Peter Thiel’s Only Pitch Deck📑, Accel AI Report 🤖, Zero-Based Calendaring🗓️

If you're building, investing, or just trying to stay ahead of the curve, you're in the right place. Every week, we break down the latest insights, funding news, and founder-friendly gems. Just what matters. Plus, we track the freshest VC funds deploying capital so you know where the money’s moving.

Let’s get into it 👇

Brought to you by Attio

The CRM used by both startups and VCs (including us)

We use Attio to manage deal flow, track founder conversations, and sync everything across our team — no clunky setup required.

Startups use it as a sales CRM from day one

VCs use it for deal tracking, LPs, and intros

Fully customizable and updates automatically

It’s fast, flexible, and built for how we actually work.

In-Depth Insights 🔍

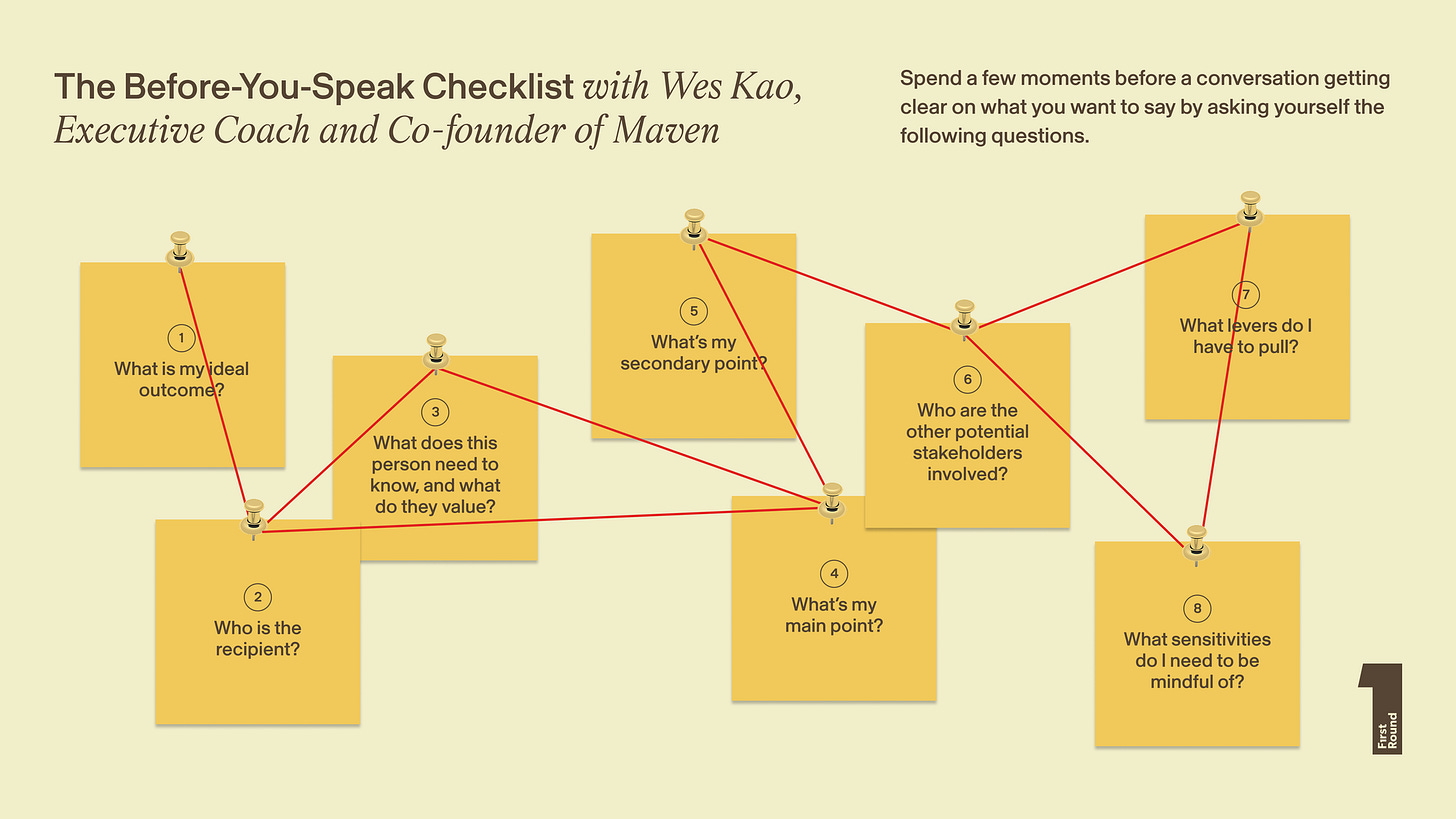

The Other PMF: Wes Kao’s Framework for Founders Who Want to Communicate 🎯

Practical guidance shows how to align communication style with message to build trust and influence. It covers self-audit, preparation habits, reading the room, decoding feedback, and leaning into spiky strengths. [Review - FirstRound]

