The Secret to Raising Once and Never Chasing Again: Keep Investors Close

How smart founders build trust, not tension, after the raise.

If you’ve ever finished a funding round and thought, “Wait, what now?” — you’re not alone.

Most founders treat investor management like an afterthought. They assume the real work starts after the money hits the bank — not realising that how you handle those relationships often determines whether you’ll raise again, get real support, or be quietly written off.

But the truth is: the post-raise period is when reputations are built.

Investors aren’t looking for perfection — they’re looking for rhythm. They want transparency, confidence, and a sense that you’re in control, even when things wobble.

The goal isn’t to please them.

It’s to keep them close — aligned, informed, and useful — without ever feeling like you work for them.

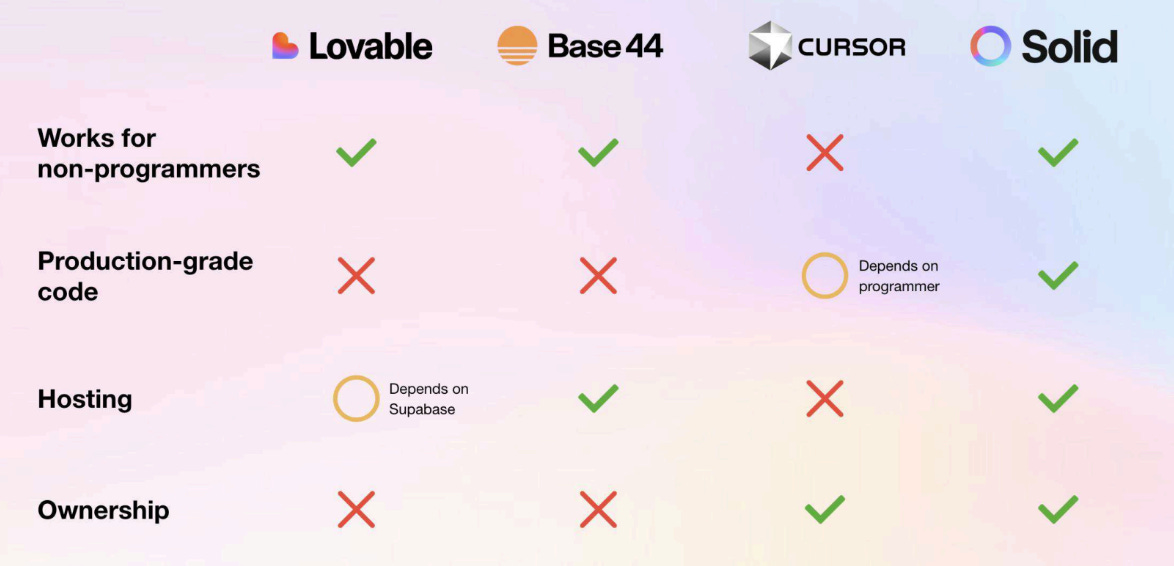

Brought to you by Solid — Production-Ready AI Apps Without Lock-In

💥 The Problem

Most AI builders hand teams a toy: a front-end shell and a prebuilt, limited backend that cannot be migrated (e.g. Base44), or a basic Supabase setup (e.g. Lovable). These are fine for demos, but when teams try to build something durable, they hit a wall.

🛠️ The Solid Approach

Solid avoids constrained backends and “toy” stacks. It delivers software the way an experienced engineer would: the only limit is what can be built with code.

Production-ready stack: React, Node.js, Postgres, and clean, extensible code that can be hosted anywhere.

Complete ownership & control: the customer owns 100% of the application and can deploy it to any environment.

Open, no lock-in: connect to any service, use any AI tool, and scale on the team’s terms.

🎯 Who It’s For

Builders who want to move fast and ship real tools

Startup teams launching products, MVPs, or internal systems

Mid-Market & Enterprise teams creating software that lasts

⚙️ Key Features

✅ Full-stack: React + Node.js + Postgres

✅ No Supabase or vendor lock-in

✅ One-shot prompts to scaffold apps in seconds

✅ Real, scalable code that teams can extend and ship

Solid have given The Founders Corner readers free credits to get started. Click here to get on the ride. If you want yours, just DM Solid on LinkedIn with the email linked to your Solid account, and they’ll add the credits for you.

