The Infinity Loop Framework for Success in B2B Tech Startups: How to Engineer Exponential Growth

Founder OS: Funnels stall but loops compound, a new growth framework for B2B SaaS founders, operators, and investors.

The B2B SaaS industry has completely changed and most companies are still playing by 2015 rules in a 2025 game. What makes things worse, is that those companies can’t even see it because their own traditional funnels are simply outdated. They are still obsessed with the “close” that they can’t see ahead.

The reality is that today, growth doesn’t hinge on how many leads you push through a pipeline. It hinges on whether every customer you win makes the next one easier to win.

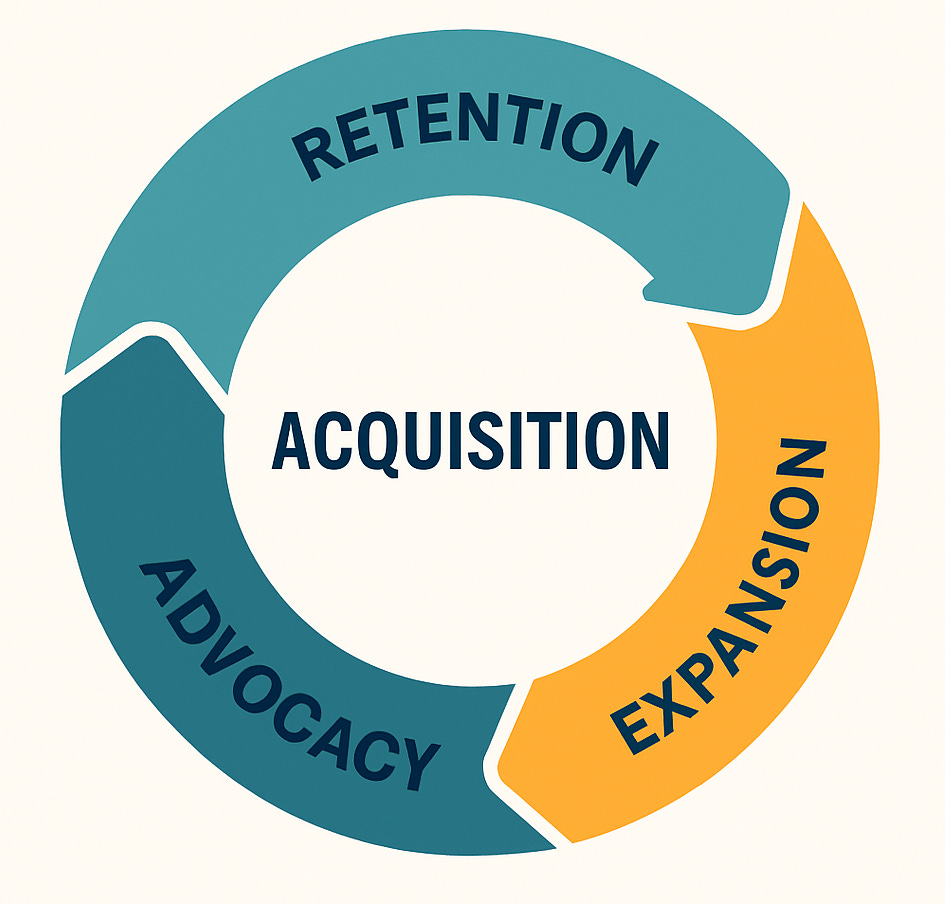

Winning companies don’t get obsessed with customer acquisition. They are focused on retention, expansion, and advocacy. We’re talking about a loop instead of a funnel.

This article introduces the Infinity Loop, a real framework for turning big pain discovery and shockingly fast value delivery into a self-reinforcing growth engine.

This is a playbook for B2B SaaS companies. We’ll break down the forces that make loops spin, the metrics that prove they’re working, and the cadences leaders can operationalize to keep them compounding.

Funnels stall while loops accelerate. The Infinity Loop is how SaaS founders, operators, and investors can engineer inevitability into growth in the decade ahead.

Table of Contents

1. Why Funnels Fail and Loops Win

2. Force One - Find a Pain That Screams

3. Force Two - Deliver Shockingly Fast Value

4. The Compounding Infinity Loop

5. Metrics That Prove the Loop is Working

6. Why Startups Break the Loop

7. How to Operationalize the Infinity Loop

8. Closing the Loop

1. Why Funnels Fail and Loops Win

The thing about funnels is that they assume a clean sequence:

Awareness → Interest → Decision → Purchase

But in B2B SaaS, that sequence almost never happens. Buying cycles today are messy and circular. Six to ten stakeholders may join at different times. A team might trial a product, abandon it, come back six months later, then push for a pilot during budget season. Even after a deal closes, renewal committees re-evaluate every year.

The problem isn’t just complexity by itself. The problem is that the funnel ends at the sale. In SaaS, that’s when the real growth begins. That’s the real paradigm shift.

A single customer rarely stays static. They onboard, expand, contract, renew, advocate, and refer. None of that activity fits a linear pipe.

Loops capture this reality. They show how retention, expansion, and advocacy feed acquisition.

