Lessons on Scaling a Startup🔥, Guy Kawasaki’s 10-Slide Pitch Deck Formula📊, America’s AI Sugar High🍭

If you're building, investing, or just trying to stay ahead of the curve, you're in the right place. Every week, we break down the latest insights, funding news, and founder-friendly gems. Just what matters. Plus, we track the freshest VC funds deploying capital so you know where the money’s moving.

Let’s get into it 👇

In-Depth Insights 🔍

Vibecoding Playbook for Builders 🛠️

A hands-on roadmap for shipping production-ready AI apps using modern agent and prompt systems. It breaks down validation, stack setup, prompt tuning, versioning, testing, and cost control for speed without waste. [Karo (Product with Attitude) and Karen Spinner]32 Lessons on Scaling a Startup 🔥

Five years of growing PostHog from 11 to 150 people condensed into hard-earned lessons on hiring, product, and culture. It’s a field guide for founders who want to scale fast while keeping their team and sanity intact. [Charles Cook]The Discomfort of Focus 🎯

Narrowing focus feels risky, but it’s how founders learn faster and validate sharper. This essay unpacks why chasing breadth kills momentum and how real growth comes from saying no early and often. [Reece Griffiths]Build a Billion-Dollar Startup with a Minimal Team 💡

Lean founders are proving massive wins don’t need massive headcount. With the right systems and automation, small teams are driving millions in revenue and defining the new shape of efficiency.Guy Kawasaki’s 10-Slide Pitch Deck Formula 📊

