Founder's AI Playbook🛡️, Jeff Bezos’ 3-Question Hiring Filter🏅, Pre‑Seed Advisor Equity Benchmarks and Red Flags🚩

If you're building, investing, or just trying to stay ahead of the curve, you're in the right place. Every week, we break down the latest insights, funding news, and founder-friendly gems. Just what matters. Plus, we track the freshest VC funds deploying capital so you know where the money’s moving.

Let’s get into it 👇

In-Depth Insights 🔍

AI Startups Require New Strategies 🤖

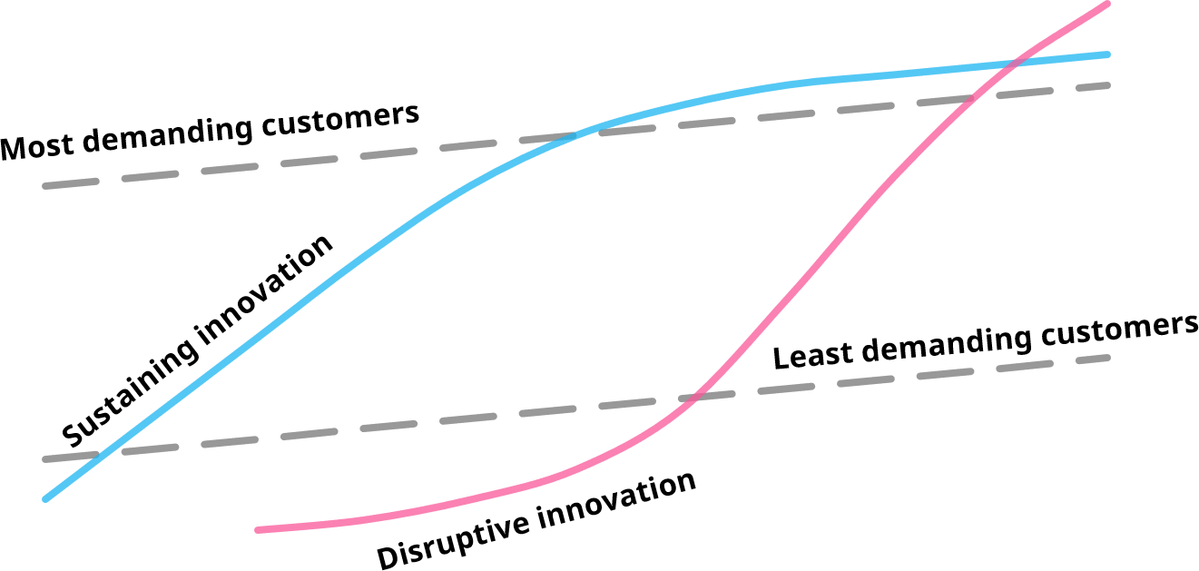

Incumbents are aggressively adopting the technology, wielding data, distribution, and talent advantages that neutralize the usual upstart playbook. Winning now demands sharper differentiation, faster go‑to‑market, and a data plan that creates durable leverage. [Jason Cohen]

