The One Question That Reveals Whether Your Company Is Truly ‘Optionality-Ready'

The mindset shift that quietly separates resilient companies from fragile ones.

Founders are often pushed to declare an identity early.

Are you building the next decade-long compounder?

Or crafting the kind of business a strategic buyer snaps up cleanly?

But the most resilient companies quietly sidestep this false choice.

They build so they can last — and so they could sell — without changing their internal wiring.

Optionality isn’t a philosophy.

It’s a design constraint.

Put in place early, reinforced often, and visible in everything from how you form your company to how you record decisions.

When you do it well, every new quarter adds strategic freedom rather than strategic debt.

Table of Contents

🏁 Why Optionality Matters Early

🏛 Built To Last vs Built To Sell

🧩 The Three Lenses Of Optionality

🏗 Structuring The Company For Future Buyers

📂 Your Always On Data Room

📊 Metrics That Impress Both Buyers And Boards

🧠 Founder Wisdom A Braindump On Default Alive

🧪 Experiments That Survive Due Diligence

🛡 Governance Without Bureaucracy

🚨 Signals You Are Quietly Killing Optionality

💡 Founder OS The Optionality Readiness Checklist

🚀 Closing Thought Design For The Fork In The Road

🏁 Why Optionality Matters Early

There’s a moment where your company feels less like chaos and more like a system.

Sales start to rhyme. Renewals stabilise. Teams stop firefighting long enough to think.

Ironically, this is also the moment when outsiders begin studying you — quietly.

A partner tests your responsiveness.

A competitor checks your hiring velocity.

An investor revisits old notes.

And someone important asks:

“If we wanted to acquire this business, could we even make sense of it?”

That question should scare you — not because you want to sell, but because it reveals whether the company is legible.

Speed creates momentum.

Optionality protects slope.

When the two combine, the business becomes far more valuable than the growth line alone would suggest.