Every cycle compounds and each turn makes the next easier:

Faster time-to-value drives renewals

Renewals create expansion headroom

Expansions fuel advocacy

Advocacy generates referrals that bring in new customers

In SaaS, the first deal is rarely the biggest. The real upside is when a champion doubles seat count, or carries your product to their next company. That’s why leaders and investors care more about net revenue retention (NRR) than top-of-funnel lead volume.

Funnels end while loops spin forever. And only loops produce exponential growth.

2. Force One - Find a Pain That Screams

The reality is that even startups with competent teams build for pains that don’t hurt enough. A mild inconvenience won’t unlock a budget line or a new customer’s political capital.

Intensity matters for SaaS companies. The difference between a nice-to-have and a must-solve problem is the difference between flat growth and exponential pull.

Three Dimensions of Pain

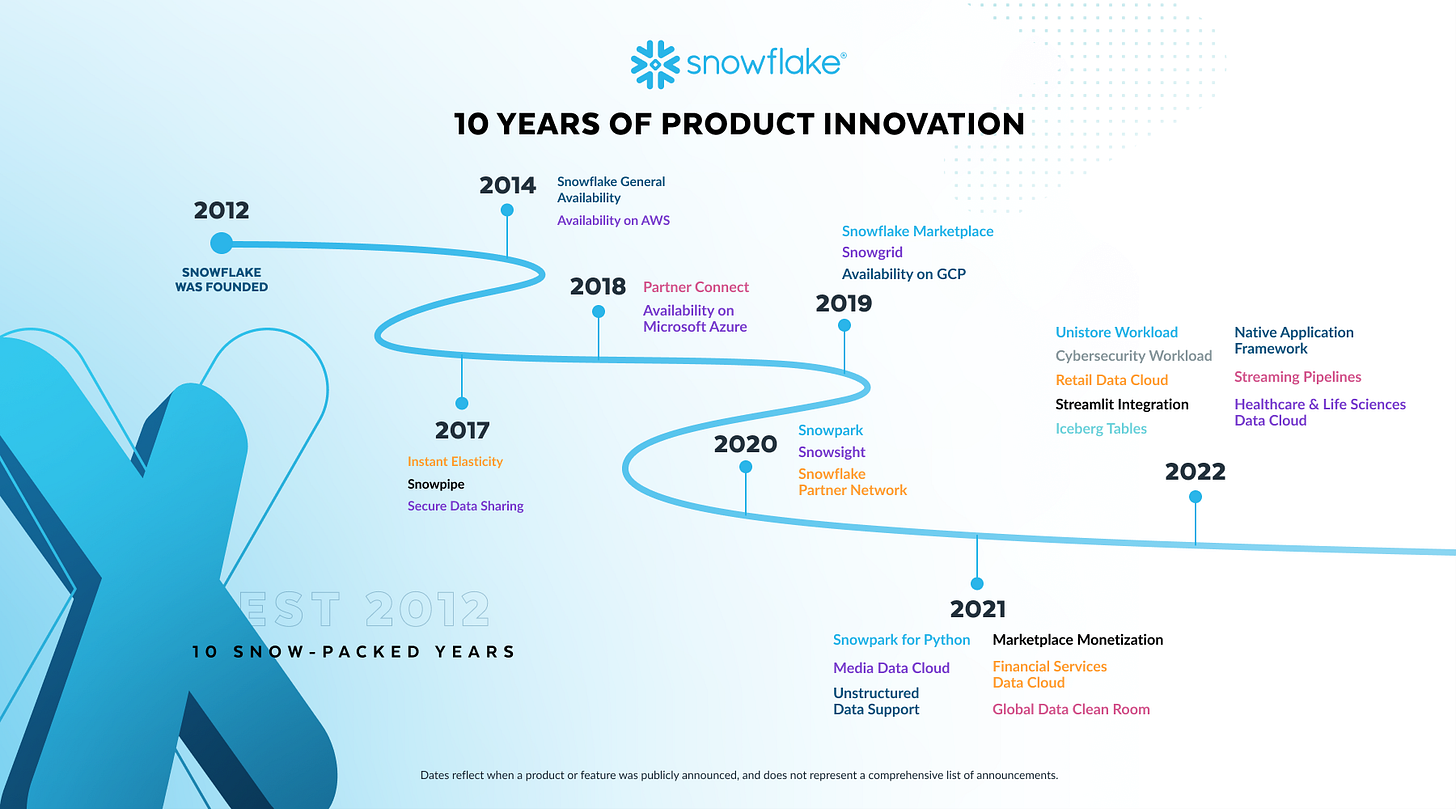

Financial Pain: Direct hits to revenue, margin, or cost structure. These get executive attention fast. Snowflake won early because CFOs saw cloud data silos driving both waste and risk, millions lost in inefficiency.