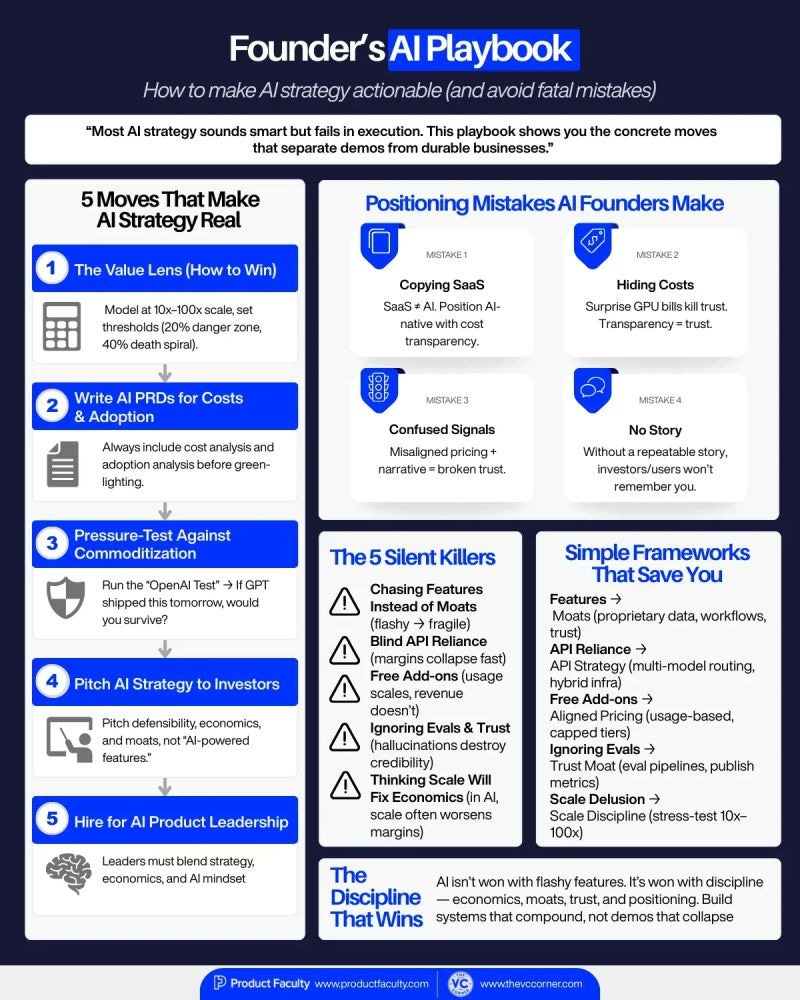

Why Most AI Startups Fail on Strategy 🛡️

Many young companies crumble when unit economics break at scale, features become commodities, and costs outrun revenue. The survivors design for defensibility and value creation from day one, pressure‑testing offerings as if a platform giant shipped the same thing tomorrow.

Don’t Reinvent the Wheel: 11 Founder Resources 📚

A curated bundle of pitch decks, investor databases, cap‑table tools, financial models, and accelerator guides speeds execution and reduces thrash. Standardized templates and distribution lists become leverage so teams can focus energy on building, not searching.Pre‑Seed Advisor Equity Benchmarks and Red Flags 🚩

Carta’s latest cut shows typical early grants ranging from 0.09% to about 1%, reframing what’s reasonable at this stage. Only contributors who unlock distribution or unlock hard technical progress justify ownership in a phase where every fraction matters.

