Seeing Your Exit Before It Happens

How ownership, dilution, and capital decisions quietly determine your outcome

Everyone loves a good exit. A sale, an IPO, a merger. The headline number becomes the story.

But exits are not a single outcome. They are two different scorecards being applied to the same event.

For investors, exits are how funds return capital to their limited partners and prove their strategy worked. For founders, exits are how years of risk, dilution, and personal sacrifice finally translate into a real outcome.

On the surface, those goals appear aligned. In practice, exits are where some of the biggest misunderstandings in venture begin.

Founders tend to anchor on the headline number we sold for £X. Investors anchor on a different question entirely what did this return relative to what we invested, given how much of the company we actually owned at the end?

That gap in perspective creates two familiar exit disappointments:

a company sells for an eye-watering amount and the founder walks away thinking I expected more

a fund describes an exit as solid, while the founder is confused why it isn’t considered a major win

No one is being irrational. Both sides are doing math. They’re just doing different math.

Brought to you by Lindy: Hire an AI employee, not a chatbot

Most AI tools suggest work.

Lindy executes it.

Instead of chatbots, Lindy lets you spin up AI employees that run real workflows end to end across email, calendar, CRM, Slack, and internal tools. Meetings get booked. Leads get followed up. Inboxes get cleared. Systems stay updated automatically.

This is not prompt and hope.

It is dependable execution with triggers, logic, and optional human approval where it matters.

Lindy also comes with ready made agents, so teams start from proven workflows in minutes instead of building from scratch.

For founders and operators who want output without adding headcount.

Table of Contents

Exit Outcomes: Where The Headline Number Comes From

Ownership: How Exits Turn Into Real Outcomes

How Dilution Actually Compounds

The Mechanics Of A Funding Round (Clearly)

How VCs Judge Exits

Why The Same Exit Can Feel Very Different

Where Founders And Investors Talk Past Each Other

The Decisions That Quietly Decide Your Exit

A Simple Sanity Check

Applying This In Practice

Exit Outcomes: Where The Headline Number Comes From

Most exits, regardless of sector, reduce to the same basic structure:

Exit valuation = an underlying business metric × a market multiple

The underlying metric depends on the business:

SaaS companies are often valued on ARR or revenue

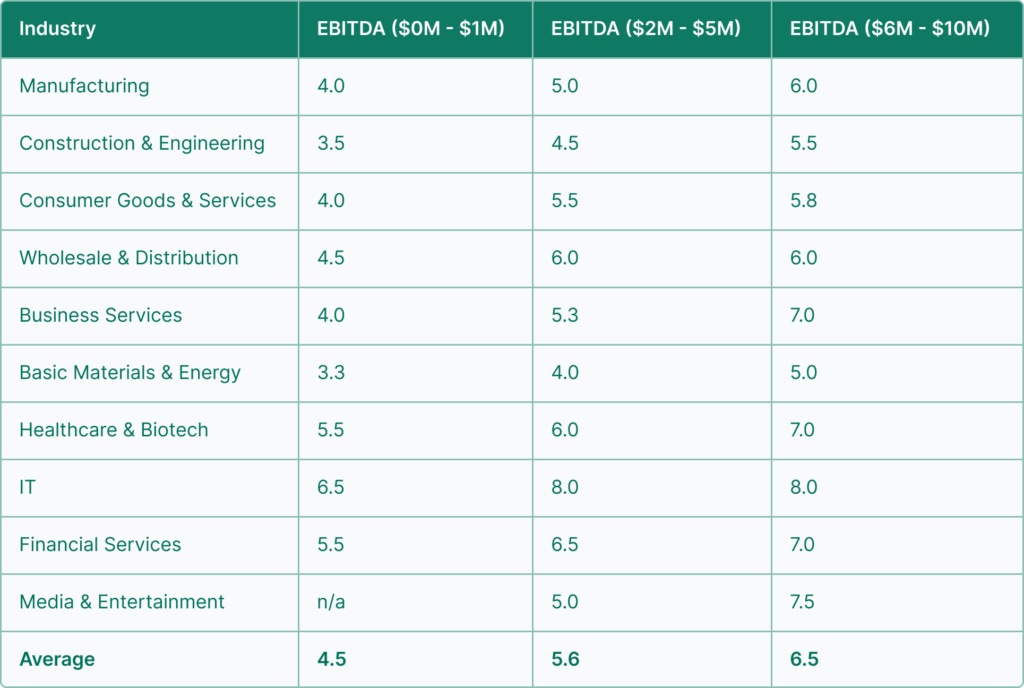

Profitable businesses are often valued on EBITDA

Marketplaces and fintech companies may be valued on revenue, gross profit, or contribution margin

The multiple reflects how the market prices risk and growth at that moment. It expands and compresses based on interest rates, comparable transactions, sentiment, and buyer appetite.