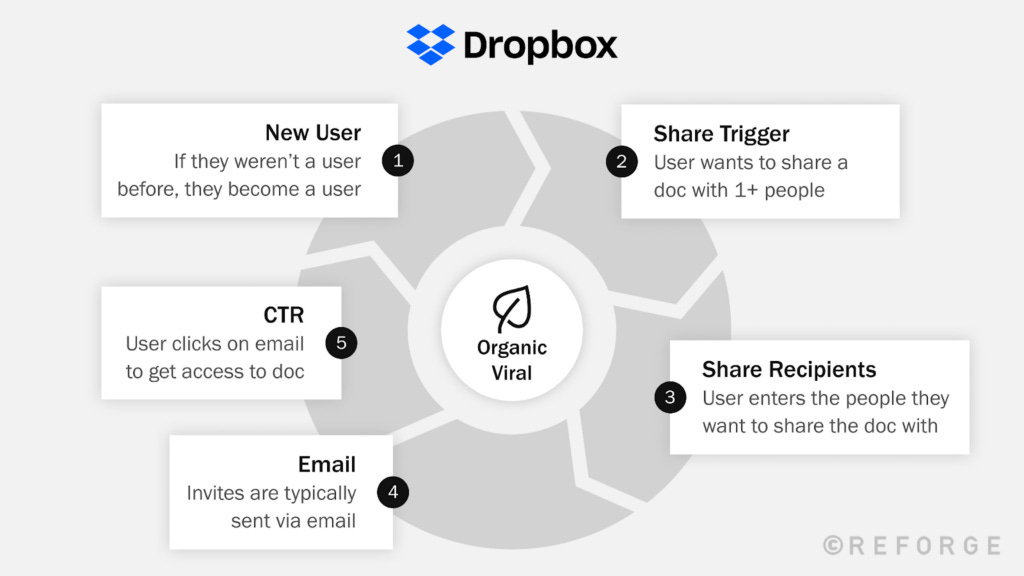

Operational Pain: Bottlenecks that block teams from doing their jobs. Dropbox spread like wildfire inside companies because employees were wasting hours emailing files back and forth. IT didn’t greenlight it at first; users adopted it anyway because the pain was immediate.

Emotional/Political Pain: Frustrations that carry internal status risk. If a VP’s team is seen as lagging because of clunky tools, the urgency to switch is as much about reputation as results. Snowflake nailed this too: data teams could suddenly deliver dashboards the business had been waiting on for years.

The Litmus Test

Ask one simple question in discovery: “Would this buyer fight for mid-year budget to fix it?” If the answer is no, the pain isn’t strong enough. Urgent problems break procurement calendars and unlock dollars.

Pain Scoring Framework

A practical tool you can use is to assign a 1–9 pain score in every discovery call.

1–3: Annoyance (a “vitamin”).

4–6: Friction that slows work (a “painkiller”).

7–9: Mission-critical, blocking revenue or reputation (a “must-solve-or-die”).

VCs run the same mental math. They don’t just ask if your product is clever, they ask if buyers have to solve this now. Markets built on screaming pains grow fast, because urgency compresses sales cycles, accelerates adoption, and fuels the loop.