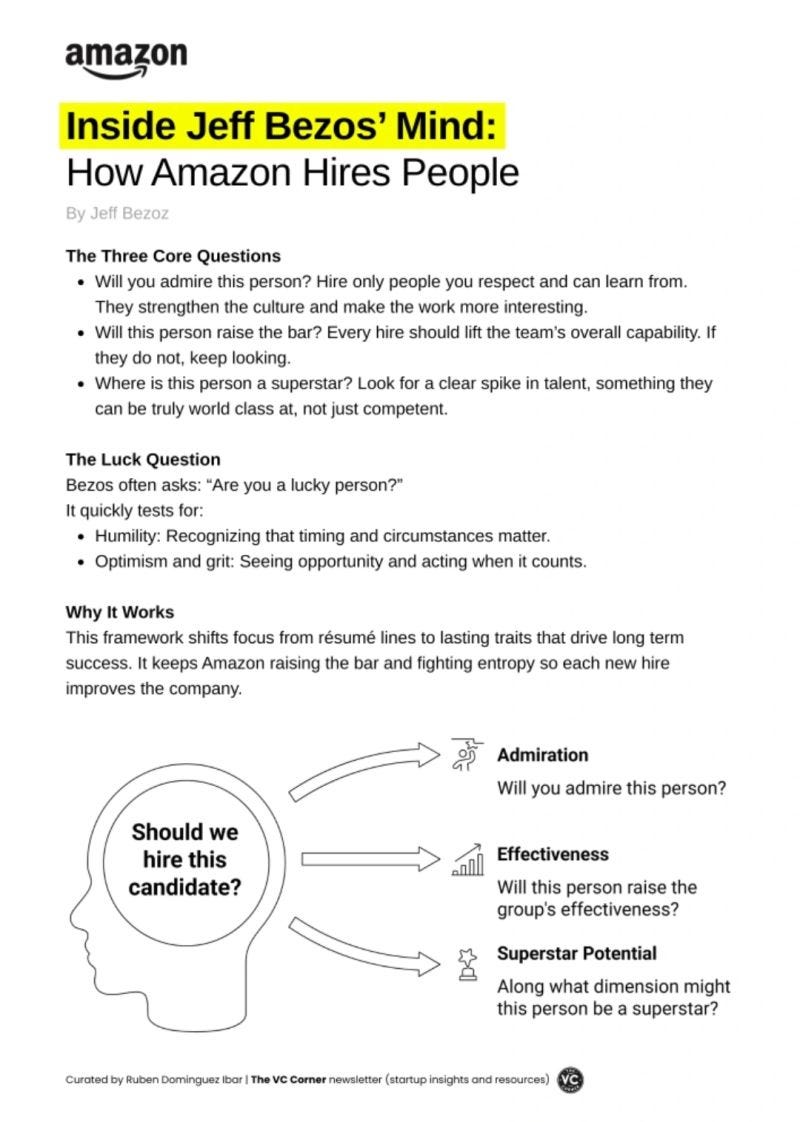

Jeff Bezos’ 3-Question Hiring Filter 🏅

The framework prioritizes people you admire, individuals who raise the bar, and candidates with a standout superpower, capped by a “luck” lens that reveals mindset. It’s a simple operating system for selecting culture multipliers who compound performance over time.Top‑Tier Seed Valuations Have Surged 🌱

