Sam Altman on the Future of AI🤖, Exit Modeling Tool💰, Anthropic hits $380B valuation 🚀

If you're building, investing, or just trying to stay ahead of the curve, you're in the right place. Every week, we break down the latest insights, funding news, and founder-friendly gems. Just what matters. Plus, we track the freshest VC funds deploying capital so you know where the money’s moving.

Let’s get into it 👇

🎁 Free AI Hiring Kit (Actually Free)

Before we dive in, we built something with Notion for early-stage founders hiring their first team.

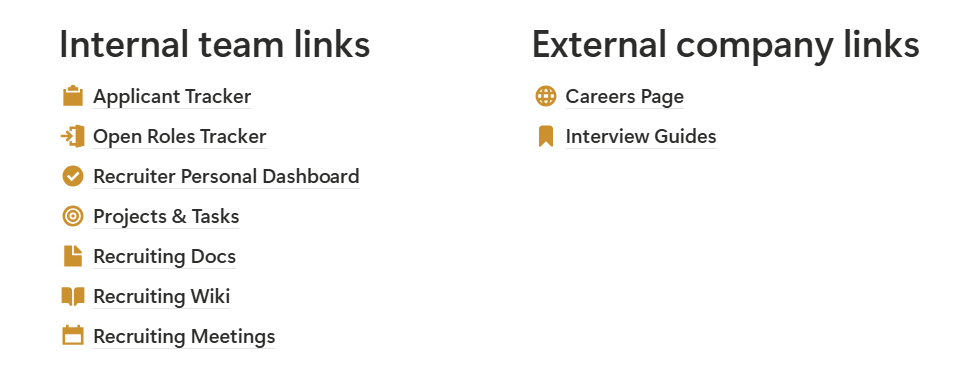

It’s a complete recruiting system with:

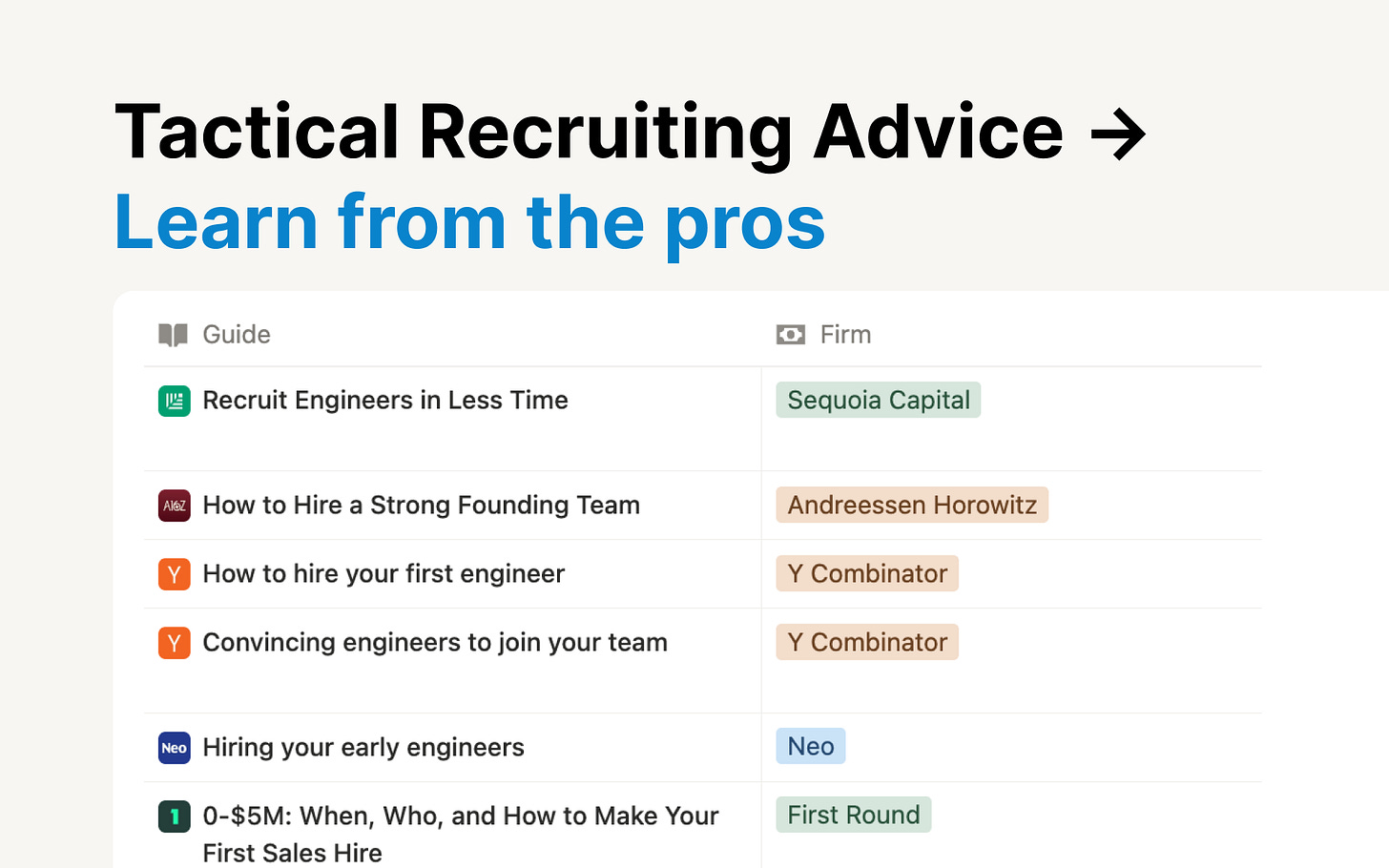

AI Agent trained on a16z, Sequoia & YC frameworks

Job description templates + interview guides

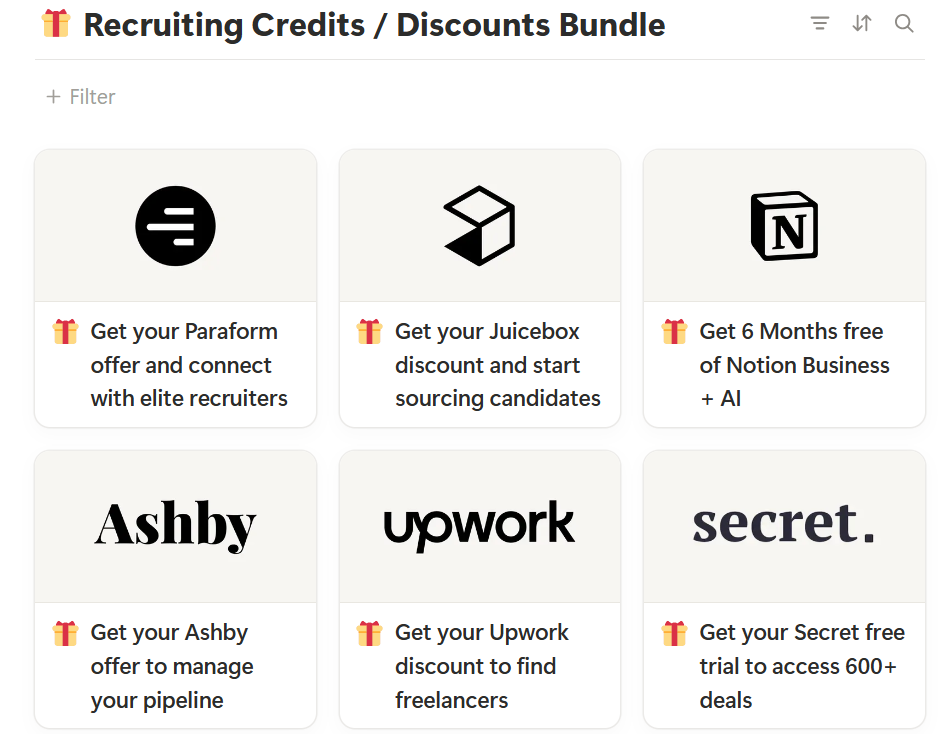

Partner credits: $5k from Paraform, $500 Upwork, 6 months free Notion Business. etc