3. Force Two - Deliver Shockingly Fast Value

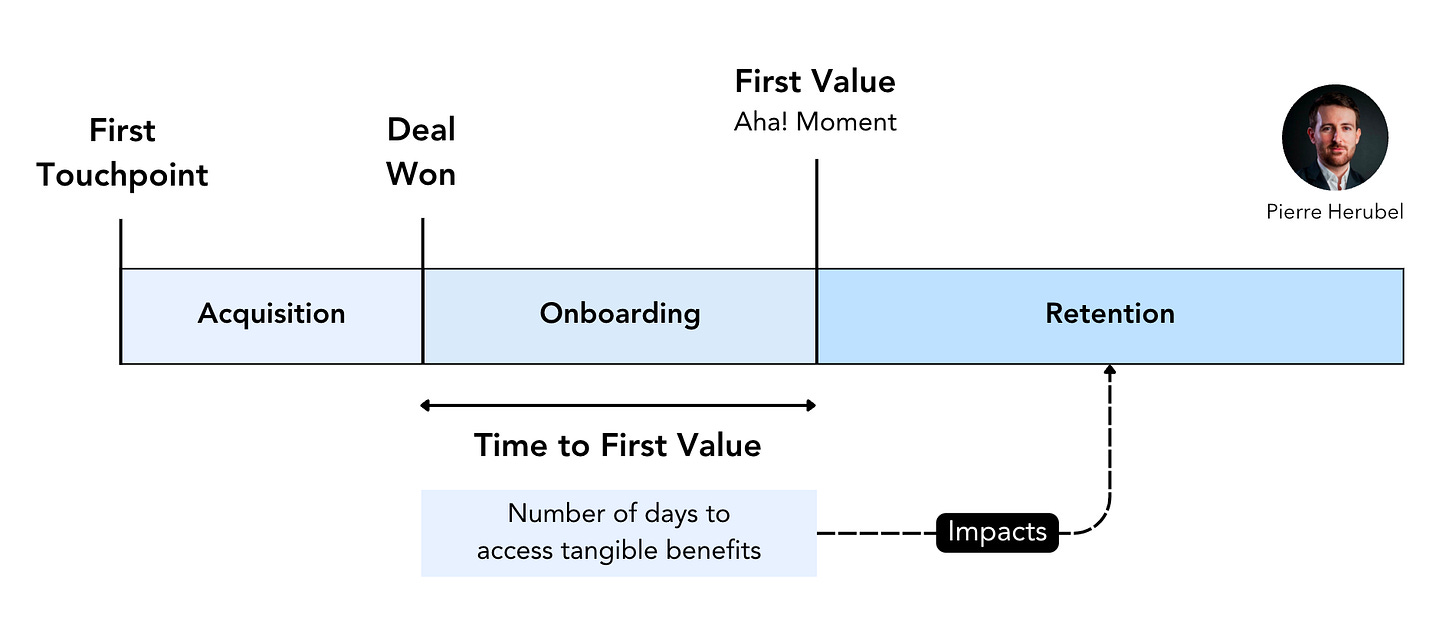

Finding a pain that screams gets you into the conversation. Delivering value fast keeps you in the deal and spins the loop. For SaaS companies, speed is the core of retention and expansion.

Why Speed Matters

Two metrics tell the story: Time-to-First-Value (TTFV) and ROI proofpoint.

TTFV measures how quickly a new customer experiences the “aha” moment. Best-in-class SaaS hits this in seven days or less.

ROI Proofpoint shows how soon a buyer can demonstrate measurable business impact. Elite teams show it in under 90 days.

Anything slower, and enthusiasm fades. In long implementations, champions lose political cover, users drift back to old tools, and churn risk spikes before renewal ever comes up.

Adoption Accelerators

Fast value doesn’t happen by accident, it’s engineered into the product and onboarding.

Integrations: Pre-built connectors eliminate IT delays.

Pre-loaded templates: Customers start with working examples, not a blank canvas.

Self-serve onboarding: Guided flows let users succeed without waiting on support.

In-app cues: Contextual prompts move users to their next win.

These accelerators collapse time-to-value, which in turn reduces churn, shortens sales cycles, and accelerates CAC payback.