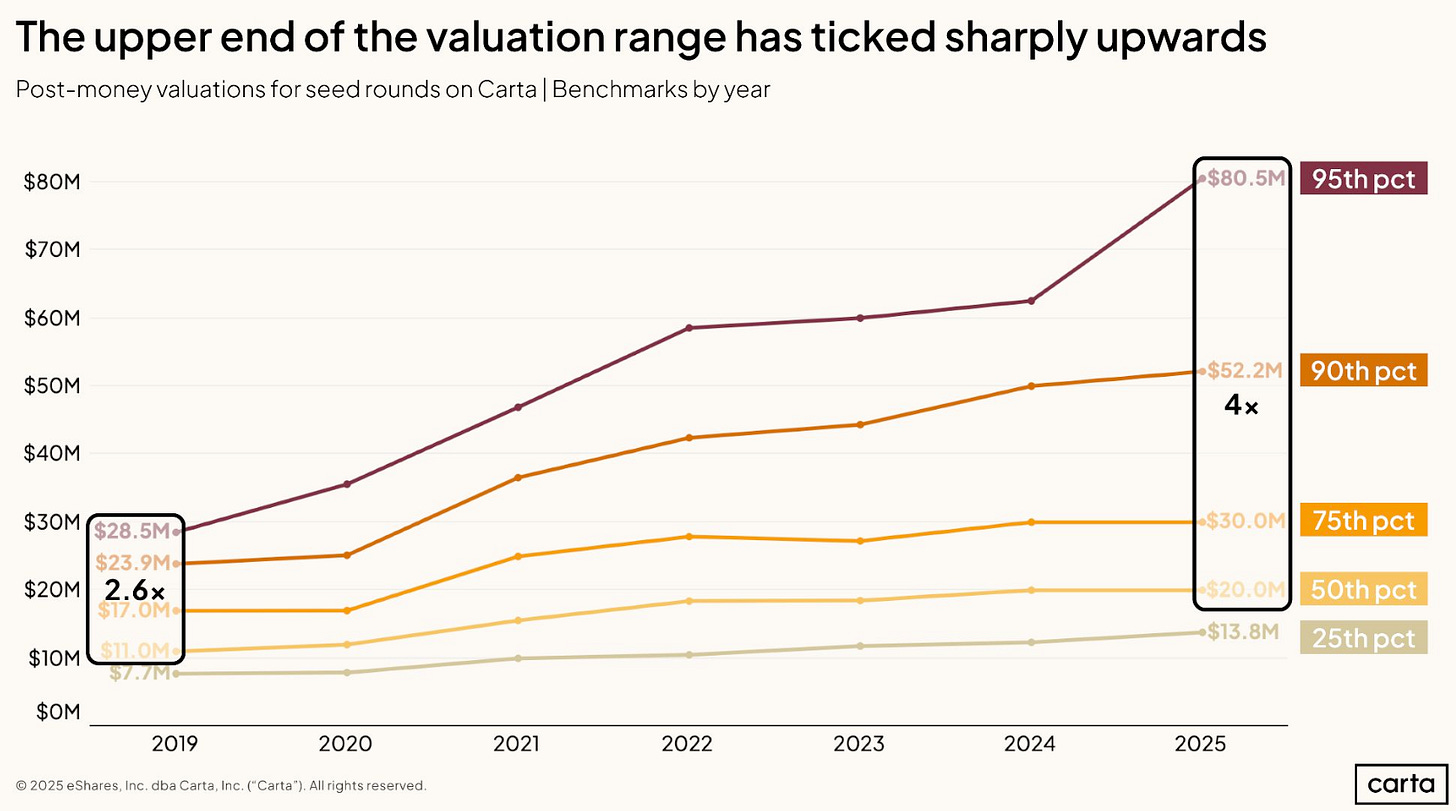

Investors are paying richer multiples for the very best new companies, signaling fierce competition for top quality. Founders may see stronger pricing but should plan fundraising with clear traction to avoid overhang and protect runway. [Luis Llorens]

10 YC Talks To Learn Startups Fast 🎥

This lineup covers ideas, talking to users, first customers, MVP planning, launching, pitching, and fundraising fundamentals from seasoned operators. It’s a concentrated path to sharpen decision‑making and shorten the learning curve for builders.

Trending News ⚡

Perplexity’s Fundraising Frenzy Spurs Bubble Jitters 💸

Investors are vying to pile in as the AI search startup fields back-to-back rounds at valuations reportedly stretching from the mid-teens to tens of billions. Rapid markups, hefty revenue multiples, and FOMO highlight how AI is reshaping venture playbooks even as some fear excess. [Business Insider]

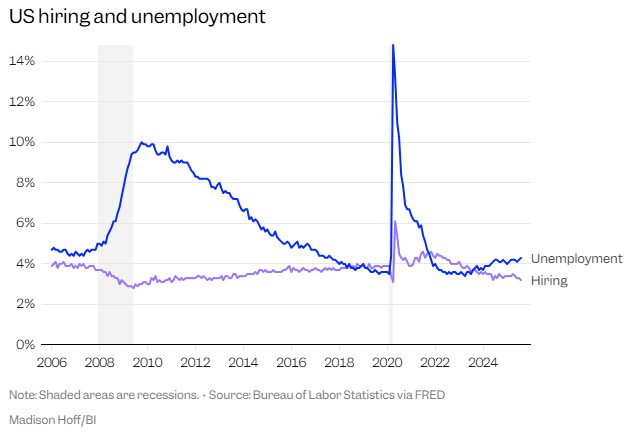

The Great Freeze Squeezes Job Seekers 📉

Hiring has cooled to levels reminiscent of the early 2010s recovery, leaving newcomers waiting longer for offers despite a relatively low unemployment rate. Analysts say companies are prioritizing productivity tech and internal stability, pushing applicants to network harder or pursue entrepreneurship. [Business Insider]Anthropic’s CEO Calls for Stronger AI Oversight 🚨