Founders often treat multiples as destiny.

Investors treat them like the weather.

You don’t control the weather, but you do control whether you’re building something robust enough to survive different conditions.

Example

If a company exits with £100m in revenue and the market pays a 10× multiple:

Exit valuation = £1,000m

This is the number that gets written about.

It is also the number that matters least for personal outcomes.

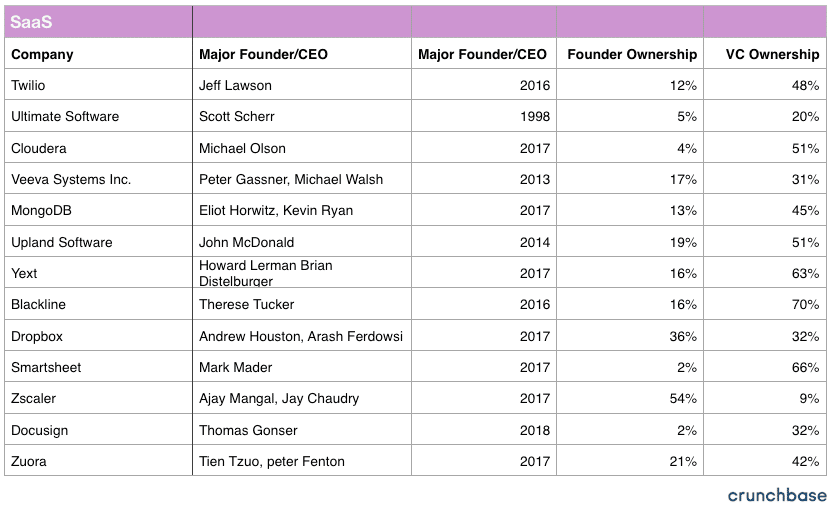

Ownership: How Exits Turn Into Real Outcomes

Founders don’t receive the exit valuation. They receive:

Founder proceeds = Exit valuation × Founder ownership at exit

Investors think in parallel terms:

Fund return = Exit valuation × Fund ownership at exit

This is where exits stop being abstract and start being emotional.

Ownership feels personal. It represents years of work and sacrifice. But the math itself doesn’t care how hard those years were.

The mistake founders make is thinking of ownership at exit as a single decision. In reality, it’s the cumulative result of many small decisions made over time.

Ownership shrinks through two mechanisms:

Capital dilution — selling equity to raise money

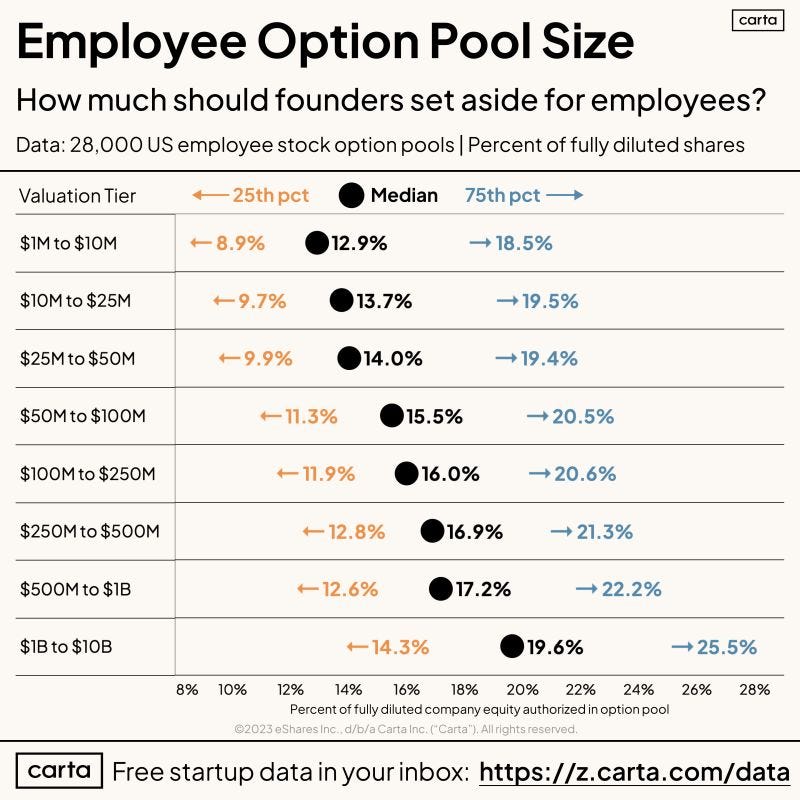

Option pool dilution — allocating equity to hire and retain talent

If you don’t model both, you’re not modelling your exit.

How Dilution Actually Compounds

Most founders intuitively think about dilution as additive.

