💰 From 5,000+ Startups: Y Combinator's Guide to Raising Your Seed Round

How to raise smart, spend wisely, and set the tone for the company you want to build.

👋 Hey, Chris here! Welcome to BrainDumps—a weekly series from The Founders Corner. If you’ve been reading along, you know this series is a preview of a bigger project. Well, it’s finally here: The Big Book of BrainDumps is out now!

It isn’t a theory book—it’s the founder’s field manual. Inside, you’ll find 70 powerful frameworks distilled from 30+ years scaling software companies to hundreds of millions in ARR, 20+ years investing in 500+ B2B tech startups, and over $1B of shareholder value created. From raising capital to hiring your first VP of Sales, this book turns scars and successes into practical playbooks you’ll return to again and again. I expect most copies will become well-worn, scribbled on, and dog-eared—because it works.

Table of Contents

1. Why Raise Money? (Hint: It’s Not Just to Survive)

2. When to Raise (Not Too Early, Not Too Late)

3. How Much Should You Raise?

4. Choosing the Right Funding Structure (Equity vs SAFE vs Convertible Notes)

5. Valuation (The Art, Not the Science)

6. Understanding Investor Types (And What Each Brings)

7. Approaching Investors: The Right Way to Pitch

8. Negotiating & Closing the Round

9. Post-Raise: The Real Work Begins

Final Words: Seed Funding is About More Than Capital—It’s a Commitment to the Mission

Raising a seed round is like jumping out of a plane and trying to sew the parachute on the way down.

You’ve got one shot to build momentum.

You’ve got one shot to land investors who actually help.

And you’ve got one shot to not overprice your company into a corner.

No pressure.

