Ben Horowitz's $46B of Hard Truths🔥, AI Will Not Make You Rich🤖, The Great IPO Awakening📈

If you're building, investing, or just trying to stay ahead of the curve, you're in the right place. Every week, we break down the latest insights, funding news, and founder-friendly gems. Just what matters. Plus, we track the freshest VC funds deploying capital so you know where the money’s moving.

Let’s get into it 👇

In-Depth Insights 🔍

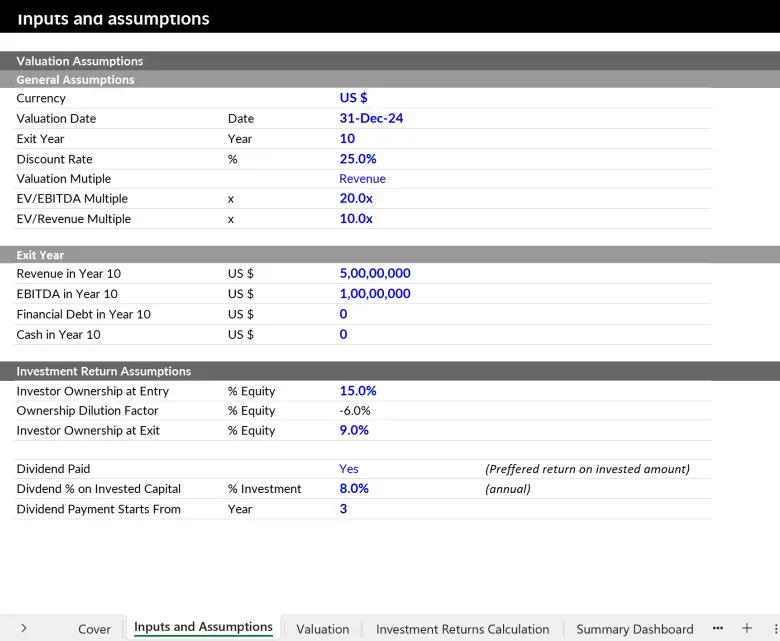

The Venture Capital Method: Valuation Without Guesswork 📊

VCs back into valuations from exit targets and required returns, not gut calls. This guide breaks down the math, dilution mechanics, and gives founders an Excel model to negotiate with precision

AI Will Not Make You Rich 🤖

Generative AI is unfolding in a mature market where incumbents capture most value. Wealth accrues downstream to consumers and cost-cutters, leaving thin upside outside infrastructure and rare plays. [Colossus]The Standard Capital Series A Framework 📑