Dario Amodei says decisions about safety shouldn’t rest with a handful of tech leaders and urges more robust guardrails. He outlines escalating risks across misuse, advanced capabilities, and autonomy while advocating transparent disclosures and public-interest regulation. [Fortune]Bezos Launches £47bn ‘Project Prometheus’ AI Venture 🤖

The new company is targeting industrial‑grade intelligence to accelerate design and production across computing, automotive, and aerospace. With billions in backing and seasoned operators at the helm, it enters the race to bring “physical AI” from labs to factories at global scale. [The Telegraph]Yann LeCun Says LLM Hype Misses the Path to Intelligence 🤔

The Meta AI pioneer argues language systems are powerful yet fundamentally limited for reaching human-like reasoning. He favors approaches grounded in perception-based models, underscoring how core scientific debates still shape the field’s direction. [Business Insider]Google Leans on Its Full‑Stack Edge With Gemini 3 📱

By tying research, chips, cloud, and distribution together, the company is pushing new capabilities directly into search and popular apps. Brand familiarity remains a hurdle, but control over infrastructure and channels could accelerate adoption. [Business Insider]

Musk Rekindles Feud With Gates Over Tesla Short ⚔️

The EV chief warned his longtime critic to unwind a bearish wager that has swollen into heavy paper losses as shares rose. The flare-up arrives amid a landmark compensation approval and ongoing public jabs between the two billionaires. [Fortune]Nvidia’s Blowout Results Quell AI Bubble Talk 📈

Data center demand powered record sales and profits, with next‑gen GPUs leading a surge across training and inference workloads. A strong revenue outlook and sold‑out capacity reinforced momentum across hyperscalers, sovereigns, and enterprise buyers. [TechCrunch]+Musk Envisions a Post‑Money Future Driven by AI and Robots 🤖

He forecasts abundant automation making paid labor optional, supported by broad income policies to cushion disruption. Cultural touchstones and humanoid platforms were cited as inspiration and enablers for this accelerated transformation. [Business Insider]Jensen Huang Downplays AI Bubble in Forum Remarks ⚡️

The chipmaker’s leader emphasized structural shifts from general‑purpose CPUs to accelerated computing as foundational to today’s applications. He framed recommender systems, generative interfaces, and agentic services as layers riding on a justified compute transition. [Global News]

Fundraising?

If you’re raising a round, Luis Llorens and The Founders Corner can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