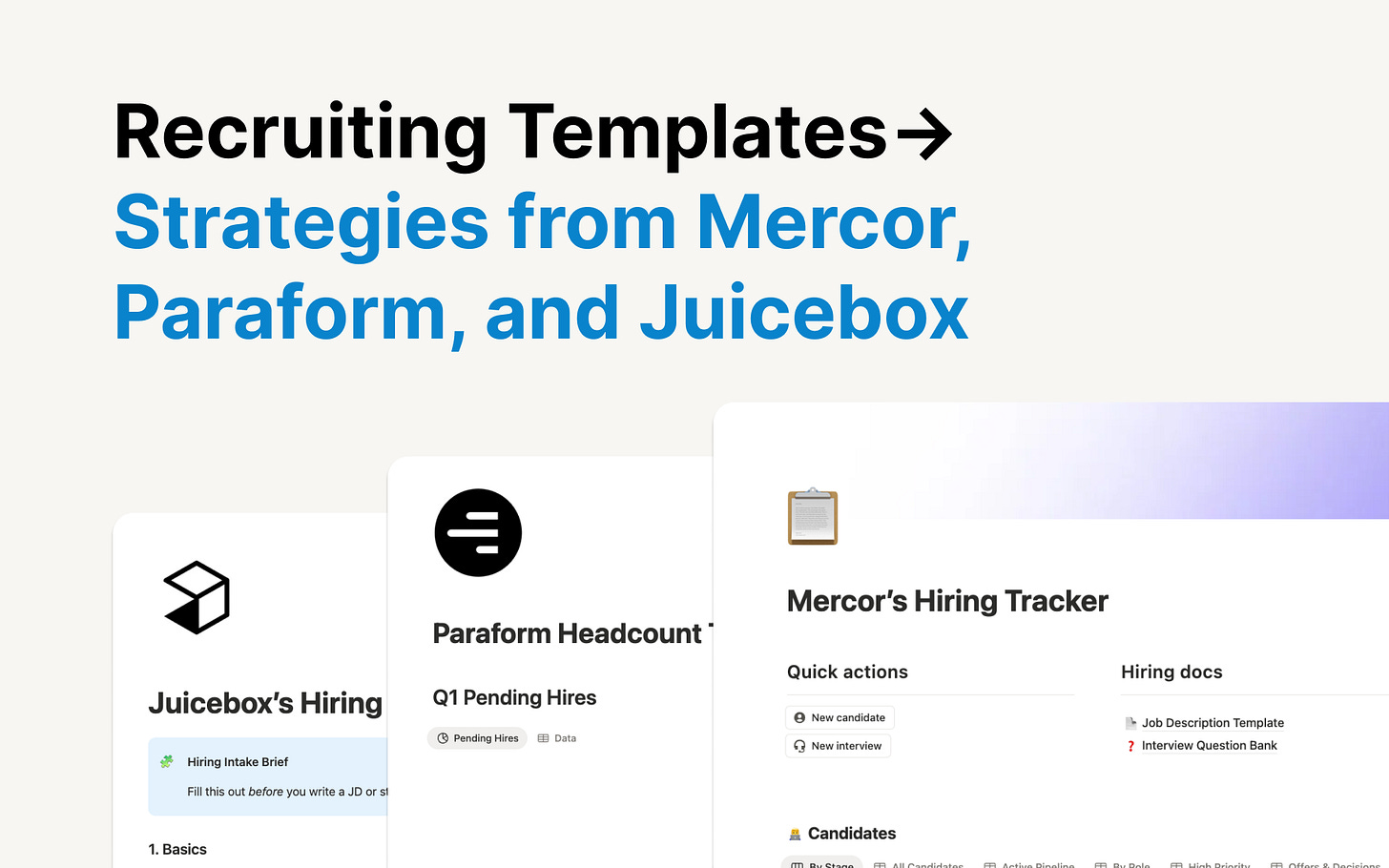

Recruiting templates: Mercor’s tracker, Juicebox comp data…

If you’re hiring engineers, operators, or GTM roles this year, this actually helps.

