SEO Traffic Is Shrinking📉, The Startup Pricing Dilemma💰, Rippling accuses Deel of trade secret theft 🕵️♂️

If you're building, investing, or just trying to stay ahead of the curve, you're in the right place. Every week, we break down the latest insights, funding news, and founder-friendly gems—no fluff, just what matters. Plus, we track the freshest VC funds deploying capital so you know where the money’s moving.

Let’s get into it 👇

In-Depth Insights 🔍

25% of YC Startups Run on AI-Generated Code ⚡

AI isn’t just assisting coders, it’s replacing them. A quarter of YC’s latest batch rely almost entirely on AI-written software. Is this the new standard for engineering? [Ivan Mehta]

Freemium vs. Paid: The Startup Pricing Dilemma 💰

Go freemium or charge upfront? A deep dive into when—and why—each model works (and when they don’t).

How Startups Should Actually Use Social Media 📢

Posting isn’t a strategy. This guide breaks down how startups can turn social media into a real growth engine. [Rifah Nawar]

10 Bold Predictions for the Future of Finance Tech Stack 🔮

From AI-powered CEOs to the next wave of unicorns, here’s what’s about to shake up the startup world. [CJ Gustafson]

How to Justify Your Product Pricing (With Math) 🧮

Pricing isn’t a gut decision. This framework helps you prove why customers should gladly pay what you charge. [Leah Tharin]

Why HubSpot’s SEO Traffic Is Shrinking 📉

Even giants take hits. Here’s why HubSpot’s search traffic is slipping—and what it means for content marketing. [Andreas Just]

Trending News

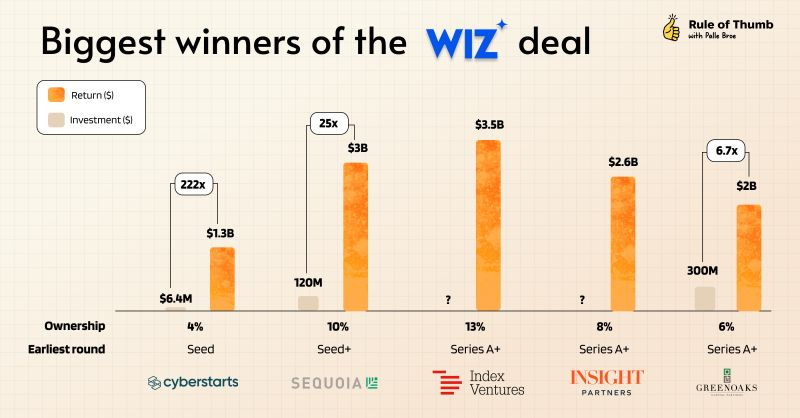

Google to acquire Wiz for ~$32B 💰

Google’s biggest cloud security play ever. A $32B bet that enterprise infra is just getting started.Rippling accuses Deel of trade secret theft 🕵️♂️

A lawsuit claims Deel ran a corporate spy op to steal Rippling’s tech. HR just got hostile.Web Summit founder charged with deception 📉

Paddy Cosgrave faces 4 counts for misleading investors. The fall of a tech conference empire.Munich Re buys Next Insurance for $2.6B 💸

Insurtech consolidation heats up. Munich Re goes all-in on SME coverage.Gmail gets AI brain transplant 🤖

Google upgrades Gmail to sort by relevance, not just time. Your inbox just leveled up.

Factorial raises $120M to scale HR SaaS 📊

Fresh cash from General Catalyst to take on Europe and LatAm. Factorial wants to be the Workday of the mid-market.Klarna targets $20B+ IPO 🛍️

The Swedish BNPL giant preps for a US listing. One of 2025’s biggest fintech exits? [Tom Matsuda & Mimi Billing]

Social Media Gems 💎

Unicorns Are Reaching $1B Faster Than Ever 🦄

AI, investor FOMO, and massive early bets are accelerating unicorn growth. Game-changing or a bubble waiting to pop? [Jason Saltzman]The Revolut Mafia: Fintech’s Next Power Players 🥷🏻

