First $5 Trillion Company🚀, $1 Trillion IPO💥, From Zero to $28.5M ARR in 3 Months📱

If you're building, investing, or just trying to stay ahead of the curve, you're in the right place. Every week, we break down the latest insights, funding news, and founder-friendly gems. Just what matters. Plus, we track the freshest VC funds deploying capital so you know where the money’s moving.

Let’s get into it 👇

Brought to you by Oceans, your U.S. caliber, offshore dream hire

You don’t need millions to have someone organize your calendar, manage your inbox, and handle the chaos.

Oceans gives you a world-class executive assistant for $3,000/month, combining real human talent with smart systems.

Top global founders and companies scale with Oceans.

In-Depth Insights 🔍

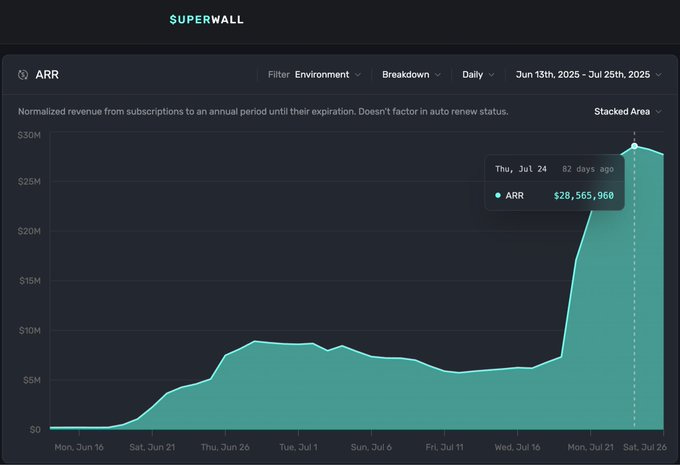

From Zero to $28.5M ARR in 3 Months 📱

Miles Nowel and Seb Turner scaled their mobile app from launch to $28.5M ARR using only organic TikTok growth. Their short-form video strategy turned viral attention into a repeatable engine for customer acquisition. [Miles Nowel]

Where VC Money Is Going in AI and How SaaS Founders Can Compete 💥

If you haven’t seen the recent numbers, you’re in for a surprise. In 2025 alone, startups building with and for intelligence have absorbed $192.7B. That’s the first time more than half of global VC dollars are flowing into a single category.

