📈 The Sequoia Way to Nail Your Pitch

Sequoia’s pitch deck formula: craft the story investors can’t ignore.

👋 Hey, Chris here! Welcome to BrainDumps—a weekly series from The Founders Corner. If you’ve been reading along, you know this series is a preview of a bigger project. Well, it’s finally here: The Big Book of BrainDumps is out now!

It isn’t a theory book—it’s the founder’s field manual. Inside, you’ll find 70 powerful frameworks distilled from 30+ years scaling software companies to hundreds of millions in ARR, 20+ years investing in 500+ B2B tech startups, and over $1B of shareholder value created. From raising capital to hiring your first VP of Sales, this book turns scars and successes into practical playbooks you’ll return to again and again. I expect most copies will become well-worn, scribbled on, and dog-eared—because it works.

Table of Contents:

Why Sequoia’s Template Works

The Four Phases of a Winning Pitch: Hook, Interest, Consideration, Action

The 10 Sections That Define Sequoia’s Perfect Deck

The Subtle Genius Behind It

Founders Who Get It: The Airbnb Example

What This Means for You

Closing Thought

Sequoia takes a slightly different route when it comes to pitch deck templates. The world-renowned Venture Capital firm behind Apple, Cisco, and Google amongst others, has developed a pitch deck framework that guides entrepreneurs through the process of crafting a compelling story — not just a collection of slides.

And that distinction matters.

Most founders approach the pitch deck like an exam paper: fill in the boxes, hit all the topics (problem, solution, market, traction), and hope the investor gives you a passing grade. But Sequoia’s approach is rooted in something more powerful — narrative flow. It’s not just about what you say; it’s about the journey you take the investor on.

Because investors don’t invest in data — they invest in conviction. And conviction is built through storytelling.

