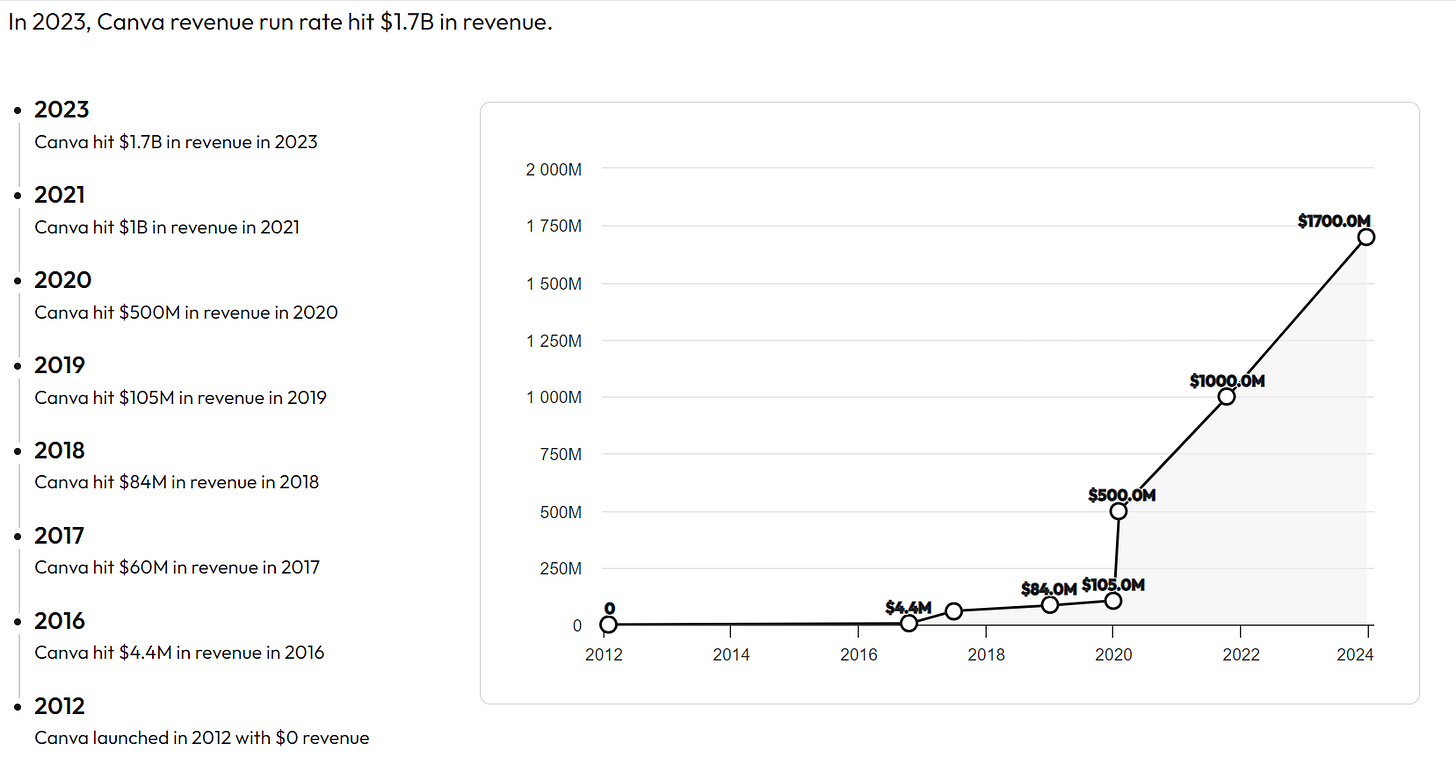

Black Friday Special: Why Most Startups Misread PMF — And the Framework That Finally Gets It Right

A founder’s guide to diagnosing real product-market fit using retention curves, qualitative pull, and the signals that actually matter.

If you’ve ever found yourself wondering whether you should pour fuel on acquisition or pull back and rebuild the foundation, you’re asking a question every founder eventually hits. It’s the moment where instinct and data wrestle — where part of you wants momentum, and another part fears you’re scaling a product that isn’t ready for the weight.

Because product market fit isn’t a switch that flips. It’s a pattern you earn over time. And when founders misread those early patterns, they don’t just stall — they compound the wrong things.

PMF isn’t a feeling. It’s a rhythm.

One that emerges slowly, then suddenly.

Brought to you by Cloudways

The hosting platform trusted by the teams who actually care about speed.