I diluted 15%, then 10%, then another 10%.

But ownership doesn’t shrink that way.

Ownership compounds multiplicatively.

If you retain 85% after one event and then retain 90% after the next:

Remaining ownership = 0.85 × 0.90 = 76.5%

That difference feels small until you repeat the process again and again.

Consider a company that sells 20% of its equity in four rounds:

Remaining ownership = 0.8⁴ ≈ 41%, before option pools

Add one or two pool refreshes, which is common in venture-backed companies, and the number can fall much further.

This is why phrases like “only 15% dilution” are often misleading. They describe a moment, not a trajectory.

The Mechanics Of A Funding Round (Clearly)

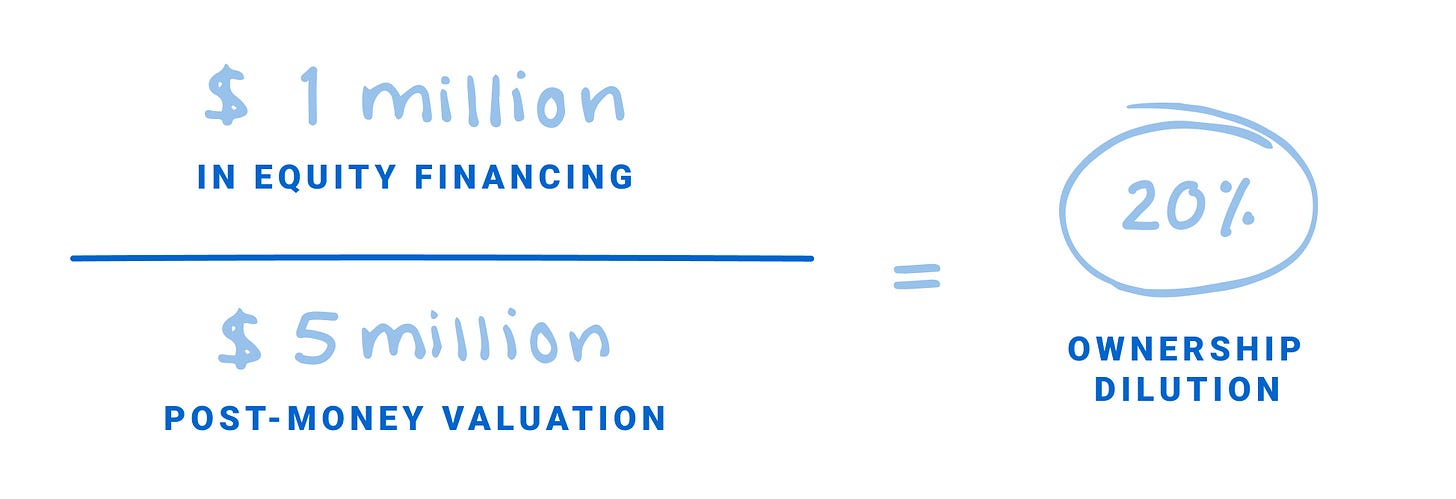

Every funding round follows the same arithmetic:

Post-money valuation = Pre-money valuation + Raise

Ownership sold = Raise ÷ Post-money

Example

Raise £10m at a £40m pre-money valuation:

Post-money = £50m

Ownership sold = 20%

That 20% permanently reduces the base from which all future ownership compounds.

Option pools work similarly, even though no cash changes hands. When a pool is created or topped up, everyone else’s ownership shrinks. This is why option pools are often described as silent dilution — you don’t feel them when they happen, but you feel them at the exit.

A useful way to think about option pools:

They are a tax on ownership that buys capability.

The question isn’t whether you should pay that tax.

It’s whether what it buys meaningfully expands the eventual outcome.

How VCs Judge Exits

Founders usually care about proceeds.

VCs care about proceeds too but always through the lens of efficiency.

Two metrics matter most.

