36 New Tech Unicorns in 2025🦄, The Great AI Awakening🤖, Where do Tech Returns Come From? 🔮

If you're building, investing, or just trying to stay ahead of the curve, you're in the right place. Every week, we break down the latest insights, funding news, and founder-friendly gems—no fluff, just what matters. Plus, we track the freshest VC funds deploying capital so you know where the money’s moving.

Let’s get into it 👇

In-Depth Insights 🔍

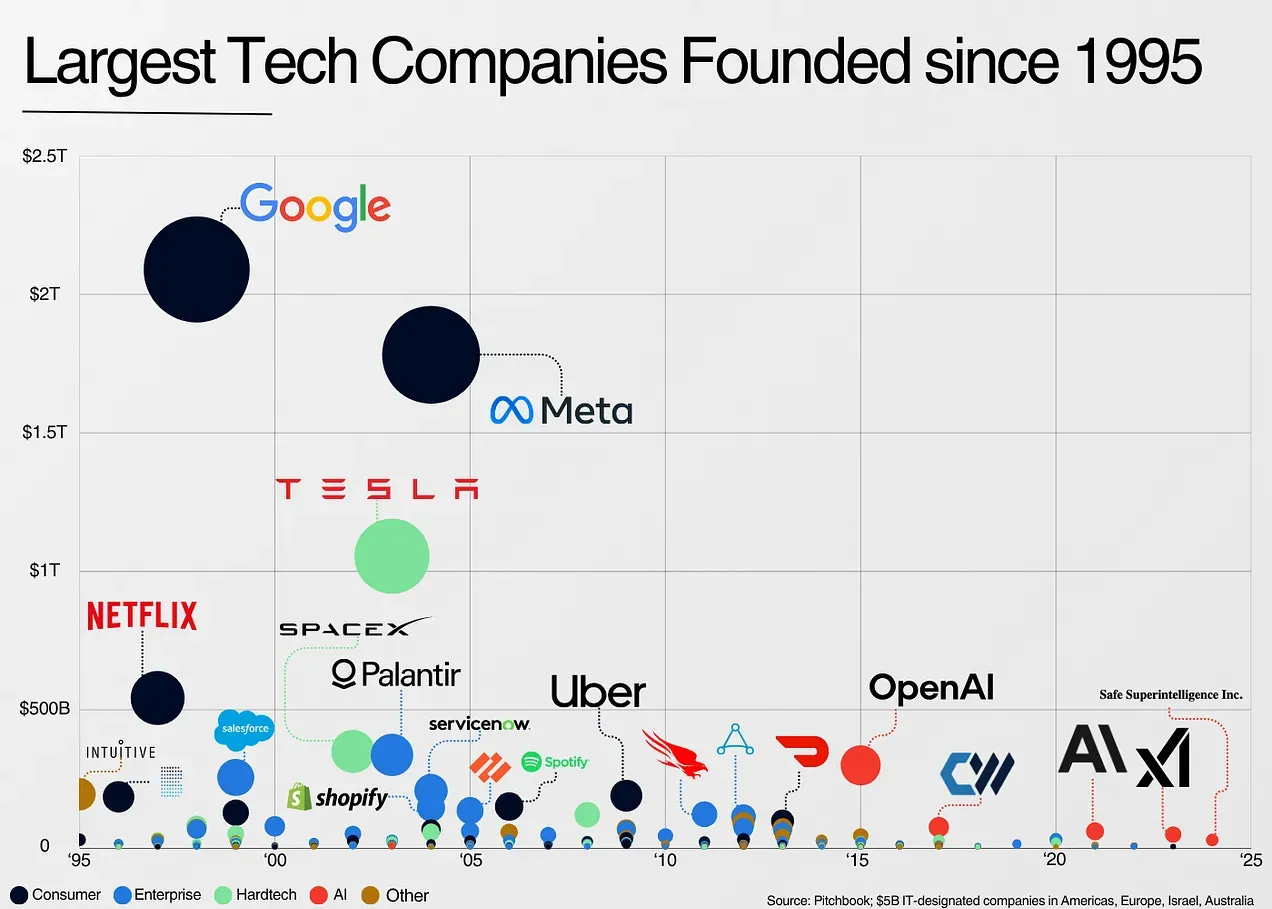

Where do Tech Returns Come From? 🔮

The next $100B company won’t follow traditional patterns. Tech’s future is shaped by anomalies, market misjudgments, and waves of innovation, with AI at the forefront. [Eric Flaningam]Blind to Disruption - The CEOs Who Missed the Future 🚗