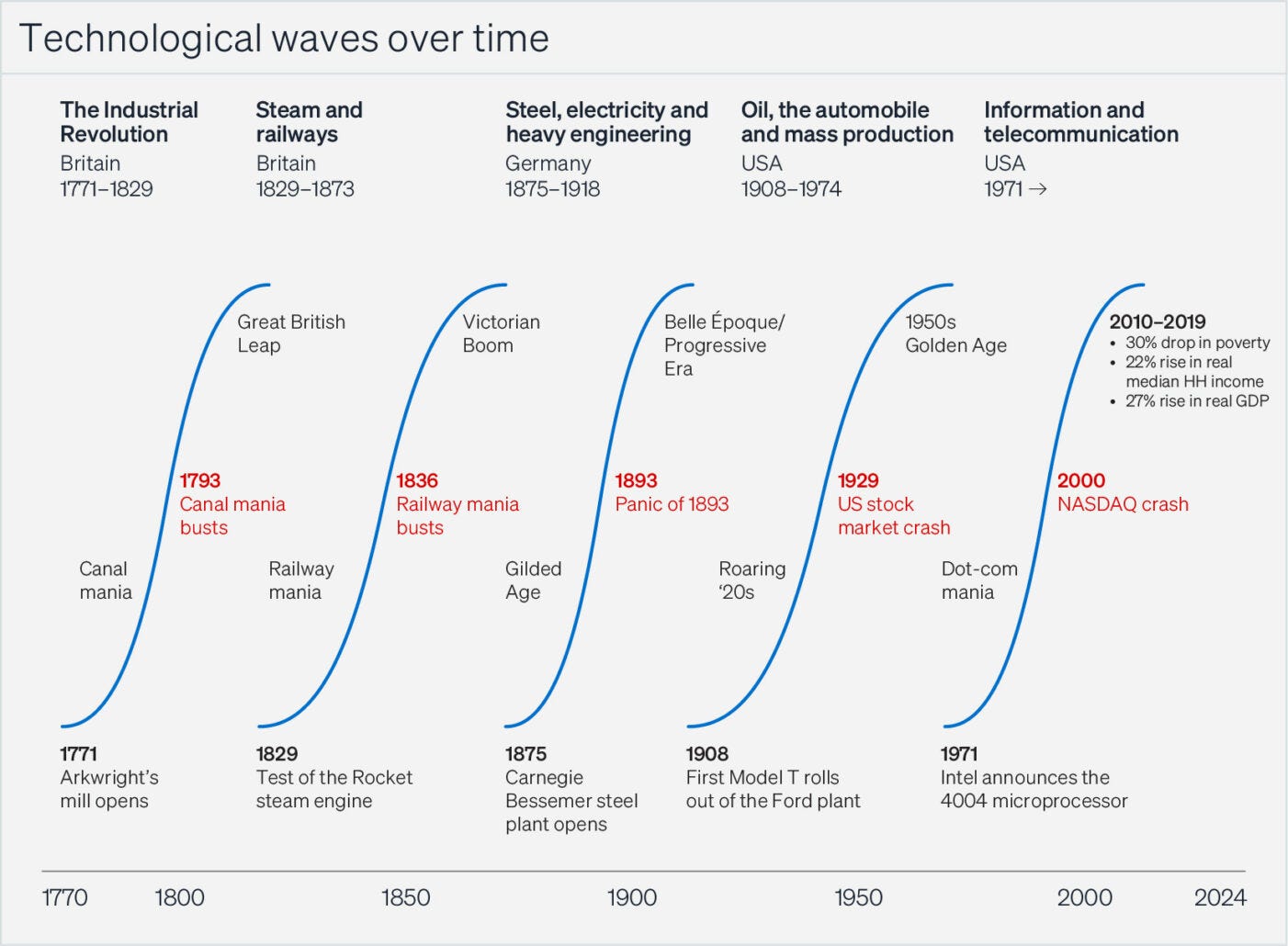

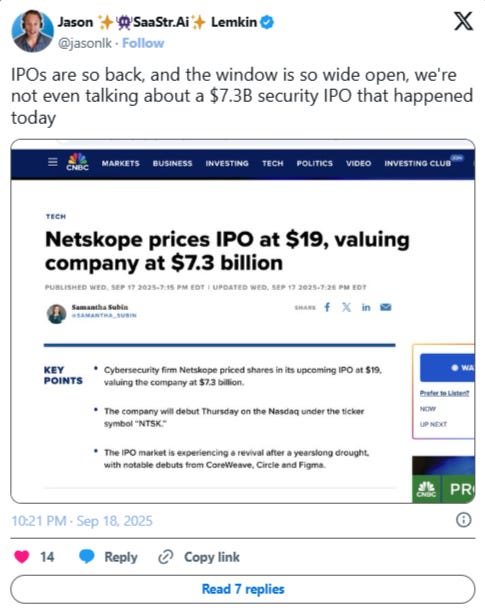

A fixed set of Series A documents now aims to streamline venture fundraising. Standardized terms balance founder and investor interests while cutting down negotiation time. [Standard Capital]The Great IPO Awakening: Real Comeback or False Dawn 📈

