A Guide to Small Business Cash Flow: Beware of Your Burn

Small Business OS: Understand the money in and out of your business, and how to turn cash flow stress into sustainable growth.

Fab.com, once a darling of the e-commerce world, raised over $300 million and achieved a valuation exceeding $1 billion. Yet, despite its apparent success, the company collapsed within a few years.

The primary culprit? Poor cash flow management.

This scenario isn't unique. A study revealed that 82% of small businesses fail due to poor cash flow management or a lack of understanding of cash flow.

This article is more than a guide, it serves as your survival toolkit. Whether you're a founder, CFO, or operator navigating the complexities of business finance, we'll navigate through how to track, protect, and optimize your cash flow.

We’ll have actionable insights, clear strategies, and a roadmap to transform cash flow from a potential pitfall into a powerful asset.

Table of Contents

What Cash Flow Really Tells You

Monitoring Cash with a Money Map

Beware of Your Burn: Fixed Costs, Variable Risks, and Hidden Leaks

Speed Up Inflow by Prioritizing Invoicing

Build a Mini-Moat with a Cash Reserve

Smart Spending: When to Tighten and When to Invest

When to Use Credit Before You Need It

The Seasonality Survival Plan

1. What Cash Flow Really Tells You

Profit can look good on paper, but cash flow tells you whether your business can actually survive the month. You might land a big client and book impressive revenue, but if that client pays 90 days later and you’ve got payroll due next week, you’re stuck.

That’s why cash flow is often a better real-time indicator of your business’s health than net income.

Think of it this way - profit is a story; cash flow is the bank balance. It reveals how much money is actually moving through your business; how fast it comes in, how quickly it goes out, and how much you have left to operate. It’s the difference between being busy and being broke.

Good cash flow management means understanding your inflows and outflows, not just at a high level but in terms of timing. Are you spending before you’re getting paid? Are collections lagging while expenses pile up? These mismatches are where many profitable businesses falter.

More importantly, cash flow gives you visibility and control. It shows whether you can hire, invest, restock, or need to slow down. A healthy cash position gives you options. A tight one forces compromises.

When you track cash flow regularly, weekly or monthly, you gain foresight. You can predict crunch points, make smarter decisions, and avoid scrambling when things get tight. In short, cash flow is the clearest signal of whether your business is built to last.