Case Studies: Slack and Notion

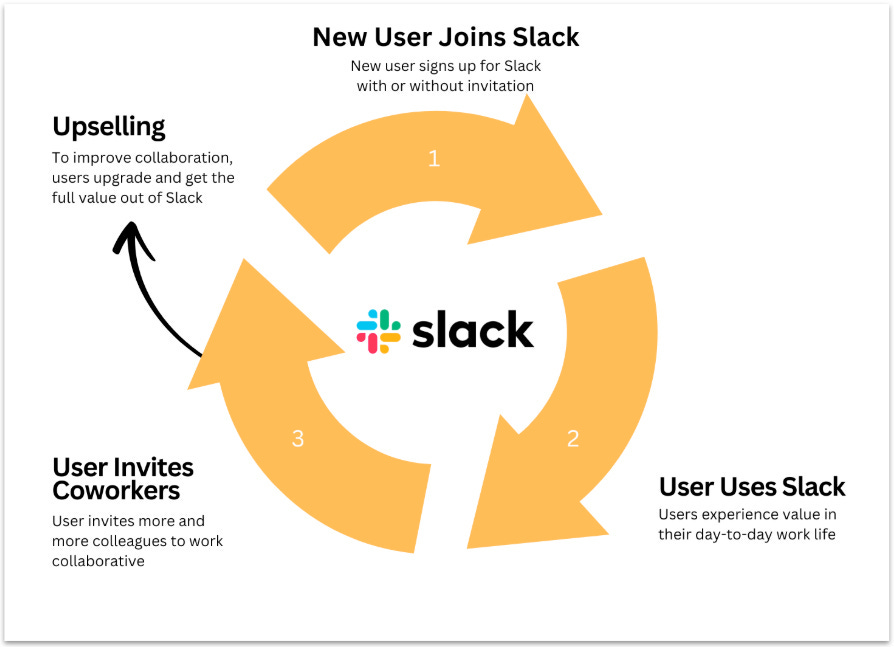

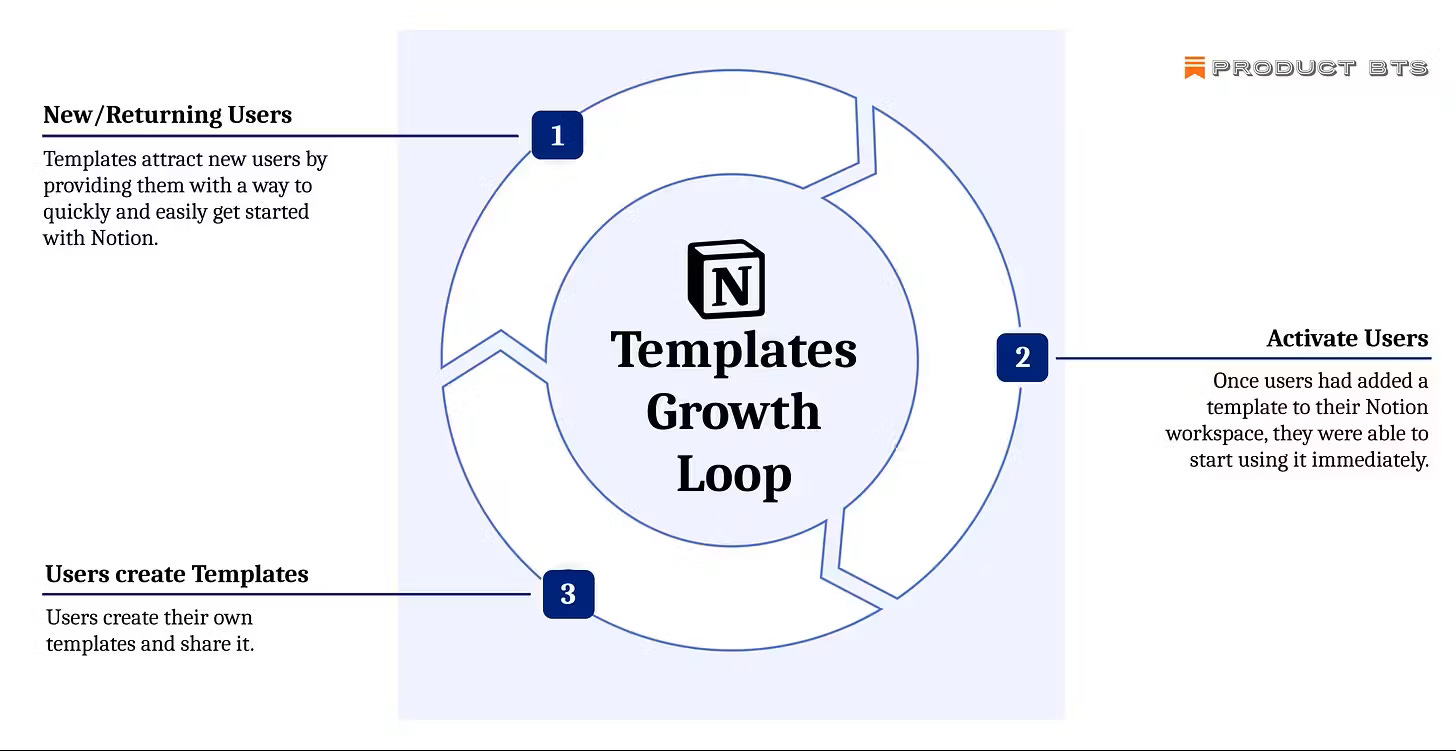

Slack’s breakout moment wasn’t just excellent product design. It was instant gratification. Teams would create a group chat, message once, and feel the difference immediately. The “aha” moment took minutes.

Notion did the same with template galleries. New users could adopt best practices immediately, making the product useful on day one instead of week twelve.

The Failure Mode

Contrast that with the enterprise platforms that promise transformation but take months to configure. Internal advocates lose momentum as implementation drags on. By the time value arrives, the excitement is gone and the renewal committee is skeptical.

The winners engineer magic early. In SaaS, whoever delivers shockingly fast value earns the right to keep compounding it.

4. The Compounding Infinity Loop

The first two forces (finding a pain that screams and delivering shockingly fast value) are what get the loop moving. But the real magic happens once those forces start compounding.

Instead of a funnel that narrows to a dead end, the Infinity Loop creates a flywheel: each turn makes the next one spin faster.

How the Loop Spins

The motion looks like this:

Pain → Adoption → Expansion → Advocacy → Referrals → New Demand → back to Adoption.

Every satisfied customer doesn’t just renew, they expand, advocate, and attract new demand. That new demand feeds into faster adoption because prospects trust what their peers are already using. The cycle repeats, with momentum building at each pass.

The Eight Stages

To make it concrete, think of the loop in eight stages:

Discover – Demand sourced from referrals, inbound, or community. Metric: Pipeline coverage (≥3x).

Close – Sales execution. Metric: Win rate vs. ICP.

Onboard – First experience. Metric: Time-to-first-value (≤14 days).

Value – Proof of ROI. Metric: ROI ≤90 days.

Expand – Cross-sell, upsell, seat growth. Metric: Net Dollar Expansion.

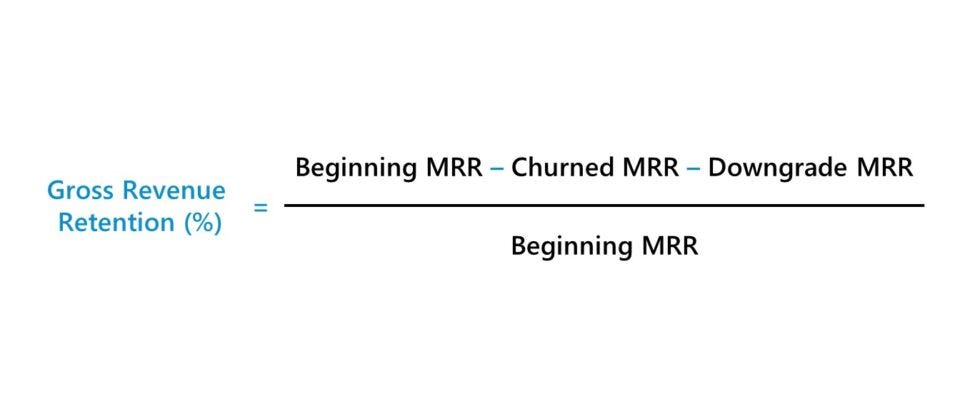

Renew – Retention discipline. Metric: Gross Revenue Retention (≥92–95%).