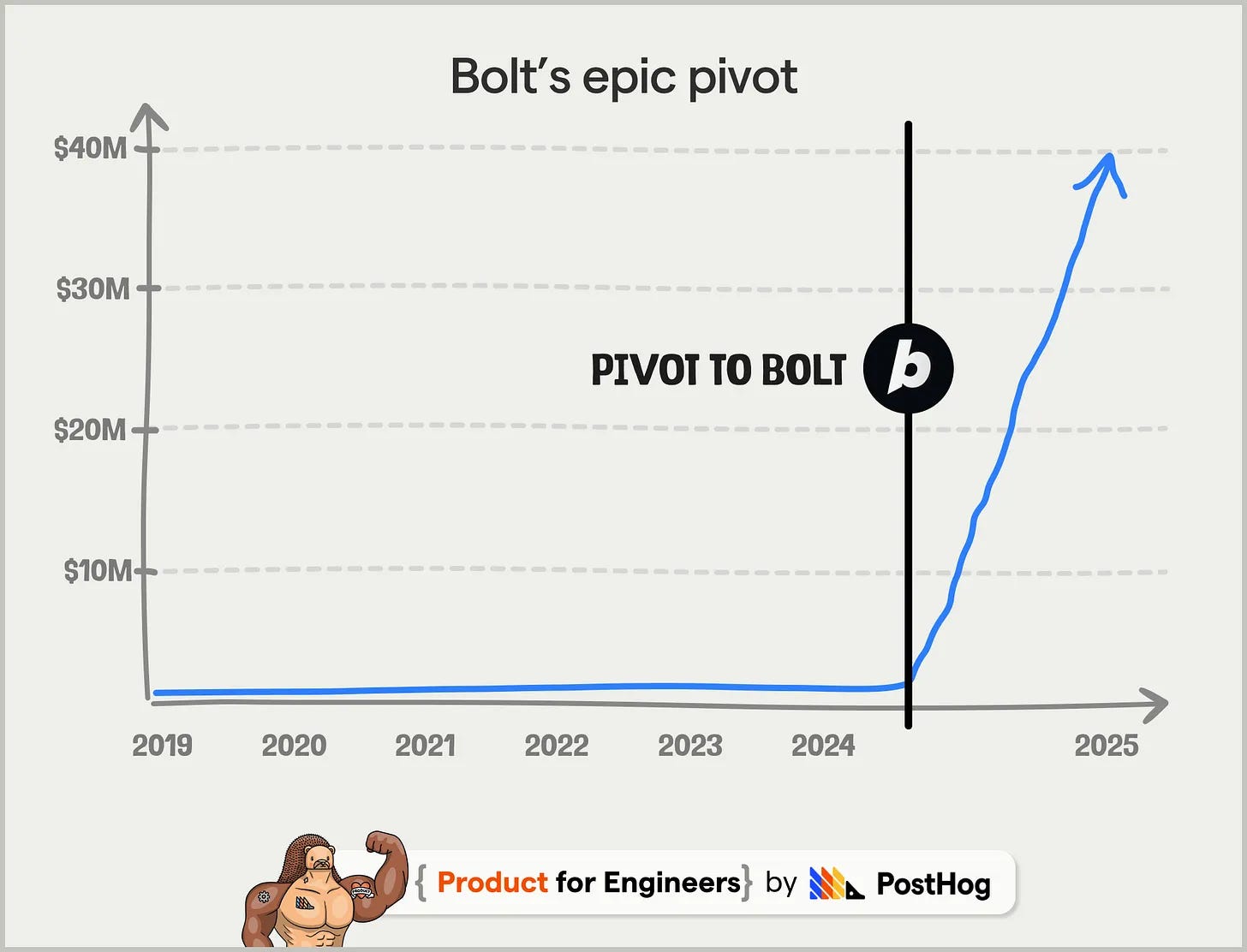

Six IPOs raised $4.4B in a week, the busiest stretch since 2021. Today’s deals lean on fundamentals and conservative pricing, with Stripe, Databricks, and Canva still in the pipeline. [SaaStr]Bolt’s $40M ARR Pivot: Browser Becomes the Server ⚡