Table of Contents

Why Investor Communication Is a Growth Lever

Finding Your Cadence: Monthly, Quarterly, or Ad Hoc

Founder OS: The Investor Communication Cadence

How to Write Updates Investors Actually Read

Tone, Transparency, and the “Bad News” Update

Running Great Investor Calls

🧠 Founder Wisdom: A Braindump on Expectations

🚀 Closing Thought: Build Allies, Not Auditors

Why Investor Communication Is a Growth Lever

Investor management isn’t investor appeasement.

Done well, it becomes leverage — one of the most underused growth tools in a founder’s arsenal.

Think about it: your investors have capital, networks, and pattern recognition. But they also have short attention spans and dozens of other portfolio companies.

Your job is to make it easy for them to remember you, trust you, and want to help.

Good updates don’t just share metrics — they reinforce your credibility. They remind investors why they bet on you in the first place.

Bad updates? They erode confidence faster than a bad quarter.

When your communication rhythm is strong, something subtle happens:

investors start working for you — not the other way around.

Finding Your Cadence: Monthly, Quarterly, or Ad Hoc

There’s no one-size-fits-all update schedule. The best cadence matches your company’s stage, speed, and stability.

Here’s a simple framework:

🧩 Monthly — Early Stage (Pre-Series A)

At this stage, speed and iteration matter. Your investors want to see movement, not polish.

Keep updates short but regular — a few paragraphs with key metrics, experiments, and insights.

You’re shaping trust through transparency.

Why it works: It builds rhythm. You become a founder who’s on top of the details.

📈 Quarterly — Growth Stage (Series A–B)

You’re scaling. You’ve got teams, revenue, and systems. The story’s now about leverage — showing that growth is structured, not chaotic.