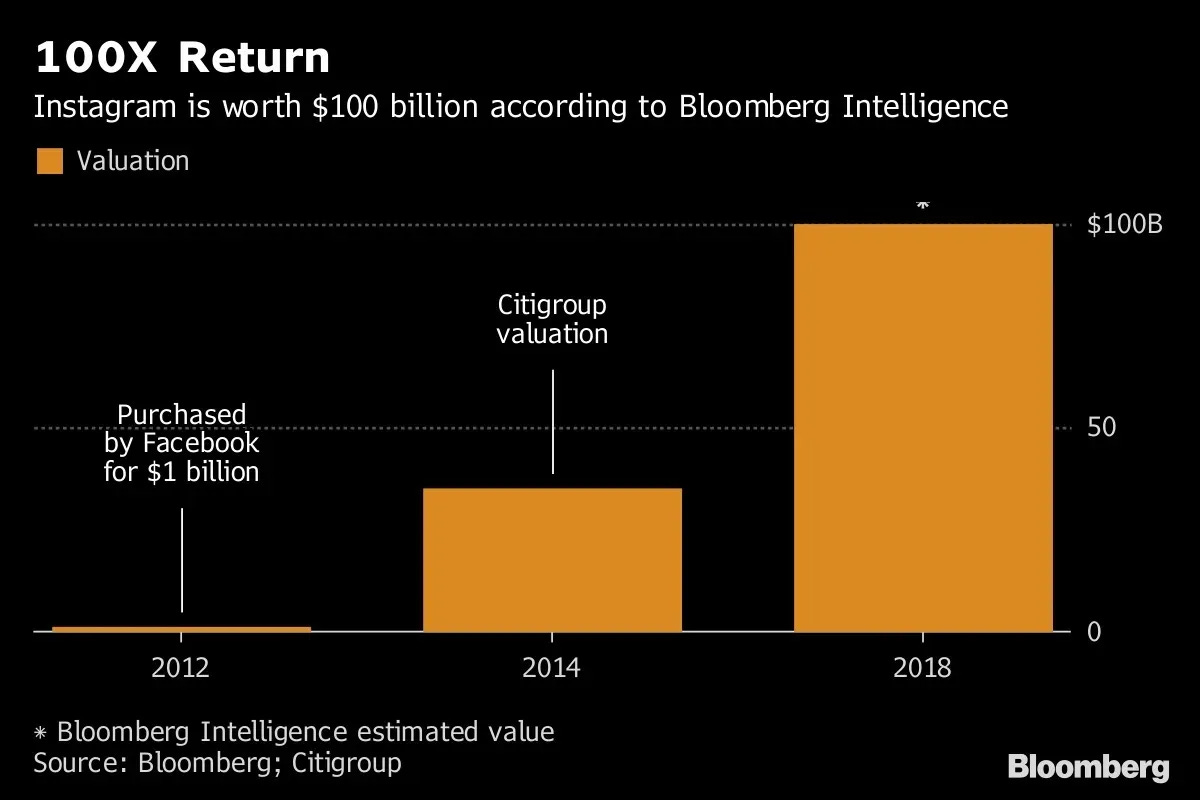

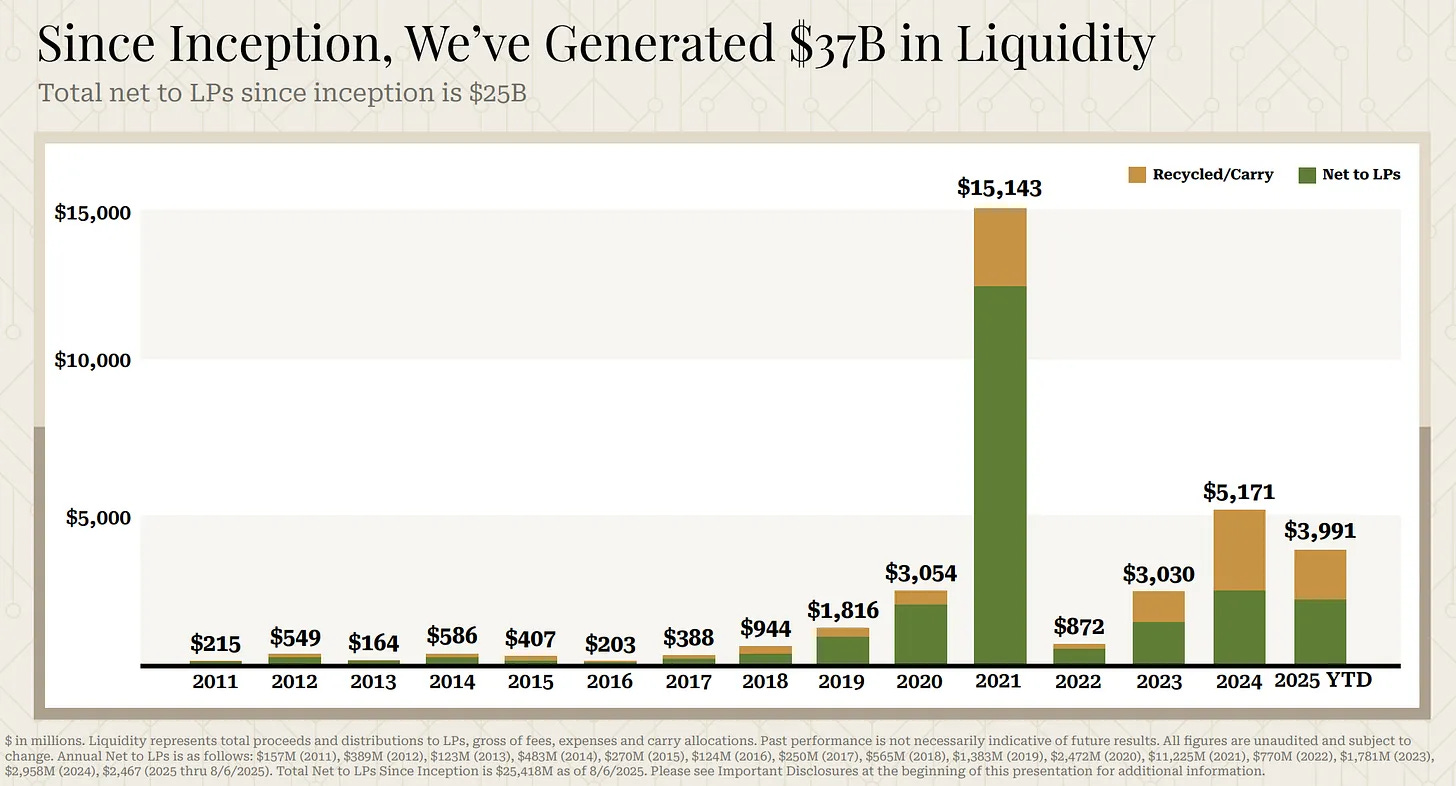

A clear, practical framework for building investor decks that actually close rounds. Each slide has a purpose, every story has a hook, and nothing wastes attention. [Chris Tottman]Andreessen Horowitz Quietly Delivers $25B+ to LPs 💰

A16z has returned more than $25 billion since 2009, anchored by a 9.4x net TVPI in its 2012 fund. Behind the hype sits real execution in defense, AI, and consumer tech. [Eric Newcomer]The AI Growth Endurance Problem ⚙️

AI startups are sprinting on fragile economics, with churn and cost overruns hiding under fast ARR. To last, founders need to trade blitz scaling for disciplined retention and margin control. [OnlyCFO]

Trending News ⚡

Goldman Bets Big on VC Future 🤝

Goldman Sachs is acquiring Industry Ventures for $665M with up to $300M more tied to performance. The deal expands Goldman’s $540B alternatives platform and opens high-growth startups to its clients. [CNBC]Motion’s $60M Raise Powers Agentic Work ⚡

Motion raised $60M at a $550M valuation to scale AI-native project managers and assistants. Backed by YC, SignalFire, and Valor, the platform now serves 10,000 SMBsOpenAI’s $1 Trillion Tightrope 💰

OpenAI earns $13B annually but pledged $1T in compute over the next decade. With 70% of revenue from $20 ChatGPT subs, it is eyeing hardware, video, and government deals to grow. [TechCrunch]Salesforce Hit With AI Copyright Lawsuit ⚖️

Two authors are suing Salesforce over training XGen AI on 200,000 books allegedly without permission. The class action alleges ongoing infringement despite similar cases favoring Meta and OpenAI. [Decrypt]Apple’s AI Brain Drain Continues 🧠

Ke Yang, former lead of Apple’s AI search, joined Meta, adding to departures from Cupertino’s AI teams. Siri’s overhaul set for March faces turbulence as top talent leaves for competitors. [TechCrunch]The Bright Side of the AI Bubble 💭

Ex-Google CEO Eric Schmidt says the AI boom drives innovation and competition. Bubbles leave stronger companies, smarter capital allocation, and lasting technological gains. [Sifted]AI Founders Are Testing VC Loyalty ⚖️

High-profile AI exits are challenging Silicon Valley’s founder-friendly norms. VCs may tighten term sheets with key-person clauses, stricter vesting, and alignment protections. [Axios]America’s AI Sugar High 🍭