Advocate – Customers becoming promoters. Metric: NPS, case studies produced.

Refer – Advocacy generating demand. Metric: Referral pipeline ≥15%.

Each stage strengthens the next. For example, tighter onboarding lowers churn, which drives higher GRR, which increases expansion headroom, which produces more advocates, and so on.

Why Loops Beat Funnels

Funnels focus on how much you can shove in the top. Loops optimize how much compounding you can create with what you already have.

The difference shows up in metrics: CAC falls because referrals replace paid acquisition. NRR rises because expansions outpace churn. Over time, loops create exponential returns that funnels simply can’t match.

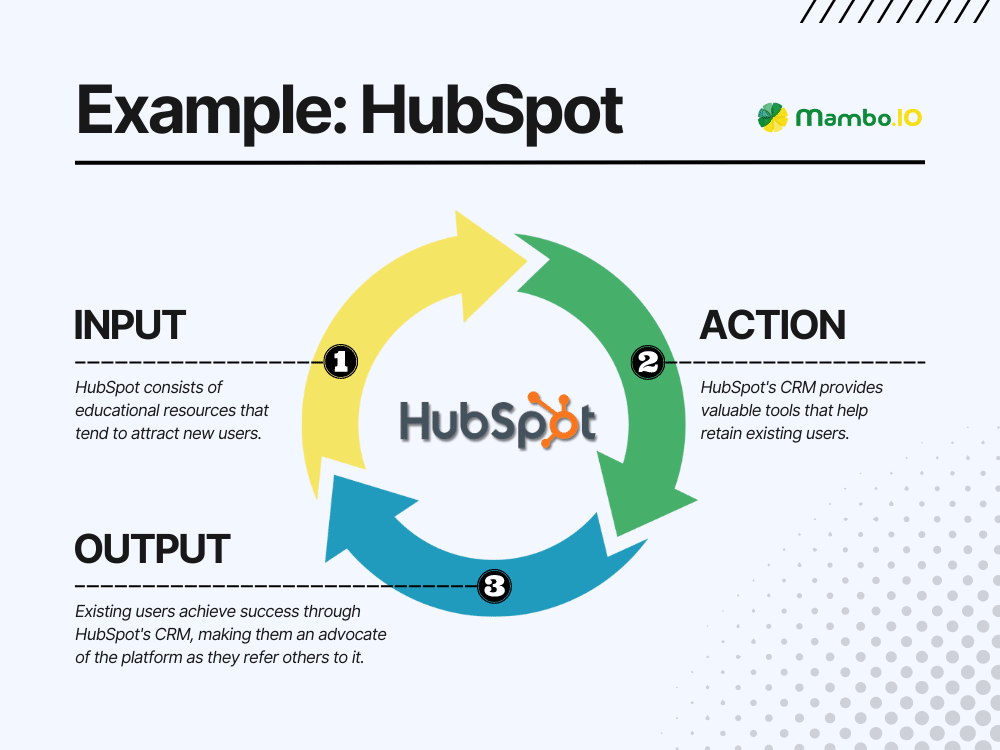

Case Study: HubSpot

HubSpot built an empire not by buying attention, but by delighting customers. Their “customer delight → inbound advocacy” loop turned every happy user into an inbound marketer.

Blogs, case studies, and referrals fueled demand at a fraction of paid acquisition costs, while renewals and expansions kept revenue compounding. It’s the Infinity Loop in action: delight drives growth, and growth drives more delight.

5. Metrics That Prove the Loop is Working

A loop is only as strong as its numbers. For founders and investors, the way to know if the Infinity Loop is compounding is to track the right metrics instead of just acquisition volume. But you also need proof that value is sticking, expanding, and multiplying.

2025 Benchmarks to Watch

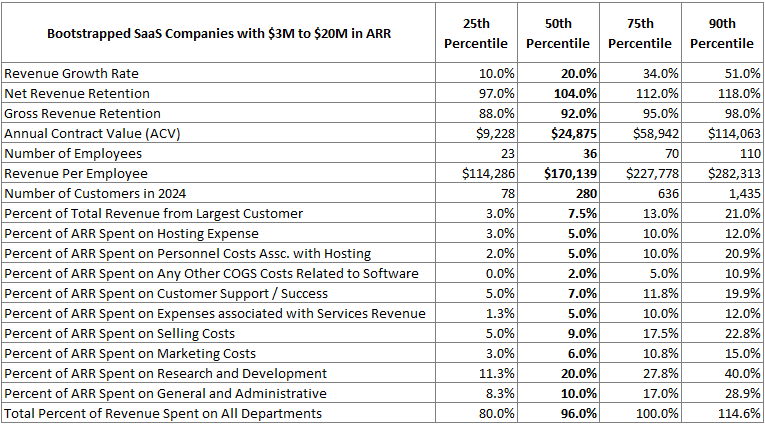

Gross Revenue Retention (GRR): Healthy SaaS companies sit at 92–95%+. Anything lower signals a leaky loop.

