The Most Misunderstood Idea in Venture Finance

The simple idea that explains every investor decision you have ever heard.

Every fundraising story has two parallel narratives.

The one founders tell: about vision, growth, customers, traction.

And the one investors hear: about speed, efficiency, and opportunity cost.

Those two narratives meet in the same place:

The maths that decide whether your round is priced correctly, whether an investor backs you, and whether your exit will ever matter inside a fund.

That maths sits on two metrics:

IRR (Internal Rate of Return)

MOIC (Multiple on Invested Capital)

Most founders understand MOIC.

Almost none understand IRR.

And the truth is simple:

MOIC tells you how much you made.

IRR tells you whether it was worth the time.

Understanding the difference, and how they interact, is one of the highest-leverage pieces of knowledge a founder can have.

Let’s break it down.

Table of Contents

📘 IRR vs MOIC: The Simplest Explanation You’ll Ever Read

🧭 Why IRR Is The Investor’s “True North”

🎯 Why Founders Must Understand IRR (Even If It Feels “Too Investor-y”)

⚠️ The Surprising Places Founders Get IRR Wrong

🔍 IRR vs MOIC: Through A Founder Lens

🚧 Where These Metrics Mislead (And How To Avoid The Traps)

📊 A Simple Model That Shows Everything (No Maths Needed)

🛠️ How Founders Should Use IRR (3 Simple Applications)

👥 Who This Knowledge Really Benefits

🏆 Master The Maths → Control The Narrative

📘 IRR vs MOIC: The Simplest Explanation You’ll Ever Read

Founders consistently ask:

“Do investors care more about IRR or multiple?”

The answer:

Both, but for different reasons.

MOIC = total outcome

It answers one question:

“How many times did my money grow?”

If an investor puts in £1M and gets £3M back, that’s a 3×.

It could take 3 years or 13, MOIC doesn’t care.

IRR = speed of the outcome

It answers a different question:

“How fast did my money grow, on an annualised basis?”

This changes everything.