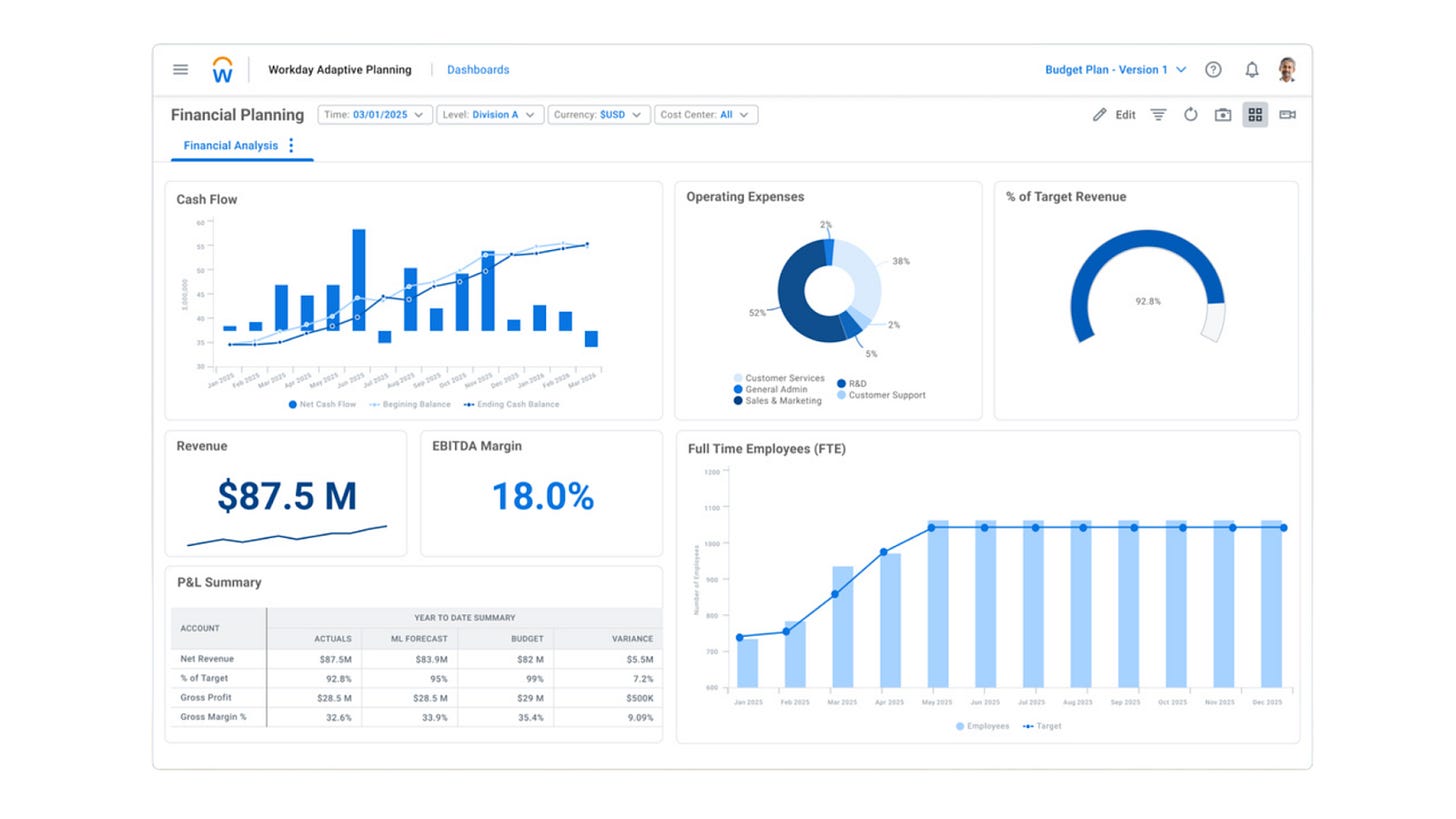

Each update should feel like a mini board summary: revenue, burn, headcount, pipeline, product, and outlook.

Why it works: Investors start to see you as a builder of systems, not a scrappy survivor.

🎯 Ad Hoc — Strategic or Crisis Moments

Use this for big milestones or pivots: a major launch, key hire, partnership, or unexpected problem.

These updates build trust through immediacy. They show confidence — the kind that says, “We’ve got this, and you’ll hear from us first.”

💡Founder OS: The Investor Communication Cadence

Here’s a plug-and-play rhythm you can drop into your business today:

Weekly (Internal):

Summarise key numbers, wins, and risks for your own team. This keeps everyone aligned and your storytelling sharp.

Monthly (Investors):

Short written update — metrics, narrative, and one ask. 3 minutes to read, 30 seconds to forward.

Quarterly (Board or Key Investors):

Structured report or call — deep dive on metrics, product, and outlook. Treat this as alignment, not defense.

Ad Hoc (Moments That Matter):

Big hires, pivots, or problems — send short notes when something meaningful happens.

Founders who stick to this cadence never lose trust, even when they lose traction.

How to Write Updates Investors Actually Read

Most investor updates fail because they try to impress, not inform.

The best ones? They read like they were written by someone who’s actually running a company — not polishing a deck.

Here’s the framework — five parts that make investors actually want to open your emails:

1️⃣ Headline (The Opening Line)

Lead with the takeaway — not the context.

Investors should understand the core message before they scroll.

✅ Example:

“MRR grew 18% this month, driven by faster onboarding and one new enterprise logo.”

Or, when things don’t go perfectly:

“We missed our Q1 targets, but activation is up 40% after the new trial redesign.”

Short, clear, and founder-led. Your first line sets the tone: I’m in control, even when it’s messy.

It also shows emotional intelligence — you’re not hiding the truth, you’re framing it with confidence.

2️⃣ Metrics (The Skeleton)

Metrics make the story real. But too many numbers overwhelm — you want signal, not spreadsheets.