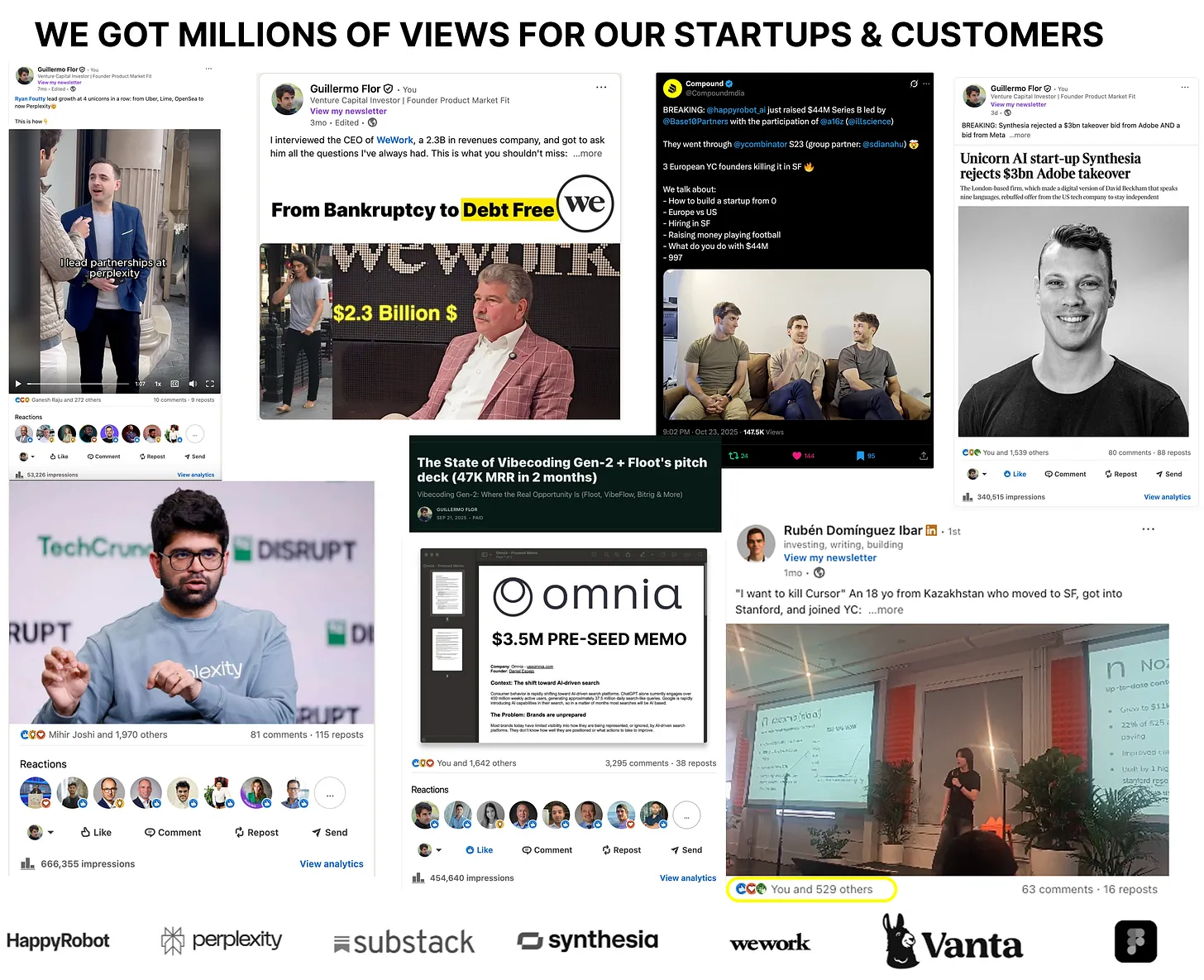

a16z New Media and YC Dealflow Playbook 🤝

a16z is building a turnkey content operation to turn attention into advantage for portfolio launches. The authors share how audience-first media helped them secure allocations in oversubscribed YC rounds and outline a plan to scale investing plus services. [Ruben Dominguez and Guillermo Flor]