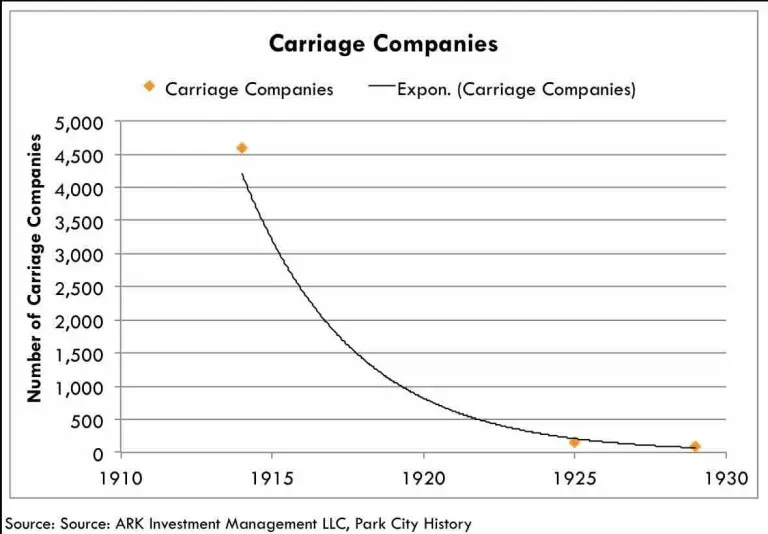

History shows that disruption is inevitable - just look at carriage companies. CEOs today must adapt to AI or risk becoming obsolete.

What’s Going on with Early-Stage Founders? 🔄

Top founders now have more fundraising options. The rise of microfunds and global competition for capital is reshaping early-stage ventures. [Chris Neumann]

The Great AI Awakening 🤖

New AI models like GPT-5 and Grok 4 are set to disrupt generative AI. Expect cheaper, more powerful models to drive personalization and long-term memory innovation. [Michael Spencer]