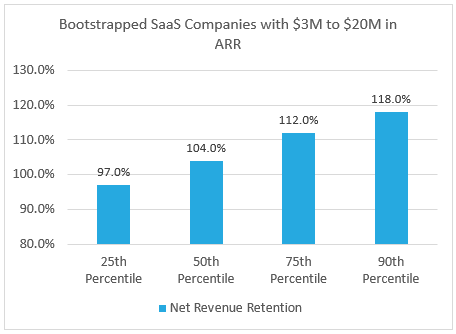

Net Revenue Retention (NRR): The king metric. Top quartile SaaS hits 110–120%+, with 118% reserved for elite operators. NRR predicts valuation multiples more reliably than topline growth, because it reflects both stickiness and expansion.

CAC Payback: Investors want to see it under 18 months; the shorter the better, as it proves efficient acquisition.

Time-to-First-Value (TTFV): Should be ≤14 days. Best-in-class SaaS gets customers to the “aha” moment in a week or less.

Referral-Sourced Pipeline: A healthy loop generates ≥15% of new demand from advocacy-driven channels.

Why NRR Rules

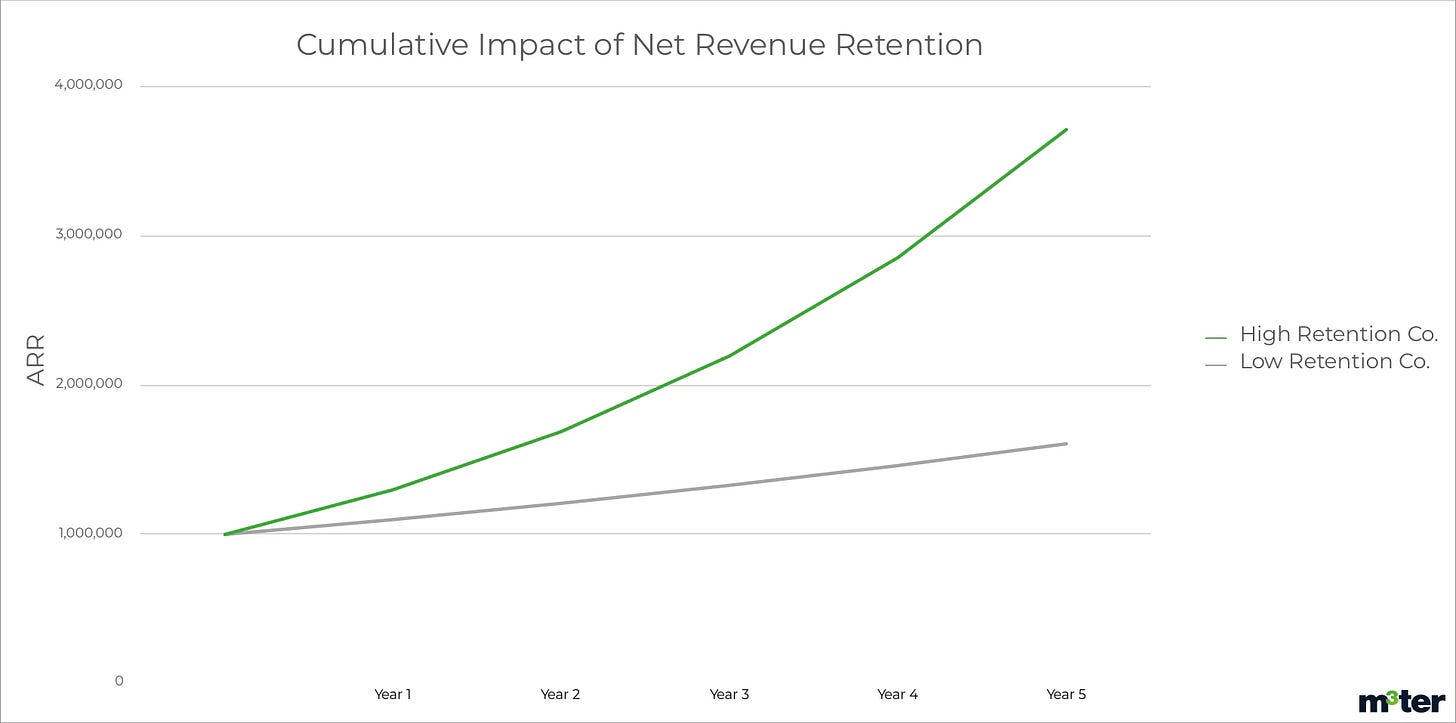

SaaS Capital data clearly show that companies with NRR in the top quartile fuel growth that is roughly double the median, a reflection of compounding retention versus churn.

Moreover, valuation studies suggest that even a 1% lift in NRR can yield an 18% bump in company valuation over five years. That’s why savvy investors focus on NRR. Because it’s the clearest signal of durable growth and enterprise value.