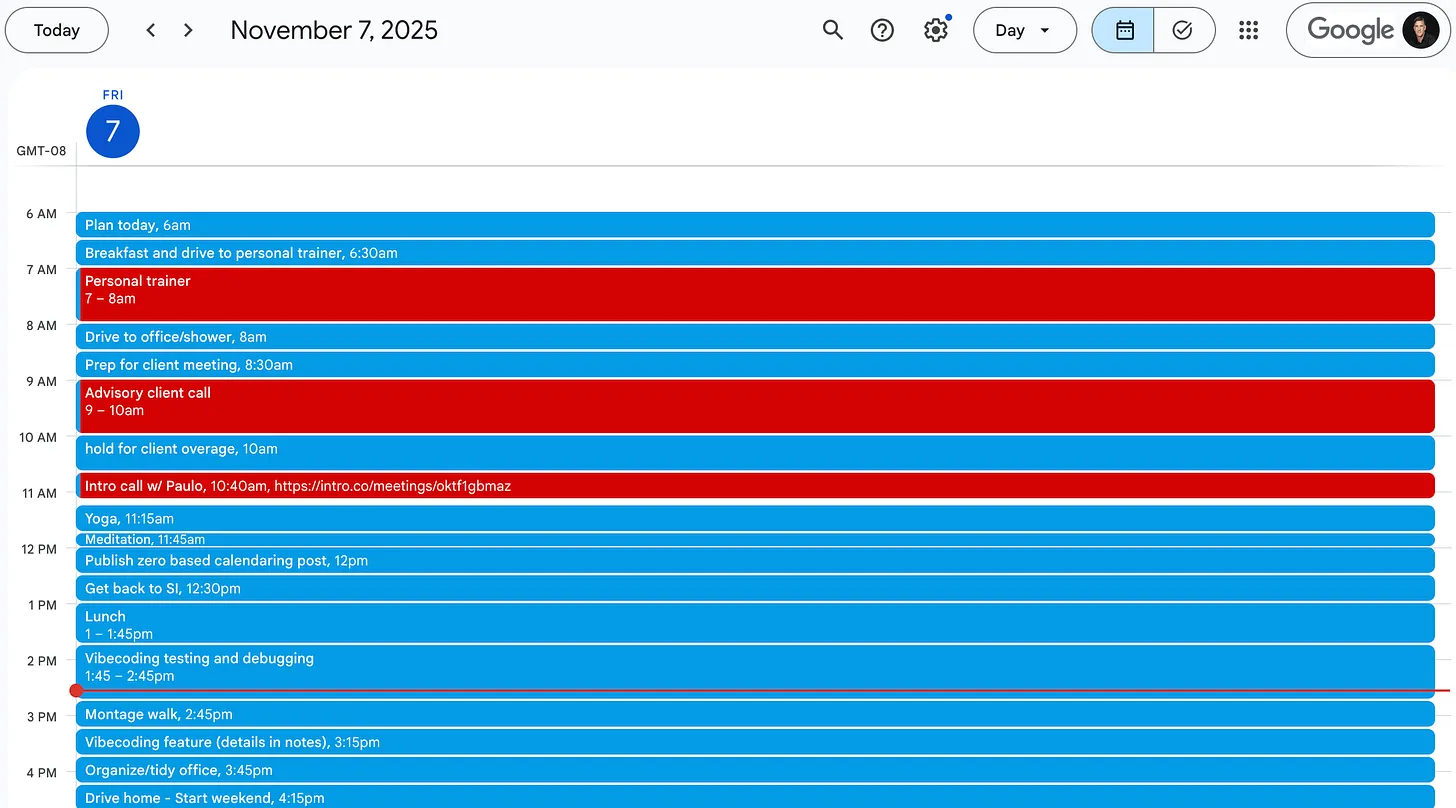

Zero-Based Calendaring for Focused Days 🗓️

Designing the day from scratch each morning increases calm, focus, and follow-through while making distraction visible. Blending timeboxing with flexible replanning also protects wellness habits and adapts smoothly to surprises. [Sean Ellis]Meet-Ting: AI Coordination’s Next Layer 🤖

The piece argues that scheduling is a network problem and explores an assistant that coordinates across threads, people, and intents. It points to an emerging platform where calendars evolve from static records into predictive maps of collaboration.Peter Thiel’s Only Pitch Deck, Decoded 📑

A rare example from 2012 lays out a clear investor narrative built on problem, solution, evidence, and team. It also shows where modern decks differ. Shorter slides, sharper headers, and separated sections that make the logic scan fast.

Trending News ⚡

Wikipedia Urges AI Companies to Use Paid API, Not Scraping 📚

The Wikimedia Foundation is asking model builders to access encyclopedia content via Wikimedia Enterprise with proper credit and support, rather than taxing its servers with covert bots. The move aims to sustain community contributions and funding as traffic shifts toward AI summaries. [TechCrunch]Yann LeCun to Leave Meta and Launch a New Venture 🚪

One of the field’s most influential researchers is preparing to strike out independently after years shaping a Big Tech lab’s research agenda. The departure underscores intensifying competition for top talent and the pull of founder-led research companies. [Financial Times]

Apple Taps Google’s Gemini to Power a Revamped Siri 🔁

Apple is finalizing a multiyear arrangement to run Siri on a 1.2-trillion‑parameter Gemini model while its in‑house systems mature. The agreement reportedly approaches $1 billion per year and is framed as a temporary bridge rather than a deep OS search integration. [Reuters]

Accel: Europe Should Win in AI at the Application Layer 🇪🇺🧩