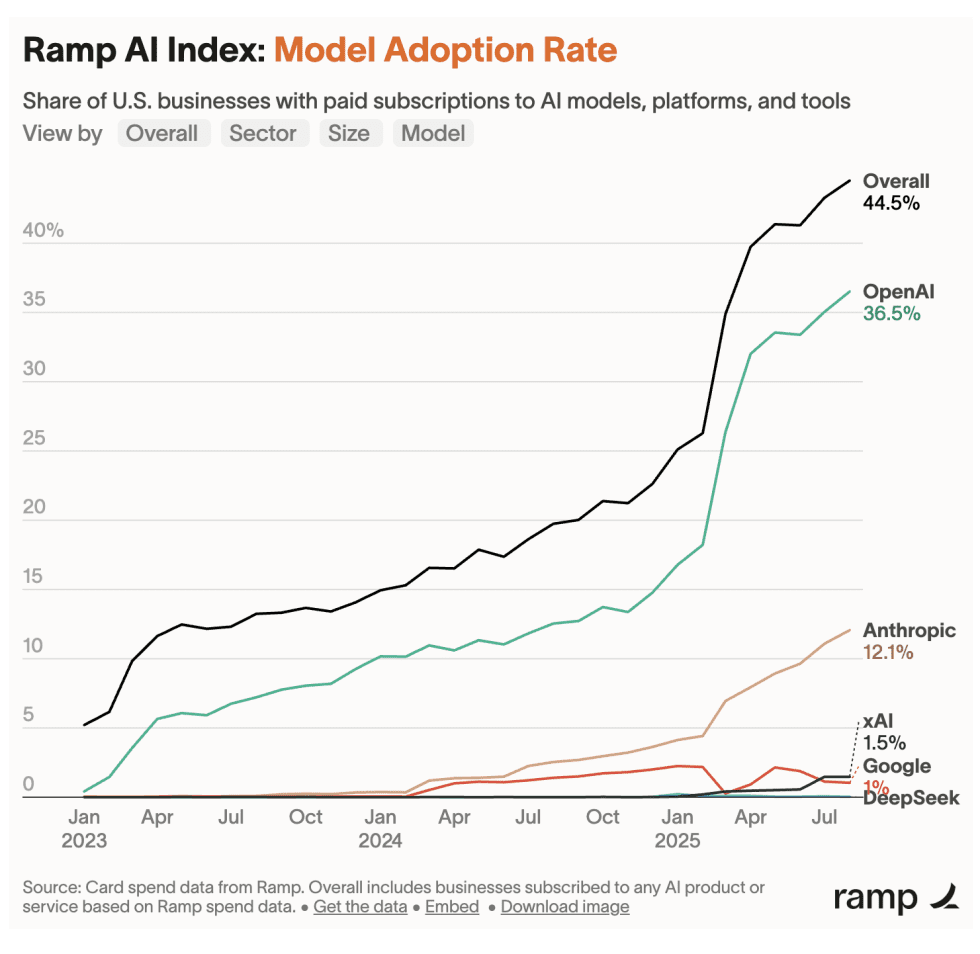

StackBlitz nearly folded before pivoting to Bolt, an AI app builder powered by WebContainer. Running Node.js fully in-browser turned a near-shutdown into $40M ARR within a year. [Lior Neu-ner]OpenAI vs Anthropic: The Real Battle in Credit Card Data 📊

Ramp data shows OpenAI at 36.5% adoption and Anthropic at 12.1%, with Anthropic gaining faster. These figures only capture card-based purchases, not the massive enterprise contracts that set the market. [SaaStr]$46B of Hard Truths: Ben Horowitz on Fear and Greatness🔥

Horowitz argues great CEOs run toward fear and win by stacking hard choices. From Adam Neumann bets to hip-hop pensions, his playbook rejects startup clichés in favor of talent and resilience. [Lenny’s Newsletter.]$40M in 20 Days: Fyxer’s Fundraising Sprint ⚡

Fyxer closed a $40M Series B in less than 3 weeks by running fundraising like a sprint. Strict deadlines, staged data drops, and narrative control gave them leverage and speed. [Fyxer]

Trending News ⚡

Europe’s TBPN Rival Set to Launch 🎙️

Two London founders are raising $150k for ETN, a daily live European tech show. Backed by angels, the format aims to revive Europe’s struggling tech media landscape. [Sifted]

Ransomware Hits Insight Partners 🕵️

Hackers stole banking, tax, and personal data of 12,600+ employees, LPs, and portfolio companies. The breach shows even $90B firms investing in security are exposed to cyber risk. [TechCrunch]Meta Shows Off Smart Glasses and VR Upgrades 👓