In-Depth Insights 🔍

Sam Altman shares six AI insights shaping the next wave 🤖

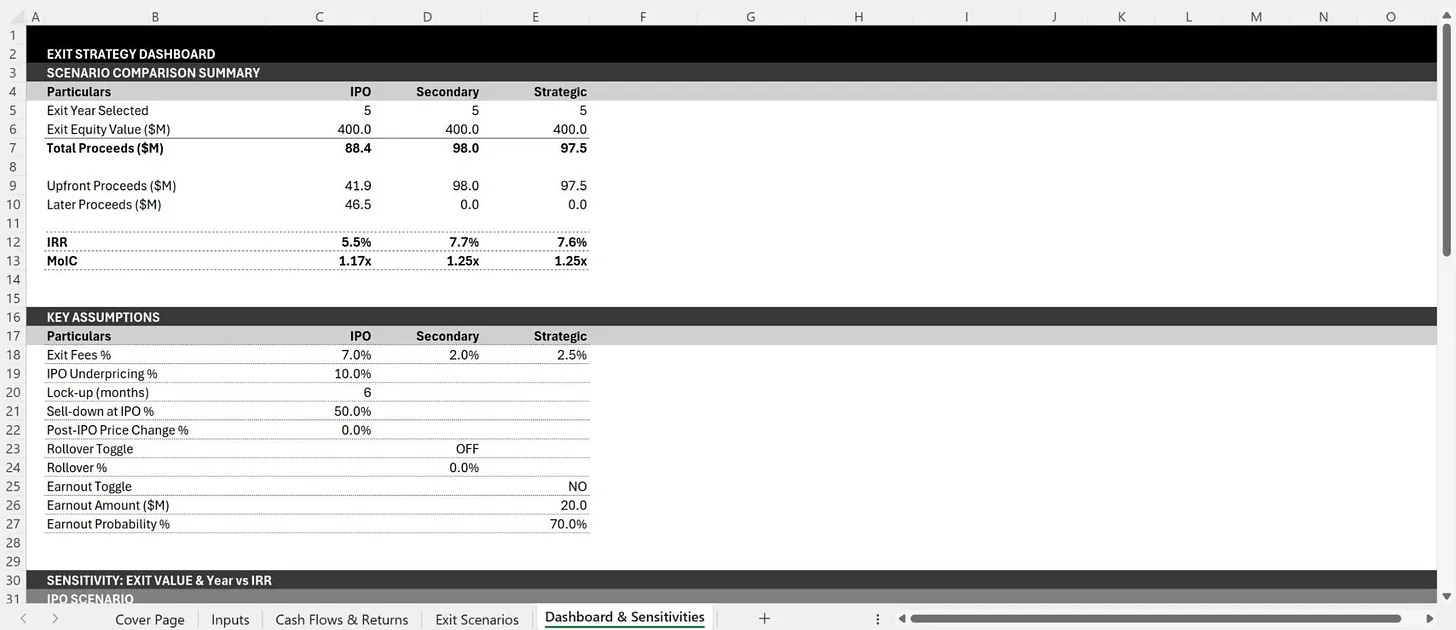

The OpenAI leader argues current systems already outperform expectations for extracting business intelligence if used properly. He also signals that video generation and vertically integrated product strategy will compound research progress faster than most anticipate. [a16z]Exit modeling tool reveals what founders actually take home 💰

The spreadsheet maps payout timing, lockups, fees, and staged proceeds across multiple liquidity paths. By calculating annualized returns and total multiples, it exposes which scenario delivers real cash sooner.

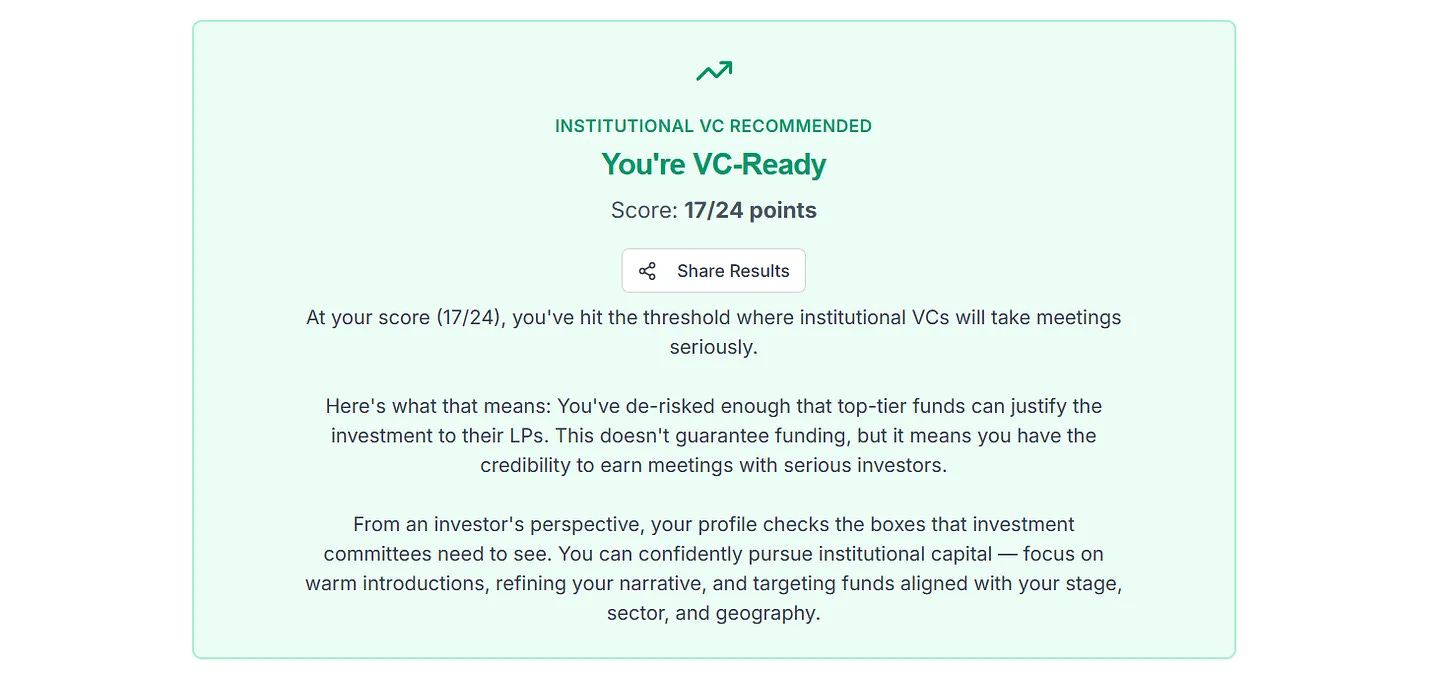

The fundraising scorecard investors quietly use 🎯📊💡🔍

An evaluation framework mirrors how committees assess teams, traction, and readiness for institutional backing. It clarifies why vague feedback often masks specific gaps in validation or execution depth. [Chris Tottman]