Accel’s Philippe Botteri argues the region can build global leaders by focusing on software built atop foundation models instead of capital‑heavy infrastructure. New data shows funding for cloud and AI apps in Europe and Israel closing ground on the U.S., with standout companies scaling fast. [Sifted]Europe’s Tech Promise Needs More Years Like 2025 🚀

A Reuters column highlights Europe’s improving setup for deep tech and AI as investors reassess valuations across regions. Sustained progress will hinge on channeling capital to startups and university spinouts while tightening the innovation pipeline. [Reuters]

Half of UK Firms’ Resilience Budgets Now Go to Tech and AI 🤖

New Elixirr research finds companies are prioritizing intelligent systems for compliance, faster decisions and risk reduction as operating conditions tighten. Leadership and ownership remain fragmented, but early adopters report measurable gains in speed, savings and scalability. [TechRound]

Data Centers Now Command More Capital Than New Oil Projects 🏗️

IEA data shows global spend on compute hubs surpassing exploration outlays, reflecting the digitization of economic activity and AI’s power needs. Grid connections, equipment bottlenecks and siting near metros are becoming decisive constraints that shape timelines and costs. [Tech Crunch]‘Chad: the Brainrot IDE’ Pushes Vibe Coding to the Extreme 👨💻

YC‑backed Clad Labs built an editor that embeds distractions like videos, swipes and games directly into the coding workspace to manage context switching. Reactions range from satire to curiosity as the team runs a closed beta targeting consumer‑app developers. [TechCrunch]Anthropic to Invest $50B in U.S. AI Infrastructure 💰

The company will build custom facilities starting in Texas and New York with partner Fluidstack, adding thousands of jobs as initial sites go live in 2026. The expansion positions the firm in the race for domestic compute capacity amid policy debates over financing and the grid. [CNBC]Musk Floats Tesla ‘Terafab’ for AI Chips, Eyes Intel Talks 🚗

Tesla’s plan calls for a massive facility to make power‑efficient accelerators optimized for its autonomy stack at a fraction of flagship costs. Early output could begin in 2026, with volumes ramping later as the company balances supplier capacity and in‑house ambitions.