Social Media Gems 💎

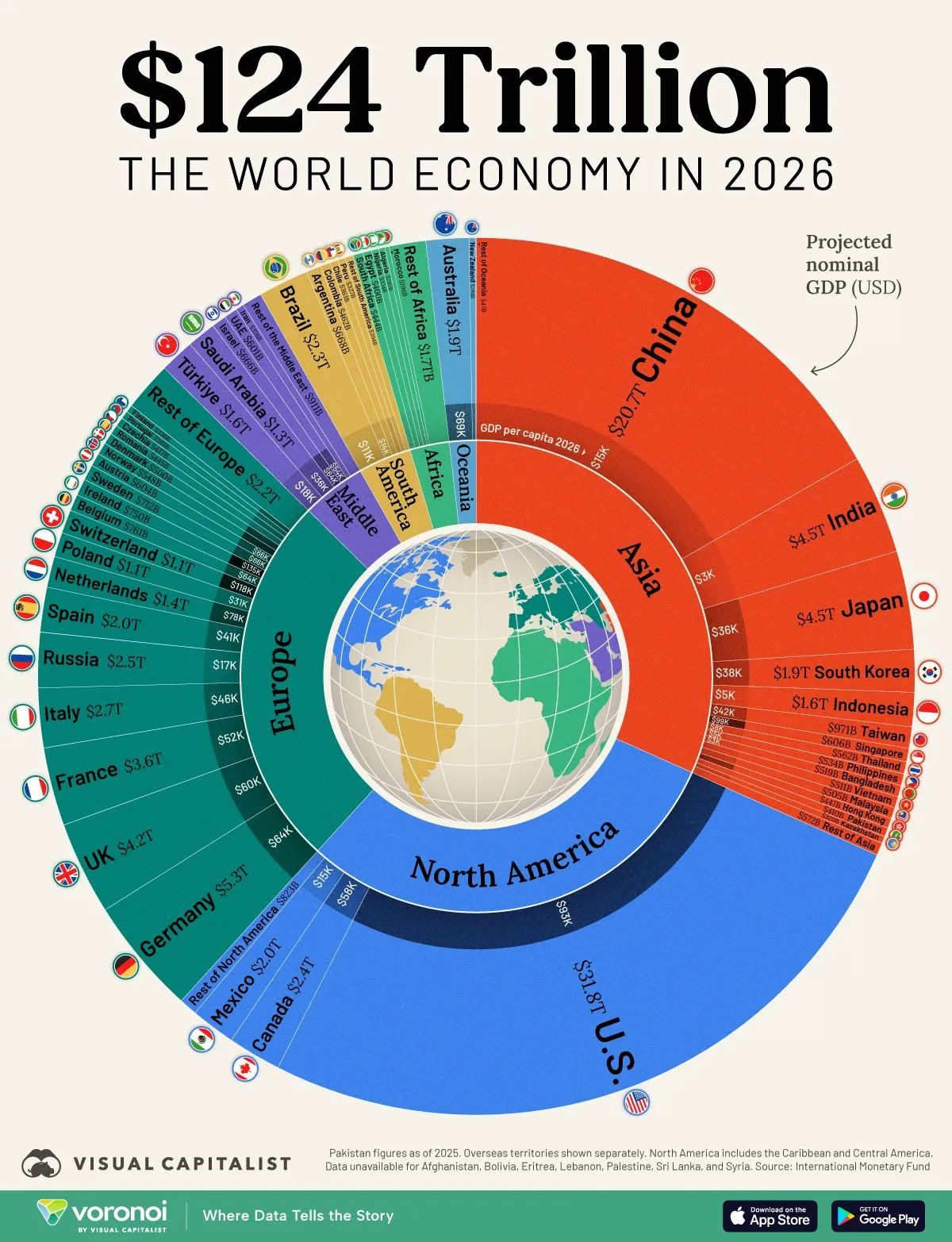

Ranked: The World’s Largest Economies in 2026 💹

Global GDP leadership is shifting as emerging markets climb and established powers jostle for position. The visualization highlights regional blocks and projected gains that could reshape trade flows and investment priorities. [Visual Capitalist]