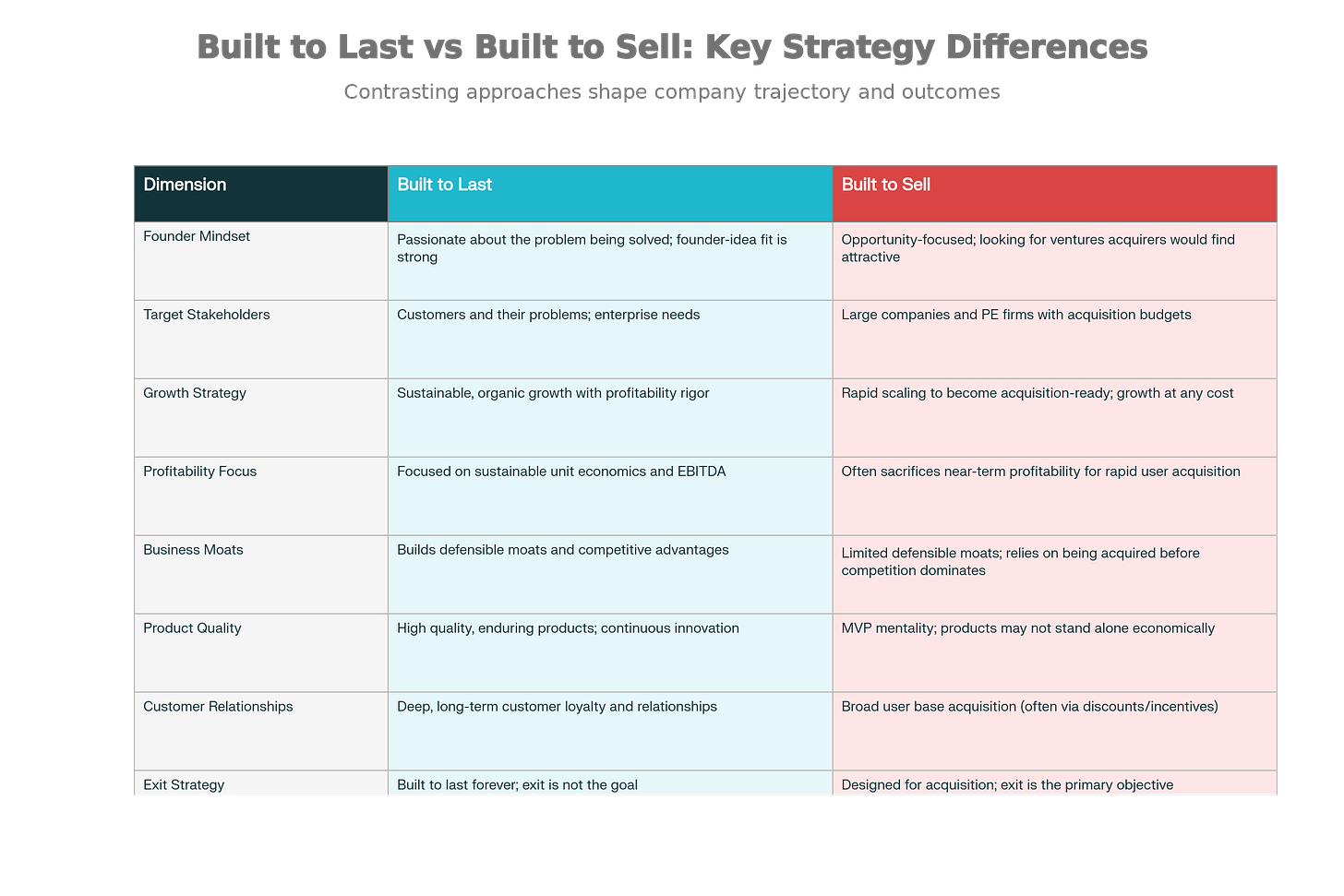

🏛 Built To Last vs Built To Sell

Founders often polarise themselves unnecessarily.

“Built to last” sounds noble — systems, moats, compounding.

“Built to sell” sounds mercenary — polish, theatre, positioning.

But when you look inside real engines, the difference is thinner than it appears.

Built-to-last companies still need:

clean ownership

consistent metrics

documented decisions

Built-to-sell companies still need:

retention that proves value

customers who deepen their usage

credible economics

The truth is simple:

Acquirable companies are usually the ones that could survive indefinitely.

Durable companies are often the ones most attractive to acquire.

The mature question is not: Which path are we on?

It’s: Would our internal truth stand up to external scrutiny?