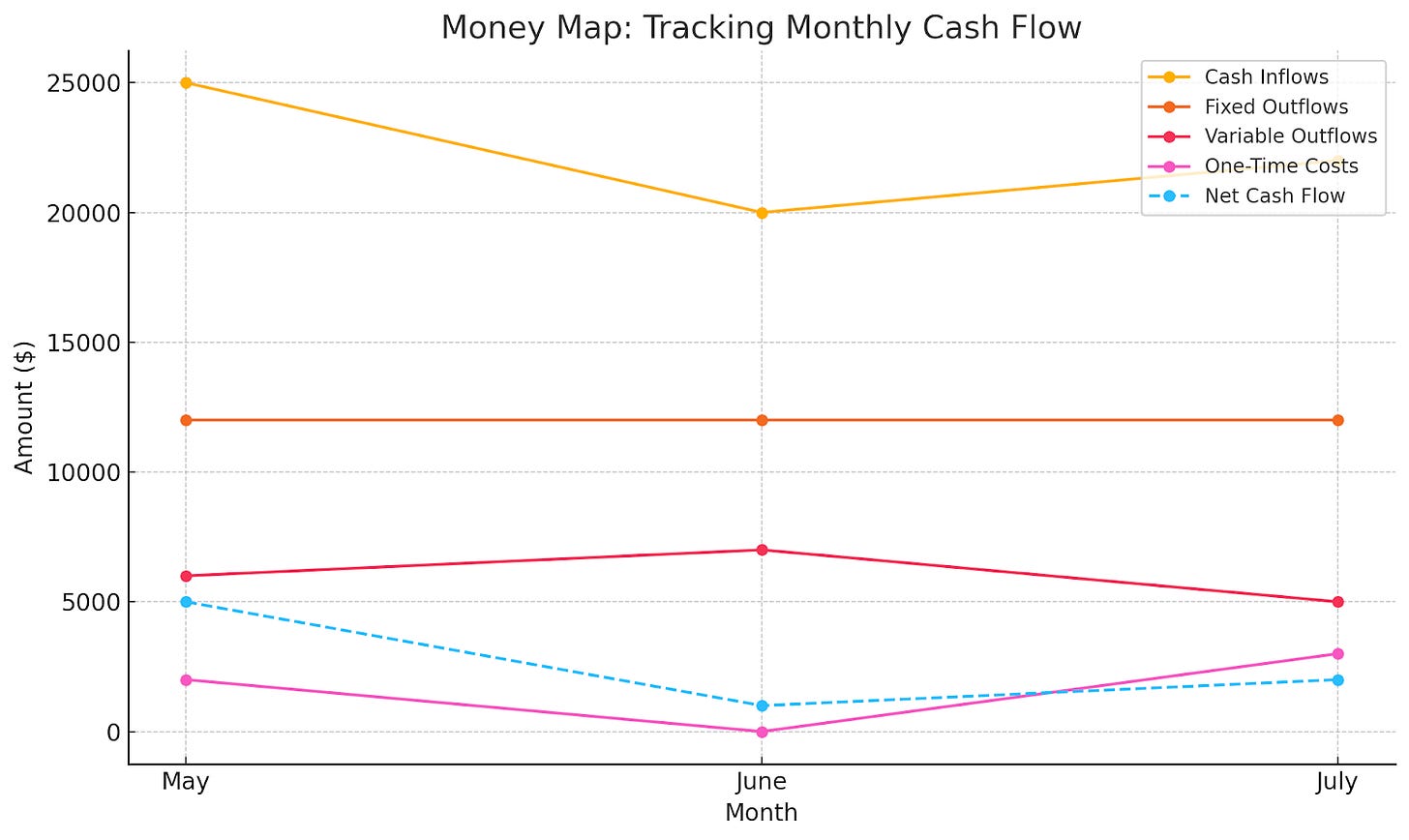

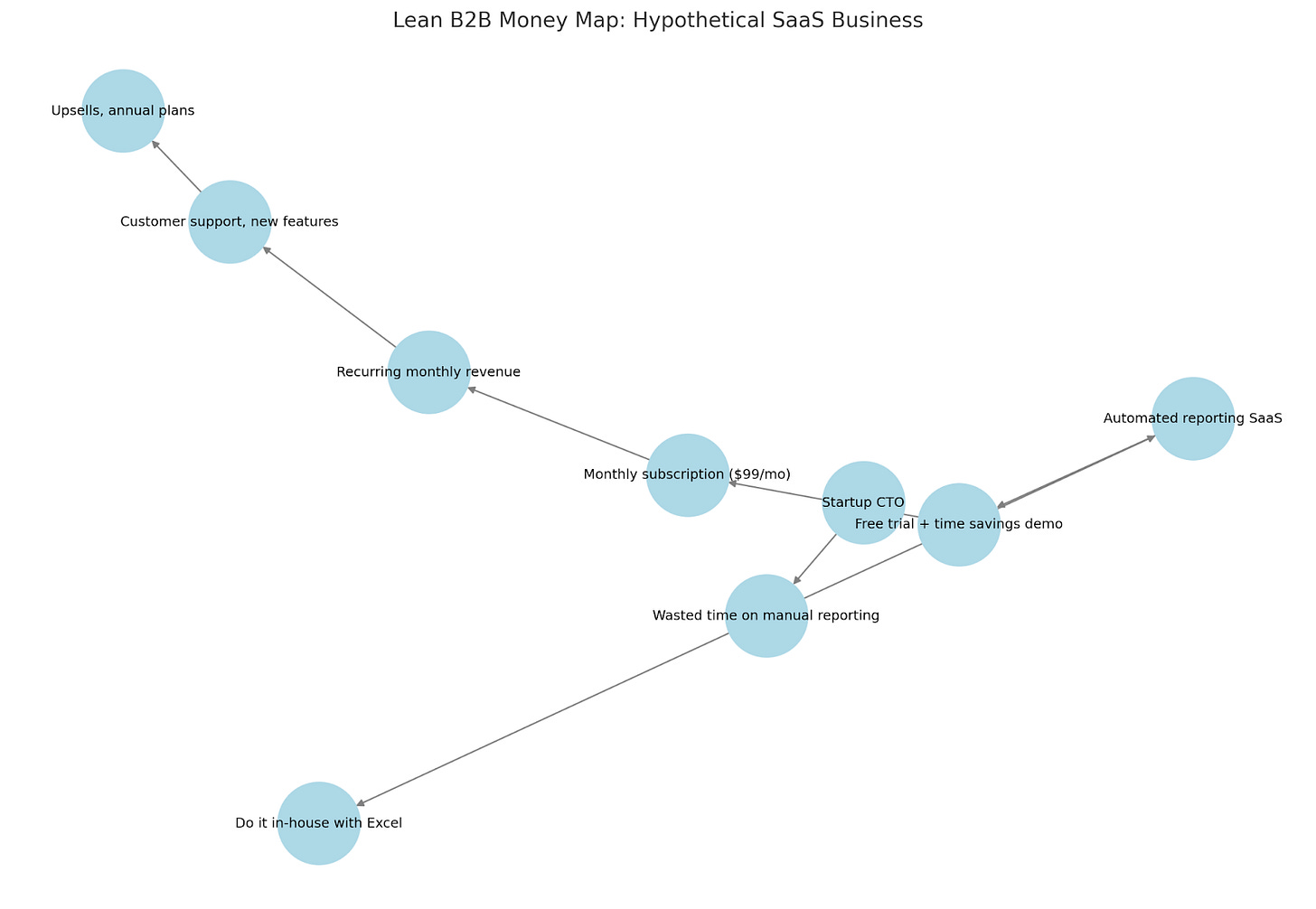

2. Monitoring Cash with a Money Map

Spreadsheets are fine. But what most business owners really need is a way to see their cash, where it’s coming from, where it’s going, and when. That’s what a Money Map gives you. A simple, visual way to track your cash movements and make better decisions in real time.

You can start with just a calendar and a marker. Plot out when you expect to get paid and when your big bills hit - payroll, rent, subscriptions, and inventory. That alone can help you catch timing gaps that spreadsheets miss.

For something more dynamic, try tools like Pulse, Float, or QuickBooks Cash Flow Planner. These let you build rolling forecasts, visualize trends, and spot issues before they become problems.

Want to go deeper? Build a strategic Money Map. It’s not just about timing—it’s about understanding how money flows through your entire business model.

Ask:

Where does the cash really come from (which customer segments)?

What friction exists between value delivery and payment?

Where are we leaving money on the table?

Here’s a simple habit to start. Every Monday, spend 15 minutes updating your money map, projecting the next 4 weeks, and flagging any shortfalls. It’s one of the highest-ROI rituals you can build as a founder or CFO.

When you can see the road ahead, you’re less likely to get blindsided. A Money Map won’t solve every cash issue, but it will make sure you’re never flying blind.

3. Beware of Your Burn: Fixed Costs, Variable Risks, and Hidden Leaks

Every business consumes cash to stay alive. When that outflow starts to outpace your inflow, you begin to burn through your reserves. And unless you’re watching closely, that burn can sneak up on you.

The first step is to audit your expenses. Separate them into fixed costs (like rent, full-time salaries, insurance) and variable costs (like packaging, shipping, or contractor payments). Fixed costs give you consistency, but they don’t scale down when revenue dips. Variable costs offer more flexibility but can spike unexpectedly if not managed.

