Always Be Launching 🚀, Fake It While You Make It 🤞, Channel-Startup Fit 📞

Your weekly BOOST to Raise and Grow Like A Pro. Tips and techniques used by prolific founders

If you're ready for practical, no-nonsense guidance, The Founders Corner is the newsletter you’ve been waiting for…

🧠 In-Depth Insights

Always Be Launching 🚀

Andrew Chen explains why the most successful startups embrace a “launch mentality,” constantly iterating and releasing new features. Learn how a strong launch strategy can accelerate growth and attract new users.Fake It While You Make It 🤞

This piece by Paul Stansik dives into the art of “faking it” in the early stages of a startup, from appearing larger than life to building trust and credibility with investors and customers. Discover the risks and rewards of this common startup tactic.On Being Funny at Work 😂

This article by Lenny Rachitsky explores the power of humor in the workplace and how a bit of levity can enhance team dynamics, improve productivity, and strengthen leadership. Perfect for founders looking to cultivate a positive, engaging company culture.

Frameworks for AI Vertical SaaS 🤖

This SignalFire article explores frameworks for AI-driven vertical SaaS models, addressing the challenges and opportunities for AI in specialized software markets. Essential reading for AI-focused SaaS founders.Channel-Startup Fit: Finding Your Sales Strategy 📞

Exploring the concept of “channel-startup fit,” this insight details how startups can determine the best go-to-market channels for their product, ensuring efficient and scalable customer acquisition.

Why Companies List Fake Jobs 🎭

This article explores why companies list fake job openings—from talent pipelining to boosting brand perception. A revealing look at a widespread HR tactic and its implications for both job seekers and employers.Clouded Judgement: The Implications of AI on Tech Giants ☁️

An analysis by Jamin Ball of how AI developments are influencing the strategies of tech giants like Amazon and Google. This report digs into their AI-driven pivots and what it means for the future of Big Tech.

Three Key Practices for Founders Balancing Family and Business 👨👩👧👦

A founder shares three powerful strategies to maintain balance between family and startup life. Essential reading for entrepreneurs juggling both personal and professional commitments.

⚡ Trending News

Walmart Heiress Alice Walton Now World’s Richest Woman 🏆

Alice Walton, Walmart heiress, has ascended as the world’s richest woman. Her journey underscores the impact of retail empires and the significance of family wealth on global wealth rankings.

Turkish Martech Unicorn Insider Raises $500M Series E 🦄

Turkey-based marketing technology leader Insider secures $500 million in Series E funding, solidifying its position in the global martech industry and fueling further expansion.Affirm Takes a Slow Move into the UK Market 💳

The US-based Buy Now, Pay Later firm Affirm has cautiously entered the UK market, signaling potential growth for the sector while facing competitive local players.

KKR & Energy Capital Partners Form $50B AI Partnership 🤝

Private equity giant KKR partners with Energy Capital Partners to form a $50 billion AI-focused investment, aiming to reshape sectors like energy and infrastructure through advanced AI applications.UK Budget 2024: Impact on Startups 💼

The UK’s new budget reveals changes affecting startups and investors, from tax adjustments to support initiatives, as the government seeks to bolster the entrepreneurial ecosystem.The Rise of Reddit’s Influence on Social Media 📱