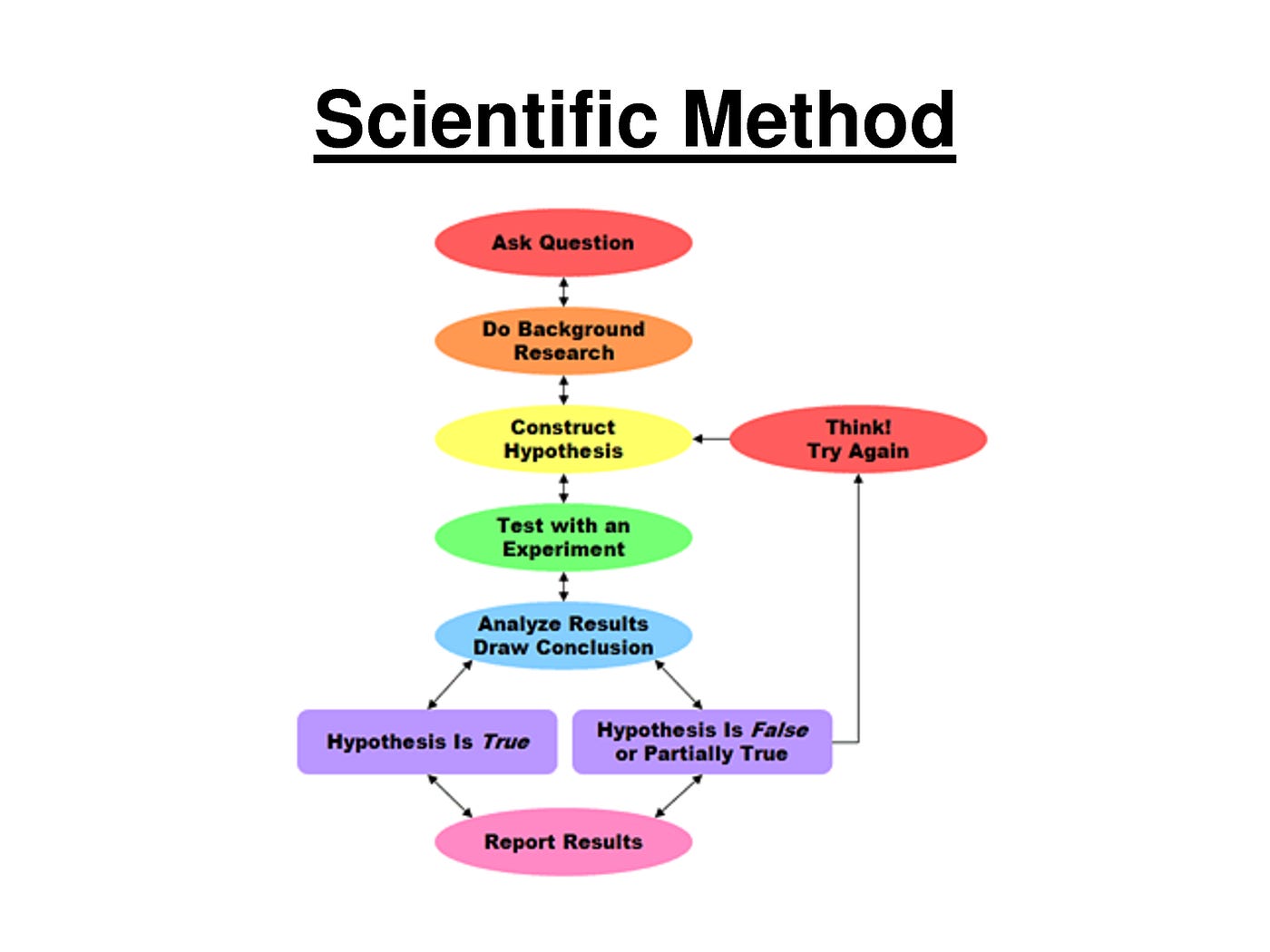

🧩 The Three Lenses Of Optionality

Optionality emerges through three layers:

Structure. Data. Metrics.

Structure determines whether someone can actually buy the company.

Data determines whether they can understand it.

Metrics determine whether they can believe it.

These lenses are the backbone of optionality.

Without them, even great growth becomes a brittle story.

And the inverse is striking:

Companies with simple structures, clean data, and consistent metrics often have more strategic demand than they ever seek.