Mercury’s Playbook for Finding Real Product-Market Fit 💡

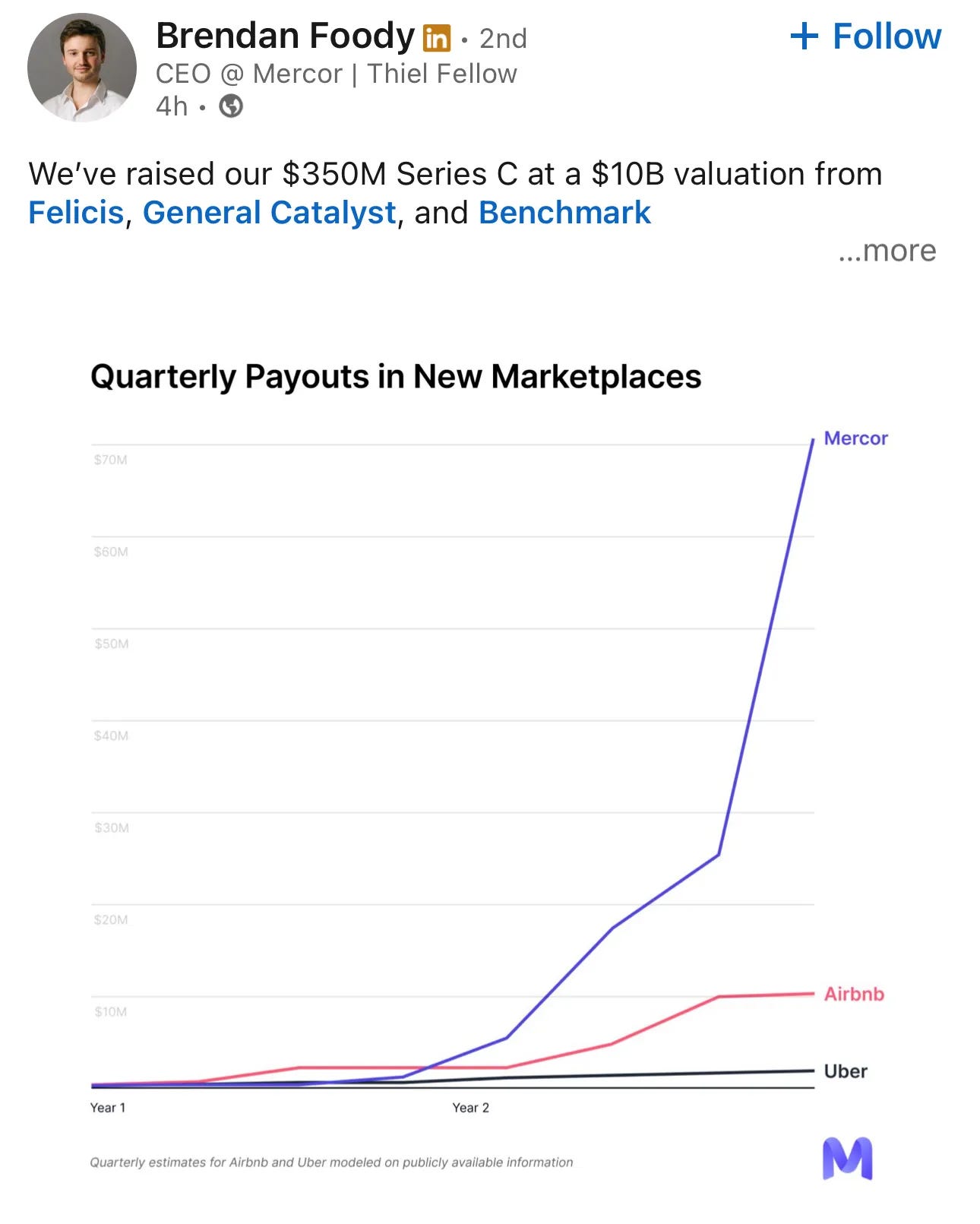

Founder Immad Akhund built Mercury by solving compliance, partnerships, and trust before chasing growth. That groundwork created a $3.5B fintech serving over 200,000 companies with real staying power. [Review]Mercor’s 10-Step Playbook to $500M in 17 Months ⚡

