🤷♂️ How Much Is Your Startup Really Worth?

A founder’s guide on how investors think about startup valuations.

👋 Hey, Chris here! Welcome to BrainDumps—a weekly series from The Founders Corner. If you’ve been reading along, you know this series is a preview of a bigger project. Well, it’s finally here: The Big Book of BrainDumps is out now!

It isn’t a theory book—it’s the founder’s field manual. Inside, you’ll find 70 powerful frameworks distilled from 30+ years scaling software companies to hundreds of millions in ARR, 20+ years investing in 500+ B2B tech startups, and over $1B of shareholder value created. From raising capital to hiring your first VP of Sales, this book turns scars and successes into practical playbooks you’ll return to again and again. I expect most copies will become well-worn, scribbled on, and dog-eared—because it works.

Table of Contents

1. Why Traditional Valuation Falls Short for SaaS

2. The Holy Grail Metrics of SaaS Valuation

3. Growth = Multiples (But Only If It’s Quality Growth)

4. Valuation Is a Narrative—Not Just a Number

5. The Valuation “Graph” Every Founder Should Know

6. What to Watch as You Scale

7. The Mindset Shift That Separates the Great Founders

Final Thoughts: Valuation Is the Scorecard of Your Strategy

Most founders have the same look on their face the first time I ask them what they think their company is worth.

It’s somewhere between “I hope I’m not about to embarrass myself” and “Please don’t call my bluff.”

And I get it. Valuation can feel like alchemy—half science, half storytelling, and a dash of bravado for good measure.

But the truth is, there is a method to the madness. Especially in SaaS.

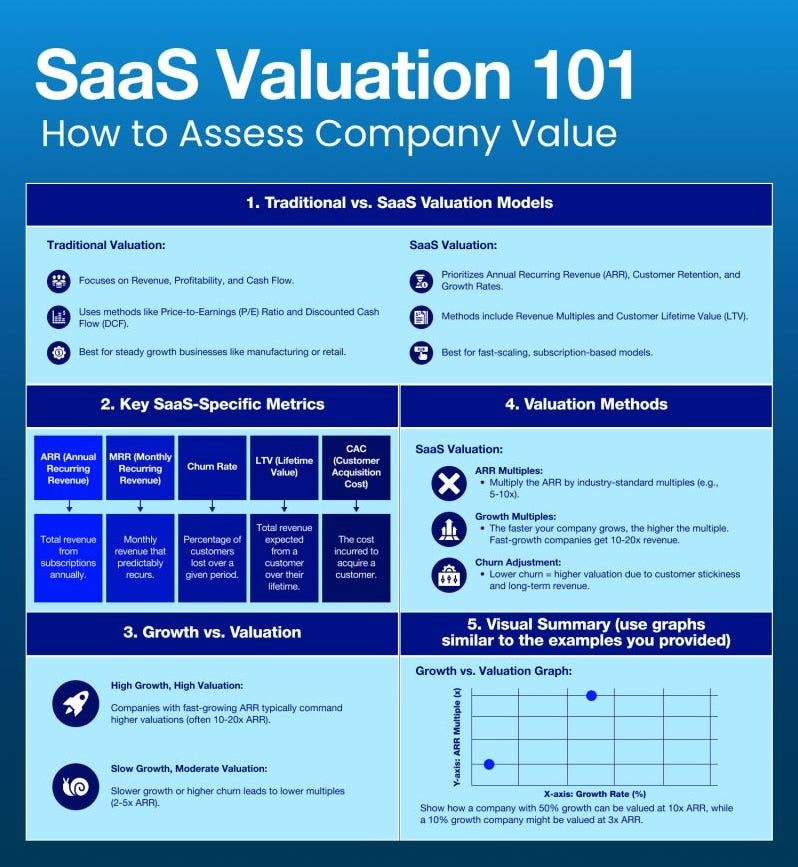

So when I saw Majd Alaily’s SaaS Valuation 101 visual, I knew we had to include it here. It demystifies what many founders overcomplicate—and cuts to the heart of what investors actually look for.

If you're a founder raising capital, understanding how valuation works isn’t a “nice to have.” It’s the oxygen in the room. The entire funding process—from your pitch deck to the term sheet—hinges on whether you understand the valuation game better than the investor across the table.

And here’s the kicker: the rules have changed.

1. Why Traditional Valuation Falls Short for SaaS

Let’s start with a confession. When I first became an investor after my operator days, I still thought like an old-school P&L guy.

Revenue, EBITDA, discount rates, DCFs… that’s what we used when we were buying boring service businesses or bricks-and-mortar assets.

But SaaS? SaaS laughs at that rulebook.

Why? Because the entire point of SaaS is recurring revenue.

And that changes everything.

In traditional businesses, revenue is transactional.

In SaaS, revenue is a subscription—predictable, compounding, and scalable.

So rather than pricing your company based on current cash flow, we price it on future potential—anchored in metrics that tell us whether your growth is real, efficient, and sustainable.

That’s why in SaaS, we focus on:

ARR (Annual Recurring Revenue)

Growth rate

LTV/CAC ratio

Churn

Net Revenue Retention

These are the levers that matter. And the better you understand them, the better chance you have of owning your valuation narrative instead of being at the mercy of it.

2. The Holy Grail Metrics of SaaS Valuation

Let’s unpack the ones that really move the needle.

ARR: The Valuation Anchor

ARR is your baseline. It’s the annualised value of your recurring contracts. It’s the first number out of your mouth in any investor meeting. Investors love ARR because it’s stable, repeatable, and gives them a lens into your revenue engine.