Why Sequoia’s Template Works

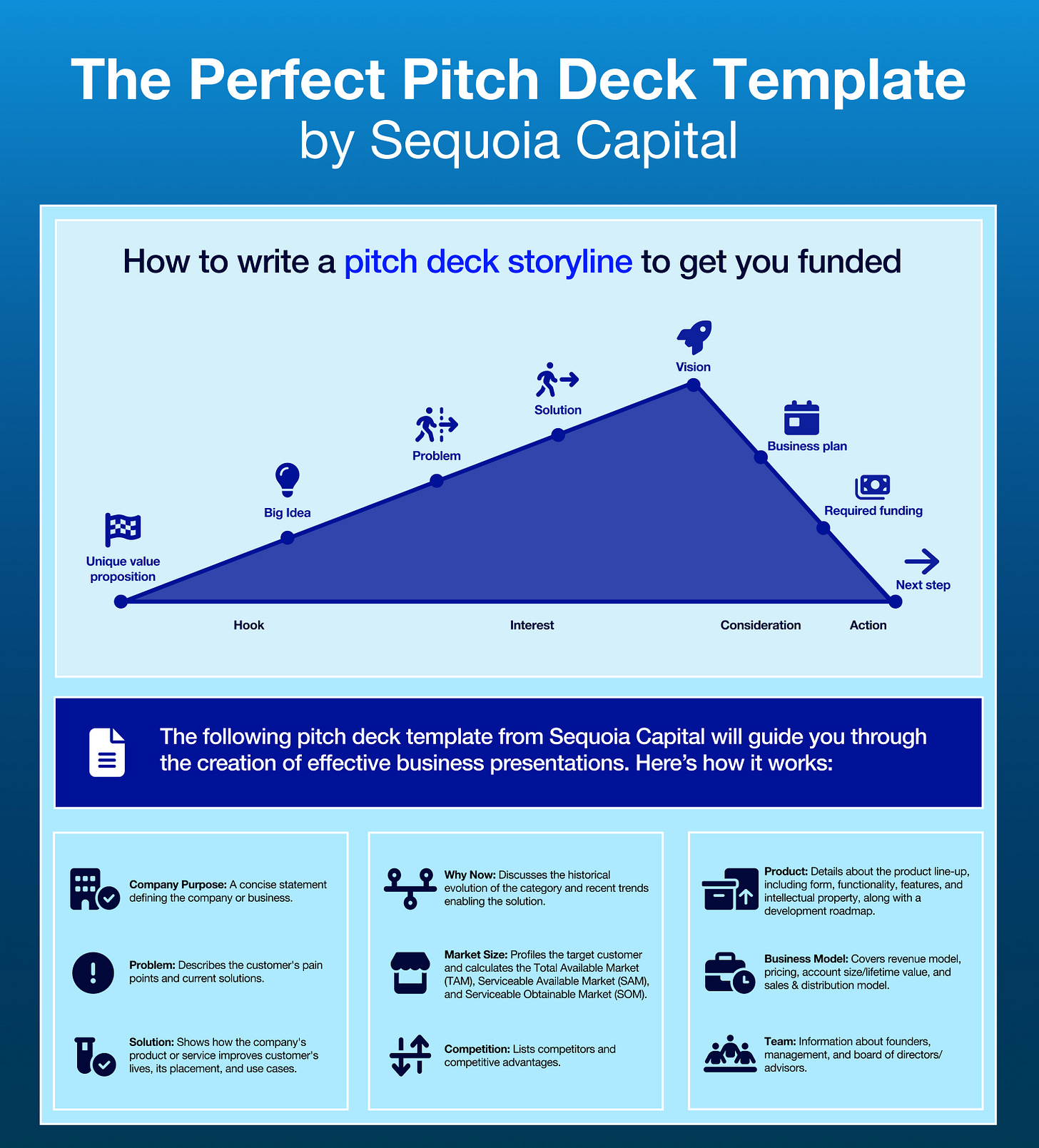

Sequoia Capital’s version of the pitch deck has stood the test of time because it follows the natural psychology of decision-making. It mirrors how humans absorb information and build trust. Their “pitch storyline” moves through four phases — Hook, Interest, Consideration, and Action — that align with the emotional arc of persuasion.

Let’s break it down.

1. Hook:

Start with something that matters — a human problem, a striking insight, or a pattern break. This is where your unique value proposition comes alive. Investors are flooded with decks every day, so your opening slide isn’t about your logo or tagline; it’s about why anyone should care.

Think about how Apple used to open their product launches: “A thousand songs in your pocket.” That’s not a feature list. It’s a hook. In your deck, the equivalent might be:

“70% of mid-market companies still manage procurement in spreadsheets.”

or

“AI is transforming legal research — but 90% of firms can’t afford to adopt it.”

A great hook creates curiosity, context, and momentum.

2. Interest:

Once the audience is leaning in, you transition into the problem and solution. But notice the sequencing — Sequoia always puts problem first. They want you to build empathy, to make the investor feel the pain. Data is important, but emotion drives decisions.

Then, when you reveal your solution, it lands with impact. You’re not just showing what you’ve built; you’re demonstrating why it has to exist.

3. Consideration:

Now that the investor understands the “what” and “why,” it’s time for the “how.” This is where you show evidence that your business works — the early traction, business model, customer feedback, and execution plan.

Sequoia’s decks here are clean and focused. No clutter. No filler. They’re designed to make the investor think, “Okay, these founders get it. They’re not guessing — they’re executing.”

4. Action:

Finally, the “ask.” Most founders stumble here. They either undersell the opportunity (“We’re raising £300k to test…”), or they overreach (“We’re raising £5 million to dominate a £100 billion market”). Sequoia’s guidance is simple:

State what you need.

Show how you’ll use it.

Paint the outcome.

The close of your deck should feel like the next logical step in a story — not a hard sell, but an invitation to join something inevitable.

The 10 Sections That Define Sequoia’s Perfect Deck

Sequoia’s structure is remarkably elegant because it forces clarity. Each section exists to answer one critical investor question. Let’s explore them in sequence.

1. Company Purpose

In one sentence, explain what you do and why it matters.

This isn’t your tagline; it’s your north star. For example:

“Stripe helps internet businesses accept payments easily.”

or

“Figma makes design accessible to everyone, everywhere.”

The simpler this statement, the more powerful it becomes.