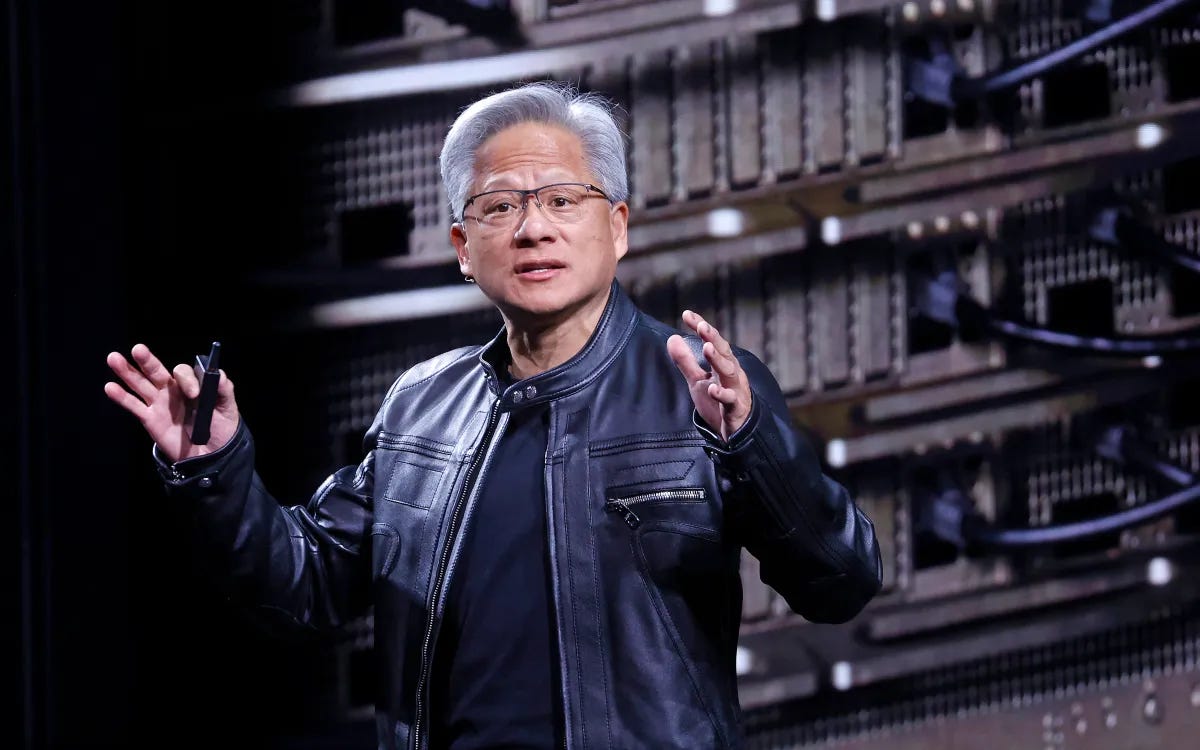

Ray-Ban glasses with displays and Oakley sports wearables push AR deeper into daily life. Quest headsets add Hyperscape scanning and Horizon TV brings Dolby and streaming to VR. [The Verge]China Blocks Nvidia AI Chips 🚫

Beijing told local giants including ByteDance and Alibaba to stop buying Nvidia’s RTX Pro 6000D. The ban boosts domestic chips and adds billions of revenue risk for Nvidia. [TechCrunch]AI Models Beat Humans in Global Coding Contest 🏆

GPT-5 and Gemini 2.5 solved ICPC World Finals problems faster than elite teams. GPT-5 scored 12 out of 12, signaling a new benchmark in complex algorithmic reasoning. [Venture Beat]Google Cuts 35% of Small-Team Managers ✂️

Google shifted hundreds of managers with under three reports back to IC roles. Buyouts span 10 product areas as leadership stresses efficiency and morale questions grow. [CNBC]Nothing Raises $200M Series C 📱

Nothing hit a $1.3B valuation with a Tiger-led round to launch an AI-first device. With 5M units shipped and $1B sales, it is betting design and OS can challenge incumbents. [TechCrunch]

Fundraising?

If you're raising a round, Luis Llorens and Ruben Dominguez Ibar can help. We gather startup fundraising data and share it with our audience of 300k+ investors and startup operators. Fill out this form and we’ll will do our best to connect you with the right investors! 🚀