If you’re doing $3M in ARR, that’s your anchor. But how that translates into valuation depends entirely on what’s wrapped around it.

MRR: The Pulse Check

MRR gives us the month-by-month momentum. It’s where we track upgrades, downgrades, expansions, and churn. This is how we know if ARR is growing healthily—or being inflated with one-off tricks.

Churn: The Silent Killer

Let’s be blunt. High churn destroys valuation.

I once worked with a founder who was doing £1.2M in ARR but had 25% annual churn. It didn’t matter how good their growth was—investors saw a leaky bucket.

Low churn tells us your product is sticky. It says, “our customers love us enough to stay.” That always earns a higher multiple.

LTV:CAC Ratio: The Efficiency Gauge

Lifetime Value divided by Customer Acquisition Cost. This is the single best predictor of long-term sustainability.

3:1 is the magic number. For every $1 you spend to acquire a customer, you make $3.

1:1? You’re burning money to stand still.

10:1? You might be growing too conservatively. Time to press the gas.

Investors want to see you’re acquiring efficiently and reinvesting boldly.

3. Growth = Multiples (But Only If It’s Quality Growth)

Here’s where things get spicy.

Let’s say you’re doing $5M ARR. What are you worth?

If you’re growing at 10%, maybe 3x ARR → $15M valuation.

If you’re growing at 50%, you could be worth 10–12x ARR → $50–60M valuation.

If you’re growing at 100%+, and retention is strong? You’re in the 15–20x club.

This is why growth rate matters so much. But here’s the nuance founders miss:

Growth is only valuable if it’s efficient.

If your CAC is spiralling, churn is climbing, and you’re buying revenue that doesn’t stick, those high multiples vanish in a puff of smoke.

4. Valuation Is a Narrative—Not Just a Number

Here’s a trick most founders don’t realise:

Investors don’t calculate your value. They underwrite your story.

They want to believe that:

Your market is big and getting bigger.

You’re the best team to win it.

Your GTM machine is repeatable.

Your revenue is sticky and scalable.

You know your numbers cold.

When that narrative lines up with the metrics, the multiple follows.

If your story’s confusing, or your numbers don’t back it up, the valuation tanks. Investors don’t penalise based on math—they penalise based on doubt.

5. The Valuation “Graph” Every Founder Should Know

One of the best parts of Majd’s visual is the simple valuation vs. growth graph.

It shows exactly what I’ve seen in practice:

Companies growing 10% YoY might get 2–3x ARR.

At 30–40% growth, that jumps to 6–8x ARR.

At 50%+, you start seeing 10–15x ARR multiples.

But there’s a catch. The graph flattens if churn is too high or if growth is being bought recklessly. That’s where valuation multiples decouple from ARR growth.

I’ve seen founders throw money at paid channels to hit 100% YoY, only to end up with unhappy customers, high churn, and no path to retention.

That’s not a business. That’s a burn.

6. What to Watch as You Scale

Different stages of growth call for different valuation mindsets.

Early Stage (Pre-Seed to Seed)

You might not have much revenue, so the valuation is driven more by:

Team credibility

Market potential

Early engagement metrics

Investors might value you at 10x forward-looking ARR if they see breakout potential.

Growth Stage (Series A-B)

Now ARR matters—and so does how you’re getting it. The quality of growth (retention, CAC, NRR) becomes central. This is where the rubber hits the road.

Late Stage (Series C and beyond)

You’re being judged like a public company. Efficiency, margins, revenue predictability, leadership team depth—these all matter. DCF models and EBITDA start to creep back into the conversation.

7. The Mindset Shift That Separates the Great Founders

Too many founders treat valuation like it’s out of their hands. “The market decides,” they shrug.

No.

Your metrics tell the story. But you control the plot.

Improve your CAC payback.

Reduce churn through onboarding and product adoption.

Expand LTV with pricing changes or upsell paths.

Dial in your GTM motion to create repeatability.

Every 1% improvement in these areas compounds. Over time, it doesn’t just add value—it multiplies it.

Final Thoughts: Valuation Is the Scorecard of Your Strategy

If you take nothing else away from this article, take this:

Valuation isn’t just about what investors are willing to pay.

It’s a reflection of how clearly and efficiently your business can scale.

It’s the external scoreboard that measures:

Your understanding of customer economics

Your ability to tell a compelling, data-backed story

Your operational discipline

Your product’s stickiness

Your ambition—and the proof you can deliver on it

In a world where capital is more selective, where investors look past vanity metrics, understanding SaaS valuation isn’t optional. It’s the difference between raising a round and getting left behind.

So print the visual. Read this article twice. And next time someone asks you what your company’s worth?

Smile.

Because now, you won’t just throw out a number.

You’ll show them why you’ve earned it.

—Chris Tottman

Amazing post Chris!

"Let’s say you’re doing $5M ARR. What are you worth?

If you’re growing at 10%, maybe 3x ARR → $15M valuation.

If you’re growing at 50%, you could be worth 10–12x ARR → $50–60M valuation.

If you’re growing at 100%+, and retention is strong? You’re in the 15–20x club.

This is why growth rate matters so much."

A curious side effect of this norm is that founders are pushed hard to show the growth dynamics. The infamous hockey stick growth.

After all, each percent is like another million or so in valuation (to stick with the original numbers). While pumping the growth from 20% to 50% may be beyond reach, playing the numbers so they show a bit more rosy reality at the right time is a piece of cake.

Just look at any corporation pushing for the numbers before the end of a fiscal year (and thus, bonuses).

With startups, it's even more broken because the payout is explicitly non-linear.

So we are designing a game where short-term gains over long-term gains are rewarded. There's no shortage of stories of how that can backfire.