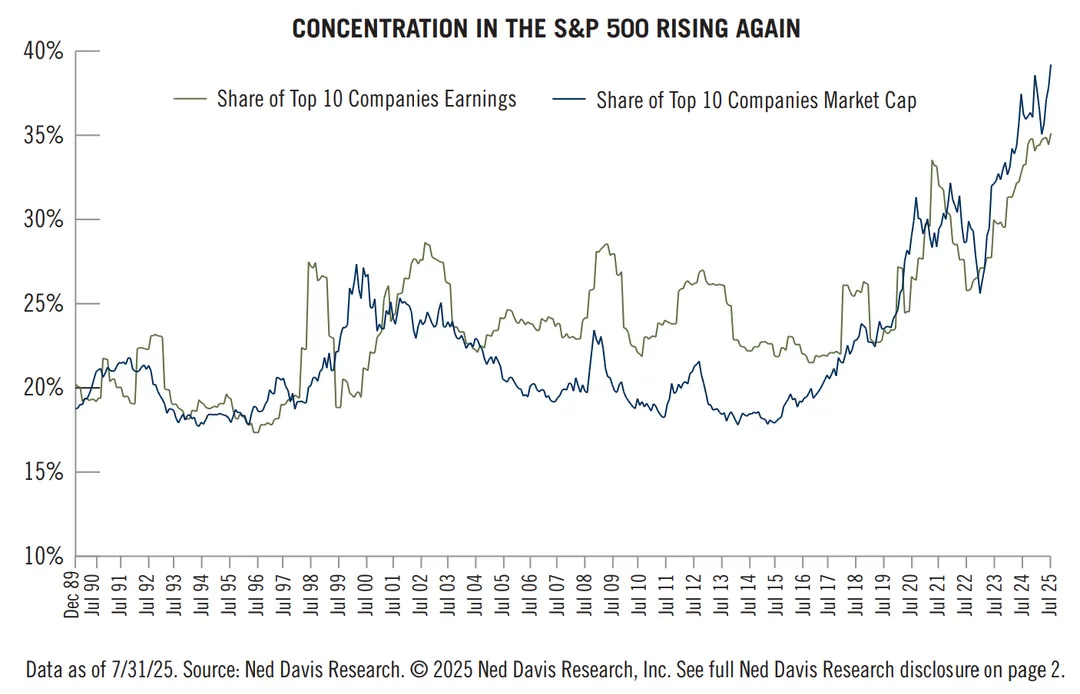

Harvard data shows 92% of U.S. growth now comes from AI spending. With massive raises like xAI’s $20B and Nvidia’s surge, bulls cheer while warnings of stretched valuations mount. [Decrypt]Blackstone Eyes $5.5B Tactical Opportunities Fund 💼

Blackstone plans Fund V with $5.5B in commitments and potential expansion to $10B. The firm remains opportunistic in sectors like tech, AI, and business services. [PitchBook]Deel Hits $17.3B Valuation Amid Legal Clash ⚖️

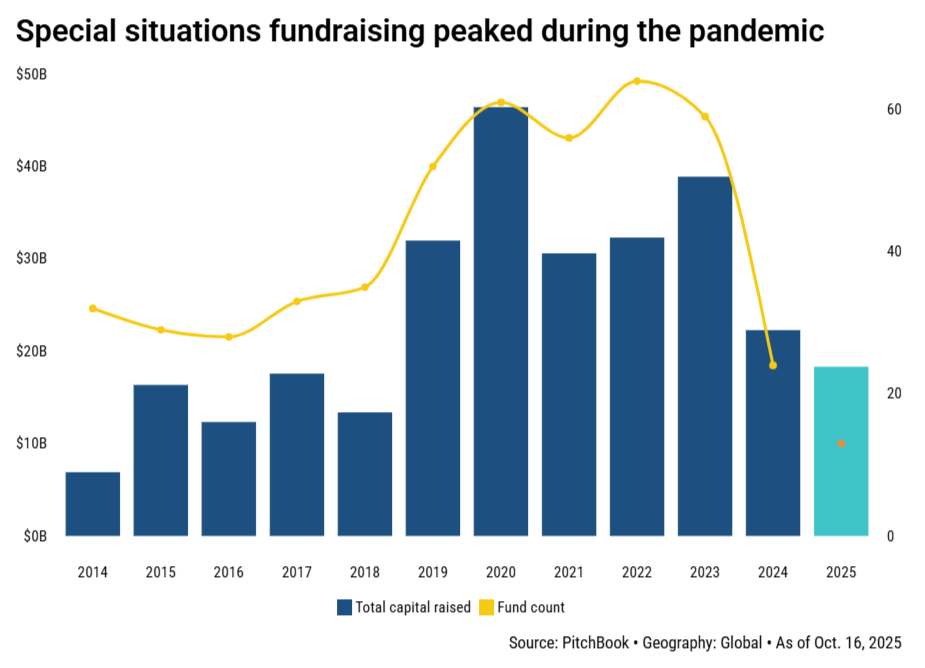

The HR tech startup raised $300M, boosting valuation 42% despite litigation with Rippling. Investors including Ribbit, Coatue, and a16z continue to back Deel’s growth. [PitchBook]VC Secondaries Keep Growing, GP-Led Deals Lag Behind ⏳