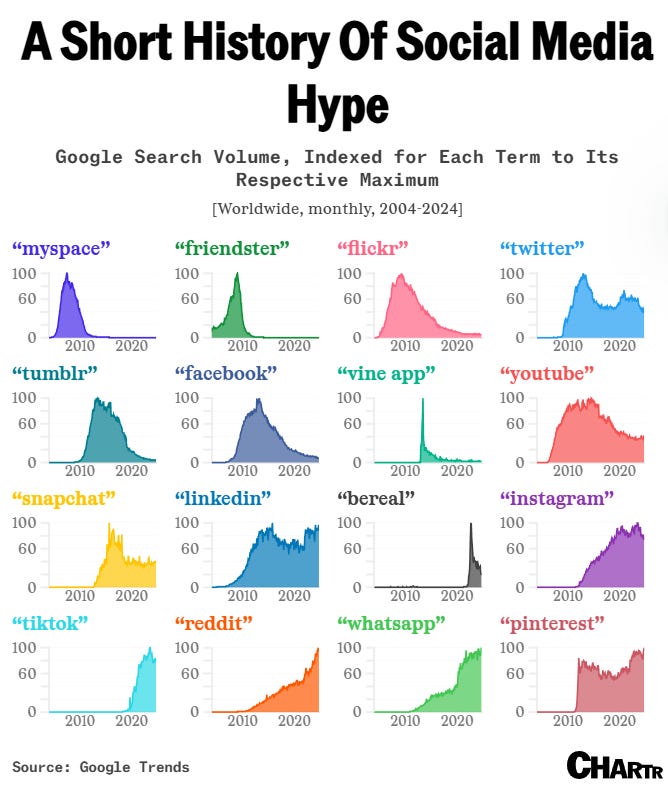

Reddit’s influence on social media dynamics continues to grow as it attracts a more diverse audience. Analysts examine how its platform format, community-driven approach, and unique content curation set it apart.