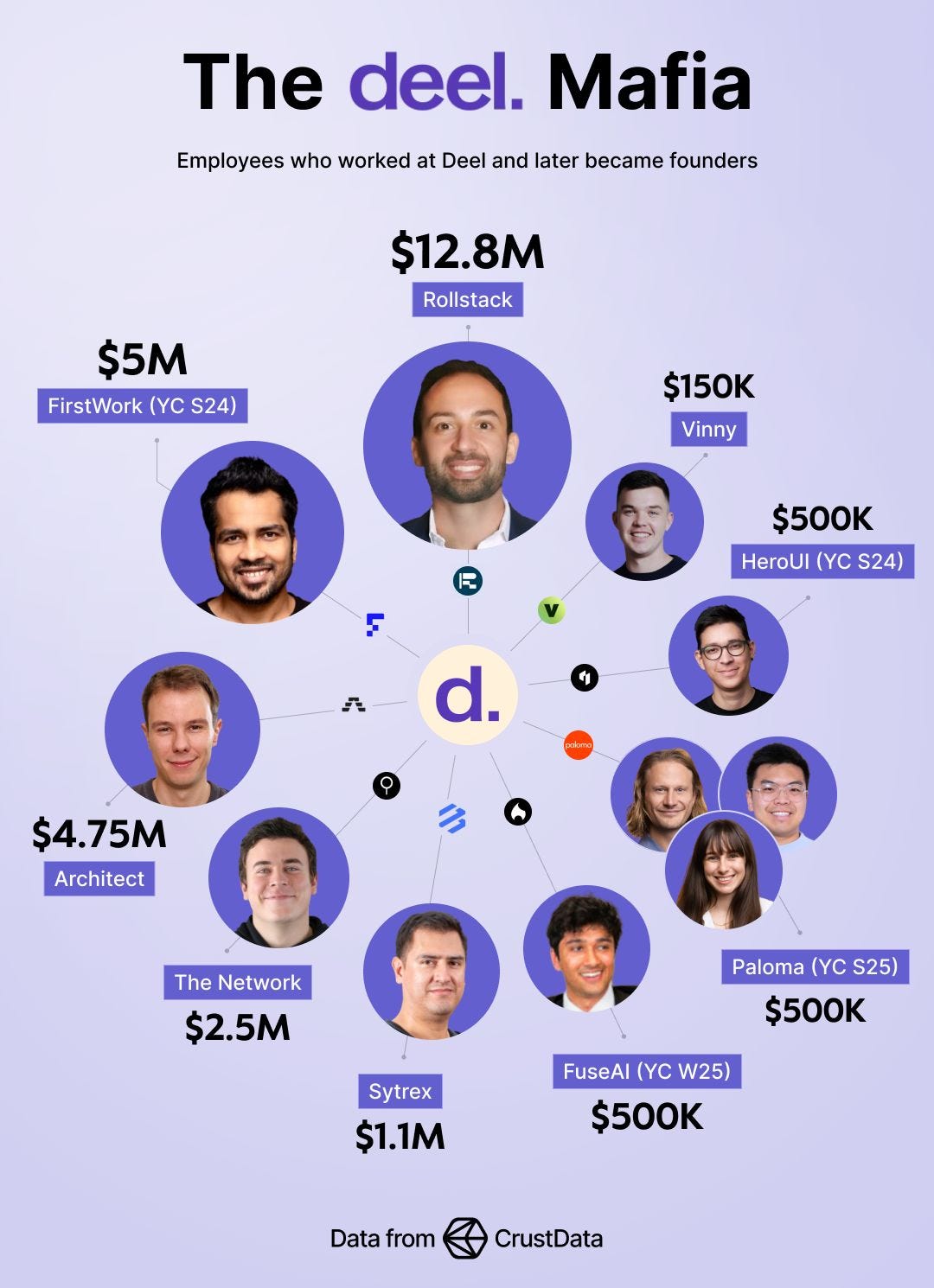

Deel Alumni Are Spinning Out Funded Startups 🚀

A growing wave of former team members is launching companies across AI, HR tech, and productivity with meaningful early backing. Cultural speed and frugality norms appear to translate into fast, capital-efficient execution. [Chris Pisarski]Bezos’ One-Way vs Two-Way Door Decisions 🚪

Most choices are reversible and should be pushed to small teams for speed, while rare, irreversible calls warrant deliberate, senior scrutiny. Matching process weight to decision type helps organizations avoid stagnation without courting chaos.

Should startups always raise as much as possible? Marc Andreessen says no 🧠

Raise to hit specific milestones and peel away risk layer by layer across rounds, from team and product to traction and unit economics. Calibrating capital to risk avoids vanity spending and unnecessary dilution while setting up the next financing on stronger footing.Sam Altman: Wealth rarely comes from high salaries 💬

