💰 Should You Bootstrap or Raise Venture Capital?

How to choose the right funding path—and avoid marrying the wrong investor.

👋 Hey, Chris here! Welcome to BrainDumps—a weekly series from The Founders Corner. If you’ve been reading along, you know this series is a preview of a bigger project. Well, it’s finally here: The Big Book of BrainDumps is out now!

It isn’t a theory book—it’s the founder’s field manual. Inside you’ll find 70 powerful frameworks distilled from 30+ years scaling software companies to hundreds of millions in ARR, 20+ years investing in 500+ B2B tech startups, and over $1B of shareholder value created. From raising capital to hiring your first VP of Sales, this book turns scars and successes into practical playbooks you’ll return to again and again. I expect most copies will become well-worn, scribbled on, and dog-eared—because it works.

Table of Contents

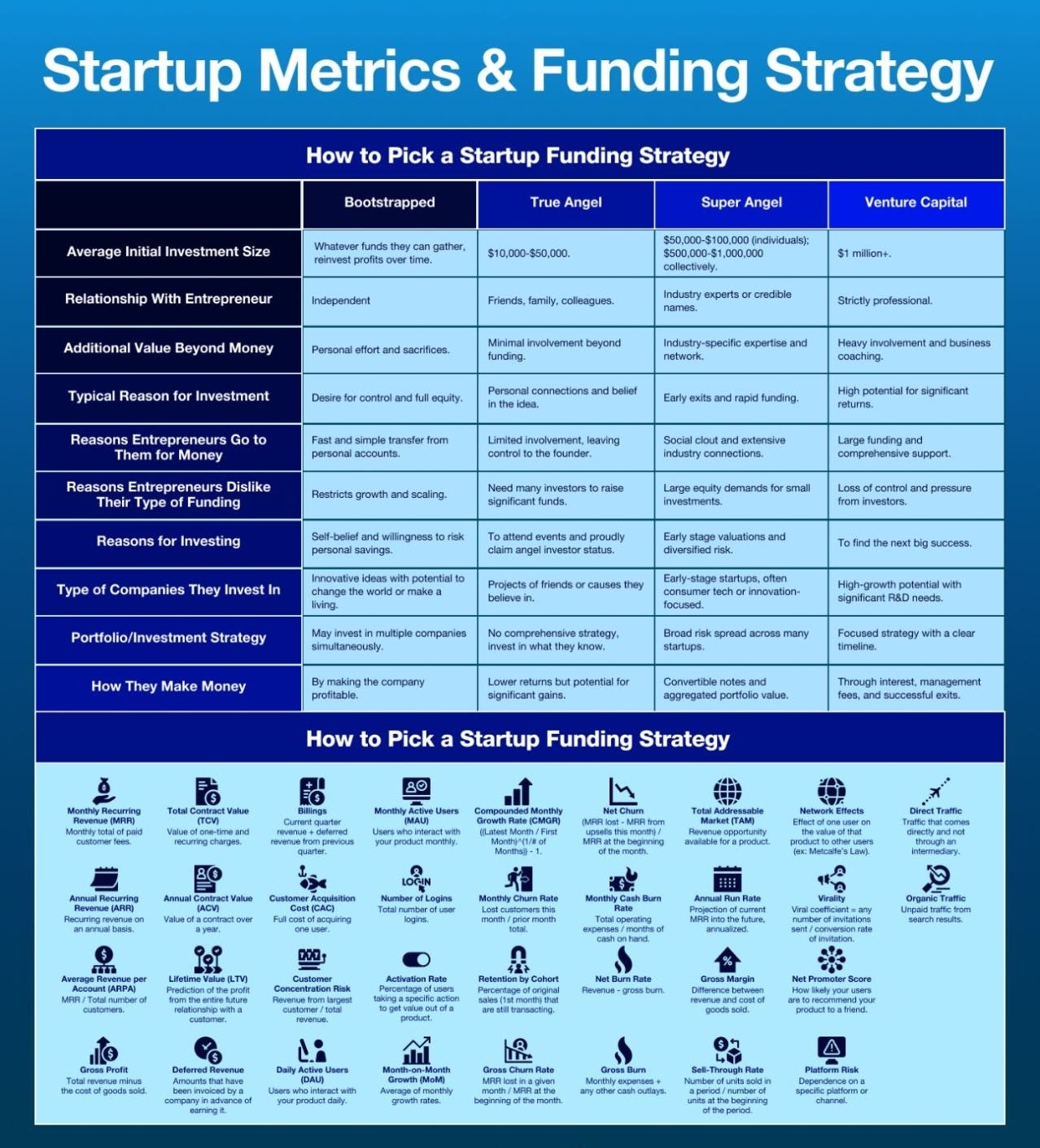

The Four Funding Paths—and What They Really Cost

1. Bootstrapping: Freedom + Frugality

2. True Angel: Friends, Family, Believers

3. Super Angel: Experienced + Engaged

4. Venture Capital: High Growth, High Stakes

Key Trade-Offs Every Founder Must Weigh

1. Control vs. Speed

2. Money vs. Momentum

3. Equity Now vs. Regret Later

4. Investor Fit vs. Investor FOMO

5. Growth Metrics vs. Gut Feel

Final Words: Fund the Company You Want to Build

One of the worst bits of advice I ever got as a founder?

“Just take the money.”

It sounds harmless. But it’s a trap.

Because how you fund your business doesn’t just determine how much capital you raise—it determines the kind of company you’ll build.

Your growth speed. Your control. Your equity. Your stress levels. Your exit options.

Funding isn’t neutral. It’s directional.

And that’s why this BrainDump is so important. It doesn’t just lay out who gives you money—it shows you what each option really means.

Let’s break it down. Founder to founder. No sugarcoating.

The Four Funding Paths—and What They Really Cost

1. Bootstrapping: Freedom + Frugality

This is the purest path.

You build. You sell. You reinvest. You keep control. You call the shots.