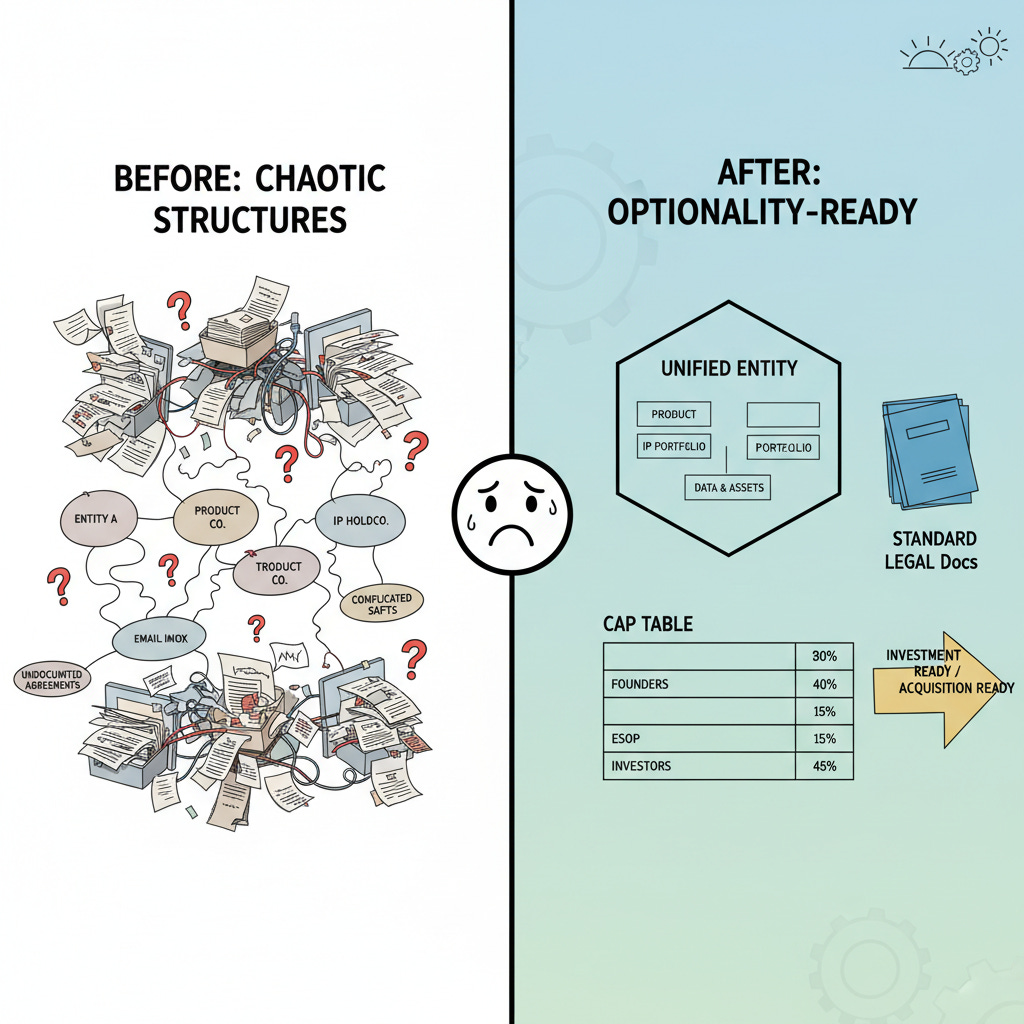

🏗 Structuring The Company For Future Buyers

Most structural issues begin innocently:

A second entity “just for a pilot.”

IP that never quite made it into the company.

Equity agreements stored in inboxes, not systems.

They feel like small administrative decisions — until the day they cost you a buyer.

A structure built for optionality tends to feel almost boring:

One entity that owns the IP and the product.

A cap table where every line is real and documented.

Standard equity terms, not favours tailored to individuals.

And occasionally:

A founder who swallowed their pride and unwound an early, messy decision rather than letting it calcify.

The companies that sell cleanly don’t simplify their structure at the end.

They avoid complexity from the start.