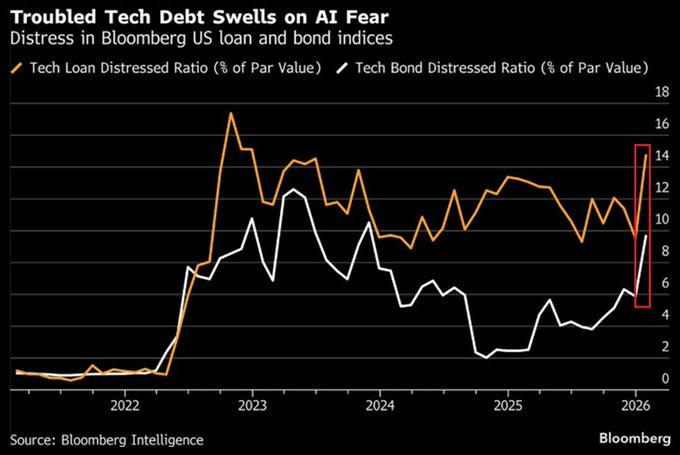

Private equity shifts away from average SaaS toward AI momentum 📉

Buyout firms are sitting on record capital yet avoiding mid-tier software companies that once cleared easily at healthy multiples. Capital now concentrates on artificial intelligence acceleration, sector tailwinds, or large consolidation targets with scale. [SaaStr]Prompting Is No Longer About Clever Wordings 🤖

Strong results emerge when users define constraints, outputs, and success criteria instead of crafting clever phrasing. Matching the right execution mode and iterating deliberately unlocks far more capability than one-shot requests.Family Offices That Cut Pre-Seed Checks 💰

A curated list highlights investors deploying capital at the earliest stages outside traditional VC cycles. Subscribers receive tested outreach frameworks aimed at accelerating conversations without weeks of research.One hundred AI Ideas, mapped by difficulty 🤖

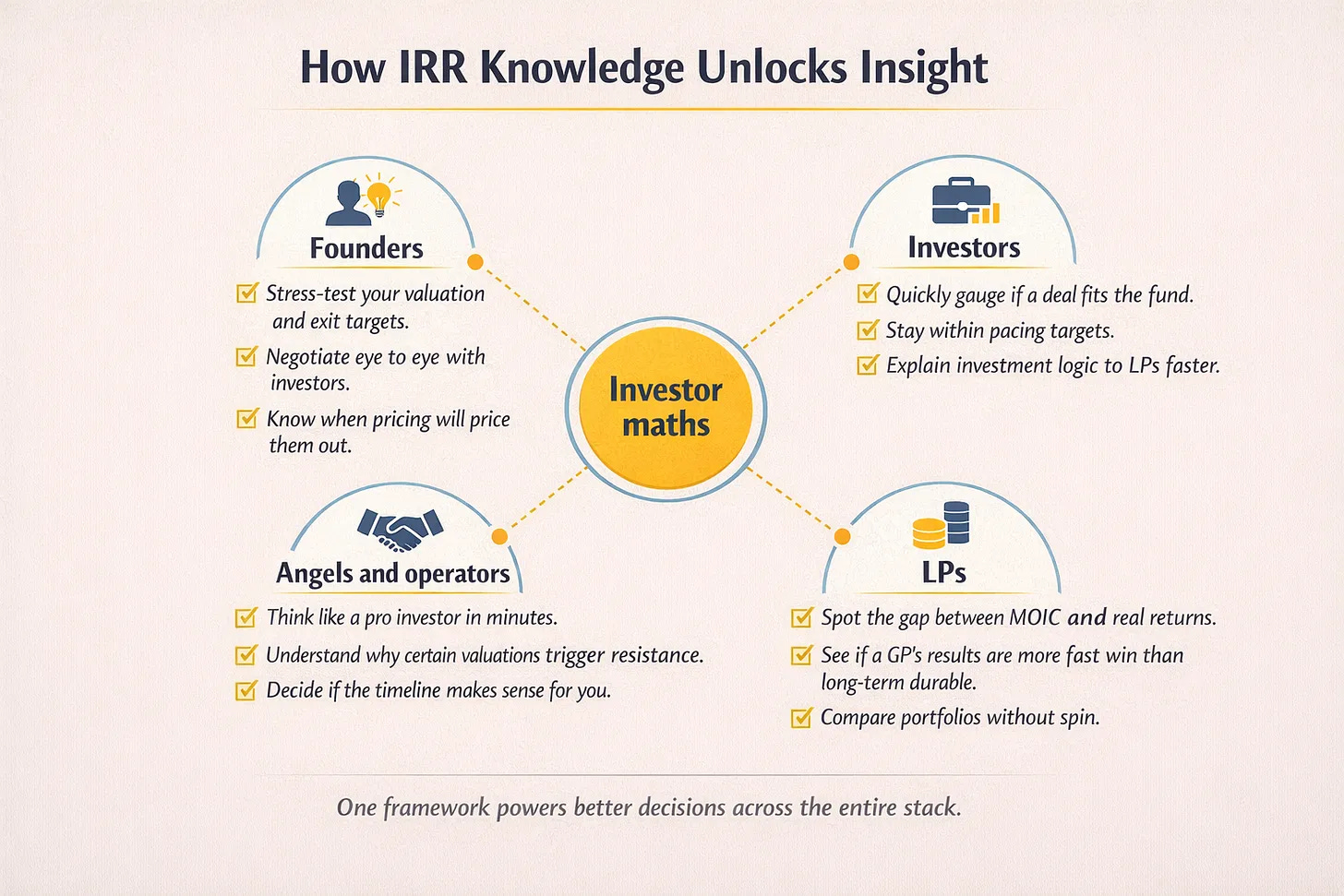

The collection outlines practical build paths across operations, sales, research, and personal productivity. Each concept includes tooling suggestions and scope guidance for builders targeting small recurring revenue streams.Understanding IRR versus MOIC changes fundraising leverage 📊