Fundraising?

If you’re raising a round, Luis Llorens and The Founders Corner can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

Social Media Gems 💎

The Great AI Reset 📊

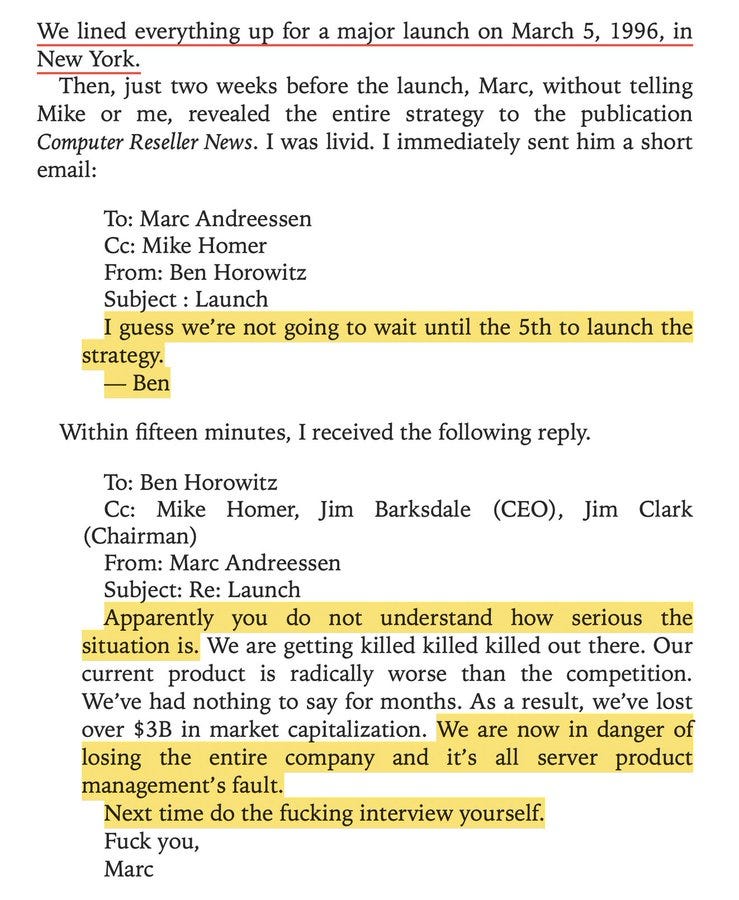

Younger technical founders, consolidation at the top of the stack, and volatile markets are reshaping the next phase of software building. The data points to divergence in growth, leaner teams, and a revitalized Bay Area as in‑person collaboration returns.Marc Andreessen’s 1996 Launch-Day Rant Resurfaces 🔥

A resurfaced message from the browser wars captures the intensity and urgency of ship‑or‑die product culture. The thread shows how high‑stakes pressure, blunt feedback, and real‑time execution shaped an era of internet history. [adriane schwager]Harry Stebbings VC Parody Skit Goes Viral 🎭