Social Media Gems 💎

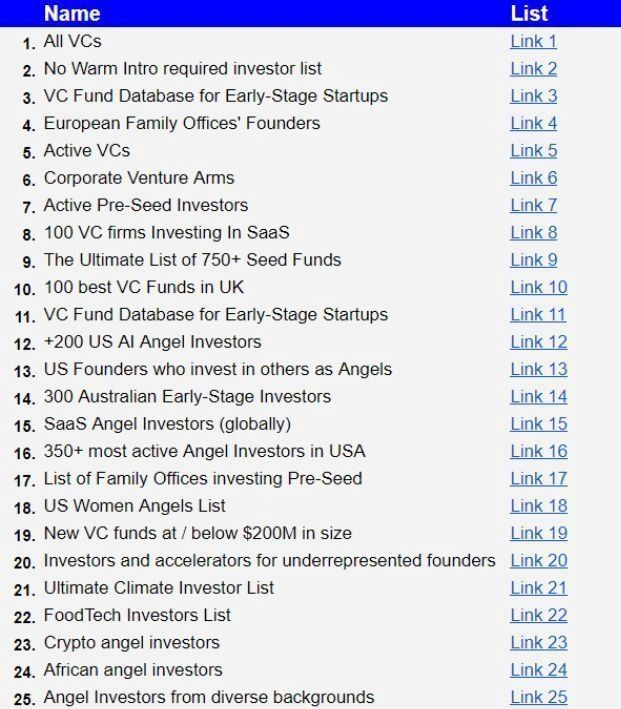

The Ultimate Startup Investor Database Goes Live 📊

A new database of 10,000+ VCs, angels, family offices, and accelerators is now available. Sorted by stage, geography, and sector, it provides founders direct access to investors

YouTube CEO Neal Mohan on Building a Stage for Creators 🎥

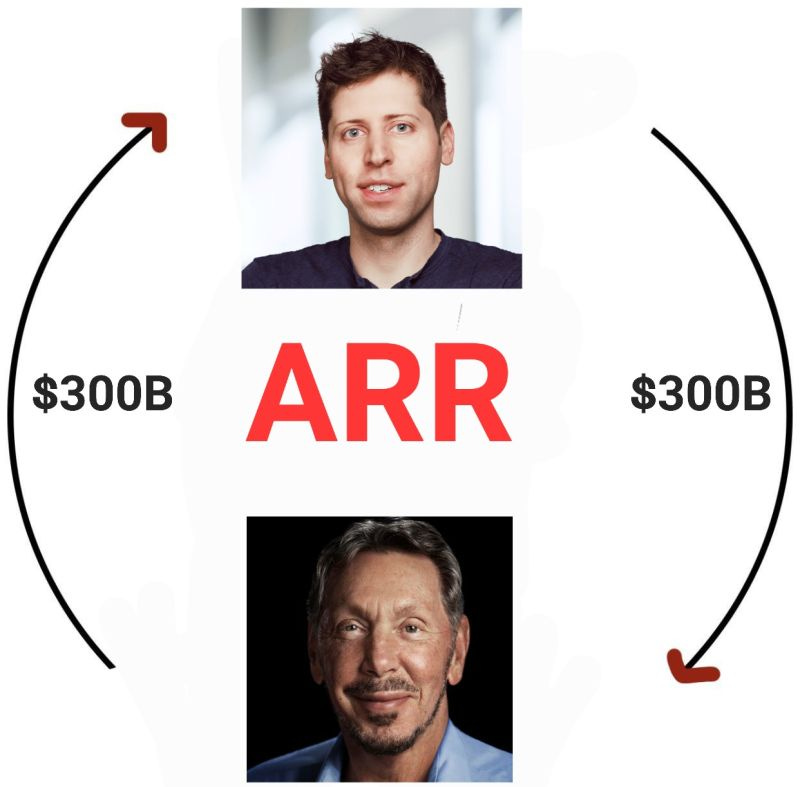

In a Stratechery interview, Mohan outlined updates like Veo 3 video creation and smarter podcast features. His vision is to empower creators with AI while expanding monetization and living room reach. [Stratechery]Inside Oracle OpenAI’s $300B Illusionary Deal 🌀

