Why Efficient Founders Win Every Down Market

What the top one percent of founders know about turning spend into momentum — even in hard markets.

If you’ve spent the last year rethinking your burn, you’re not alone.

After the boom, capital got expensive and “capital efficiency” became the new mantra. Suddenly the goal wasn’t just growth, it was efficient growth: the kind where your ARR keeps climbing even as your spend flattens.

Efficiency is not about spending less. It is about knowing which dollars actually shift the trajectory and which dollars are just background noise.

The best founders I’ve spoken to didn’t just cut costs. They rewired how their companies convert capital into compound growth. They turned chaos into cadence. They learned to scale when everyone else was turning on the brakes.

Brought to you by Spinnable.AI — AI Coworkers That Actually Do the Work

Most AI tools add friction — new dashboards, new workflows, more management overhead.

Spinnable.AI flips the script.

Instead of giving you another assistant to supervise, it embeds AI coworkers directly inside the tools your team already uses — Slack, Notion, email, WhatsApp, GitHub, your CRM. They handle repetitive operational work automatically and learn your team’s habits over time, just like a real teammate.

🎯 Who Uses It

Founders running lean teams

Operators who want leverage without adding headcount

Small businesses that want enterprise capability without enterprise complexity

⚙️ What You Get

Instant integration across Slack, Notion, email, CRM, GitHub

Multiple specialised coworkers — not just one generic assistant

No training, no prompting, no retraining

Setup in under five minutes

🚀 What They Do

Research leads, draft proposals and reply to clients automatically

Manage tasks, documentation and comms with zero micromanagement

Handle customer support 24/7 across multiple channels

Spinnable.AI gives lean teams leverage — scaling output without burning people out.

The founders at Spinnable.AI have given The Founder’s Corner readers an exclusive offer — 50% off your first month once you’ve moved up the waitlist.

Just DM confirmation of your account to Spinnable.AI on LinkedIn here to claim it.

📖 Table of Contents

⚡ Why the Old Playbook Broke

🧠 The Efficient Growth Equation

🔁 From Burn to Rhythm

💡 Founder OS: The Efficiency Cadence

🎛️ The Levers of Efficiency

📊 Measuring What Matters

🧠 Founder Wisdom: A Braindump on Efficiency

🧩 The Investor View

🔍 Case Examples from the Field

🚀 Closing Thought: Discipline as a Superpower

⚡ Why the Old Playbook Broke

When capital was cheap, efficiency didn’t matter. The only KPI was momentum.

When the market flipped, founders suddenly discovered that the old playbook, grow first and optimise later, stopped working.

So the real question became: How do you keep growing when your board tells you to halve your burn?

The answer isn’t magic, it’s maths.

🧠 The Efficient Growth Equation

Every efficient company I’ve invested in runs on the same three numbers:

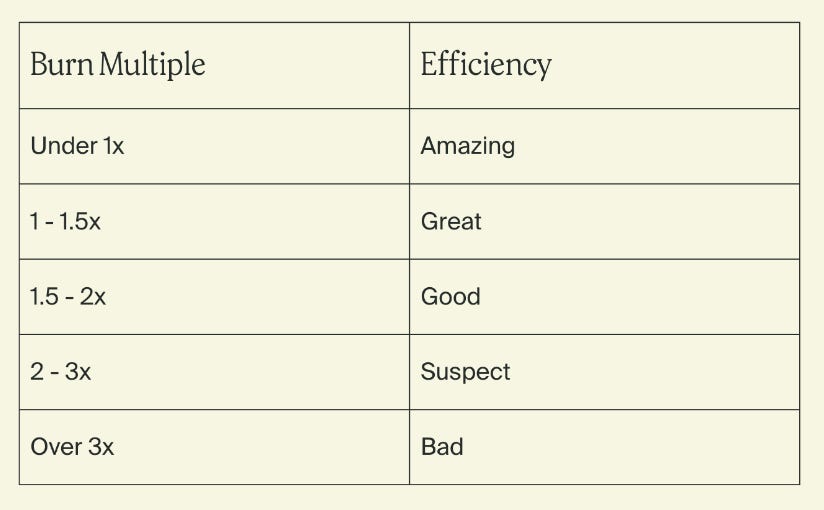

Burn Multiple — how many dollars you burn for every dollar of new ARR.

Rule of 40 — the balance between growth and profitability.

CAC Payback — how long it takes to earn back your acquisition cost.

But the founders who really nailed this didn’t treat these as investor metrics.

They treated them as operating tools.

Once you measure efficiency weekly, it changes how you behave daily.

“We stopped talking about runway and started talking about velocity per dollar. That’s when the business got fun again.”

When you make efficiency visible, it becomes addictive.

Week by week, the team finds new ways to do more with the same.

And then you realise: efficiency isn’t about spending less, it’s about spending better.

🔁 From Burn to Rhythm

The shift starts with a mindset change.

In early days, growth feels like a sprint. You chase every channel, every idea, every shiny object. But efficient growth is more like interval training: controlled bursts, measured recovery, deliberate pace.

