😇 Should You Raise from Angels or VCs?

A founder’s guide to navigating the first critical step of startup capital.

👋 Hey, Chris here! Welcome to BrainDumps—a weekly series from The Founders Corner. If you’ve been reading along, you know this series is a preview of a bigger project. Well, it’s finally here: The Big Book of BrainDumps is out now!

It isn’t a theory book—it’s the founder’s field manual. Inside, you’ll find 70 powerful frameworks distilled from 30+ years scaling software companies to hundreds of millions in ARR, 20+ years investing in 500+ B2B tech startups, and over $1B of shareholder value created. From raising capital to hiring your first VP of Sales, this book turns scars and successes into practical playbooks you’ll return to again and again. I expect most copies will become well-worn, scribbled on, and dog-eared—because it works.

Table of Contents

Angels vs VCs: What’s the Real Difference?

When Should You Approach Angels Instead of VCs?

How Most Startups Actually Do It: Angels First, VC Later

How to Find Angel Investors (Even if You Know No One)

8 Ways to Win with Angels (Even If You’re Early)

The X-Factor: Angel Relationships Are Personal

Final Words: Angels Are Your First Believers—Treat Them Like Partners

If you’re an early-stage founder with a killer idea and no cash in the bank, chances are you’ve asked yourself:

“Should I raise from Angels first, or go straight to VCs?”

It’s a fair question.

And like most things in startup life, the answer is nuanced—but not complicated, once you understand the mindset of both sides.

This BrainDump cuts through the fluff. So let’s walk through it, founder-style, and get real about what makes Angel funding work, when it’s better than VC, and how to actually land that first cheque.

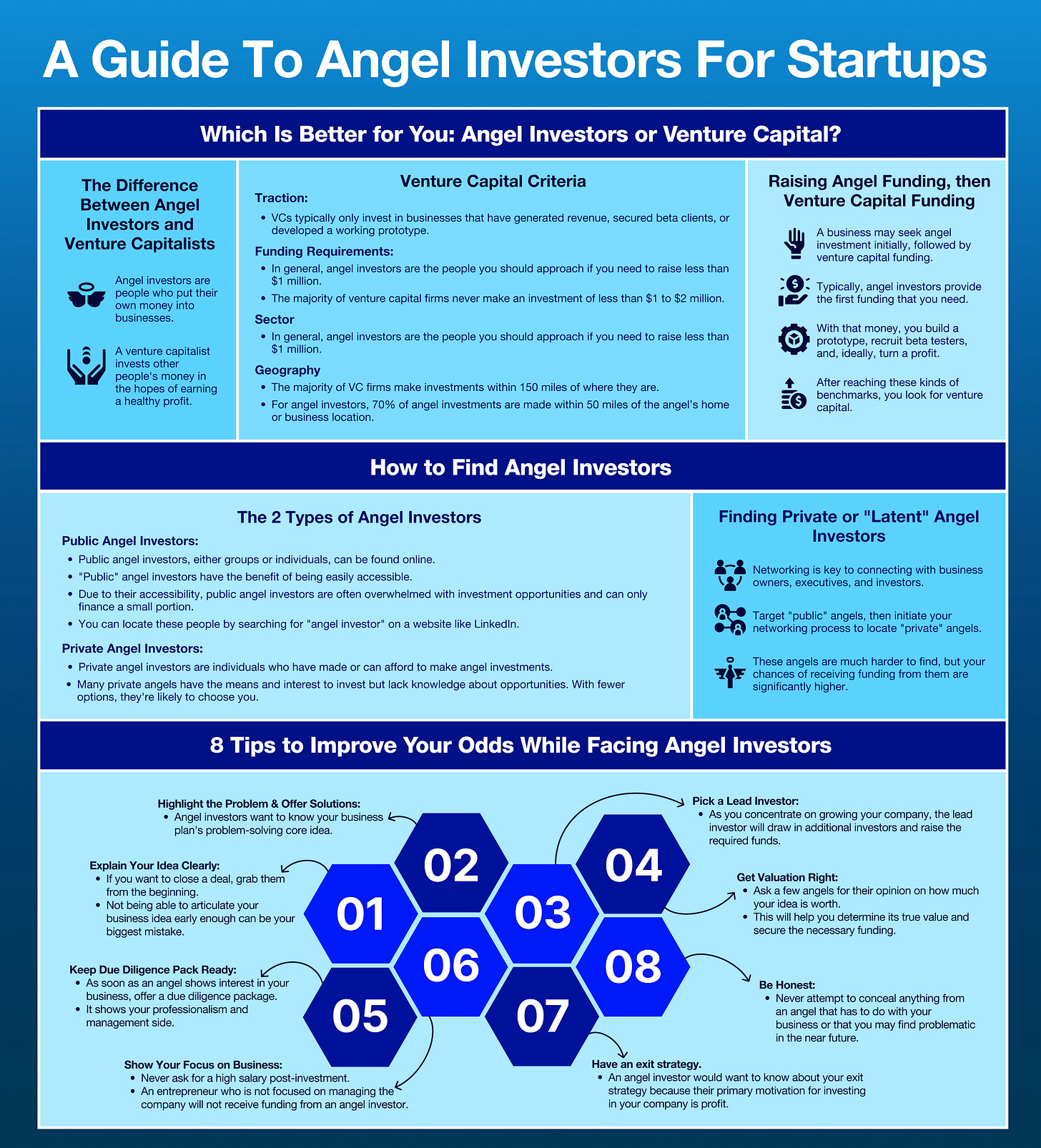

Angels vs VCs: What’s the Real Difference?