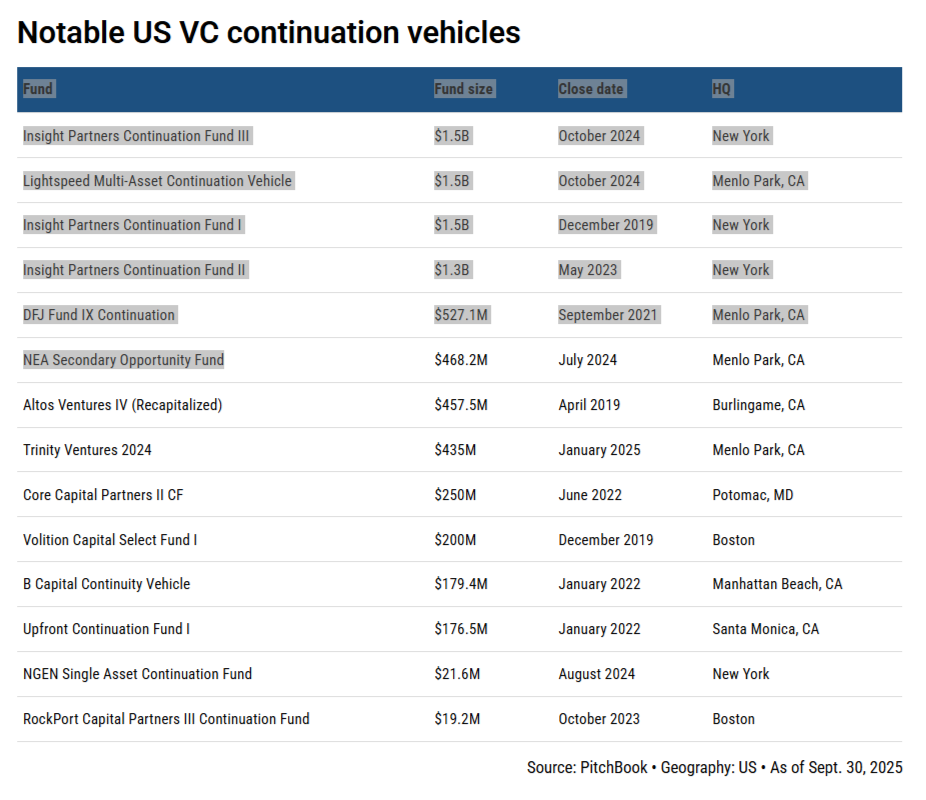

Direct venture secondaries hit $60B annually, while GP-led deals reach $14.6B. Liquidity needs compete with long-term upside as the GP-led market grows slowly. [PitchBook]

Fundraising?

If you’re raising a round, Luis Llorens and The Founders Corner can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

Investing?

THESE are the companies RAISING right NOW

Social Media Gems 💎

10 Must-Have Tools for Founders🔥

Skip the trial and error with this curated toolkit of pitch decks, investor lists, Notion templates, and financial models. Built for founders who value time over guesswork.

