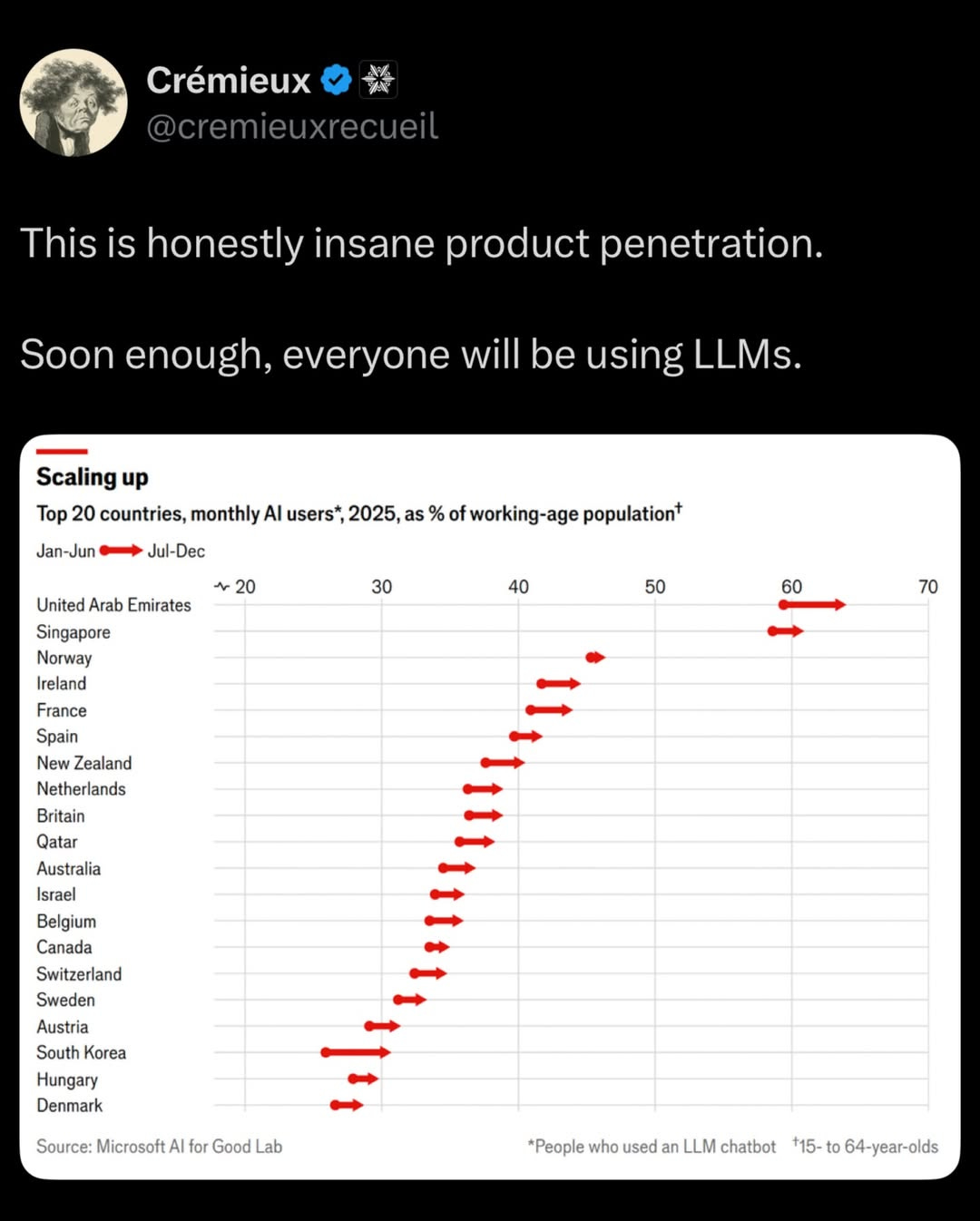

Large language models are moving from niche applications to mass market adoption at unprecedented speed. Several countries are already racing ahead, demonstrating how mainstream and habitual usage transforms industries. [wehavedata]The Djokovic Rule for Long Term Excellence 🎾

Sustained advantage comes from genuinely enjoying the repetitive core of the work rather than relying on talent alone. Over time, consistency driven by passion cannot be outperformed by intensity or short term grind. [Sahil Bloom]Europe’s Innovation Gap Is a Policy Choice 🌍

Europe produces world class companies despite limited capital and political backing, showing the potential that exists under constraints. If governments and investors commit more boldly, these firms could compete globally and reshape long term economic growth. [Carles Reina]2026 Will Redefine Tech’s Power Centers 🚀