Total return multiples matter less than the speed at which capital compounds annually. Founders who grasp time-adjusted math position deals more effectively during negotiations. [Chris Tottman]Vibe coding finds strength in rapid iteration and niche builds 💻

Agentic development tools excel at prototypes, lightweight apps, and workflow utilities. They empower non-technical operators to ship quickly, though sustaining production-grade systems still requires discipline. [SaaStr]

Trending News ⚡

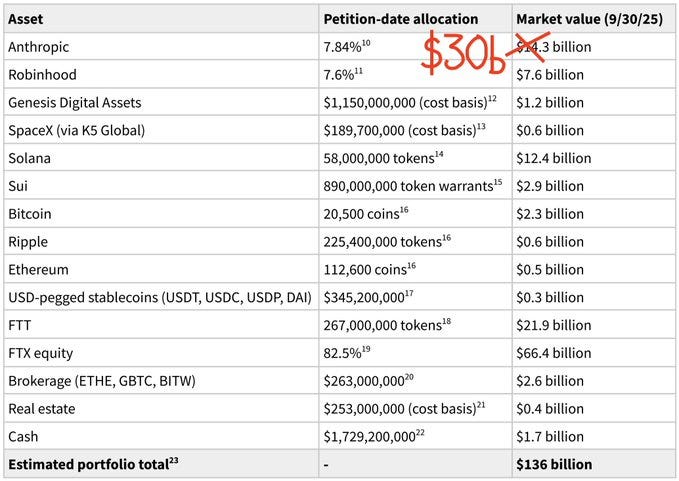

Anthropic hits $380B valuation with $30B funding round 💰

The AI company more than doubled its worth after massive investor demand fueled a record-breaking raise. Strong enterprise adoption and rapid developer traction pushed annualized revenue to $14 billion. [Reuters]Spotify’s top developers haven’t coded since December thanks to AI 🎵

The company’s internal AI system now writes production code while engineers supervise and deploy remotely. Feature launches and bug fixes can happen from a phone during a commute without touching a keyboard. [TechCrunch]Microsoft AI CEO predicts full white-collar automation within 18 months ⏰

Mustafa Suleyman argues knowledge work across law, accounting, and management is nearing full automation. Industry leaders warn the shift could trigger historic labor disruption if adoption accelerates. [Business Insider]SoftBank books $4.2B gain on OpenAI as Vision Fund rebounds 💹

The Japanese conglomerate reported a strong quarterly recovery driven by appreciation in its AI holdings. Proceeds from selling other major stakes have been redirected into concentrated artificial intelligence bets. [CNBC]Sam Altman’s eye-scanning startup hemorrhages senior executives 👁️

Multiple top leaders departed amid cultural strain and restructuring at the biometric identity venture. Interim appointments were introduced as management doubled down on performance and mission intensity. [Business Insider]AI productivity gains lead to burnout, not time savings 😰

Research shows efficiency tools are expanding workloads instead of shrinking them for many professionals. Expectations rise faster than output, pushing tasks into evenings and weekends. [TechCrunch]Alphabet issues rare 100-year bond to fund massive AI spending 📜

The tech giant secured tens of billions in global debt markets amid extraordinary investor demand. Capital will support aggressive infrastructure buildouts as industry AI spending surges. [Reuters]Elon Musk’s xAI loses fourth cofounder in a year💔

Another founding member exited following internal reorganization and leadership shifts. The departures signal ongoing turbulence as the startup restructures its research teams. [Business Insider]OpenAI rolls out ads despite Altman’s past anti-advertising stance 🔄

The company introduced advertising to ChatGPT users in the United States based on engagement patterns. The move intensifies competition as rivals position trust and neutrality as differentiators. [Business Insider]

Fundraising?