It’s not just about cheque size. It’s about mindset, risk tolerance, and relationship style.

😇 Angel Investors

Invest their own money

Back people, not just traction

Often ex-founders or operators

Motivated by returns and the journey

Happy to take early bets on unproven ideas

👔 Venture Capitalists

Invest other people’s money

Manage funds, answer to LPs

Want strong traction, metrics, and market signals

Typically come in after some validation: MRR, users, PMF

📝 Bottom Line

Angels invest in the story. VCs invest in the spreadsheet.

At pre-seed or seed, if you’ve got more vision than metrics, start with Angels.

When Should You Approach Angels Instead of VCs?

This BrainDump lays out the key factors beautifully—here’s how to interpret them in practice.

🚀 Traction

VCs want proof. Angels want promise.

If you’ve:

Just launched an MVP

Got 10 beta users

Maybe a small pilot…

...you’re not VC-ready. But that’s exactly where Angels come in.

💰 Funding Requirement

Need < $1M? That’s Angel territory.

Most VCs don’t look at rounds under $1–2M unless they have a dedicated pre-seed fund. Angels are happy to fund $25K–500K to help you build and prove.

🌍 Geography

VCs stick close to home (70% of deals within 150 miles of HQ). Angels are everywhere.

Some of the best early cheques I’ve seen have come from retired founders living nowhere near a startup hub—but excited to back the next big thing.

How Most Startups Actually Do It: Angels First, VC Later

If you think of startup fundraising as a relay race, Angels run leg one.

They help you:

Build the prototype

Validate with early customers

Show signs of PMF

Hire the first team

Set early metrics in motion

Then—and only then—you run the second leg and pass the baton to VCs.

VCs want acceleration. Angels help you get on the track.

How to Find Angel Investors (Even if You Know No One)

This is where many founders stall.

You’ve got a great idea, a scrappy product, and momentum—but no clue where the money is.

There are two types of Angels:

🔊 Public Angels

On LinkedIn, AngelList, syndicates, pitch events

Accessible, but inundated

Great if you’re persistent, polished, and clear

🔒 Private Angels

Quietly wealthy founders, exited operators

Don’t list their investment activity

Reachable only through warm intros and network effects

🧠 Top Tip

Use public Angels to build credibility and visibility. Then ask them to refer you to private Angels. It’s the warm intro flywheel that unlocks 90% of early cheques.

8 Ways to Win with Angels (Even If You’re Early)

Here’s where this visual guide really shines—eight practical founder moves that boost your odds immediately:

1. 🚨 Highlight the Problem

Don’t lead with your solution. Lead with a problem so painful, your audience feels it in their gut.

2. 💡 Explain Your Idea Clearly

If your pitch takes more than 30 seconds to explain, it’s not ready. Clarity builds confidence.

3. 📊 Know Your Metrics (Even Scrappy Ones)

Even if you don’t have revenue, show activation rate, retention, waitlist size—something that suggests momentum.

4. 🙋 Pick a Lead Investor

Landing one credible Angel de-risks the round. Others follow fast once the first cheque is in.

5. 📑 Do the Diligence Work Early

Have your data room ready: cap table, roadmap, financial model (even if simple), legal docs. It screams “I’m ready.”

6. 🚀 Show You’re All In

If you’re paying yourself a fat salary from day one, it raises red flags. Founders should eat last (at least early on).

7. 🤷 Be Honest About Risks

Smart Angels respect realism. If churn’s high or the market is early, say so—then show how you’re tackling it.

8. 💵 Share Your Exit Strategy

No one invests without a return plan. Whether it’s IPO, acquisition, or strategic consolidation, know your likely endgame.

The X-Factor: Angel Relationships Are Personal

Here’s what most decks don’t teach you:

Angels back people. Not just ideas. Not just TAM. But you.

They want to know:

Do you have grit?

Do you learn fast?

Are you coachable but decisive?

Will you go the distance?

You’re not just selling your startup. You’re selling yourself as a founder worth believing in.

📖 My Story

One of the best founders I backed early on had no traction. But he had insane curiosity, clarity of thought, and relentless follow-up. Three years later, he raised a $12M Series A. Same product. Bigger proof. Same founder. But everyone now saw what we saw at day zero.

Final Words: Angels Are Your First Believers—Treat Them Like Partners

Don’t treat Angels as stopgaps.

Treat them as the early partners who gave you runway when no one else would. The ones who bet on you, not just your pitch deck.

And remember: you’re not just raising capital. You’re raising confidence.

The best Angels want to back founders who know where they’re going—even if the map isn’t fully drawn yet.

Be clear. Be coachable. Be compelling.

And most of all—be ready.

—Chris Tottman

Chris, I’ll flip this. Angels vs VCs is secondary. The first Angels must be the founders themselves.

At 0 WHY NOT, me and my partners funded it ourselves. Because if an idea can’t survive on our own dime, no Angel cheque makes it real.

Capital isn’t oxygen. Not for demand inflation. Not to crush competition. Only to expand what already breathes.

Angel investing is much more personal than VC investment