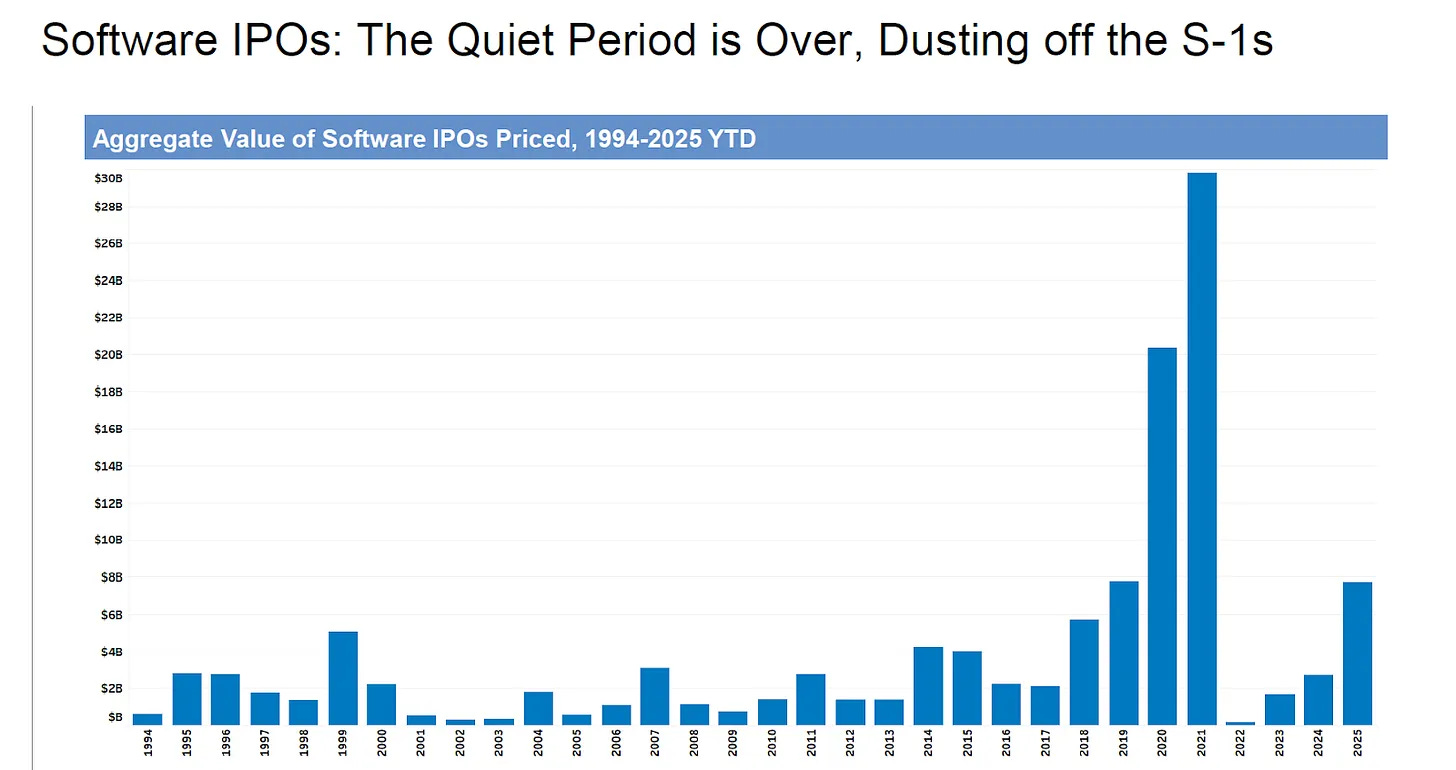

Public markets are reopening with IPOs, mega acquisitions, and defense technology taking center stage again. AI is shifting from models to embodied systems and continual learning, setting the stage for the next wave of strategic advantage. [Janelle Teng Wade]The Question That Keeps Builders Moving 🔥

Lasting drive comes from curiosity, not external outcomes, when work becomes a way to explore what is still unanswered. Purpose persists when effort is tied to expanding possibility rather than simply accumulating rewards or recognition.

New Funds 💰

Andreessen Horowitz, raised $15B across five funds spanning AI, growth, infrastructure, and American dynamism themes.

Catalio Capital Management, closed its second credit fund at over $325M, focused on life sciences financing.

TrueBridge Capital Partners, raising up to $275M for a direct fund targeting mid- to late-stage technology companies.

Dharana Capital, closed a $250M second growth fund to support scalable businesses in emerging markets.

Semcap Food & Nutrition, closed its inaugural $125M fund dedicated to food, nutrition, and health-focused investments.

Arkin Capital, closed a $100M fund targeting biotechnology and life sciences opportunities.

Rosberg Ventures, closed Fund III at $100M to continue investing in early-stage technology startups.

Company Ventures, raising up to $80M for its third fund focused on early-stage, founder-led companies.

UPenn, BioNTech & Oxford University Press, launched a $50M life sciences fund to commercialize academic and biotech research.

Superorganism, closed a $25.9M maiden fund focused on early-stage consumer and technology startups.

Arya Ventures, raised £400K for an early-stage fund focused on backing Indian-diaspora founders building tech-enabled startups.

That’s a wrap for this week.

If you want to stay ahead of the curve, make sure you're subscribed. No fluff, just real startup insights delivered straight to your inbox.

See you next time 🚀

This feels curated for builders who value signal over noise.

Seems hard by the day that Meta will be able to catch up in the AI frontier research! Thanks for putting this together.