If you’re raising a round, Luis Llorens and The Founders Corner can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

Social Media Gems 💎

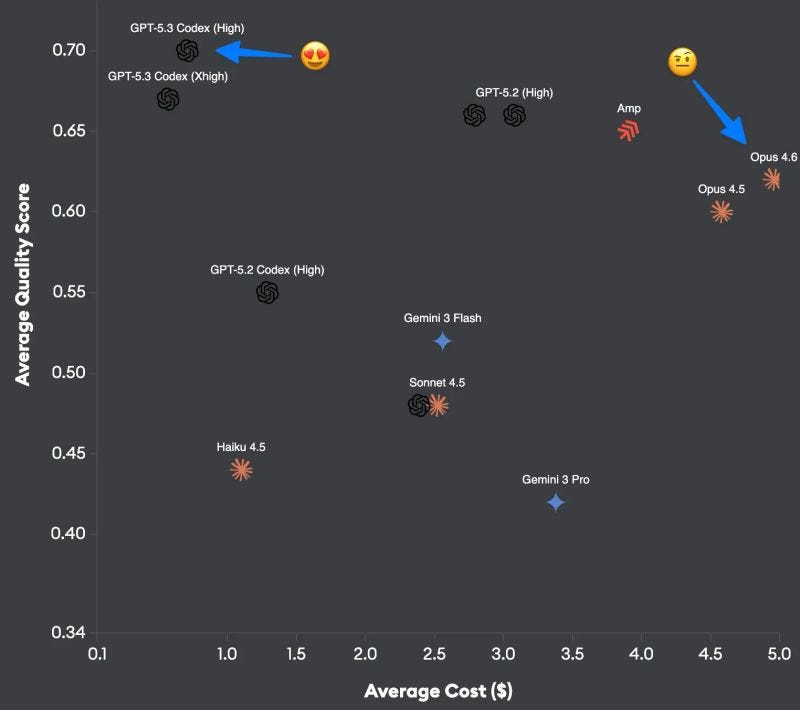

Codex impresses devoted Claude Code user with precision ✨

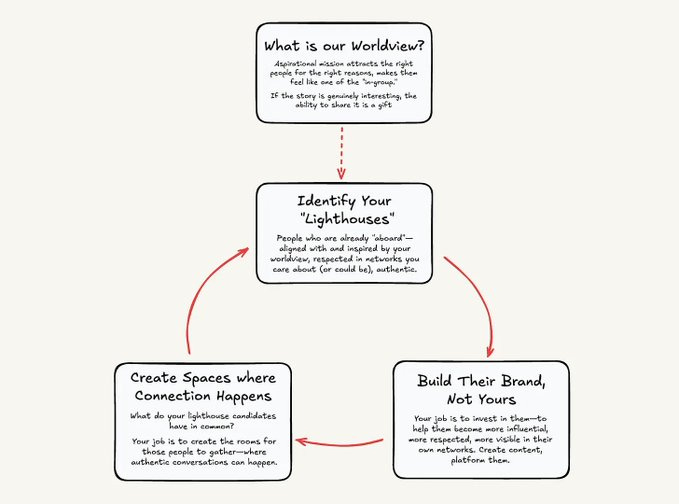

A well-known AI developer admitted the tool handled complex implementation work without hallucinating features or cutting corners. Observers describe its approach as deliberate and structured, favoring correctness over rapid iteration. [Walid Boulanouar]Startups need preferential attachment to unlock network effects 🔗

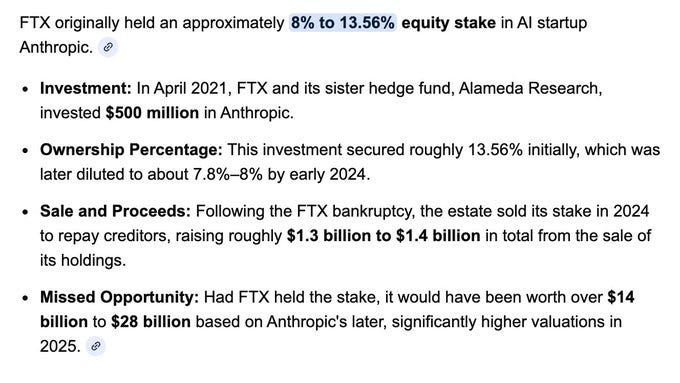

Early traction comes from identifying aligned insiders who can open doors to concentrated audiences. By helping those connectors grow their own influence, companies compound distribution organically. [a16z]FTX’s $500M Anthropic bet balloons after bankruptcy sale 💰

The collapsed exchange invested heavily in the AI startup before liquidating the stake to repay creditors. That early position would be worth many multiples more today based on the company’s latest valuation. [SBF]Claude’s slide automation sparks debate in strategy consulting 💀

Automation tools can now generate polished presentations in minutes, reducing junior-level production work. Senior consultants argue their value lies in judgment, synthesis, and driving decisions beyond formatted slides.McKinsey scales thousands of AI agents across its workforce ⚡