I use Cloudways because it gives me fast, secure, hands-off hosting without wrestling with servers or DevOps. It just works — and it stays fast when traffic hits.

• Premium cloud providers (AWS, GCP, DigitalOcean)

• Automatic backups, security, and caching

• One-click staging and easy scaling

• No lock-in, no nonsense

It’s clean, quick, and built for how founders ship today.

Cloudways have given The Founder’s Corner readers access to a super exclusive Black Friday deal - click here for 50% off for 3 months.

Table of Contents

• 💥 The PMF Problem

• 🧭 What PMF Actually Looks Like

• ⚖️ Why PMF Is Not Binary

• 📡 The Three Types of Signals

• 📊 Quantitative Signals That Matter

• 💬 Qualitative Signals You Can’t Fake

• 📈 Retention Curves: Your CT Scan

• 🔢 Benchmarks the Best Teams Use

• 🕳️ The False Positive Traps

• 🧠 Founder Wisdom: A Braindump on PMF

• 🪜 The PMF Ladder

• 🧰 What to Do When You Don’t Have PMF

• 🔬 What to Do When You’re Close

• 🎯 What to Do When You’ve Just Hit It

• 💡 Founder OS: The PMF Diagnostic

• 🚀 Closing Thought

💥 The PMF Problem

Most founders imagine PMF as a single achievement — a finish line you cross once. But PMF behaves more like weather than a milestone. It changes with segments, timing, and how your product is actually used in the real world. You see sparks of promise, enthusiastic feedback, early revenue, and you want it to mean something definitive.

But it rarely does.

What founders are really searching for is the moment where product, customer, and market lock into each other. That alignment doesn’t happen suddenly — it builds through retained behavior, repeated value, and usage that stops feeling fragile.

The danger is mistaking early motion for long term slope.

Speed is seductive, but trajectory decides everything.

🧭 What PMF Actually Looks Like

When PMF arrives, it doesn’t announce itself. It emerges through patterns that feel increasingly hard to ignore. Users return because they want to, not because you chase them. Expansion starts appearing without being engineered. Support requests change tone — they become “How do I do more with this?” instead of “Why does this not work?”

You also notice internal markers. The team stops debating the roadmap endlessly. Your meetings shift from brainstorming to alignment. And the product conversation moves from “What should we build?” to “How do we keep up with demand?”

PMF isn’t loud. PMF is obvious.

When you have it, the feeling isn’t excitement — it’s lift.