You’re answerable to no one but your customers—and your own burn rate.

1.1. But Make No Mistake:

Bootstrapping is hard. Really hard. You’re constrained by cash. You grow slower. You take fewer risks. You say “no” a lot—not for strategic reasons, but because your bank balance forces you to.

1.2. Best For:

Founders with a monetizable product early, niche SaaS, agency-spinouts, or indie developers.

1.3. Avoid If:

You need upfront capital to build infrastructure, or you're in a “winner takes most” category where speed is critical.

1.4. My Take:

Some of the best businesses I’ve seen were bootstrapped to $1M+ ARR before raising. The discipline they developed was gold dust. But it’s not a badge of honour—it’s a choice. And you need to be honest about what it limits.

2. True Angel: Friends, Family, Believers

This is often your first “outside” capital. $10k–$50k, usually from someone who knows you personally.

The good news? They’re investing in you—your grit, your vision, your story.

The tough part? They may not know much about startups.

2.1. You’ll Get:

Encouragement, trust, and a bit of breathing room.

2.2. You Won’t Get:

Strategic input, fundraising experience, or sector expertise.

2.3. Great For:

Getting from zero to MVP. Covering the first 6–12 months. Surviving before your first customers land.

2.4. Word of Warning:

Don’t take money from people who can’t afford to lose it. It’ll mess with your head. I’ve seen founders carry the guilt of a failed startup like a family secret. Keep your cap table clean and your conscience clearer.

3. Super Angel: Experienced + Engaged

Now we’re talking sophistication.

These are angels who’ve likely built and sold businesses themselves. They invest $50k–$1M, bring operational experience, and usually open doors you can’t.

3.1. They’re the In-Betweeners:

Not a fund. Not a mate. But sharp, fast-moving, and founder-friendly.

3.2. They’ll Help You:

Shape your go-to-market

Build your first exec hires

Prepare for Series A

3.3. Best For:

Post-MVP traction, early revenue, GTM experiments. Think $20k–$100k MRR stage.