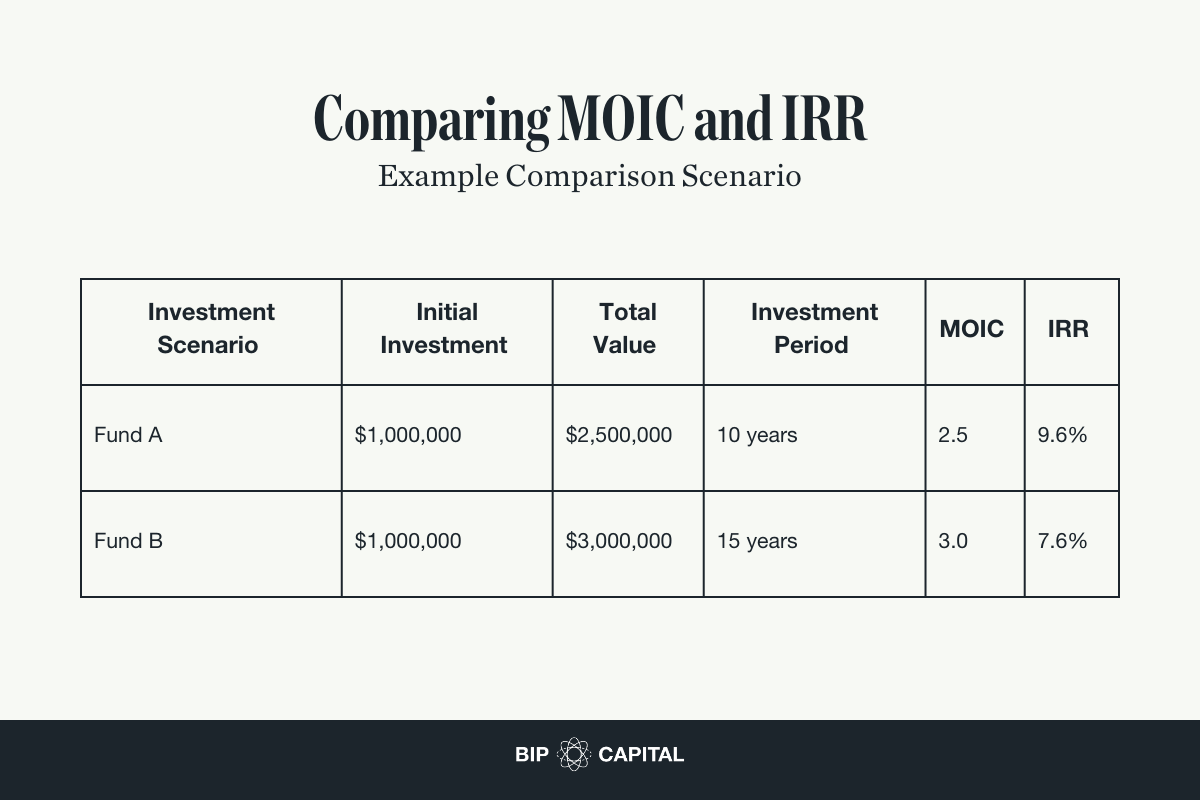

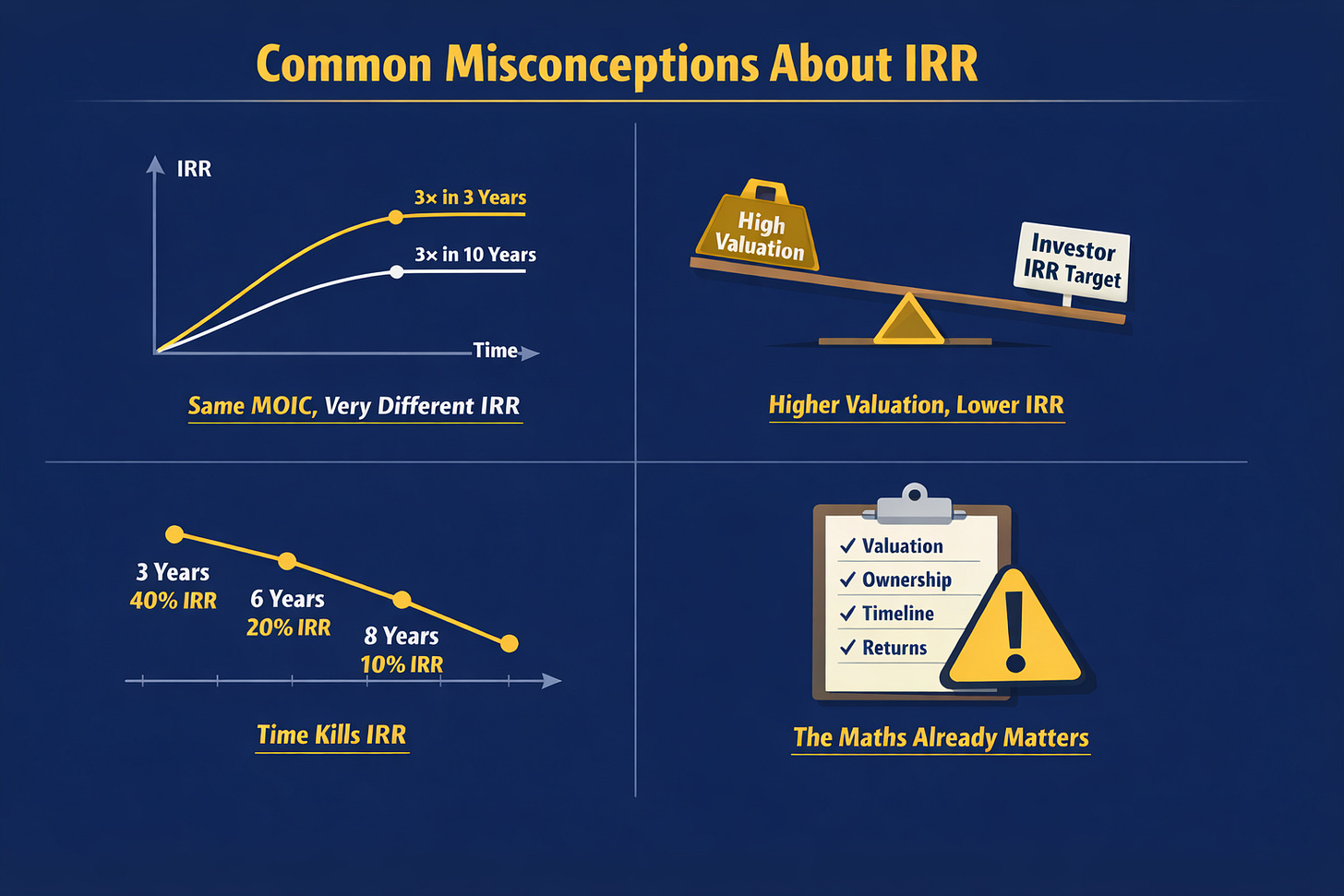

A 3× in 3 years is a ~44% IRR.

A 3× in 10 years is ~12% IRR.

Same multiple.

Completely different investment.

This is why IRR and MOIC are two sides of the same coin.

You cannot understand one without the other.

🧭 Why IRR Is The Investor’s “True North”

Investors don’t have unlimited time.

They don’t have unlimited capital.

And they don’t have unlimited shots at big winners.

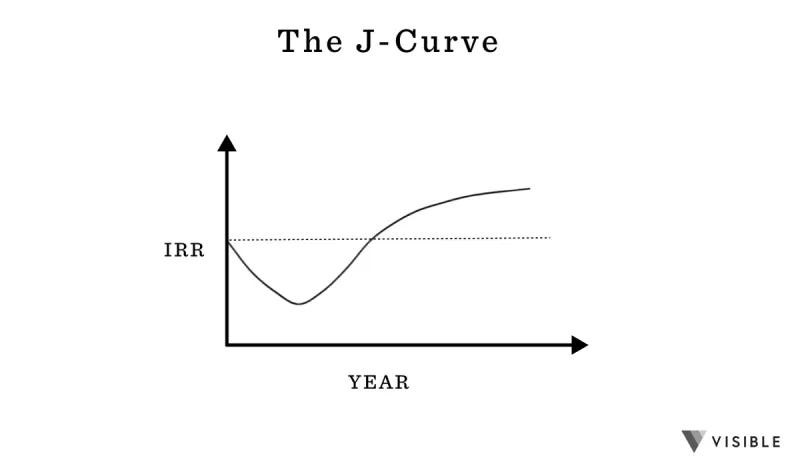

What LPs really judge a fund on is velocity.

Not just value.

A few examples:

A slow 3× can underperform the stock market.

A fast 2× beats most asset classes on earth.

A quick partial exit can spike IRR more than the final outcome.

A huge exit that lands too late can drag down IRR massively.

This is the thing founders forget:

➡️ Investors are not only buying your upside.

They are buying the time it takes to reach it.

That is why IRR exists.

🎯 Why Founders Must Understand IRR (Even If It Feels “Too Investor-y”)

This is the uncomfortable truth:

Founders who understand IRR negotiate better.

Founders who don’t… overprice.

Here’s why:

When a founder sets a valuation, they are setting the investor’s IRR target.

If your Series A valuation requires an investor to achieve a 5× exit inside 5 years…

the IRR math had better pencil out.

If it requires a 12×, or a 20×, or a miracle…

the investor knows instantly.

Even if the founder doesn’t.

This is why founders often think investors “don’t get it.”

In reality, the investor is running IRR calculations in their head:

“Does this deal clear our hurdle rate?”

“Does this timeline kill our fund pacing?”

“What IRR does this valuation imply?”