The Hidden Trap in Term Sheets ⚠️

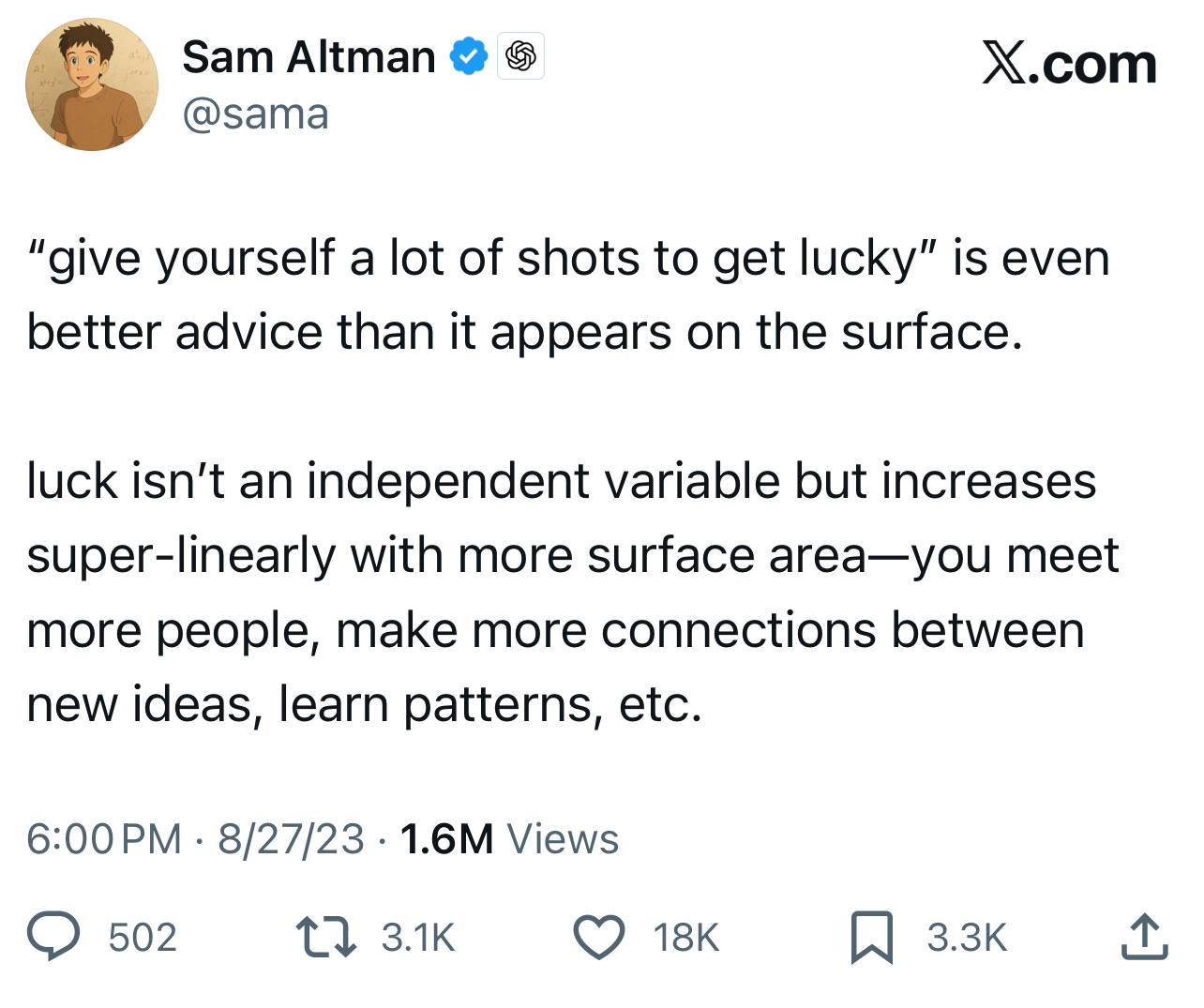

A founder raised $20M but lost half after missing a milestone by 6%. Milestone-based tranches quietly hand control to investors and can cripple momentum fast. [Itamar Novick]The More You Create, The Luckier You Get ✨

Luck scales with output, not chance. Each post, product, and idea increases your surface area for opportunity and compounds into outcomes you can’t plan. [ Ivan Landabaso]Culture Is What You Do, Not What You Say 💼