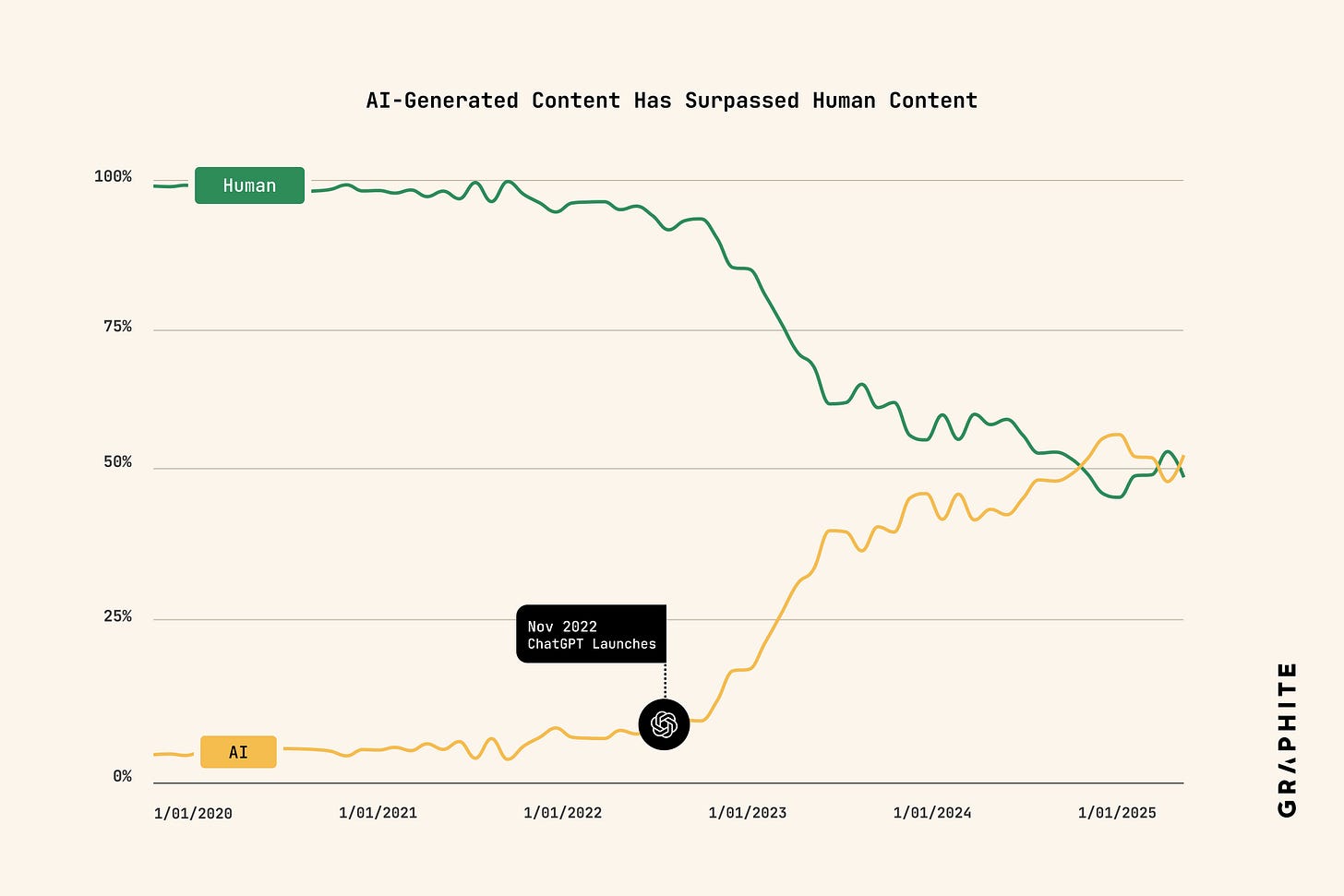

Mercor grew from $1M to $500M ARR and a $10B valuation in less than two years. The company combined perfect market timing with a new AI labor economy powered by 30,000 expert contributors. [Guillermo Flor]AI Now Outwrites Humans on the Internet 🤖

AI-generated content has surpassed human writing across the web as companies scale output with LLMs. The challenge has shifted from creation to visibility, with search and discovery now the true frontier. [FIVE PERCENT]

Trending News ⚡

Google and Anthropic Sign Cloud Deal Worth Tens of Billions 🤝

Anthropic will tap up to one million of Google’s TPUs, adding a gigawatt of compute capacity by 2026. The deal lifts Anthropic’s $7B run rate and reinforces its multi-cloud position with Google, Amazon, and Nvidia. [CNBC]Legal AI Startup Harvey Hits $8 Billion Valuation After $150M Raise ⚖️

Andreessen Horowitz led the round, valuing the legal AI firm at $8B as it powers clients like A&O Shearman and KKR. Harvey now exceeds $100M ARR, cementing its dominance in enterprise-grade legal automation.OpenAI Reportedly Prepping $1 Trillion IPO 💥

OpenAI is said to be planning a $60B+ raise for a late-2026 debut, aiming for a $1T valuation. If realized, it would surpass every IPO in history, including Saudi Aramco’s $25.6B offering. [Liquidity]Sam Altman’s New Startup Wants to Read Your Mind with Sound Waves 🧠

Altman’s Merge Labs is building a noninvasive brain-computer interface using ultrasound instead of surgery. With Caltech’s Mikhail Shapiro as cofounder, the goal is to link thought and computation safely. [The Verge]AI Assistants Get the News Wrong Nearly Half the Time ⚠️