2. Problem

Describe the pain. Who feels it, how big is it, and what happens if it’s not solved?

Investors are drawn to tension. The more vividly you describe the problem, the more compelling your solution becomes.

3. Solution

Show how your product resolves that pain.

Keep this focused on outcomes, not features. Visuals, screenshots, or short demos work beautifully here.

4. Why Now?

Timing is everything.

Sequoia puts this early in the deck because even a great product can fail if the market isn’t ready. Use this slide to show why this moment is the inflection point — the convergence of technology, regulation, behaviour, or economics that makes your business inevitable now.

5. Market Size

The TAM/SAM/SOM slide.

But here’s the nuance: Sequoia doesn’t just want numbers — they want logic. Investors see inflated TAMs all the time. Instead, show how your market expands as you win. Maybe your initial segment is £500M, but your adjacent markets multiply that over time. Be honest, but ambitious.

6. Product

Demonstrate what you’ve built.

Use visuals and storytelling to show how users experience it. The goal is to make investors think, “I get it — and I can see people using it.”

7. Business Model

How do you make money, and how scalable is it?

Investors aren’t allergic to experimentation, but they want to see discipline. What are your unit economics? How do you grow margins over time?

8. Traction

The proof.

Numbers talk. Share growth metrics, pipeline strength, conversion rates, or customer logos. If you’re pre-revenue, focus on validation — pilots, testimonials, product adoption, or engaged waitlists.

9. Competition

Map the battlefield.

Don’t say “we have no competition.” That’s a red flag. Instead, show you understand the market landscape. Then articulate your moat — your proprietary advantage, your insight, or your speed.

10. Team

The most important slide of all.

Investors back founders, not just products. Use this to show why you are uniquely qualified to win this market. Backgrounds, track records, domain insights — this is your credibility moment.

11. Financials & Funding

The destination.

Lay out projections for the next 3–5 years. Show your logic, not just your optimism. Then close with your funding ask and what it will achieve.

The Subtle Genius Behind It

What makes the Sequoia template so enduring is not its structure, but its storytelling rhythm. It guides you through tension, relief, and resolution — the same emotional beats found in any good film or novel.

And that’s no accident. Sequoia’s partners know that founders who can communicate with clarity tend to execute with clarity. The discipline required to distil your story into this format is the same discipline required to build a scalable business.

When a founder can walk an investor through a narrative that flows effortlessly — from problem to vision to execution — they demonstrate mastery. Not just of their market, but of their own thinking.

Founders Who Get It

Consider Airbnb’s original pitch to Sequoia in 2009. Their deck followed a similar pattern:

Problem: Hotels are expensive, impersonal, and disconnected from local experiences.

Solution: A platform that lets anyone rent out space in their home.

Why Now: Economic downturn + rise of social media = trust and income need.

Market: $100 billion global travel market.

Business Model: 10% commission.

Traction: 800 bookings during Democratic National Convention.

It wasn’t flashy. But it was clear. It told a story that made sense emotionally and logically. And that’s what won over Sequoia.

What This Means for You

As a founder, you can take two lessons from Sequoia’s approach:

Your deck isn’t a data room — it’s a story.

Your numbers, charts, and diagrams are important, but they’re supporting actors. The lead role is your narrative — why your company exists and why now is the time.Clarity wins.

If someone can’t understand your business in five minutes, you don’t have a business — you have a puzzle. Sequoia’s framework forces you to sharpen your thinking until it cuts through noise and doubt.

Closing Thought

That’s probably enough on how to create the perfect pitch deck. You get the point. Most VCs — from Sequoia to a local angel syndicate — will tell you the same thing: keep it short, keep it simple, and make it flow.

A great pitch deck isn’t about dazzling investors with detail; it’s about aligning their imagination with yours. It’s a story of what could be, anchored in evidence and conviction.

And if you can tell that story well, the right investors won’t just fund you — they’ll believe in you.

Now that we’ve mastered storytelling, let’s move on to the slide that so often derails great pitches: Market Sizing. Because when it comes to fundraising friction, this is the one topic that sparks more debate than any other — and it’s time to get it right.

—Chris Tottman