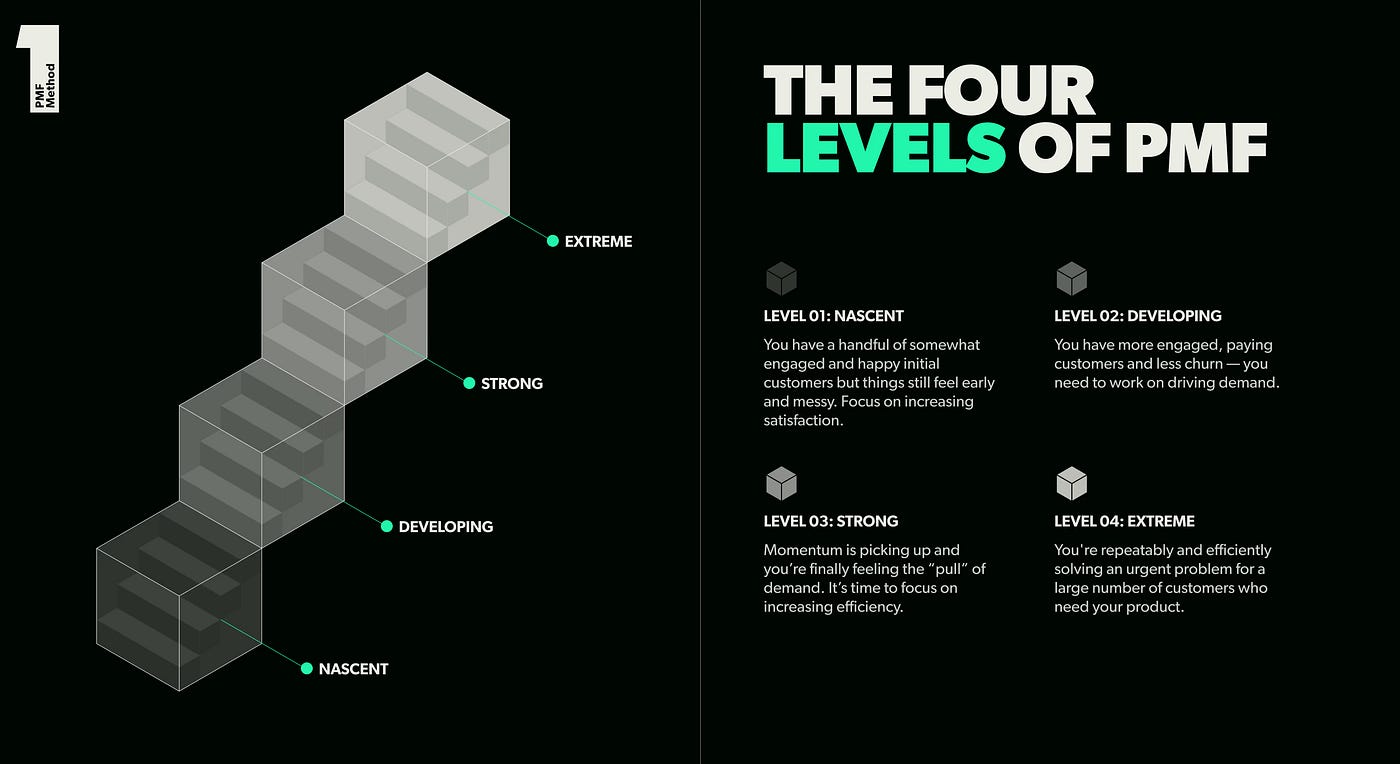

⚖️ Why PMF Is Not Binary

We talk about PMF like it’s binary because we want certainty. But PMF behaves like a gradient. You pass through recognisable phases: a few users who love you, then a niche that sticks, then a broader ICP that doesn’t churn, then eventually a segment that compounds.

These phases each require different decisions. Early on, you need to narrow. In the middle, you need to deepen. Later, you need to scale deliberately. Treat all stages the same, and you end up overbuilding for the wrong user or underinvesting in the right one.

The most dangerous moment is the “almost PMF” stage — where enthusiasm is high but the curve still sinks.

That’s where founders overcommit.

You don’t earn the right to scale by believing you have PMF. You earn it by proving users stay.

📡 The Three Types of Signals

PMF shows up across three dimensions, and the strength of PMF depends on how many of them align.

Behavioral signals are the most reliable: recurring usage, stable retention, and users reaching value quickly without help. These signals compound because behavior doesn’t lie.

Emotional signals offer nuance: urgency in feedback, dependence in tone, and complaints that reveal commitment. These signals matter because they expose the “why” behind the usage.

Market signals show you whether distribution friction is lowering. When people start hearing about you rather than hearing from you, that’s pull — and pull is what separates PMF from good marketing.

When all three show up, the slope of your business shifts noticeably.

📊 Quantitative Signals That Matter

You don’t need dozens of metrics to assess PMF. You need the right ones.

Activation is the earliest truth — if users don’t reach value, nothing else matters.

Engagement in Week 1 shows whether that value is felt.

Retention curves tell you whether the value lasts.

Expansion tells you whether the value grows.

Organic acquisition tells you whether the value spreads.

Most dashboards are built to impress investors.

PMF signals are built to confront reality.

💬 Qualitative Signals You Can’t Fake

When PMF nears, the qualitative tone changes. Users shift from liking the product to depending on it. They reference workflows, not features. They talk about outcomes, not UI. They ask for improvements because they’ve adopted the product into their day, not because they’re curious.

You’ll also hear them advocate for you. They’ll fight internally to keep your tool. They’ll explain your value to their colleagues better than your own website does.

Sounds dramatic, but it’s not. It’s just what necessity looks like.

Qualitative pull always appears before quantitative certainty.

📈 Retention Curves: Your CT Scan

Retention curves tell the truth every founder eventually needs to hear. A strong curve drops early, flattens quickly, and holds. A weak curve nosedives and whispers a warning founders don’t want to admit: users don’t need you enough.

A curve that flattens shows a habit loop, a durable use case, and a real problem solved. A curve that keeps sinking shows novelty, not necessity.

Retention curves cut through narrative, ego, and storytelling. They’re the CT scan of your product.

They don’t predict your future.

They reveal your present.

You can fake growth for months. You can’t fake retention for a week.

🔢 Benchmarks the Best Teams Use

Benchmarks aren’t answers — they’re boundaries that keep you honest. Strong companies use them to sanity-check their assumptions.

Consumer social: Day 30 retention above 25%

Productivity SaaS: Month 6 above 40%

SMB SaaS: Logo retention above 80%

Enterprise SaaS: NRR above 115%

If you’re far below these numbers but scaling aggressively, you’re running a stress test your product can’t pass.