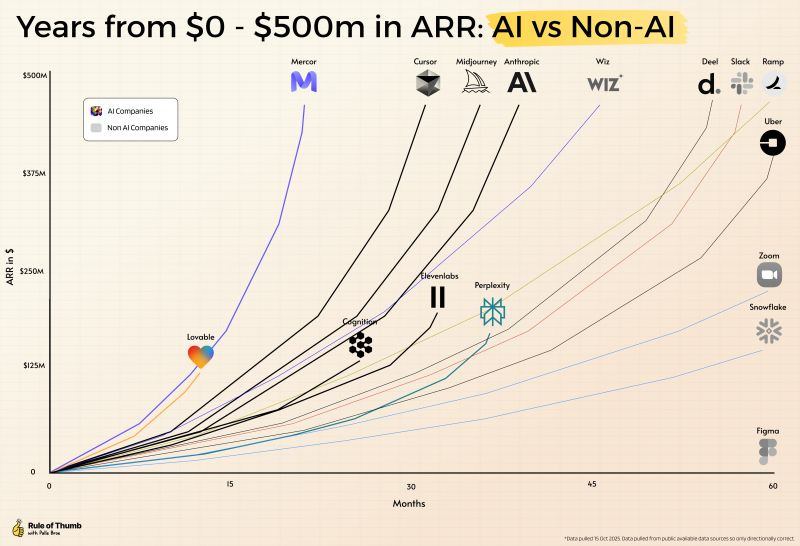

Ben Horowitz nailed it: culture shows up in decisions, not slogans. It’s built through hard calls when values meet reality, not team offsites or wall art. [Andreessen Horowitz]$0 to $500M ARR Is the New AI Standard 💥

Lovable is racing toward $500M ARR faster than any SaaS before it. The AI era is rewriting what “fast growth” means, leaving even past giants looking slow. [ Palle Broe]PE Holding Periods Hit Decade Highs 📈

European buyout firms now hold assets for a median 5.7 years. Slower exits are fueling a boom in secondaries and creative GP-led liquidity plays. [Philip De Vusser]Seeing Beyond Moore’s Law 💡

In 1993, Jensen Huang bet on accelerated computing while others doubled down on CPUs. That contrarian call turned NVIDIA into one of tech’s defining stories. [Konstantine Buhler]

New Funds 💰

Maximum Frequency Ventures launches a $50M fund to back early-stage startups across deep tech and frontier innovation sectors.

SaaS Capital raises $100M for its fifth fund, continuing its focus on supporting recurring revenue software businesses.

Town Hall Ventures closes Fund IV at $440M to invest in healthcare innovation and underserved communities.

Radical Ventures closes a $650M AI-focused fund to back cutting-edge artificial intelligence startups globally.

Maia Ventures closes €55M fund aimed at supporting agtech and foodtech founders driving sustainability.

DVC launches a new $75M fund targeting early-stage investments in digital infrastructure and tech-enabled platforms.

Ascenta launches a new venture fund focused on early-stage startups driving innovation across climate tech and sustainable industries.

Radical Ventures expands its AI investment portfolio with a fresh fund targeting transformative artificial intelligence and machine learning companies.

Verne Capital introduces a growth fund to support emerging technology companies in energy, mobility, and sustainability.

Ukraine Phoenix Tech Fund launches to fuel Ukraine’s tech ecosystem recovery with investments in resilient startups and innovation-led ventures.

Monterro raises new capital to back B2B software growth companies across Northern Europe, strengthening its operational focus.

Notion Capital announces a new fund dedicated to European SaaS founders, emphasizing global expansion and category leadership.

Creator Fund unveils a fund empowering student founders and academic entrepreneurs building frontier technology startups.

Lisk launches a venture fund to support blockchain developers and startups expanding the Web3 ecosystem.

Wave Function Ventures debuts a science-driven fund investing at the intersection of physics, computation, and deep technology innovation.

That’s a wrap for this week.

If you want to stay ahead of the curve, make sure you're subscribed. No fluff, just real startup insights delivered straight to your inbox.

See you next time 🚀

Thanks for writing this, it clarifies a lot. AI playbook is key.

This is excellent! So many insights. And thank you SO much for the mention, I really appreciate it!