Focus on the 4–6 metrics that actually define your business. Present them in a simple, skimmable format.

✅ Example:

MRR: £82K (+12% MoM)

Burn: £47K/month → 10 months runway

CAC Payback: 5.8 months (steady)

NRR: 109%

Active Users: 2,930 (+9%)

That’s all investors need.

This level of clarity takes less than 15 seconds to digest — which is why they’ll actually read it.

The secret isn’t complexity, it’s consistency.

Use the same metrics every time so investors can track momentum without hunting for patterns.

3️⃣ Narrative (The Context)

Numbers tell the “what.” Narrative tells the “why.”

This is where you show judgment — the difference between being data-driven and being data-literate.

✅ Example:

“Growth came mainly from existing customers expanding usage — our top 20 accounts increased spend by 22% after adding new integrations. We also tested outbound last month, which produced strong interest but long sales cycles. We’ll keep experimenting there, but the focus remains product-led expansion.”

That’s not storytelling — that’s operational thinking on paper.

It shows you know which levers are working, which ones aren’t, and how to prioritise.

Investors read this and think: ‘This founder knows their engine.’

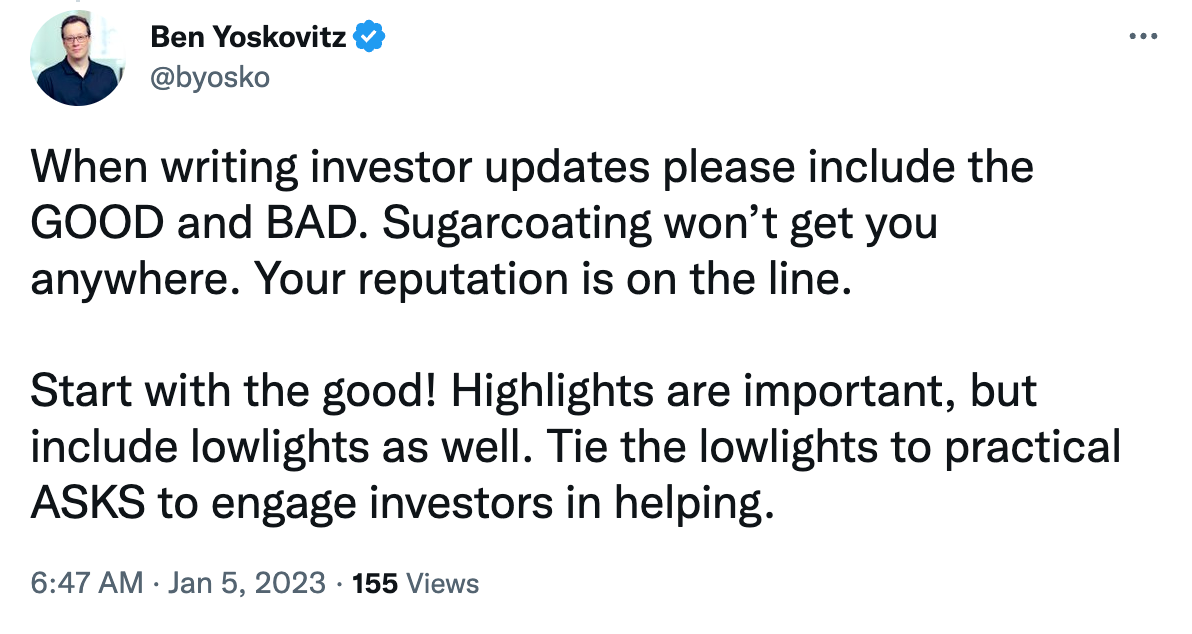

4️⃣ Asks (The Leverage Point)

This is where most founders go vague — “let us know if you can help” — and lose the opportunity.

Make helping you frictionless. Be specific enough that an investor could forward your ask over coffee the next morning.

✅ Example:

“We’re hiring a Head of Sales — ideally someone who’s scaled SaaS from £1M → £10M ARR. Warm intros appreciated.”