One B2B SaaS founder I spoke with went from burning £180K per month to £95K per month while doubling ARR in the same period. They didn’t find a magic growth hack, they simply re-sequenced. They went deeper into the one channel where CAC payback was under nine months and paused the rest.

They focused the whole company around three questions:

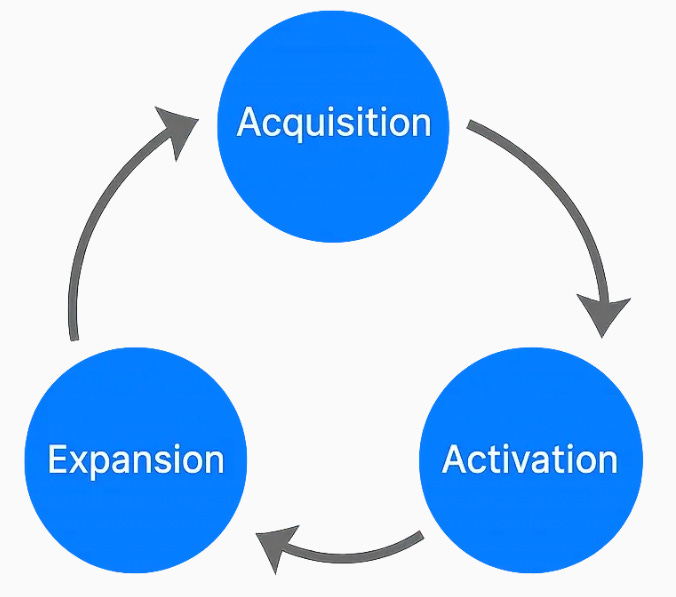

Are we acquiring efficiently?

Are we activating fast?

Are we expanding by default?

That rhythm — acquire, activate, expand — became their operating loop.

By month four, their Burn Multiple fell below 1.2.

By month six, they were cash flow positive without cutting headcount.

That’s not luck. That’s system design.

💡 Founder OS: The Efficiency Cadence

Here’s the operating rhythm that underpins every efficient business I’ve seen:

Weekly: Pulse

Short Monday sync, same dashboard every time: Burn Multiple, Rule of 40, CAC Payback, Activation Rate.

Don’t just report numbers; ask: what behaviour moved these this week?

Monthly: Adjust

Pick one lever — pricing, activation, channel mix, or expansion — and run a 30 day experiment. Document what changed, what broke, what compounded.

Quarterly: Reallocate

Revisit headcount, marketing spend, roadmap priorities. Every quarter, something that felt essential 90 days ago becomes optional.

Prune ruthlessly. Protect velocity.

The best teams make this cadence visible. They talk about efficiency the way they used to talk about growth.

Because it’s not just about surviving this market. It’s about compounding through it.

🎛️ The Levers of Efficiency

Once founders establish rhythm, they start noticing which levers truly move the dial.

Three stand out again and again:

Pricing. Most companies underprice by 15 to 20 percent. A simple price floor review every quarter can do more for your Burn Multiple than any cost cut.

Activation. The fastest ROI comes from time to value. The shorter it gets, the faster revenue compounds.

Expansion. Add-ons, usage tiers, and annual prepay programs don’t just lift ARR, they tighten CAC Payback almost overnight.

Efficient growth isn’t found in finance spreadsheets. It’s built inside the product, pricing, and customer success layers that make revenue compound without spending a pound more.

📊 Measuring What Matters

When the noise clears, here’s what efficient founders really track:

Burn Multiple

How many dollars you burn to generate one new dollar of ARR.

Below 1.5 is great. Below 1.0 is elite.

Rule of 40

Growth rate plus profit margin.

If you’re growing 50 percent year on year but burning minus 10 percent margin you still hit 40.

It’s not about perfection, it’s about maintaining balance.

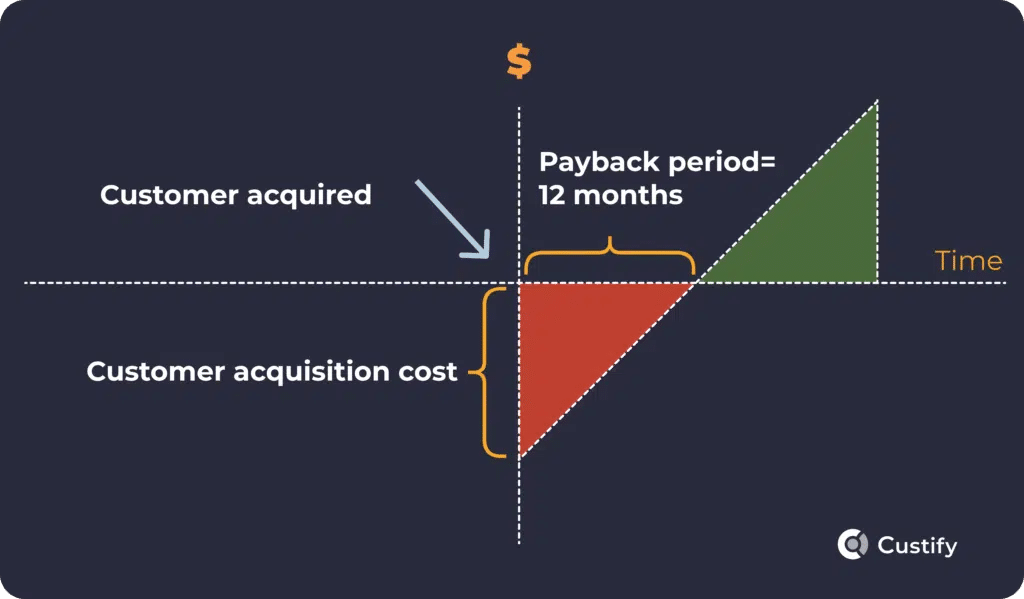

CAC Payback

The truest test of your growth engine.