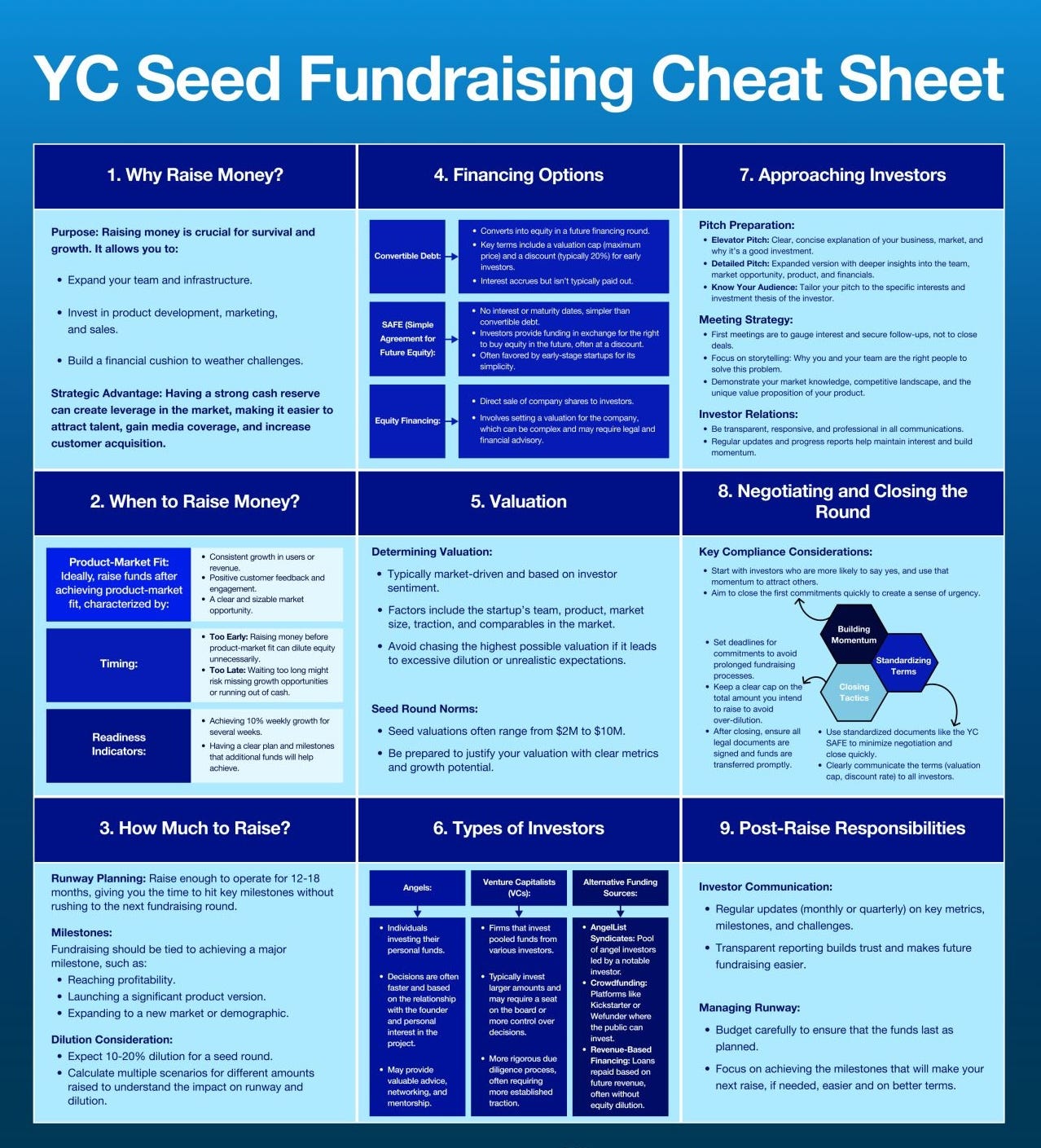

This next BrainDump—courtesy of the smart minds at Y Combinator—pulls together a ridiculously clear cheat sheet on how to think about Seed Funding.

And while it may look like just another how-to diagram, I’d argue this might be the most important visual guide in this whole book—because it gives you the full picture:

Why you’re raising

When to do it

How much to take

Who to take it from

What terms to use

And what to do after the money hits the bank

Let’s unpack it. And as ever—I’ll throw in the stuff I’ve learned from the trenches, so you don’t have to learn it the hard way.

1. Why Raise Money? (Hint: It’s Not Just to Survive)

Founders sometimes ask:

“Should we raise?”

Here’s my rule of thumb:

Raise when you know exactly what that capital unlocks.

Don’t raise just because “it’s time.” Or because your friend did. Or because you read a TechCrunch article about some guy who raised £3M on an idea.

Capital should be fuel for something specific.

The Y Combinator cheat sheet is bang on:

Hiring engineers to ship faster? ✅

Building a sales team to drive growth? ✅

Extending runway to outlast competitors? ✅

Buffering against shocks so you can think long-term? ✅

But here’s the kicker: money is not momentum. It’s just the means. The clarity of your why will determine how well you raise—and how wisely you spend.

2. When to Raise (Not Too Early, Not Too Late)

The worst time to raise? When you’re desperate.

The second-worst time? Before you’re ready.

What “ready” looks like depends on the business—but here’s a general framework I use with SaaS founders:

Too Early

🚫 No product

🚫 No users

🚫 No insight beyond “big idea”

Right Time

✅ MVP with usage

✅ Early revenue or active users

✅ Signs of product-market fit (low churn, high retention, repeatable use cases)

✅ Realistic plan for what capital will do

This is where the cheat sheet nails it: the timing of your Seed round has huge implications on both dilution and traction.

Raise too early: you’ll give away 25%+ of your company for a dream and a slide deck.

Raise too late: you might miss a window, stall out, or lose your lead in the market.

There’s no perfect time—but there’s a smart time. That’s what you’re aiming for.

3. How Much Should You Raise?

This is the section where founders love to go off-script.

They either:

Ask for too little, run out of runway, and come crawling back for a bridge round 6 months later.

Ask for too much, get bloated, and create a burn rate that makes Series A terrifying.

Here’s what YC recommends—and what I believe works:

Raise for 12–18 months of runway.

This gives you space to breathe, hire, build, test, sell, and show traction—without living in constant fear of zero cash.

To get the number:

List your core hires

Add realistic operating expenses

Add a buffer (6 months)

Factor in expected growth-related spend (marketing, infrastructure)

Typical Seed rounds: $750k–$2M, often at 20–25% dilution.

Be realistic. Not aspirational. And don’t build your model on the assumption that “everything goes perfectly.”

4. Choosing the Right Funding Structure (Equity vs SAFE vs Convertible Notes)

You’ve got options when it comes to how you structure the raise. And this is where first-time Founders can get badly burned by bad advice or “friendly” investor terms.

Let’s walk through the options.

🟦 SAFE (Simple Agreement for Future Equity)

This is YC’s baby. Simple. Clean. No valuation negotiations upfront.

Instead:

You set a valuation cap

You offer a discount

Investor converts to equity at next round

Pros

✅ Easy to execute

✅ No board required

✅ No interest or maturity date

Cons

🔺 Can stack up over time and complicate future rounds

🔺 If your cap is too low, future dilution can be brutal

🟨 Convertible Notes

Debt that turns into equity later. Used to be the default pre-SAFE.