A BBC-led study across 18 countries found 45% of AI news summaries contained factual or sourcing errors. Researchers warn the growing reliance on AI for information risks deep public misinformation. [BBC]Amazon to Cut 30,000 Corporate Jobs 💼

Amazon plans its biggest corporate layoff since 2023, eliminating up to 30,000 roles across major units. CEO Andy Jassy said automation and AI tools are making traditional corporate functions redundant. [TechCrunch]Sam Altman: OpenAI Aims for a Fully Autonomous AI Researcher by 2028 🧠

OpenAI expects intern-level research capabilities by 2026 and full autonomy two years later. The shift to a public benefit corporation gives Altman more funding flexibility for the superintelligence push. [TechCrunch]Nvidia Becomes the First $5 Trillion Company 🚀

Nvidia hit a $5T market cap after $500B in new chip orders and plans for seven U.S. supercomputers. The company’s five-year, 1,500% stock surge cements it as the core engine of the AI economy. [Business Insider]Bill Gates Says We’re in an AI Bubble 💸

Gates told CNBC that while AI is the biggest shift of his lifetime, many startups are overvalued and unsustainable. He compared the frenzy to the dot-com era, predicting short-term pain but lasting transformation. [Business Insider]OpenAI and Nvidia: Wall Street’s Ultimate Kingmakers 👑

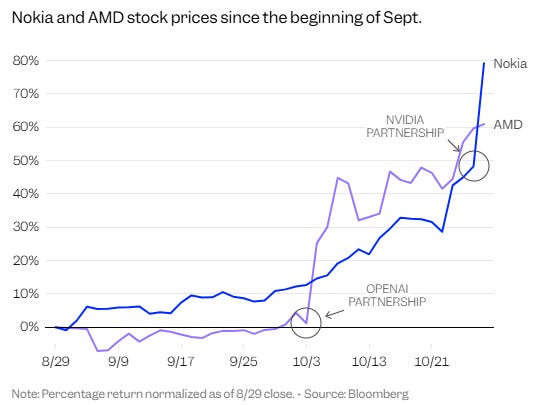

Every time OpenAI or Nvidia announce a new partnership, stocks surge across sectors from AMD to Nokia. The two have become market catalysts, shaping trillions in value and investor behavior with each move. [Business Insider]

Fundraising?

If you’re raising a round, Luis Llorens and The Founders Corner can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

Social Media Gems 💎

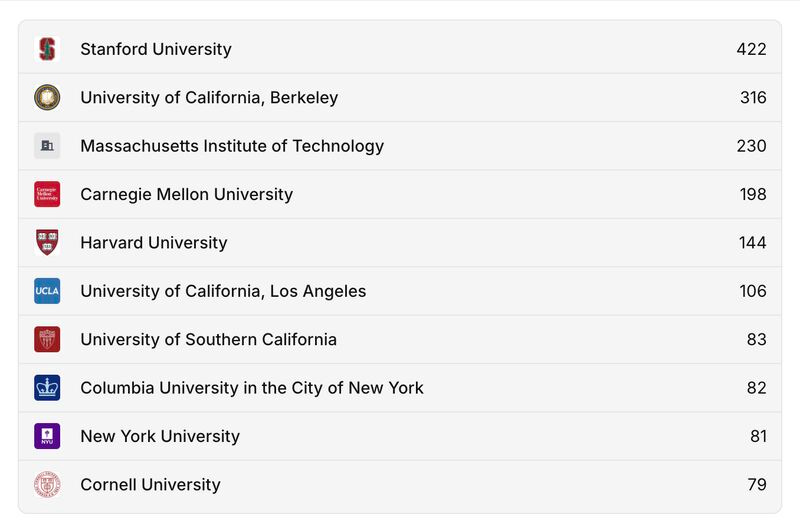

Where OpenAI’s Talent Really Comes From 🎓

A deep look into the academic roots of OpenAI’s 4,000 employees shows that Stanford, Berkeley, and MIT now anchor the global AI talent pipeline. The next wave of innovation is forming in research labs, not Big Tech offices.