Benchmarks don’t tell you what to build.

They tell you when to pause.

🧠 Founder Wisdom: A Braindump on PMF

I wrote about this in my Braindump ‘Do Things That Don’t Scale’ — a warning that early traction often hides fragile foundations. Founders see enthusiasm, urgency, or a handful of active users and assume PMF has arrived. But enthusiasm is not retention, and urgency is not loyalty.

In that piece, I talked about the psychological trap founders fall into: trying to scale out of uncertainty rather than sitting in it. You build features to avoid asking hard questions. You automate processes before the underlying value is stable. You hire ahead of conviction.

But PMF is never built by widening prematurely. It’s built by deepening ruthlessly.

Here’s the line I always return to:

You don’t have PMF until the product does the pulling — not you.

If the user moves without you pushing, that’s PMF.

If you must carry them, it isn’t.

🕳️ The False Positive Traps

Several patterns mislead founders into thinking PMF is closer than it is. Paid acquisition can mask a leaky bucket. A passionate niche can create the illusion of broad demand. Enterprise pilots can look like traction despite zero expansion. Press creates spikes that vanish without a trace. Discounts can impersonate willingness to pay.

The common thread:

They all generate motion, not momentum.

You don’t scale motion.

You scale momentum.

🪜 The PMF Ladder

PMF unfolds across rungs. You don’t jump from the first to the last — you earn your way up, one layer of evidence at a time.

First, a group of users adopts your product repeatedly.

Then they naturally bring others in.

Then their behaviour becomes predictable enough to measure and model.

Then acquisition becomes profitable rather than accidental.

Then retention stabilises without heroic intervention.

Then expansion emerges without persuasion.

Each rung confirms something deeper than the last.

Skipping a rung doesn’t save time — it just removes the structure beneath your feet.

Every rung is a proof point.

Skipping a rung only sets you up to fall from the next one.

🧰 What to Do When You Don’t Have PMF

When PMF is absent, contraction is your leverage. Narrow your ICP. Tighten the moment of first value. Remove friction aggressively. Speak to users weekly — not out of desperation, but out of curiosity.

Your goal isn’t wide appeal.

Your goal is one segment that would genuinely miss you if you disappeared.

Pre-PMF isn’t about acceleration.

It’s about truth-seeking.

🔬 What to Do When You’re Close

When the signals begin to align, don’t widen the funnel prematurely. Instead, reinforce what users already love. Improve onboarding clarity. Eliminate side quests in the product. Tune workflows until value becomes a reflex.

This is the moment where founders get impatient.

But “almost PMF” is the most delicate stage — and the one where discipline compounds fastest.

🎯 What to Do When You’ve Just Hit It

When PMF lands, everything starts moving faster — users, revenue, expectations, and infrastructure needs. Your job is to manage the newfound lift without losing rhythm. That means opening new acquisition channels carefully, hiring ahead of needs without inflating the organisation, and putting guardrails around the core value your PMF depends on.

PMF doesn’t make your job easier.

It changes the nature of your job.

💡 Founder OS: The PMF Diagnostic

Before every planning cycle, ask yourself four questions.

Where are we losing leverage — top or bottom?

If users churn, fix retention. If demand is soft, fix distribution.

Which segment actually retains?

One sticky segment is stronger than five noisy ones.

Are our curves flattening for the real ICP or the convenient one?

Good retention in the wrong segment is a disguised distraction.

Is expansion emerging organically?

Voluntary expansion is the clearest sign of value.

These four questions eliminate wishful thinking.

They force clarity.

And clarity makes PMF measurable.

🚀 Closing Thought: PMF Is a Founder’s Tuning Fork

The best founders don’t force PMF into existence. They tune into it. They notice the curves that flatten. They hear the frustration that reveals dependence. They feel the shift when push turns into pull.

PMF isn’t about ambition.

It’s about accuracy.

So ask yourself the only question that matters:

Are users staying because they want to — or because we’re forcing them to?

When the answer becomes obvious, your next move becomes inevitable.

Want the full BrainDumps collection?

I’ve compiled all 70+ LinkedIn BrainDumps into The Big Book of BrainDumps. It’s the complete playbook for founders who want repeatable, actionable growth frameworks. Check it out here.

I love this definition

Selling the same thing

Same product/service, pricing, packaging

To the same buyer

Same titles, industries, company sizes

In the same way

Same messaging and acquisition channels

With the same results

Same customer outcomes, satisfaction, and retention

this is awesome. great write up