Pros

✅ Delays valuation conversation

✅ Familiar to most Angels

Cons

🔺 Includes interest

🔺 Includes maturity date

🔺 Can force you into conversion before you’re ready

🟥 Equity

Actual priced round with a fixed valuation.

Pros

✅ Clear cap table from Day 1

✅ Investors know what they own

✅ Sets clean baseline for future rounds

Cons

🔺 Slower to close

🔺 Requires valuation negotiations

🔺 Legal costs higher

My Take

If you’re early and want to move fast—go SAFE.

If you’ve got leverage, metrics, and strong interest—go priced.

If you’re somewhere in between—choose what creates the least friction for your next round.

Just don’t let a financing tool stop you from building.

5. Valuation (The Art, Not the Science)

Founders get obsessed with valuation like it’s a badge of honour.

“We raised at £10M post!”

“We got a 25x ARR multiple!”

Okay—but what did you give up to get that?

Did you promise hockey-stick growth you can’t deliver?

Did you give away board control?

Did you price yourself out of a clean Series A?

Seed-stage valuation is often market-driven.

It’s based on:

Team quality

Market size

Early traction

Competitor comps

Investor appetite

Not on revenue. Not on CAC/LTV. Not on DCF models.

So ask yourself:

What valuation justifies the risk for early investors?

What valuation allows me to raise again without needing a down round?

What valuation reflects where we are today—not where we hope to be?

My Take

Raise at a valuation you can grow into in 12–18 months.

6. Understanding Investor Types (And What Each Brings)

Not all money is created equal.

When you raise Seed, you’ll meet all kinds:

🧑💻 Angels

Small cheques

High engagement (sometimes)

Operational experience

Risk-tolerant

🧢 VC Funds

Larger cheques

Formal decision process

Board rights, term sheets

Often looking to lead

🤝 Syndicates

Group of Angels via one lead

Easy access to $500k+

Lower admin, less dilution

Often more passive

💻 Crowdfunding & RBF

Non-dilutive or community-driven

Easier to close

Less strategic help

Each has trade-offs.

Your job as a founder is to find alignment.

Take money from people who:

Get your model

Get your market

Get you as a founder

Don’t just chase the biggest cheque. Chase the right relationship.

7. Approaching Investors: The Right Way to Pitch

This cheat sheet reminds us: raising money is a process, not an event.

That process starts with how you show up.

Great founders do three things:

7.1. Tell a Clear Story

Problem → Solution → Market → Traction → Team → Why Now

7.2. Show Traction (of any kind)

MRR

DAUs

CAC/LTV estimates

Sales cycle insights

Testimonials

7.3. Follow Up Like a Pro

Keep a tight CRM of investor convos

Send concise updates

Make it easy for them to say yes

My Take

Investors back momentum. You don’t need perfect numbers—you need clear progress and the ability to tell the story well.

8. Negotiating & Closing the Round

The YC Cheat Sheet is right: it’s not over until the money’s in the bank.

Be clear on:

Cap table post-raise

Rights and responsibilities

Pro rata terms

Board structure

Investor expectations

Use a standard SAFE or Series Seed template if you can. Don’t get lost in edge-case negotiations.

If an investor is asking for:

Veto rights

Multiple board seats

Unusual liquidation preferences

🚨 RED FLAG. You’re being over-engineered.

9. Post-Raise: The Real Work Begins

Congrats. You’ve raised the money.

Now what?

You manage it. Ruthlessly. Transparently. Strategically.

Your responsibilities:

Build the product

Hit the milestones

Communicate monthly or quarterly

Track burn, runway, and runway extensions

Keep investors informed (but not overwhelmed)

Founders who treat investors like partners build long-term trust.

Founders who go dark after raising lose optionality and support.

Final Words: Seed Funding is About More Than Capital—It’s a Commitment to the Mission

You’re not just raising to keep the lights on.

You’re raising to:

Prove your business can work

Find the right market

Build the right product

Show that your team can execute

Set the stage for Series A and beyond

The YC cheat sheet is gold because it doesn’t just tell you what to do. It reminds you why you’re doing it.

So print it out. Tape it to your wall. Use it not just to raise your round—but to raise your standard for how you run your business.

Because in the end, it’s not about how much you raised.

It’s about what you built with it.

—Chris Tottman

this breakdown is incredibly valuable, especially for first-time founders.

The focus on raising smart and the nuance between different funding structures like SAFE vs. Equity is a fantastic guide.

Great guide! Chris, would love your thoughts on this: I've seen some resilient founders deliberately raise less early on. Not because they couldn't get more, but to force focus and avoid the bloat that comes with overcapitalization. How do you spot the founders who can pull that off versus those who just end up with too little runway?