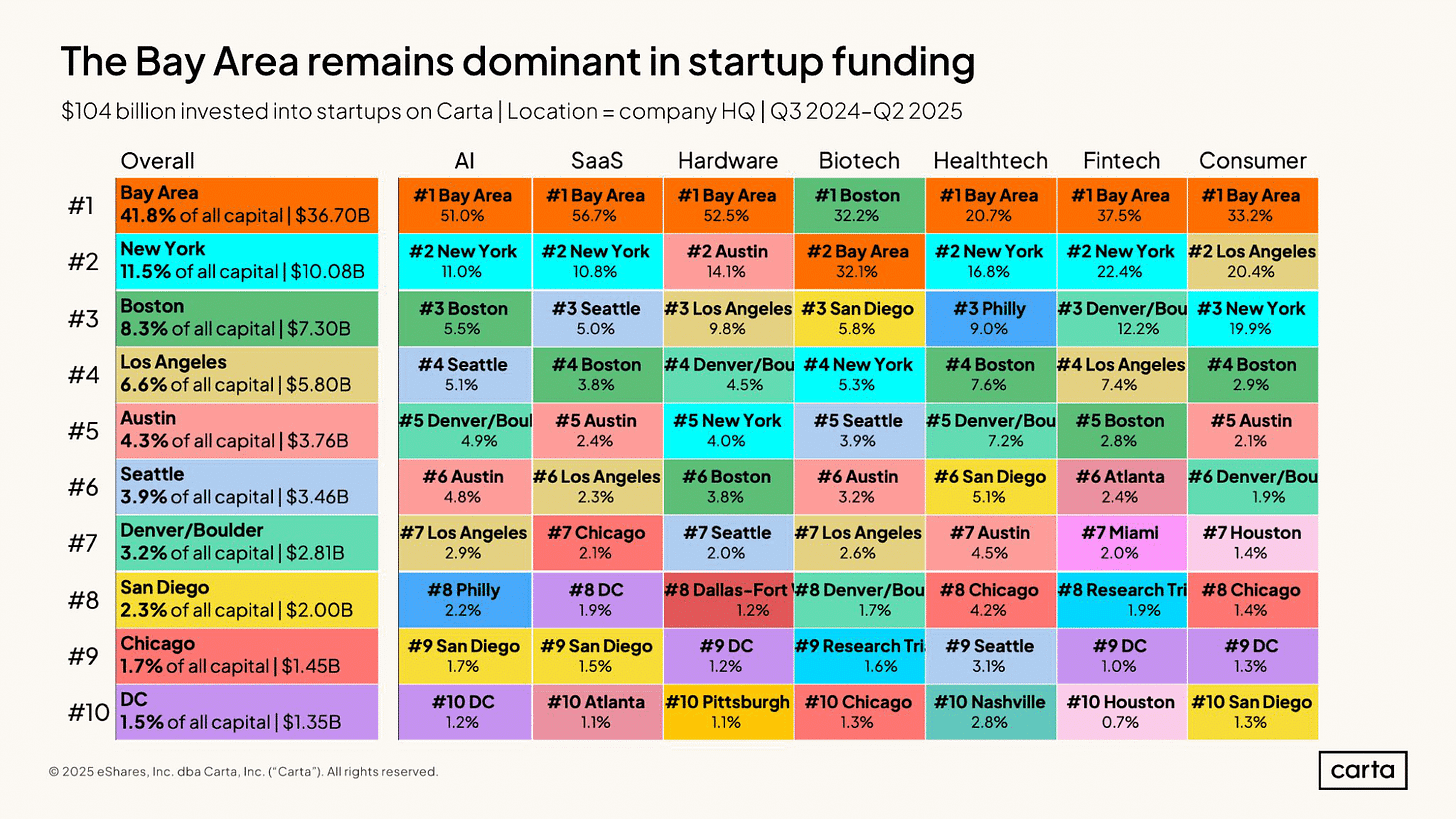

The Great Startup Concentration of 2025 💡

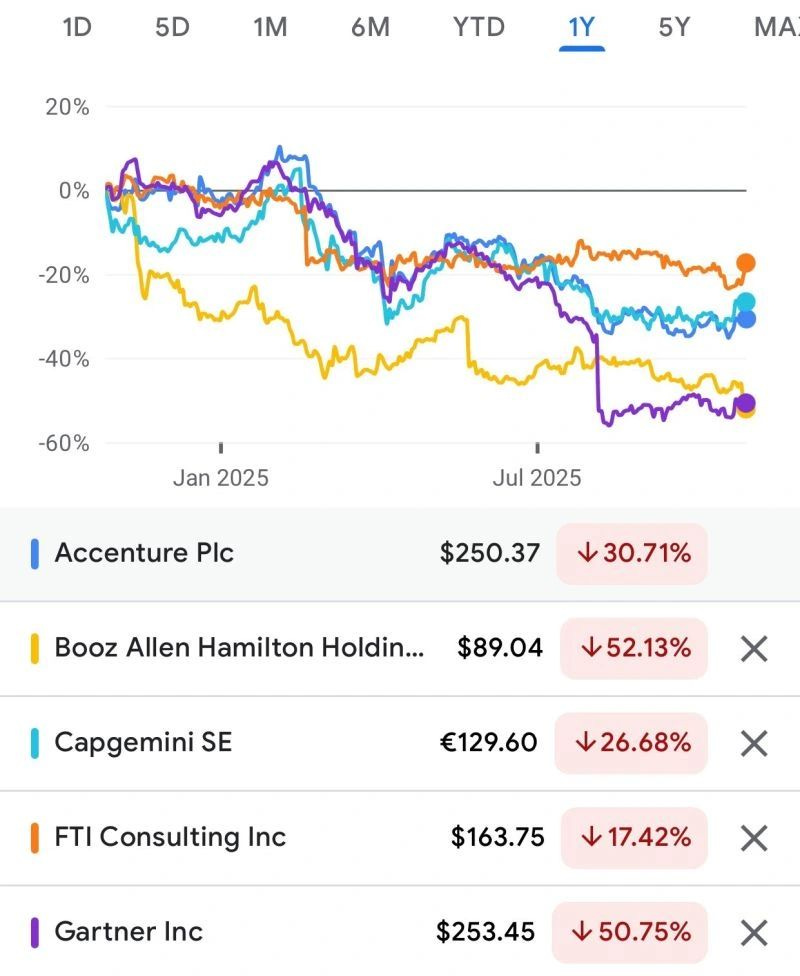

Capital, talent, and attention are clustering into fewer companies, tighter sectors, and one dominant geography. With AI soaking up funding and the Bay Area pulling ahead, venture is turning into a high-stakes game of “winner takes most.” [Peter Walker]AI Is Deleting Half of Consulting, Not Just Disrupting It 🔥

Traditional consulting models are collapsing as AI replaces entire analyst layers. The edge that remains is human: strategy, empathy, and storytelling that clients still trust when algorithms cannot decide.

New Funds 💰

The T1D Fund, launching a new raise to fast-track investments in Type 1 diabetes therapies.

Emerald Global Water Fund II, securing €60M first close to back water sustainability tech.

Insight Partners, planning a fresh investment in 3Ventures Group to deepen tech growth bets.

Sequoia, rolling out $950M in new venture and seed funds to fuel next-gen startups.

Maple Bridge Ventures, closing the first round of its debut fund at CAD $10.2M to support Canadian founders.

Encoded Ventures, debuting to invest in early-stage biotech and genomics innovators.

Novagria Ventures, launched with an initial €5.65M to back startups driving innovation in sustainable agriculture and biotech.

That’s a wrap for this week.

If you want to stay ahead of the curve, make sure you're subscribed. No fluff, just real startup insights delivered straight to your inbox.

See you next time 🚀

a fantastic roundup.

$1T valuation for OpenAI and $5T for Nvidia... we are seeing a complete reshaping of the market in real time. It’s a seminal moment.

There’s so much to unpack here 🍿