How to Talk About Your Competition Without Sounding Like a Jerk 👀

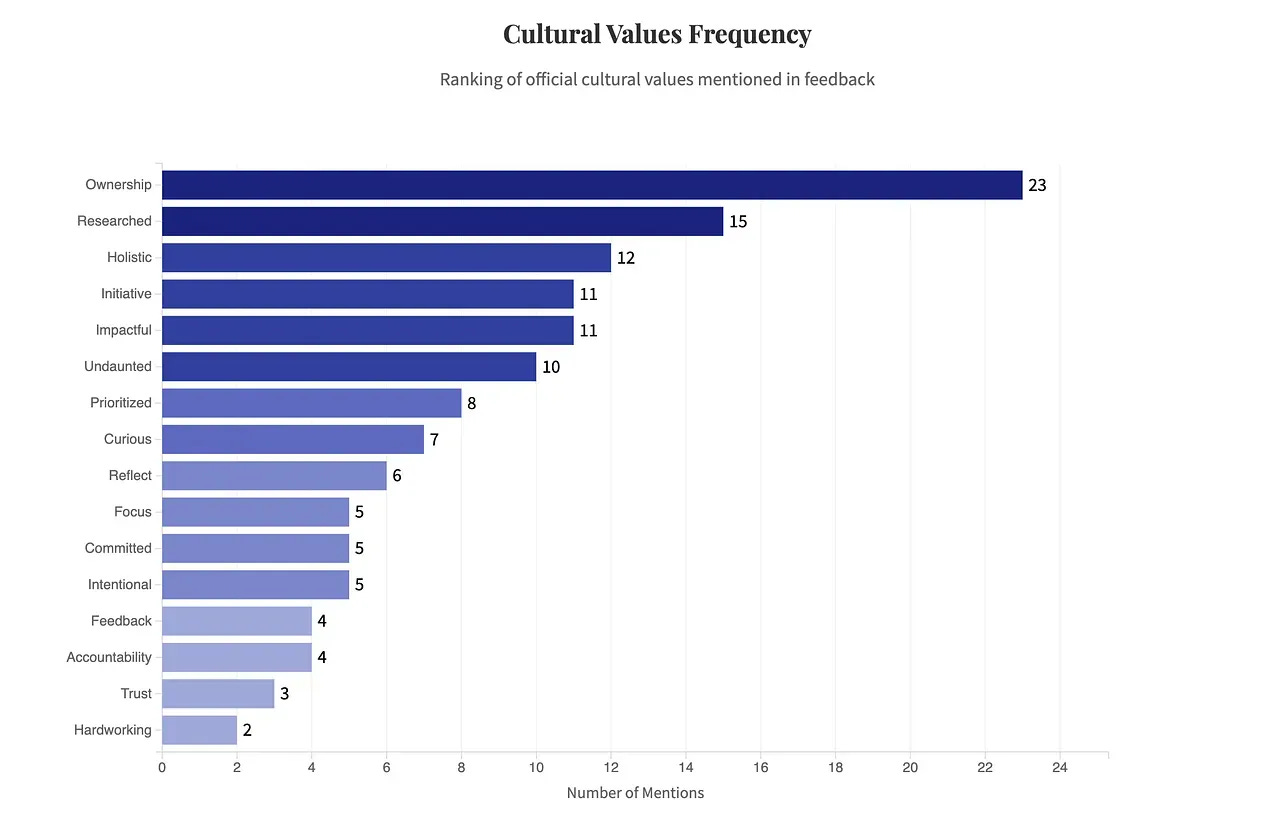

Competition validates your market. Focus on what sets you apart, not tearing others down, and stay focused on your unique value proposition. [CJ Gustafson]Feedback Culture: A Practical Guide to Tying Feedback to Culture 💬

Tying feedback to company values fosters growth and alignment. Companies like StartPlaying turn feedback into action with clear hiring, firing, and promoting practices. [Nate Tucker]

The Other VC Barbell: Engagement 🎯

Venture capital isn’t just about portfolio size. Two strategies dominate: massive diversification for high-volume returns, and deeply engaged, concentrated portfolios for strategic impact. [The Angle Ventures]Solo Founder, $80M Exit, 6 Months: The Base44 Bootstrapped Startup Success Story 🚀

Maor Shlomo bootstrapped Base44 to an $80M exit in six months, leveraging AI to write code and growing to 400,000 users without VC funding. [Lenny’s Newsletter]

Trending News ⚡

Nvidia Reaches $4 Trillion Market Cap 💰

Nvidia hits a $4 trillion market cap, solidifying its AI dominance. This milestone signals Wall Street's confidence in AI, with Nvidia's chips driving innovation at an unprecedented scale. [Routers]Section 174 Reversed: Full Expensing of Domestic R&D Expenses 💡

The U.S. reverses Section 174, allowing businesses to fully expense R&D costs upfront. Startups can now amend tax returns for 2022-2024 and take catch-up deductions in 2025. [Afternoon]36 New Tech Unicorns in 2025 🦄

2025 sees 36 startups reach unicorn status, with AI leaders like Thinking Machines hitting $10B. The growth is not just in AI - industries like satellite tech and blockchain are scaling rapidly. [Tech Crunch]Perplexity Launches Comet: The Web Browser That Thinks 🌐

Comet by Perplexity redefines browsing. It’s a smart, intuitive interface that adapts to your needs, cutting through tab clutter and making every online interaction faster and more seamless.