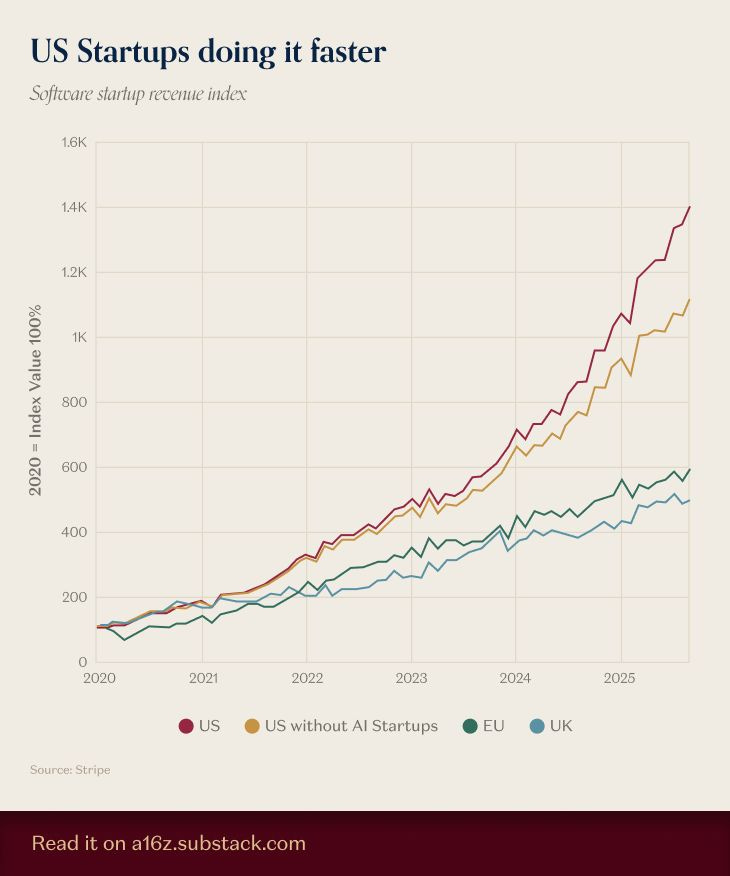

A sharp satire pokes fun at fundraising buzzwords, metrics worship, and media theatrics in the venture ecosystem. The bit lands because it mirrors real incentives: status loops, acronym soup, and attention as a growth channel. [Henry Hayes]Stripe Data: US Startups Are Pulling Ahead 📈

Longitudinal revenue data shows a widening acceleration gap versus Europe and the UK, even after excluding frontier categories. Faster adoption cycles, large addressable markets, and lighter friction appear to compound the advantage. [ a16z]YC Bets on a 10‑Person, $100B Company ⚡️

The thesis centers on extreme leverage: modern tooling shrinking headcount while maximizing revenue per employee. High‑agency teams that cut politics and optimize for speed could translate small footprints into outsized enterprise value.Elon Musk’s Work Ethic Quote Sparks Debate ⚔️

Relentless hours as a badge of honor divides builders and critics over sustainability and culture. The reaction underscores a broader question: what tradeoffs are acceptable when chasing outsized outcomes.

New Funds 💰

Glasswing Ventures just closed Fund III at $200M, doubling down on AI-first enterprise and cybersecurity startups across North America.

Step Fund kicked off with a $30M first close, eyeing early-stage tech ventures in emerging markets ready to scale.

Vendep Capital raised €80M for its fourth fund, to back the next wave of AI-era SaaS founders across Europe.

Backed VC locked in a $100M seed fund, reaffirming its mission to fuel bold early-stage founders in tech and science.

Quantum Exponential Group PLC launched a £100M fundraise, all-in on advancing the UK’s quantum tech ecosystem.

Activate Capital rolled out a AUD 50M fund, aiming to supercharge Canberra’s startup scene with innovation-driven bets.

Vendep Capital confirmed another €80M close, laser-focused on next-gen European SaaS founders building in the AI era.

That’s a wrap for this week.

If you want to stay ahead of the curve, make sure you're subscribed. No fluff, just real startup insights delivered straight to your inbox.

See you next time 🚀

Peter Thiel having only one pitch deck from 2012 that people still analyze is peak 'show your work once and let it speak forever' energy

Will be interesting to see what Yann LeCun puts together. I really don't think there will be an Ai bubble the way everybody thinks like BOOM, big burst, but just constant changing.

PLUS, I think that all the Ai creators are going to hit a brick wall because there will be nothing proprietary, just lots of prompt sharing.

What do you think?