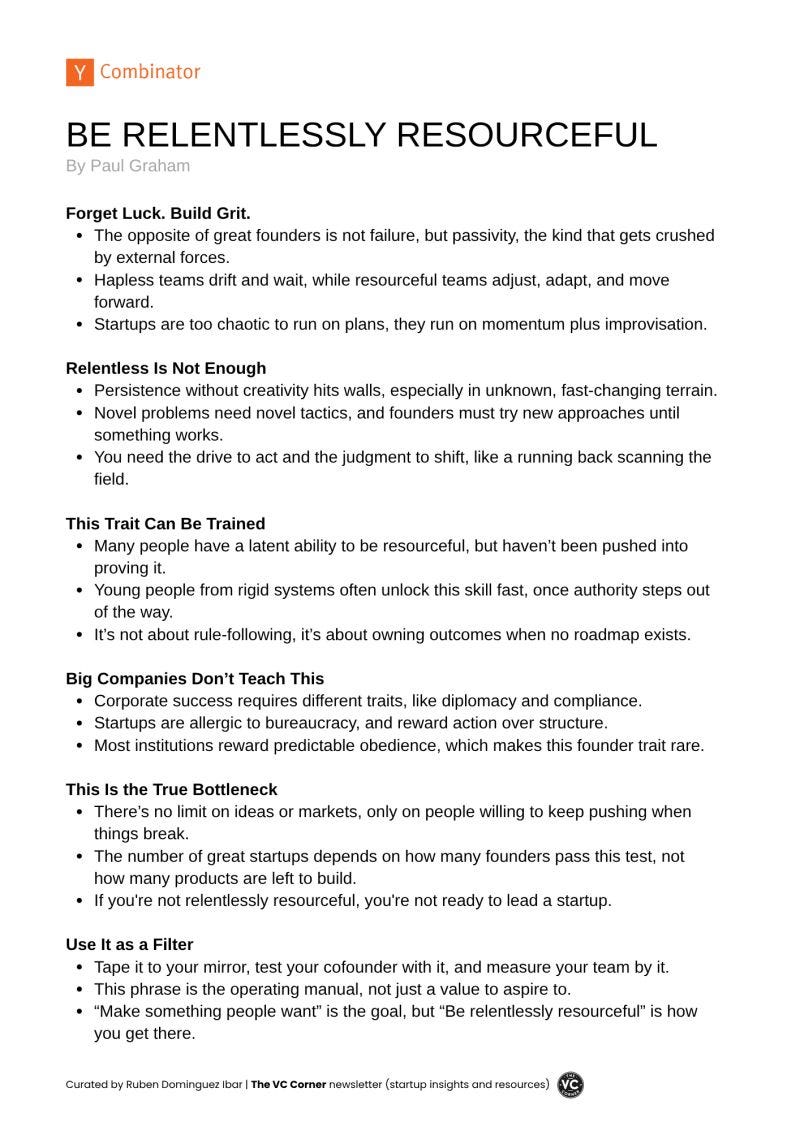

Oracle’s stock jumped $100B on a $300B commitment tied to future infrastructure. Investors see the circular money flow but continue backing it to avoid being first out. [Abdu Khol]Paul Graham’s Ultimate Founder Trait: Relentless Resourcefulness 🛠️

Great founders succeed by solving problems without maps, relying on grit and creativity. In chaotic startup environments, adaptability drives progress and can be developed over time. [Ruben Dominguez Ibar]Why Startups Really Fail: Not Products but GTM ❌

90% of startups collapse, yet only 8% fail from bad products. Go-to-market mistakes, missed signals, and isolation from customers remain the biggest killers. [The VC Corner]AI First Startup Artisan’s Decks 💵

Artisan closed $2.3M with its pitch deck, then raised $12M post-YC and $25M Series A. With 250 customers, $5M ARR, and 40+ hires, it is reshaping marketing workflowsFloot (YC S25) Races to $46K MRR with Vibecoding ⚡

The no-code platform reached 500 customers in 2 months, growing 300% MoM. Built by ex-Retool and SaaS veterans, Floot delivers production-ready AI code for serious apps.

New Funds 💰

BNVT Capital launches its debut $150M fund to back early-stage startups.

T.Rx Capital announces Fund I with $77.5M focused on healthcare innovation.

VoLo Earth closes Fund II at $135M to support climate tech and sustainability ventures.

OneWorld Alliance Airlines & Breakthrough Energy Ventures launch a joint fund to advance and commercialize sustainable aviation fuel technologies.

Summit Peak Ventures raising $150M for its fourth venture fund.

Crane Venture Partners launches its $135M APAC I fund targeting enterprise software startups.

Robinhood rolled out its first venture capital fund to back private companies, expanding beyond retail investing.

Glilot Capital closed a $500M fund to target investments in AI and cybersecurity, reinforcing its deep tech focus.

Octave Capital & Katapult Ocean launched Asia’s largest $75M ocean-focused impact fund during Impact Week 2025.

Vastpoint introduced an €18M Polish fund led by ex-entrepreneurs from ElevenLabs and Y Combinator to back early-stage startups.

Credit Saison unveiled a $50M blockchain-focused VC fund to support Web3 and decentralised finance innovation.

That’s a wrap for this week.

If you want to stay ahead of the curve, make sure you're subscribed. No fluff, just real startup insights delivered straight to your inbox.

See you next time 🚀

Love collaborating with you !