OpenAI to Launch AI-Powered Browser, Directly Competing with Google Chrome 💻

OpenAI’s AI-powered browser is set to take on Google Chrome, integrating task-executing AI agents and reshaping ad targeting. The move heats up competition in the browser market. [Reuters]

Elon Musk Unveils Grok 4 Amid Antisemitic Posts Controversy 💥

Elon Musk launches Grok 4, an AI model from xAI, but it’s facing backlash for recent antisemitic remarks. Musk is pushing for growth while addressing the controversy. [Wired]

Google Adds Image-to-Video Generation to Veo 3 🎥

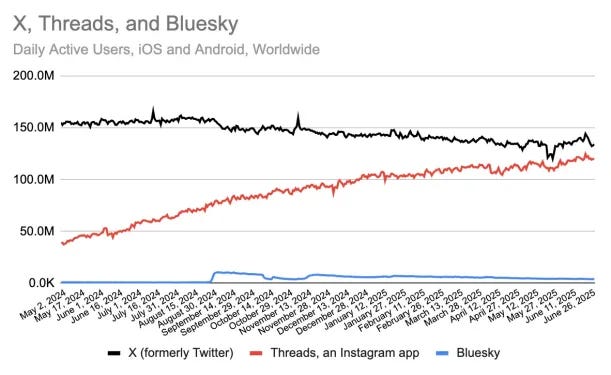

Google’s Veo 3 now includes image-to-video generation, allowing users to turn photos into videos. Over 40 million videos have already been created, marking a leap in AI-driven video tools. [Tech Crunch]X Faces Decline in Users as Competition from Threads Grows 📉

X is seeing a 10% drop in daily users as Threads catches up, signaling shifting dynamics in the social media space. X’s engagement remains strong, but Threads and new competitors are narrowing the gap. [Tech Crunch]

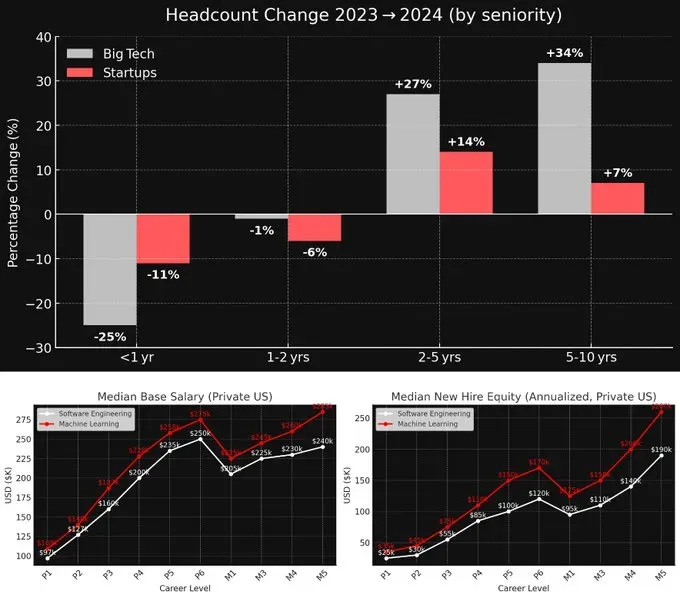

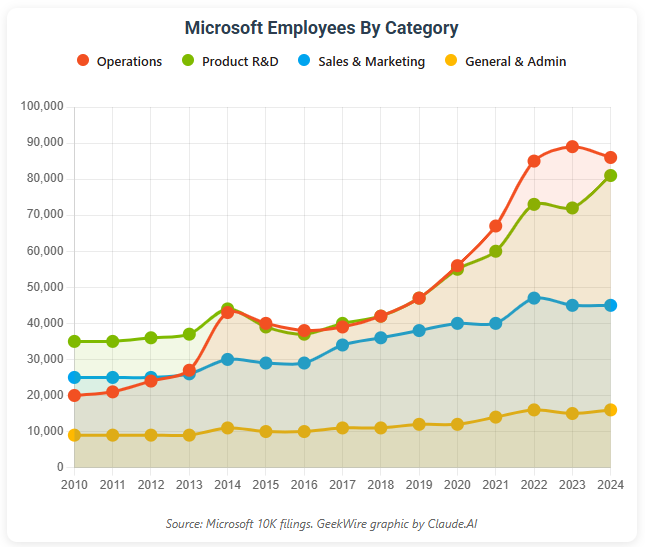

Microsoft Cuts 9,000 Jobs as AI Push Drives Efficiency 🧑💼

Microsoft announces 9,000 more layoffs as AI helps automate tasks, streamlining operations for efficiency. The company’s ongoing restructuring reflects a broader trend in tech. [Geek Wire]