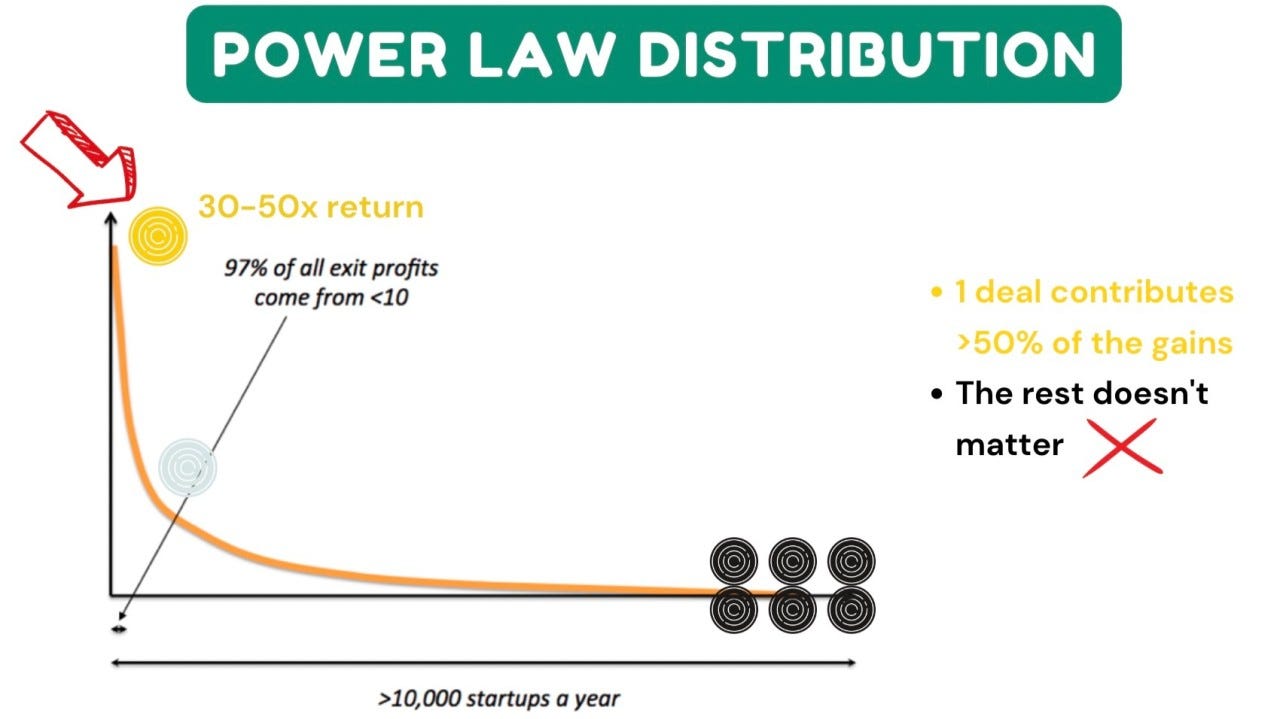

Fund return is the absolute amount of money returned.

MOIC (Multiple on Invested Capital) measures how many times the invested capital was returned.

MOIC matters because venture funds are built on power-law outcomes.

A £30m return can be excellent or mediocre depending on how much capital was invested and how much ownership survived.

MOIC influences:

Follow-on appetite

How investors evaluate acquisition offers

Whether they push for more growth or accept liquidity

How they talk about the exit internally

Understanding MOIC helps founders understand investor behaviour.

Why The Same Exit Can Feel Very Different

Consider two outcomes.

Scenario one

Exit valuation: £1,000m

Founder ownership: 3%

Founder proceeds: £30m

Scenario two

Exit valuation: £500m

Founder ownership: 8%

Founder proceeds: £40m

Smaller headline. Bigger personal outcome.

This is the core venture math insight:

Valuation is only half the equation. Ownership is the other half.

Where Founders And Investors Talk Past Each Other

Founders tend to evaluate exits based on:

Absolute valuation

Personal proceeds

Narrative and prestige

Investors evaluate exits based on:

MOIC

Timing of returns

Portfolio construction logic

Neither side is wrong. They are optimising for different objective functions.

A founder who understands both can manage expectations, negotiations, and board conversations far more effectively.

The Decisions That Quietly Decide Your Exit

The market sets the multiple.

You control the path.

Raise size, valuation discipline, round sequencing, and option pool strategy all feed into ownership compounding over time.

Under-raising can look ownership-friendly until it forces another round. Over-raising can look dilutive until it buys time and optionality. High valuations feel like winning until they create fragility later.

The best founders don’t optimise for the next round. They optimise for a path that preserves meaningful ownership if things go right.

A Simple Sanity Check

Before celebrating a valuation or signing a term sheet, ask yourself:

What is a realistic exit outcome if this works?

What ownership is likely to remain at exit?

How does ownership change round by round to get there?

Then ask one final question:

Is the outcome worth the cost implied by the path?

If the answer is no, you don’t have an exit strategy. You have hope.

Applying This In Practice

Seeing exit math early changes how founders make decisions.

That is why I built The Founder Exit Simulator.

A founder grade spreadsheet that makes ownership, dilution, and outcomes visible before choices become permanent. It shows how exits actually resolve once the path is set, not after the headline is written.

This is not a full financial model. It is the tool you reach for before a raise, before a valuation anchor, before leverage quietly disappears.

Most founders only discover their real exit at liquidity, when nothing can be changed.

This is what it looks like when you run the numbers while you still can.

Keep reading with a 7-day free trial

Subscribe to The Founders Corner® to keep reading this post and get 7 days of free access to the full post archives.