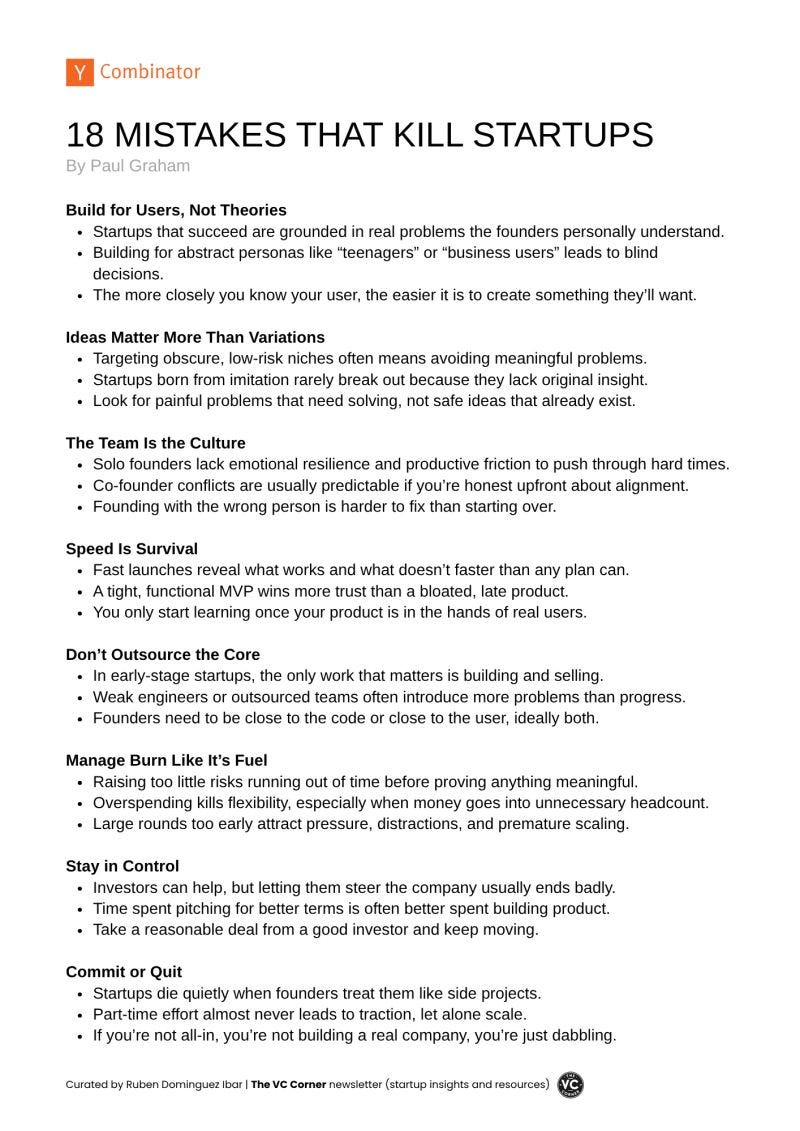

The real engine of outsized wealth is ownership and leverage, not hourly rates or pay bands. Equity in valuable companies compounds far beyond linear compensation. [Z Fellows]Paul Graham’s 18 mistakes that kill startups 🚫

Build for real users and ship quickly to learn, staying close to both product and customer while keeping burn in check. Avoid outsourcing core work early, prioritize decisive deals, and choose cofounders with alignment and resilience.

New Funds 💰

Lifeline Ventures selected Fundcraft as administrator for its €400M fund, ensuring smooth operations and compliance at scale.

Bitfury rolled out a $1B program focused on accelerating ethical adoption of frontier and emerging technologies.

BVP Forge closed its second fund at $1B, continuing its mission of long-term support for durable growth businesses.

R136 Ventures wrapped up its third fundraise (amount not disclosed) to back global founders building generational companies.

Remagine Ventures raised $25M for its second fund, focused on early-stage investments across media, entertainment, and gaming.

Keen Venture Partners held a first close of over €150M for its European Defence and Security fund, targeting frontier-tech opportunities.

The Legaltech Fund closed its second fund at $110M to continue backing innovation across legal, regulatory, and compliance tech.

Vistara Growth raised $321M for its fifth fund, fueling growth-stage investments across software, tech, and services.

NVP Capital closed its second fund at $80M, doubling down on its focus across fintech and future of commerce.

Sofinnova Partners closed Sofinnova Capital XI at €650M, continuing its leadership in life sciences venture capital.

That’s a wrap for this week.

If you want to stay ahead of the curve, make sure you're subscribed. No fluff, just real startup insights delivered straight to your inbox.

See you next time 🚀

Great resource. Great to know investors are paying a premium hot high quality

there is a lot of money flying around these days, exciting for startups, 🌱