If you understand that maths too?

You’re negotiating eye to eye.

⚠️ The Surprising Places Founders Get IRR Wrong

A few common misconceptions:

❌ “A 3× is always good.”

Try telling that to an LP after 10 years.

❌ “A higher valuation always helps us.”

Only if the investor’s IRR target still fits.

❌ “Our 8-year exit still looks great.”

Maybe in MOIC.

But in IRR? You might have just cut the return in half.

❌ “We don’t need to worry about investor maths yet.”

Yes, you do.

Because that maths is pricing your round today.

When founders see the IRR grid for the first time, they usually have the same reaction:

“Oh… so this is how investors think.”

Exactly.

And once you see it, you cannot unsee it.

🔍 IRR vs MOIC: Through A Founder Lens

Example 1: The good-looking slow win

£1M → £3M

Time: 10 years

MOIC: 3×

IRR: 12%

Looks great at first.

Until you realise it barely beats public markets.

Example 2: The smaller, faster win

£1M → £2M

Time: 3 years

MOIC: 2×

IRR: 26%

Half the total return.

More than double the speed.

Investors will take this all day.

Example 3: Why timing is everything

£10M invested

£5M returned in Year 3

£25M returned in Year 8

Total returned: £30M

MOIC: 3×

Same multiple as the earlier examples, yet, the IRR lands somewhere between the fast 32% case and the slow 12% case.

Why?

IRR cares about when money comes back.

The £5M that returns in Year 3 lifts the IRR because capital starts coming home early.

The £25M that waits until Year 8 drags it down because most of the gain arrives late.

MOIC is unchanged because it ignores time.

IRR shifts because it reflects the pace of each cash flow.

This is why investors study both.

MOIC shows total outcome.

IRR shows the speed of that outcome.

🚧 Where These Metrics Mislead (And How To Avoid The Traps)

When MOIC misleads

Makes slow capital look impressive

Masks poor fund pacing

Hides late exits that tank IRR

When IRR misleads

Overstates early partial returns

Rewards speed over magnitude

Can be inflated by tiny quick wins

This is why LPs look at both.

The rule

MOIC shows scale.

IRR shows efficiency.

If you want investor confidence, you must speak both languages.