Next, take a hard look at what’s essential and what isn’t. Some things are non-negotiable, like your core team, your production inputs, and your infrastructure. Others drift into the “nice-to-have” zone. That could be overlapping software subscriptions, lightly used tools, or services you’re no longer benefiting from.

Don’t overlook the small stuff. Unused app licenses, quite increases in vendor pricing, outdated energy plans, or that monthly “pro” account you upgraded and forgot about. These hidden leaks slowly chip away at your buffer.

Track your burn rate monthly. Know how much cash you’re spending compared to what’s coming in. If your burn is accelerating, don’t wait. Adjust quickly. Pause spending, renegotiate a contract, freeze hiring. Small moves, made early, can preserve months of runway.

4. Speed Up Inflow by Prioritizing Invoicing

Strong sales won’t help your cash flow if the money doesn’t land in your account soon enough. One of the easiest ways to improve liquidity is to tighten up how and when you get paid.

Start by sending invoices promptly. Don’t wait till the end of the week or the month. Bill as soon as work is delivered or a milestone is hit. Every day you delay is a day your cash is stuck in limbo.

Next, revisit your payment terms. If you’re still offering Net-30 by default, ask yourself why. For many businesses, Net-15 or even due-upon-receipt works better. You can also request partial upfront deposits, especially for custom work, large orders, or new clients. This covers your costs early and signals seriousness from the buyer.

Consider adding late fees for overdue payments. You don’t have to enforce them every time, but the policy itself sets expectations. To keep things on track, set up automated reminders so clients don’t “accidentally forget.”

Tools like Wave, HoneyBook, and FreshBooks make all of this easier. They let you create branded invoices, set recurring billing schedules, and track overdue accounts in real time.

Getting paid faster isn’t about being pushy. It’s about building a system that protects your cash flow and respects the value of your work.

5. Build a Mini-Moat with a Cash Reserve

Even lean, fast-growing businesses need breathing room. A cash reserve gives you that space - a buffer you can fall back on when sales dip, a client pays late, or a surprise expense shows up. Think of it as a mini-moat that protects your operations when things get shaky.