💎 Social Media Gems

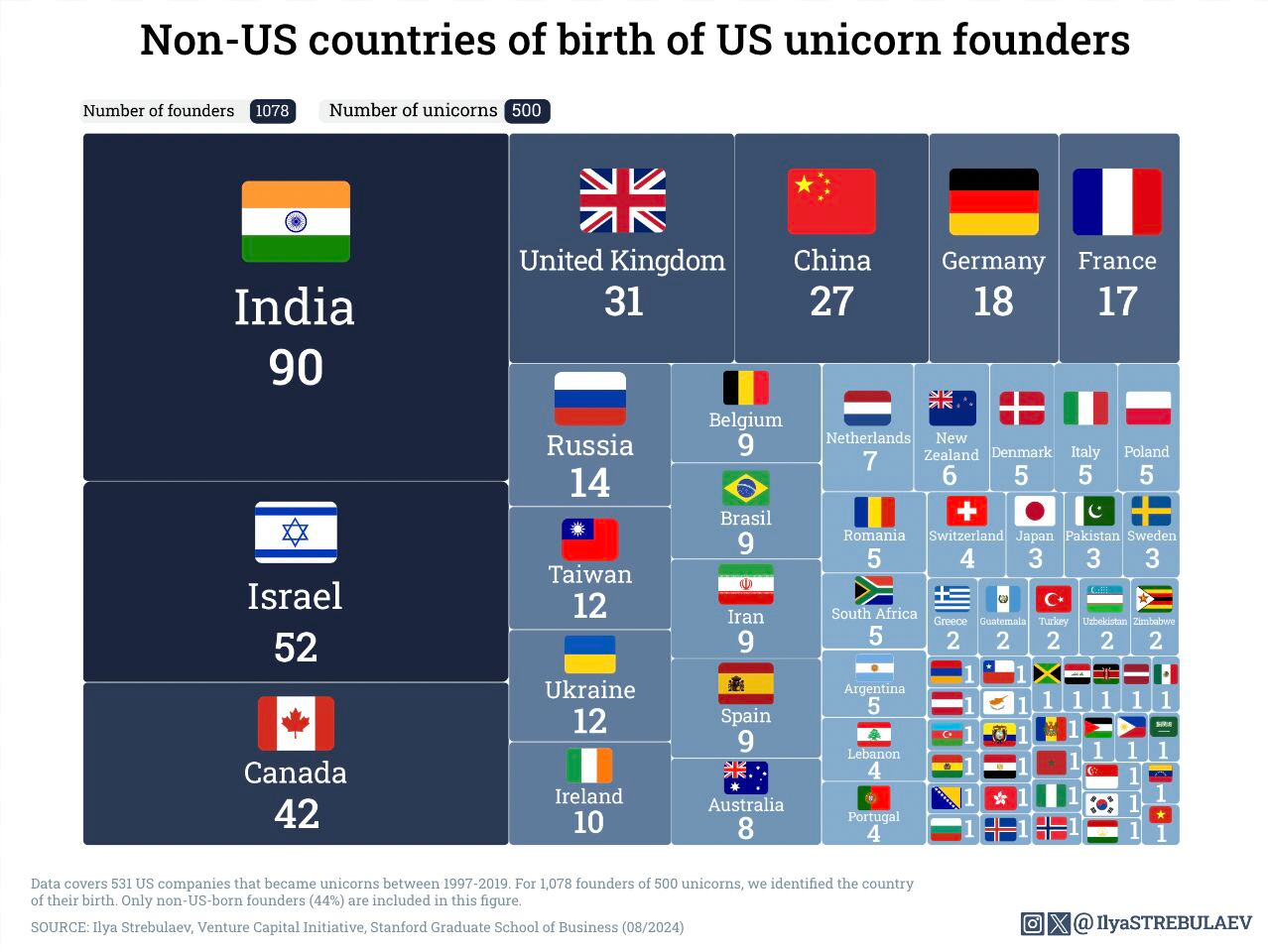

Nearly Half of US Unicorn Founders Were Born Outside the US 🌎

Research shows that almost half of US unicorn founders were born outside the US, with countries like India, the UK, and Canada leading the charge. This highlights immigrants' vital role in driving American innovation.

Why Startup Founders Should Never Employ Anyone Over 30, According to Peter Thiel 👶

Peter Thiel argues that startup founders should avoid hiring anyone over 30, as younger employees often bring fresh, innovative perspectives. Do you agree with Thiel's viewpoint?Getting Off the VC Train 🚂

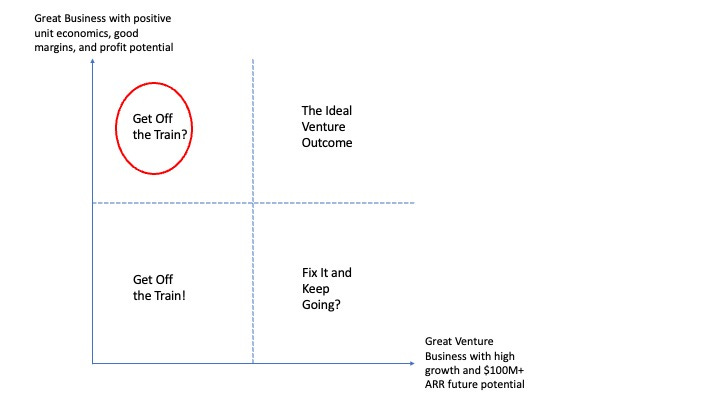

Charles Hudson explores the downsides of continuous venture funding, discussing why some founders choose to step away from the traditional VC path in favor of sustainable growth.

Shades of Product-Market Fit: An Action Plan 🧩

Product-market fit isn’t binary. Kyle Poyar and Maja Voje’s framework for achieving PMF focuses on stages like proof of concept, monetization, scalable GTM, sustainable business, and market expansion.

4 Powerful Segmentation Strategies VCs Love 🎯

Chris Tottman explains how granular segmentation in demographics, psychographics, geographics, and behavior is key for SaaS companies aiming to build a VC-attractive rocketship.

What Should Be De-risked at Each Funding Stage? 🚸

Understanding which risks to address at each funding stage—from market validation at Seed to operational scaling at Series C—helps founders focus on strategic growth, making each funding round a step forward.

💰 New Funds

ReSurge Growth Partners: Launches with a focus on mid-stage startups looking to scale across Europe, targeting sectors like technology and healthcare.

Faber Deep Tech Fund: With a new €60M fund, Faber aims to back deeptech innovation across the Iberian Peninsula, with an emphasis on AI and data.

Chemistry Capital: Founded by former Index Ventures, Bessemer, and a16z investors, this $350M fund targets chemistry-based solutions in sustainability, agriculture, and energy.

Thrive Capital: A $5B fund led by OpenAI’s backer Thrive Capital, focused on tech infrastructure, AI, and companies pushing the boundaries of digital transformation.

XGen Venture Fund: XGen announces a $160M first close, with a focus on early-stage investments in transformative tech across the U.S. and Europe.

Dawn Capital V: Launches its fifth fund at €400M, dedicated to scaling B2B software across Europe.

Seedcamp VII: A €200M fund targeting early-stage startups in fintech, health tech, and climate tech in Europe.

EQT Growth Fund II: Launching a $2B fund to scale tech-enabled businesses across Europe and North America.

Playground Ventures Fund III: With $500M, Playground focuses on advanced tech fields, including AI, robotics, and quantum computing.