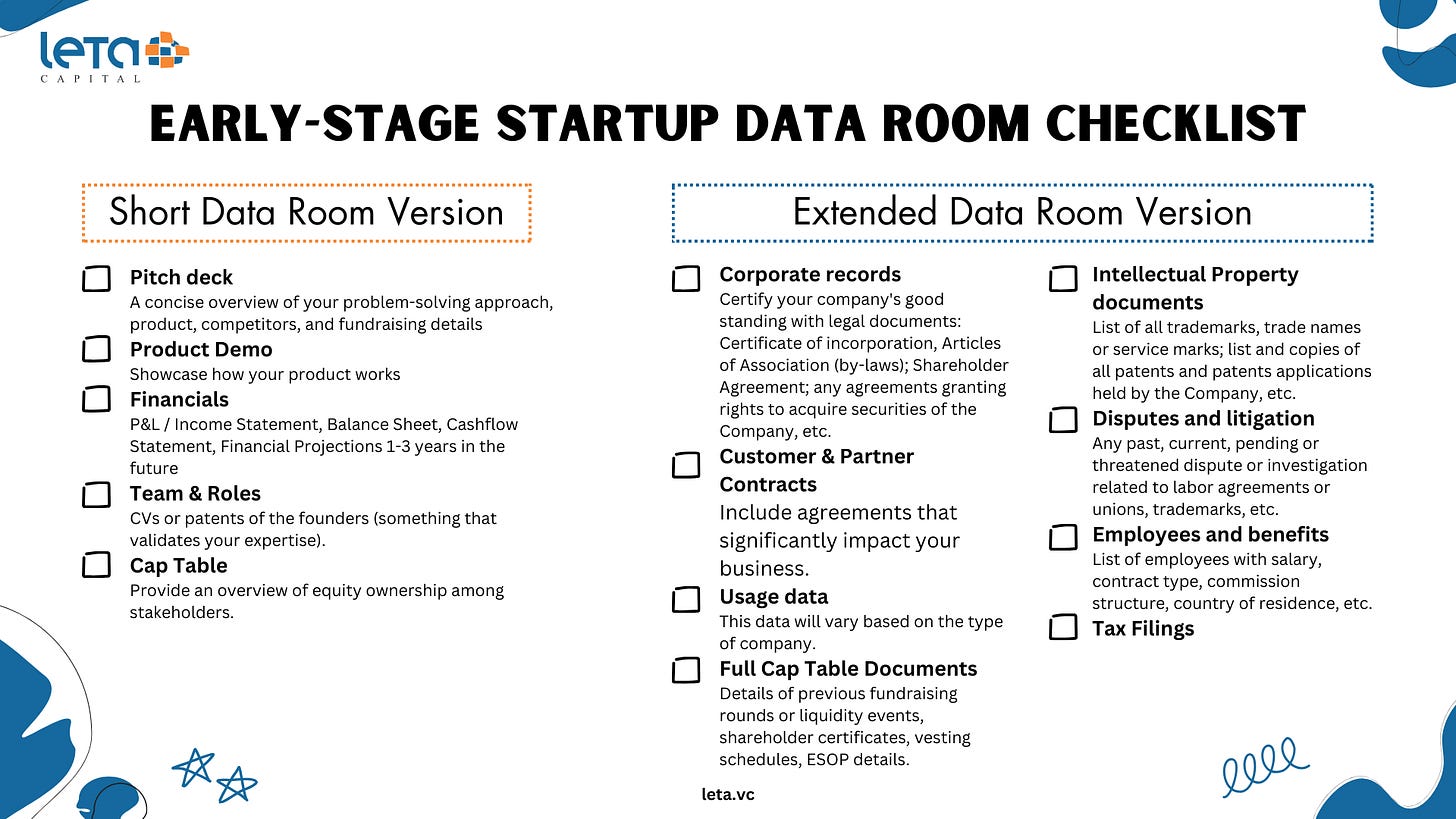

📂 Your Always On Data Room

Think of this less like a diligence folder and more like an x-ray machine.

It reveals how seriously you run the company.

The worst data rooms are built in panic.

The best ones already exist.

A living data room doesn’t need to be beautiful.

It needs to be current.

Some founders update it monthly. Others quarterly.

The cadence matters less than the habit.

Because when your data room is always modern:

You make fewer decisions from anecdotes.

Leadership debates sharpen.

A buyer could enter tomorrow and find a company that looks the same inside as outside.

You are always live on diligence — whether anyone has opened the folder or not.

📊 Metrics That Impress Both Buyers And Boards

Metrics are where optionality becomes visible.

Not because buyers worship graphs,

but because metrics reveal whether the business behaves like a system or a series of lucky breaks.

Buyers (and strong boards) look for three threads woven into one story:

Growth — velocity and volume

Quality of revenue — who stays, who expands, who dominates

Efficiency — whether new money steepens the slope or just extends the runway

A great metrics pack feels like a narrative you can trust.

A weak one feels like a collage of numbers fighting each other.

And the test is simple:

If you weren’t the founder, would these numbers convince you?

🧠 Founder Wisdom: A Braindump On Default Alive

I wrote about this in one of my LinkedIn Braindumps in The Big Book of Braindumps — Default Alive vs Default Dead.

In that piece, I argued something founders rarely want to confront:

Your cash profile quietly dictates your strategic freedom long before anyone says the words “optionality.”

If you are Default Dead, your options collapse.

Runway becomes the board.

Every decision is defined by survival.

Every negotiation smells of urgency.

But if you are Default Alive, something important shifts.

You choose when to raise.

You choose when to entertain a strategic offer.

You choose whether this is a year for acceleration or consolidation.

Default Alive isn’t about frugality.

It’s about leverage.

And leverage is the foundation of optionality.

🧪 Experiments That Survive Due Diligence

Optionality does not mean caution.

You still need to run experiments — aggressively and often.

But experiments only create value when they produce knowledge, not noise.

The pattern among high-optionality companies is simple:

They write down what they tried, why they tried it, what happened, and what they learned.

These aren’t research papers.

They’re short, sharp memos.