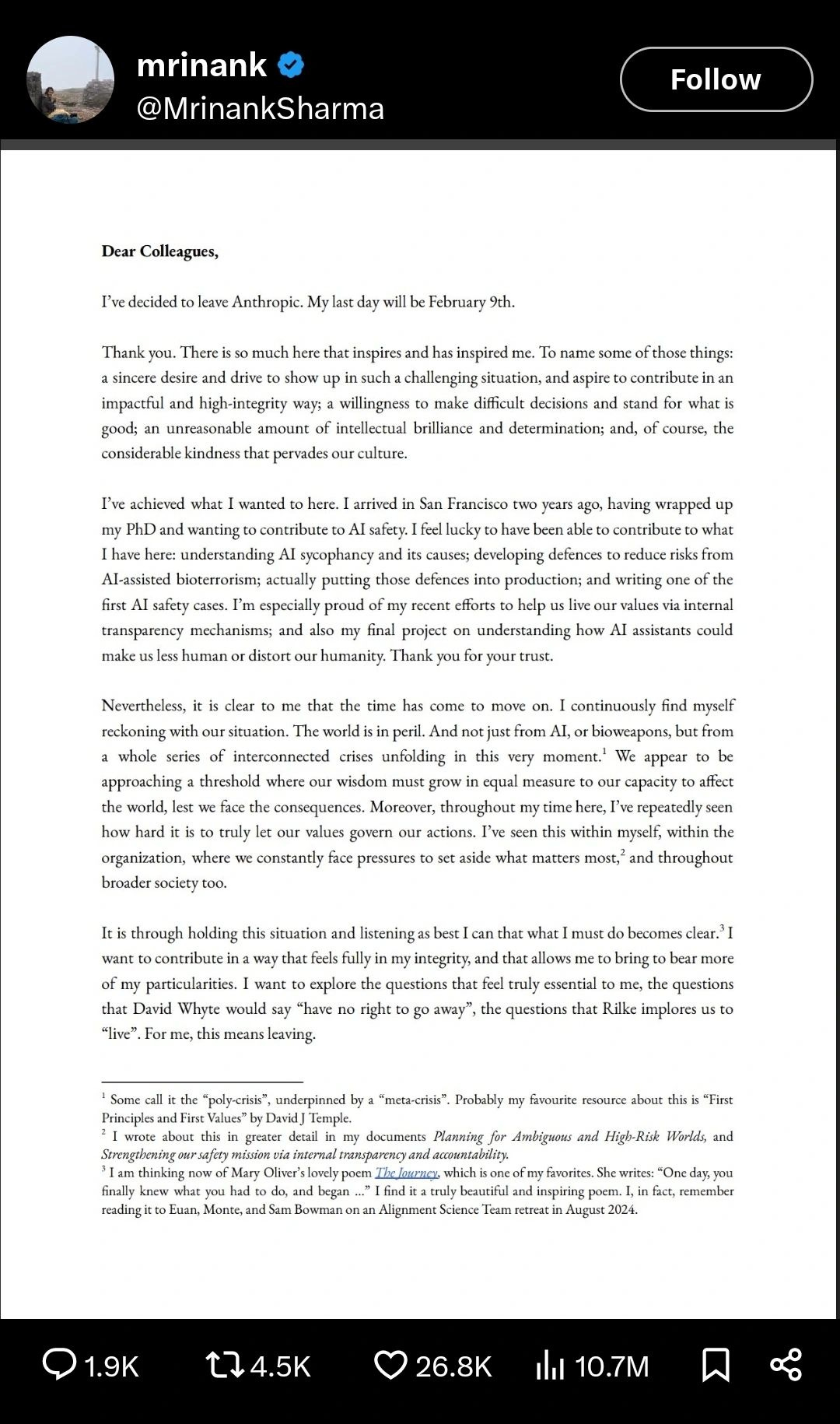

The firm has rapidly expanded internal agent deployment and is routing a growing share of projects through AI systems. Leadership is experimenting with outcome-based pricing while hiring hybrid builders who blend strategy and engineering.Anthropic safety researcher exits over principles gap ⚠️

A senior researcher resigned after expressing concern about alignment between stated values and operational decisions. His departure sparked discussion about integrity, governance, and responsibility in frontier AI labs.

New Funds 💰

Seligman Investments launched a $500M venture capital arm to back high-growth startups, expanding its platform into direct VC investing.

Union Capital Associates closed Fund IV at $450M, reinforcing its commitment to scaling middle-market and growth-stage companies.

Kindred Ventures raised approximately $227M across two funds to continue backing early-stage technology startups.

Shorooq established a $200M late-stage growth fund to support scaling technology companies across MENA and beyond.

Karmel Capital raised approximately $170M for a new AI-focused investment strategy targeting next-gen artificial intelligence startups.

Elaia held the first closing of its fifth digital venture fund at €120M, targeting European deep tech and digital startups.

Gerber Taylor closed a $111M co-investment vehicle to deepen participation alongside leading private market managers.

Masna Ventures launched a $100M defense-tech fund to invest in next-generation national security and dual-use technologies.

All Aboard Fund raised $99M for its maiden fund, focusing on supporting diverse and underrepresented founders.

Multimodal Ventures closed its first fund at $15M to invest in early-stage startups across multimodal and emerging tech sectors.

That’s a wrap for this week.

If you want to stay ahead of the curve, make sure you're subscribed. No fluff, just real startup insights delivered straight to your inbox.

See you next time 🚀