3.4. What to Watch:

Some Super Angels operate like mini-VCs. They might want board seats or influence. Be clear on what kind of relationship you want.

3.5. My Story:

We once had a Super Angel join a pre-Series A round and single-handedly accelerate hiring, pricing strategy, and intros to our first five enterprise clients. That kind of value-add? Worth more than the money.

4. Venture Capital: High Growth, High Stakes

Here’s where the big guns come in.

You’re raising $1M–$10M+. You’re expected to scale fast, dominate a category, and exit in 5–7 years.

4.1. VCs Bring:

Huge capital

Deep networks

Pattern recognition

Pressure

4.2. But They Want:

Rapid growth

Big outcomes

Clear metrics

Serious control

4.3. What Changes:

You lose equity fast

You hire senior fast

You spend faster than you’re used to

You can no longer “just test and learn”—you execute

4.4. VC is Rocket Fuel:

But rockets either reach orbit… or explode.

4.5. Best For:

Category-defining SaaS, platforms, network effects, big TAM plays.

4.6. Not For:

Lifestyle businesses. Solo founders. Anything where scale isn’t the game.

Key Trade-Offs Every Founder Must Weigh

This BrainDump nails the comparisons, but let me translate it founder-to-founder.

Here are five trade-offs that matter most:

1. Control vs. Speed

Bootstrapped = full control.

VC = shared control, board oversight, performance plans.

Ask yourself: are you comfortable giving up equity and decision-making for acceleration?

If your TAM is massive and time-sensitive, you might need to. If not, you might not want to.

2. Money vs. Momentum

Money is just fuel. It doesn’t guarantee direction.

I’ve seen $10M-funded startups do less than bootstrapped teams. Why? No urgency. No focus. Just burn.

Choose partners who bring momentum—mentorship, connections, strategic pressure—not just capital.

3. Equity Now vs. Regret Later

It’s easy to give away 25% in your first priced round.

But fast forward: what happens after three more rounds? What do you own when you exit?

Think 3–5 rounds ahead. Don’t just optimise for valuation—optimise for outcome.

4. Investor Fit vs. Investor FOMO

Just because someone has a big name doesn’t mean they’re right for you.

Find investors who:

Believe in your mission

Understand your market

Won’t jump ship at the first wobble

I’ve seen too many founders get romanced by a flashy term sheet, only to end up misaligned within 12 months. You’re not just raising capital—you’re picking a co-pilot.

5. Growth Metrics vs. Gut Feel

Metrics matter. But context is king.

If you’re talking to angels, show vision, founder-market fit, and momentum.

If you’re talking to VCs, bring the spreadsheet:

CAC payback

LTV:CAC ratio

MRR/ARR

Churn

NRR

GTM motion

Know your numbers cold. But never lose the story. The best founders make data emotional.

Final Words: Fund the Company You Want to Build

There is no one “right” path.

Some of the best businesses we’ve backed were bootstrapped to $1M ARR before ever raising. Others raised $3M pre-revenue and became global players.

The key is alignment.

Know your values. Know your ambition. Know your constraints.

And remember: you’re not just picking money. You’re picking a pace. A pressure. A partner. A path.

Choose wisely. Build patiently. And never let funding distract you from the only thing that truly matters:

Building something people love.

—Chris Tottman

This is such a clear breakdown, Chris!

I love how you show that funding isn’t neutral—it shapes the kind of company you build, the pace you move at, and the people you work with.

The trade-offs you highlighted: control vs. speed, equity now vs. regret later, investor fit vs. FOMO are exactly the questions every founder should ask before signing a term sheet.

Too often, people chase money without thinking about how it changes their business and life.

For anyone choosing between bootstrapping, angels, or VC, this is a solid reminder: pick the path that fits your goals, values, and vision, not just the biggest check.

Such a clear breakdown — really drives home that funding isn’t just money, it’s direction. Loved the founder-to-founder honesty.