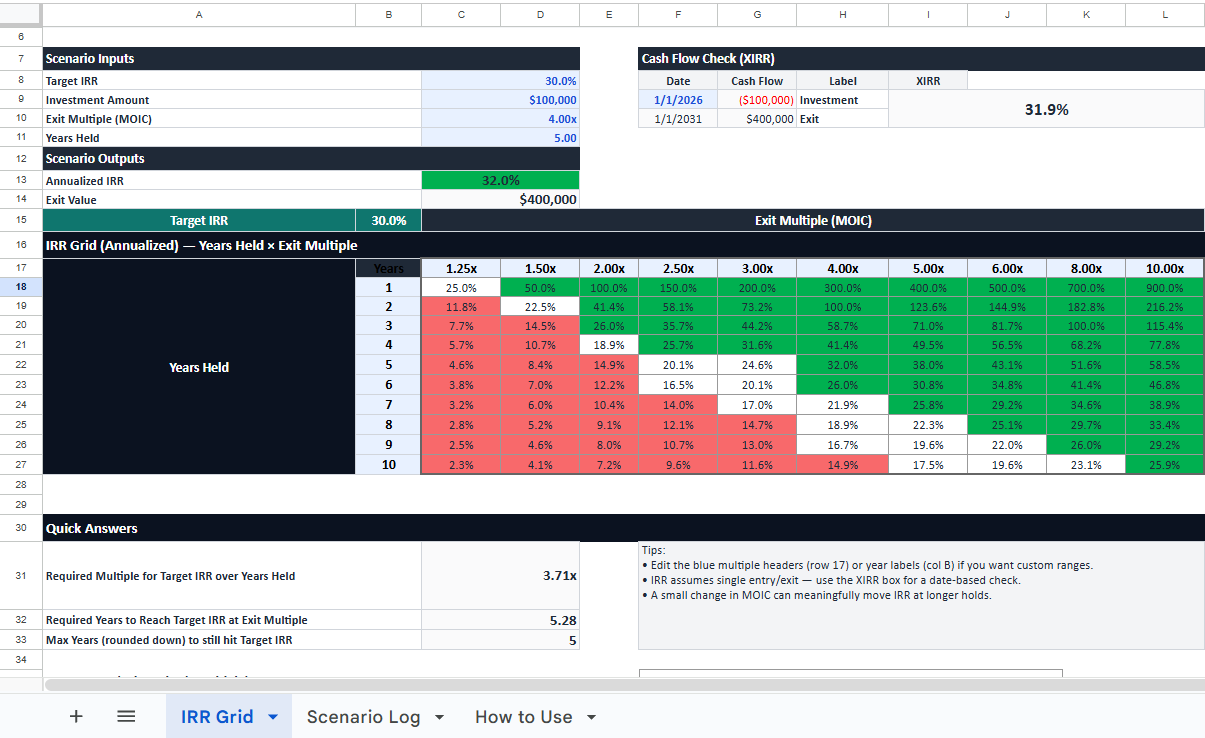

📊 A Simple Model That Shows Everything (No Maths Needed)

IRR only makes sense when you see it visually.

This grid shows everything in seconds.

A clean, idiot-proof, colour-coded model that instantly shows:

What IRR each multiple delivers

How holding period affects return

Where investor hurdles sit

Whether your valuation puts pressure on IRR

Whether an exit scenario actually works

And what IRR investors expect at your stage

Change one number and the entire grid recalculates.

It is the fastest way to understand investor maths, without needing an MBA or a quant brain.

🛠️ How Founders Should Use IRR (3 Simple Applications)

1️⃣ Sanity-check your valuation

Before you walk into a pitch, plug in your ask.

If the IRR looks unrealistic… adjust your price.

2️⃣ Strengthen investor conversations

Show investors:

“We’ve run the IRR math and here’s why our valuation works.”

You will be in the top 1% of founders immediately.

3️⃣ Pressure-test your exit model

If you’re projecting:

a big exit,

far into the future,

with slow compounding…

the IRR grid will tell you instantly if it’s credible.