Although funnels may inflate short-term revenue through spend, loops will sustain and amplify bottom-line impact through expansion.

The Loop Dashboard

Founders should build a “Loop Dashboard”. That means having one metric per stage, visible weekly. Pipeline coverage, TTFV, GRR, NRR, advocacy rates. That’s what we call operational hygiene.

When leaders review the loop alongside financials, they can spot friction early, fix weak gears, and keep the compounding engine spinning.

In a market where capital is tight and efficiency trumps blitzscaling, these numbers are the scoreboard. Loops don’t lie.

6. Why Startups Break the Loop

Even with a strong model, many startups stall because the loop gets jammed. The patterns are predictable. Six “loop breakers” show up again and again, and each has a fix.

1. Solving “Meh” Problems

If the pain isn’t urgent, sales cycles drag and deals slip.

Fix: Use pain scoring in discovery. Only chase pains that score 7–9 on urgency.

2. Slow or Complex Adoption

Long onboarding kills momentum. Champions lose political cover before users see value.

Fix: Redesign onboarding for a 30-day value window. Push TTFV to ≤14 days.

3. Mis-ICP Targeting

Selling to the wrong profile floods the funnel with customers you can’t make successful.

Fix: Run quarterly ICP audits. Ask: who adopts fastest, expands deepest, advocates loudest?

4. Over-Engineered Product

Teams chase edge-case features, bloating the roadmap and slowing adoption.

Fix: Prioritize ruthless focus. If a feature doesn’t accelerate activation, expansion, or advocacy, cut it.

5. Broken Handoffs Between Sales and CS

Customers promised the world in presales often hit a wall after the contract. That disconnect spikes churn.

Fix: Build a success plan alignment ritual: sales, CS, and product agree on outcomes before onboarding begins.

6. Chasing Logos Before Repeatability

Founders often sprint to new logos before proving the loop works in their core ICP. The result is scattered wins and no compounding.

Fix: Nail repeatability in one ICP first. Expansion and referrals from a strong core base are worth more than a dozen random logos.

Avoiding these loop breakers isn’t just risk management, it’s how you keep the flywheel spinning clean and fast.

7. How to Operationalize the Infinity Loop

Loops don’t run on hope, they’re engineered. Founders who treat the Infinity Loop like a system, with cadences and accountability, see compounding growth. Here’s how to put it into practice.

Cadence as Discipline

Weekly Loop Review: Every leadership meeting should include one metric per stage, one insight, and one action. Example: if TTFV slipped from 10 to 17 days, the action is to rework onboarding flows.

Monthly ICP & Messaging Check: Pressure-test whether you’re still aligned to a pain that screams. Are new customers scoring 7–9 on urgency? If not, recalibrate ICP and refine messaging.

Quarterly Roadmap Review: Close the loop by integrating customer feedback. Product, CS, and sales should confirm that features being built directly address adoption or expansion friction.

These rituals keep the loop healthy and prevent drift into vanity metrics.

Growth Accelerators

Product-Led Growth: Use self-serve onboarding to drive quick wins, then layer sales assist for high-value accounts. This hybrid “product-led sales” model is what turned Slack’s viral adoption into enterprise contracts.

Outcome Loops: Publish case studies tied to ROI. Proof of impact boosts win rates and fuels expansion conversations. Snowflake mastered this by showcasing cost savings and speed gains as concrete outcomes.

Advocacy Loops: Formalize programs that turn happy customers into public champions such as reviews, referrals, advisory boards. Each advocate becomes a micro-acquisition engine.

Signal Loops: Use CS telemetry like usage data, NPS trends, support tickets, in order to feed back into the product roadmap. Fixing friction before renewal is the surest way to protect GRR.

The Takeaway

Operationalizing the Infinity Loop isn’t all about embedding discipline so that every team - product, sales, CS - pulls in the same direction. When these cadences and accelerators are in place, growth stops being episodic. It becomes inevitable.

8. Closing the Loop

The best SaaS operators don’t take bets on features or funnels. They engineer inevitability themselves.

The startups that scale are the ones that design systems where each customer creates momentum for the next, not the ones with flashy roadmaps.

The equation is simple:

pain so big it screams × value so fast it feels magical = compounding growth.

That’s it. That’s the Infinity Loop. It captures what funnels miss, that growth is self-reinforcing when customers not only buy, but adopt, expand, advocate, and refer.

Looking ahead, the winners of 2025 won’t be defined by how much they spent to acquire leads but by how efficiently they turned retention into expansion, and expansion into advocacy. In this era, retention-led growth consistently beats acquisition-led growth.

Every founder should remember: you don’t just sell to one customer. You sell to their future renewals, their expansions, and their referrals. Every customer you win should make the next one easier to win. To infinity.

Read more from Founders Corner:

CEO-Level Strategies for Confident Negotiation

How to Delegate Like a Founder CEO

Co-Founder Conflict 101: Should You Stay Together or Part Ways?

Thanks team, this is a great article! I like how the Infinity Loop shifts attention from short term wins to retention, expansion, and advocacy. You have made this approach seem very actionable as well. 🙏

Great read. I think we should collaborate.