But they have an outsized effect.

Because to a buyer, they signal something rare:

“This company learns deliberately.”

A company that learns deliberately is a company people want to own.

🛡 Governance Without Bureaucracy

Governance has a reputation problem.

It conjures images of binders, committees, and consensus-driven paralysis.

But the kind of governance that expands optionality is the opposite:

Light.

Explicit.

Unemotional.

A small board with structured packs.

Decision logs for major moves.

A shortlist of risks reviewed regularly, not ceremonially.

Good governance doesn’t slow a company down.

It prevents you from tripping over your own speed.

🚨 Signals You Are Quietly Killing Optionality

Optionality rarely dies loudly.

It fades.

You see it in the unformalised equity grants.

In the contracts with toxic change-of-control terms.

In metrics redefined every quarter to make the line go “up and to the right.”

In the legal structure that no one has looked at in two years.

Individually, these are frictions.

Collectively, they tell an acquirer everything they need to know:

“This company chooses convenience over clarity.”

When you see these signs, the fix is not dramatic.

It is deliberate.

And it is worth doing long before anyone asks for a data room link.

💡 Founder OS: The Optionality Readiness Checklist

A quick internal diagnostic before your next planning cycle:

1. Structure

Is our ownership and entity setup understandable — fully — in under an hour?

2. Data

Does the data room reflect reality, not perform for it?

3. Metrics

Do our numbers tell one consistent story?

4. Default Status

Given our burn and trajectory, are we Default Alive or Default Dead?

Optionality answers itself once you know these four truths.

🚀 Closing Thought: Design For The Fork In The Road

Founders consistently overestimate what they can tidy in the final three months before a raise or sale.

And they underestimate what they can transform in three years of disciplined structure, clean data, and coherent metrics.

Optionality isn’t a luxury.

It’s the byproduct of running a company whose internals match its ambition.

When you do, something rare happens:

You gain the freedom to choose.

Scale or sell.

Accelerate or consolidate.

Hold or hand over.

The market cannot give you that freedom.

You build it.

And before your next major decision, ask:

Are we optimising for the next announcement,

or designing a company that could sell or scale on our terms?

If the answer comes easily, you’re already building with optionality.

Want the full BrainDumps collection?

I’ve compiled all 70+ LinkedIn BrainDumps into The Big Book of BrainDumps. It’s the complete playbook for founders who want repeatable, actionable growth frameworks. Check it out here.

If you're not built to last... you won't last.

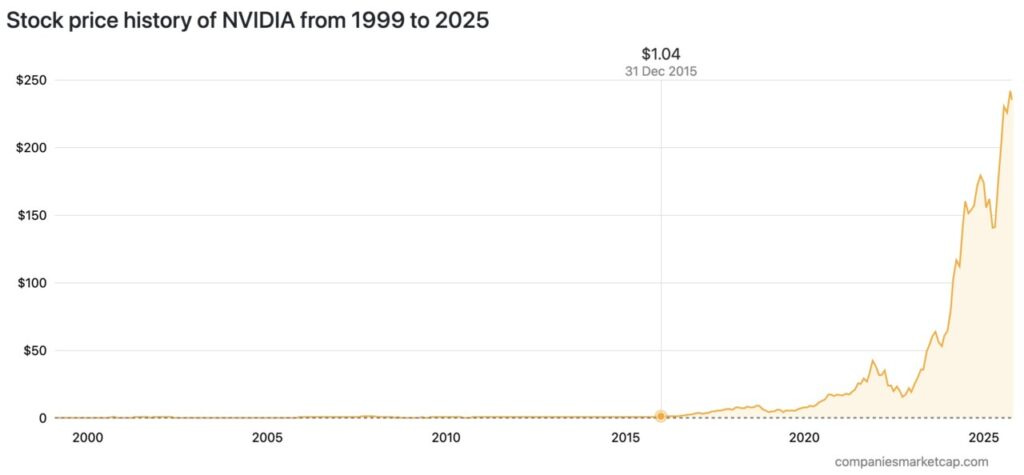

Those hockey stick growth curves are sweet! Substack did that too :-)

“Governance has a reputation problem.

It conjures images of binders, committees, and consensus-driven paralysis”

so true Chris!