Start small. Set aside a percentage of every payment that comes in - 5%, 10%, even 2% if margins are tight. If your income varies week to week, consider automating a fixed transfer every Friday into a separate business savings account. The amount doesn’t have to be huge. What matters is consistency.

Over time, aim to build a cushion equal to at least one to two months of core operating expenses. This includes rent, payroll, software, insurance, and anything else you’d need to keep the business running in a slow month.

Having that kind of reserve means you don’t have to panic if cash gets tight. You can keep your team paid, your lights on, and your focus steady.

Keep this reserve slightly out of reach. A separate account, ideally one that earns interest, can reduce the temptation to dip into it for non-essentials. Some founders nickname theirs “do-not-touch” or “sleep-well fund” to stay disciplined.

This isn’t about stockpiling out of fear. It’s about control. A cash reserve gives you more time to make good decisions when pressure hits, and that can be the difference between surviving a rough patch and getting derailed by it.

6. Smart Spending: When to Tighten and When to Invest

Every expense in your business should earn its place. That doesn’t mean cutting everything to the bone. However, it does mean thinking clearly about what actually drives value. The key is learning when to hold back and when to lean in.

Start by tightening where the return is low. Review your recent spend - Are you paying for tools no one uses? Are your overheads creeping up without adding productivity?

These are signs it’s time to trim. Look closely at general admin costs, unused subscriptions, or projects that have stalled. Reducing those won’t hurt your momentum, but they will protect your runway.

At the same time, don’t shy away from investing when the math makes sense. If a tool, hire, or campaign can improve efficiency, increase revenue, or reduce churn, and you can measure that impact, it’s often worth it.

This could be automation software that saves hours every week, upgraded equipment that cuts waste, or a well-targeted marketing push that pays for itself.

Ask yourself: Will this spend make us faster, better, or more profitable in the next quarter or two? If the answer is yes, and if your cash position allows it, it may be the right move.

One more rule - time your investments wisely. Spending after a cash flow spike is smarter than stretching during a lull. Keep your baseline protected, and use surplus cash to grow strategically.

7. When to Use Credit Before You Need It

The best time to access credit isn’t when you’re low on cash; it’s when your financials are strong, and your runway is clear. Too many business owners wait until they’re feeling the pressure to apply for a loan or open a credit line, only to find their options limited or the terms unfavorable.

Start early. Open a business credit card or apply for a small line of credit while your revenue is steady. Use it occasionally, pay it off promptly, and build a positive credit history. This not only boosts your credit score but also increases your chances of qualifying for larger credit limits down the road.

Credit is a tool, not a fallback plan. Use it to smooth out timing mismatches, like covering vendor payments while you wait on incoming invoices, or to fund short-term opportunities, such as bulk purchasing at a discount.

Business cards from providers like Ramp or American Express also come with perks - spending insights, category tracking, cashback, and even short-term float at zero interest if you pay on time. These features can ease day-to-day strain without locking you into long-term debt.

The key is discipline. Don’t lean on credit to fund recurring losses. Have a repayment plan before you borrow, and avoid carrying balances month over month unless it’s part of a broader financing strategy.

A well-managed credit strategy gives you flexibility when you need it most. It’s not about spending more, it’s about staying ahead of the curve.

8. The Seasonality Survival Plan

If your business has seasonal highs and lows, you’re not alone. Many do. Whether it’s holiday retail, summer travel, or quarterly billing cycles. The challenge isn’t the fluctuation itself. It’s how well you plan for it.

Start by mapping out your year. Look back at at least 12 months of revenue and expenses. When does cash usually peak? When does it slow down? Overlay this with known events, like tax deadlines, marketing pushes, inventory cycles, or off-season lulls. This becomes your cash flow calendar.

During strong months, avoid the temptation to ramp up spending just because your bank balance looks healthy. Instead, plan to set aside surplus cash to cover leaner periods. A portion of every big sales month should go into your reserve or toward paying down credit used in slower times.

In quieter seasons, lean into efficiency. Scale back variable costs, review fixed expenses, and delay non-urgent projects. Use the time to refine operations, reconnect with customers, or plan for the next growth cycle.

If you consistently face a predictable dip, say, every Q1, build it into your forecast. Knowing a slowdown is coming removes the panic and gives you time to prepare.

Seasonality isn’t a threat if you treat it like a pattern. Anticipate it, budget around it, and adjust your rhythm. That’s how businesses turn seasonal cycles into a sustainable strategy instead of a recurring scramble.