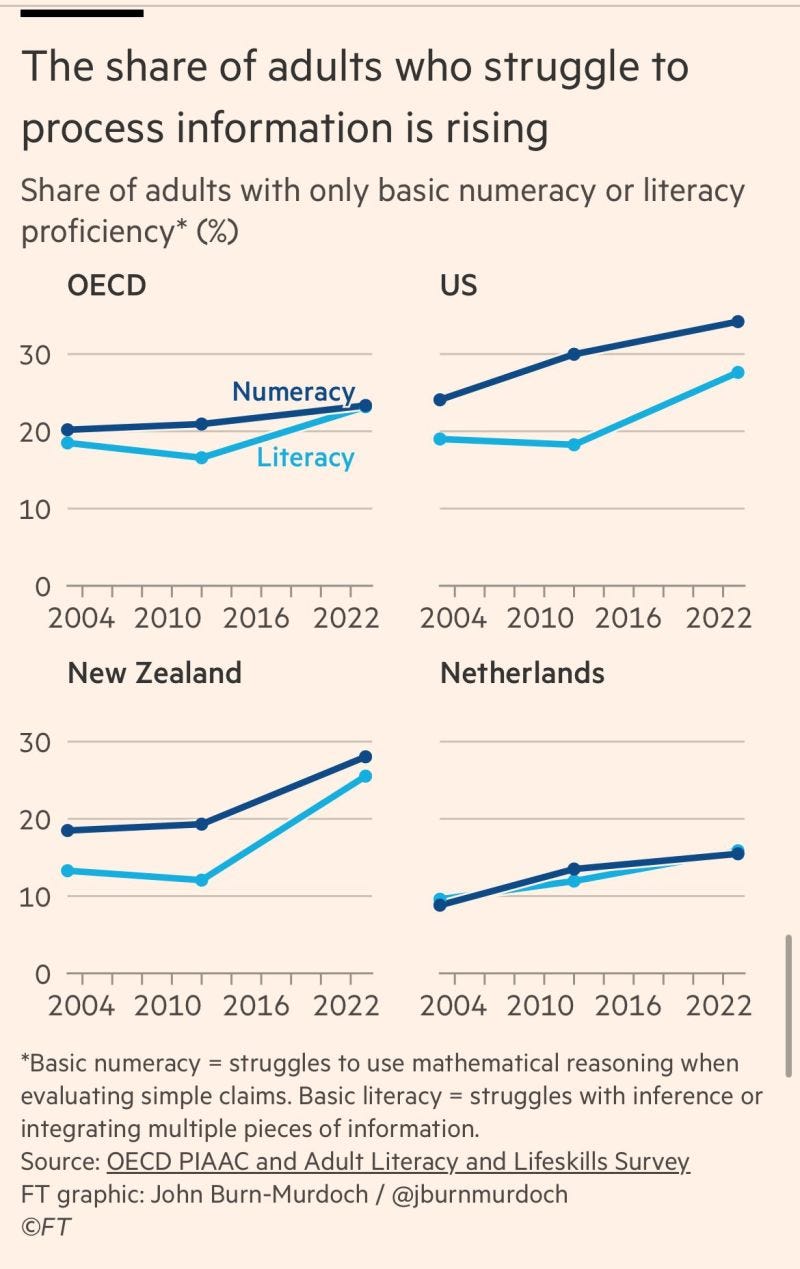

Ex-Revolut founders are shaping the future of fintech. Who’s leading the charge? [John Kim]The Decline of Human Intelligence 🧐

As AI gets smarter, humans are slipping. Cognitive decline is real—making critical thinking a superpower. [Rika Christanto]Wiz’s Mega Exit: Who Won Big? 🚪

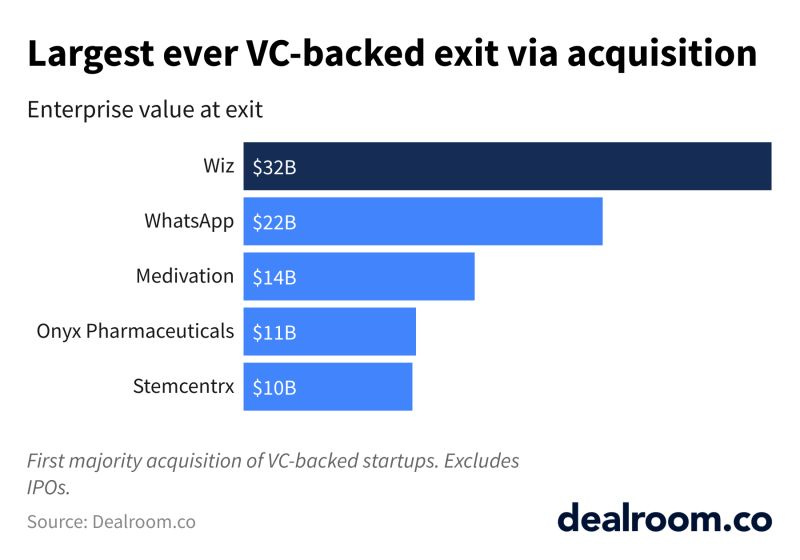

Wiz investors just hit the jackpot—some scoring up to 222x returns. [Palle Broe]Biggest VC-Backed Acquisitions of All Time 🤝

Wiz’s $32B exit tops the charts, followed by WhatsApp, Medivation, Onyx Pharmaceuticals, and Stemcentrx. [Yoram Wijngaarde]Inside the Mind of the World’s Top Angel Investor 🧑🏻💼

Ed Lando breaks down his winning formula for angel investing, startup incubation, and building Pareto Holdings. [The Peel with Turner Novak]

New Funds 💰

Long Journey Ventures locked in $181.8M to back bold bets in consumer, commerce, and culture across the U.S.

Incore Invest launched Fund II to fuel early-stage software across Europe—with laser focus on founder-market fit.

SemperVirens Venture Capital closed $177M across two funds to shape the future of work, health, and financial wellness.

Motion Ventures launched a $100M fund to transform maritime, supply chain, and logistics through tech.

Bread & Butter Ventures baked up $40M for Fund IV, doubling down on foodtech, digital health, and enterprise SaaS in the Midwest.

Soulmates Ventures dropped a €50M climate tech fund for startups driving sustainability and green innovation.

Sofinnova Partners closed a €165M Biotech Acceleration Fund—targeting early-stage European biotech breakthroughs.

Pillar VC raised $175M for Fund IV to keep backing deep-tech and life sciences from zero to one.

That’s a wrap for this week.

If you want to stay ahead of the curve, make sure you're subscribed. No fluff, just real startup insights delivered straight to your inbox.

See you next time 🚀

Typo on Wiz acq price being inverted, should be $32bn

Great edition, as always!