A 6 to 12 month payback says your model’s tight. A 24 month payback? Time to re-price, not just re-market.

When founders build around these numbers they stop making decisions emotionally. They start running the company like investors, not just founders.

🧠 Founder Wisdom: A Braindump on Efficiency

I wrote about this in one of my LinkedIn Braindumps — The TAM–SOM Paradox — how too many founders chase massive markets before they’ve mastered the mechanics of their own.

The same pattern shows up in efficiency.

Most founders fixate on how big their opportunity is, not how effectively they’re capturing it. They spend to scale before they’ve learned how to sustain.

But efficiency starts small. It’s earned through clarity — understanding how each pound of spend converts into activation, retention, or expansion.

You don’t achieve efficiency by cutting burn. You achieve it by sequencing correctly: learn the market, tighten the funnel, then scale what compounds.

The best founders build efficiency the same way they build trust — gradually, deliberately, through consistent rhythm.

Because capital efficiency isn’t about doing less. It’s about doing what works, repeatedly, until it compounds.

🧩 The Investor View

Investors today are watching a different set of signals. The fastest way to stand out isn’t to show wild top line growth; it’s to prove control.

When your Burn Multiple trends down while ARR trends up, every investor takes notice.

When your CAC Payback compresses month over month, they don’t see a smaller company, they see a founder who knows how to compound value.

Efficient founders are the ones investors trust in hard markets because they don’t rely on perfect conditions to grow. They build engines that work in any climate.

And when capital flows back, these are the teams that raise first, because efficiency never goes out of style.

🔍 Case Examples from the Field

Example 1: The SaaS company that re-priced mid cycle

A mid market SaaS business had a CAC Payback of 18 months and a Burn Multiple of 2.8. They realised that while new logos looked good, expansion was weak and sales cycles long. They increased minimum deal size by 25 percent, cut the longest sales cycle verticals, and reallocated 40 percent of funnel budget into onboarding and success. Within nine months payback dropped to 11 months and Burn Multiple to 1.4, while ARR grew 48 percent year on year.

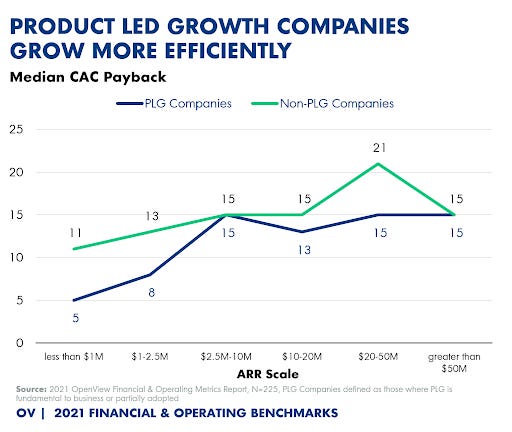

Example 2: The PLG business that activated faster

A self serve product was acquiring many users but activation to first value took 14 days and only 27 percent of sign ups converted. They introduced in app guidance, improved onboarding flows and set an internal goal: time to first value under seven days. Activation rose to 46 percent, conversion improved by 30 percent, CAC Payback compressed from 12 to 7 months, and that injected momentum across the expansion pipeline too.

🚀 Closing Thought: Discipline as a Superpower

When everyone else is cutting burn, the instinct is to slow down.

But efficient founders do the opposite: they double down on clarity.

They know capital efficiency isn’t about austerity. It’s about control, sequencing, and momentum. It’s about mastering the conversion rate between dollars spent and trust earned — from customers, teams, and investors alike.

Because efficient growth isn’t just how you survive a down market.

It’s how you build a company that lasts in any market.

So next time you’re staring at your burn chart, ask yourself one question:

“Am I cutting burn, or am I compounding efficiency?”

The best founders know the difference.

And they scale while everyone else is shrinking.

Want the full BrainDumps collection?

I’ve compiled all 70+ LinkedIn BrainDumps into The Big Book of BrainDumps. It’s the complete playbook for founders who want repeatable, actionable growth frameworks. Check it out here.

Such a timely and important article with great tips from the driver's seat, Chris. B2C companies backed by VCs wanted to grow at all costs pre-pandemic, and honestly in India it's still pretty much the same playbook. But B2B companies got to be efficient—probably even more so in the current market. Thanks for putting this together!

Lovable is unreliable, doesn’t remember edits and certainly doesn’t live up to the hype. It is a waste of money. I tried it out, another AI rip off.