👥 Who This Knowledge Really Benefits

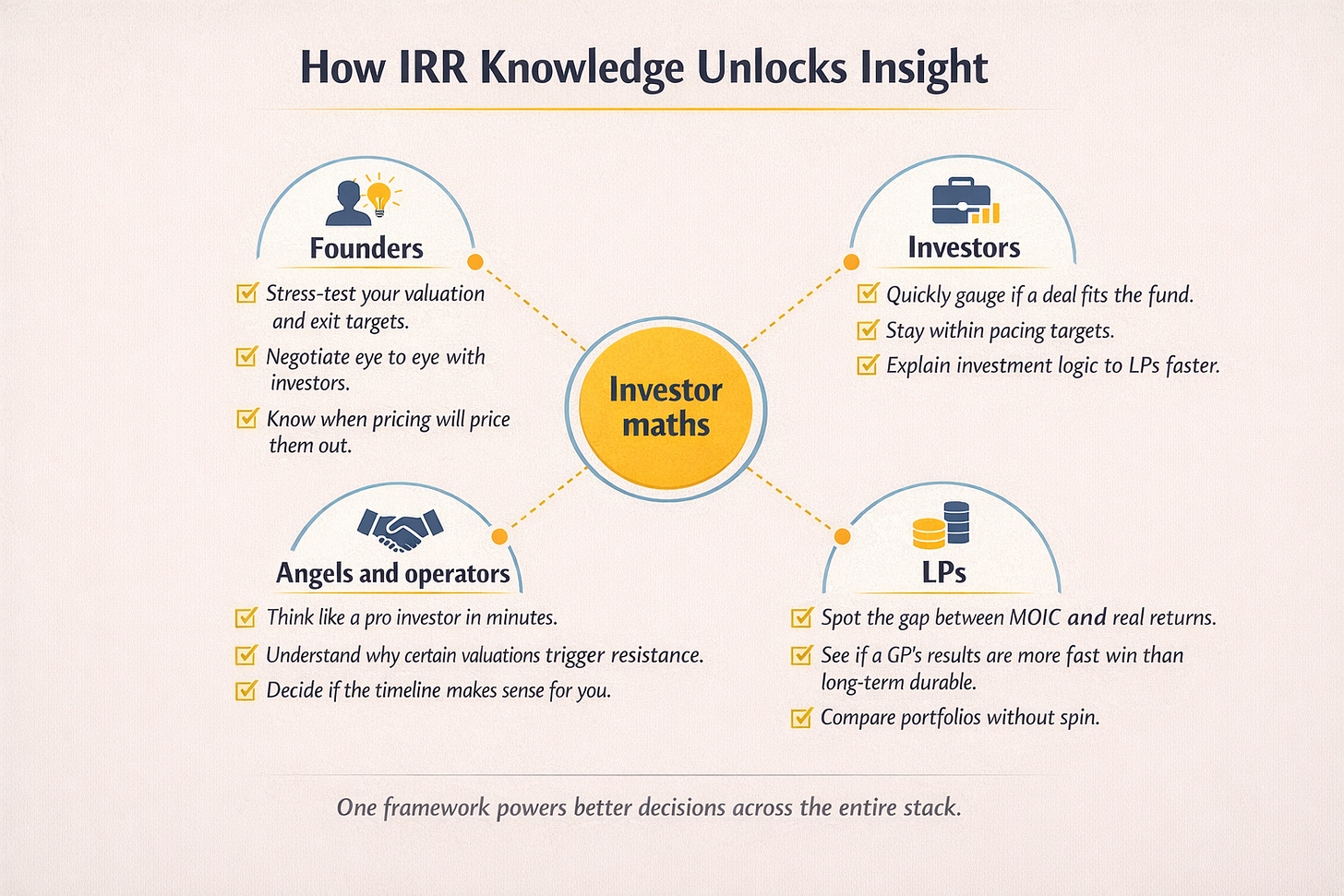

Founders

Understanding IRR makes you a sharper negotiator. It removes guesswork around valuation and shows you when pricing will quietly turn investors away. It also builds credibility fast because once you can translate a valuation or an exit into IRR, you sound like someone who understands the real decision process.

Investors

For investors this becomes a fast decision engine. It makes go or no go choices clearer, shows when a good multiple is actually a slow return, and keeps fund pacing on track. It also gives them cleaner explanations for investment committees and for LP conversations where numbers always matter more than story.

Angels and operators

For angels and operators it compresses real learning into minutes. It reveals how professional investors think, explains why certain valuations trigger resistance, and helps them decide how their own capital should be allocated across realistic timelines and outcomes.

LPs

For LPs this knowledge brings real clarity to a fund’s strategy and pacing. It shows whether a GP understands portfolio construction, highlights the gap between headline multiples and actual performance, and creates a clearer way to compare managers without relying on narrative

🏆 Master The Maths → Control The Narrative

Every funding conversation eventually comes back to the same thing:

“Does the return, and the speed of the return, justify the risk?”

MOIC tells you the what.

IRR tells you the how fast.

Once you understand both, the fundraising game changes:

Your valuation makes sense.

Your exit model becomes believable.

Your conversation shifts from hope → logic.

You start speaking investor language fluently.

In venture, you don’t just sell the story.

You sell the story and the maths behind it.

Master those numbers and you will own the room.

This tool is how you turn that confidence into something investors can feel.

Keep reading with a 7-day free trial

Subscribe to The Founders Corner® to keep reading this post and get 7 days of free access to the full post archives.