“Looking for intros to mid-market logistics operators — we’re piloting a workflow tool with early traction in that space.”

Every ask should pass the coffee test: could an investor repeat it easily to someone else?

If yes, you’ve made it easy to help.

If not, you’ve made it easy to ignore.

5️⃣ Outlook (The Forward Frame)

Always end with momentum.

This is where you signal direction — not forecasts, but focus.

✅ Example:

“In April, we’re launching our new usage-based pricing model. Early tests suggest it could lift NRR by 8–10%. Will share early data in next month’s update.”

Short, forward-looking, and specific.

It gives investors something to look forward to, and more importantly, it closes the loop: you told them what’s coming next.

Great founders don’t just report the past — they frame the future.

This structure doesn’t just make updates easier to write — it makes your investor relationships easier to manage.

Because once you nail this rhythm, every update builds trust, not tension.

Investors stop feeling like supervisors.

They start feeling like allies.

Tone, Transparency, and the “Bad News” Update

Here’s the golden rule: own the story before someone else does.

Bad news doesn’t kill trust — surprise does.

When things go wrong (and they always do), write with honesty and control. The tone should sound like:

“We hit turbulence, here’s what caused it, and here’s how we’re correcting course.”

Avoid apology theatre. Replace “we’re sorry” with “we’re acting.”

💬 Example: The Bad News Update

Subject: Quick Update — Q2 Pipeline Shortfall

Hey everyone,

Wanted to share some context before we publish the full quarterly report. Our Q2 pipeline came in 25% below target, mainly due to a delayed enterprise deal and slower activation in self-serve.

Here’s what we’re doing:

– Refocusing outbound on mid-market (shorter sales cycles)

– Adjusting onboarding flows to improve conversion

– Extending runway through spend reductions in non-core areasEarly data this month already shows a recovery. I’ll share updated metrics in the July report, but wanted you to hear it from me first.

Appreciate your continued support,

[Your Name]

That’s not a weakness — that’s leadership in writing.

Running Great Investor Calls

You don’t need to over-orchestrate investor calls. They’re not mini board meetings; they’re alignment sessions.

Here’s what works:

Prep: Send a one-page summary or deck 24 hours in advance.

Structure: 10 minutes recap, 15 minutes on key topic (e.g. retention, hiring, strategy).

End: One specific ask — “What’s one thing you can help with this month?”

Most importantly: record action items. Follow up within 24 hours. Small touches compound trust.

🧠 Founder Wisdom: A BrainDump on Expectations

As I wrote in my BrainDump “OKRs & KPIs”, OKRs set the ambition — KPIs prove the momentum.

One defines direction. The other defines discipline.

Most founders think these tools are just for internal alignment.

They’re not. They’re the framework your investors use to understand how you think.

Clear expectations turn updates into conversations, not reports.

They give investors a shared language for progress — a way to track momentum without demanding it.

Your OKRs tell the story of what you’re building and why it matters.

Your KPIs show how close you’re getting.

When those two are in sync, trust compounds.

Because the best founders don’t just communicate results — they teach investors how to read their rhythm.

🚀 Closing Thought: Build Allies, Not Auditors

Investor relationships don’t need to feel transactional.

When communication becomes consistent, transparent, and strategic, investors stop acting like overseers and start behaving like allies.

Because great founders don’t manage investors —

they lead them.

And when your updates make investors feel part of the mission, not just passengers on the ride, they’ll open doors you didn’t even know existed.

So next time you hit send on that update, ask yourself one question:

“Am I informing them, or enrolling them?”

The best founders do the latter — every single time.

Want the full BrainDumps collection?

I’ve compiled all 70+ LinkedIn BrainDumps into The Big Book of BrainDumps. It’s the complete playbook for founders who want repeatable, actionable growth frameworks. Check it out here.

Oh absolutely! It is. Infact, I remember reading Brad Feld’s blog about LP relationships back when I started working in VC and this was the most important advice he had.

The ‘build allies, not auditors’ - great mindset shift.

Love all these frameworks you create, Chris, so useful for founders