Revolut Seeks $1B Funding to Achieve $65B Valuation 💸

Revolut looks to raise $1B, pushing its valuation to $65B. Backed by Greenoaks, the fintech giant aims to expand its user base and continue its growth as a primary banking option. [Sifted]

Social Media Gems 💎

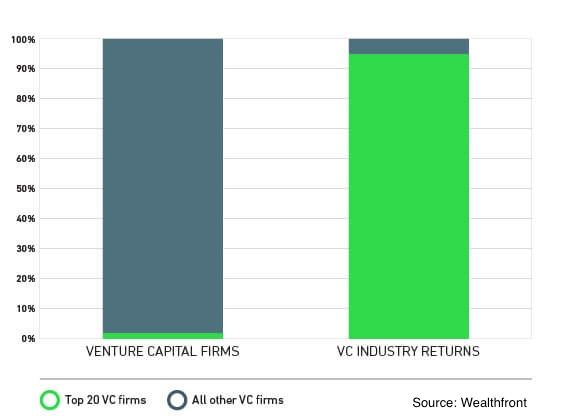

20 VC Firms Capture 95% of All Profits 🏆

The power law is real in venture capital. Just 20 firms capture most of the profits, showcasing the high-stakes, high-reward nature of the ecosystem. Access to these elite firms is rare, making competition fierce.

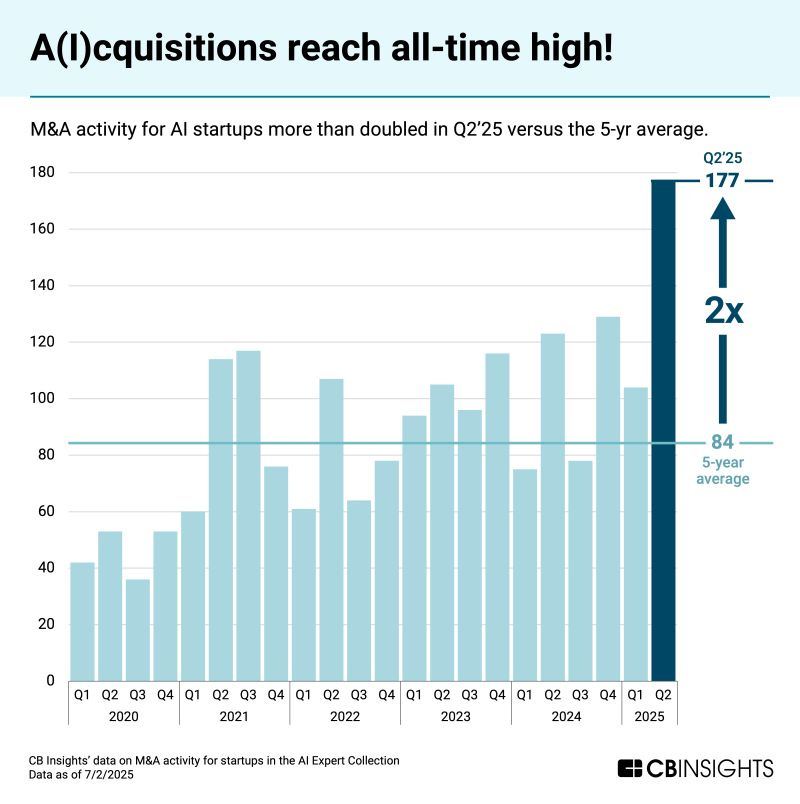

AI M&A Activity Surges in Q2’25 📊

AI M&A is on fire, with Q2’25 doubling the previous 5-year average. Acquisitions are driven by the need for top-tier tech and talent, as industry giants like OpenAI and Databricks push the envelope.

Founders Fund’s Big Beautiful Bets 💡

Founders Fund is all in with $100M across 23 companies. With $671M in SpaceX now valued at $18B, their concentrated bets in AI and aerospace are reaping massive returns.

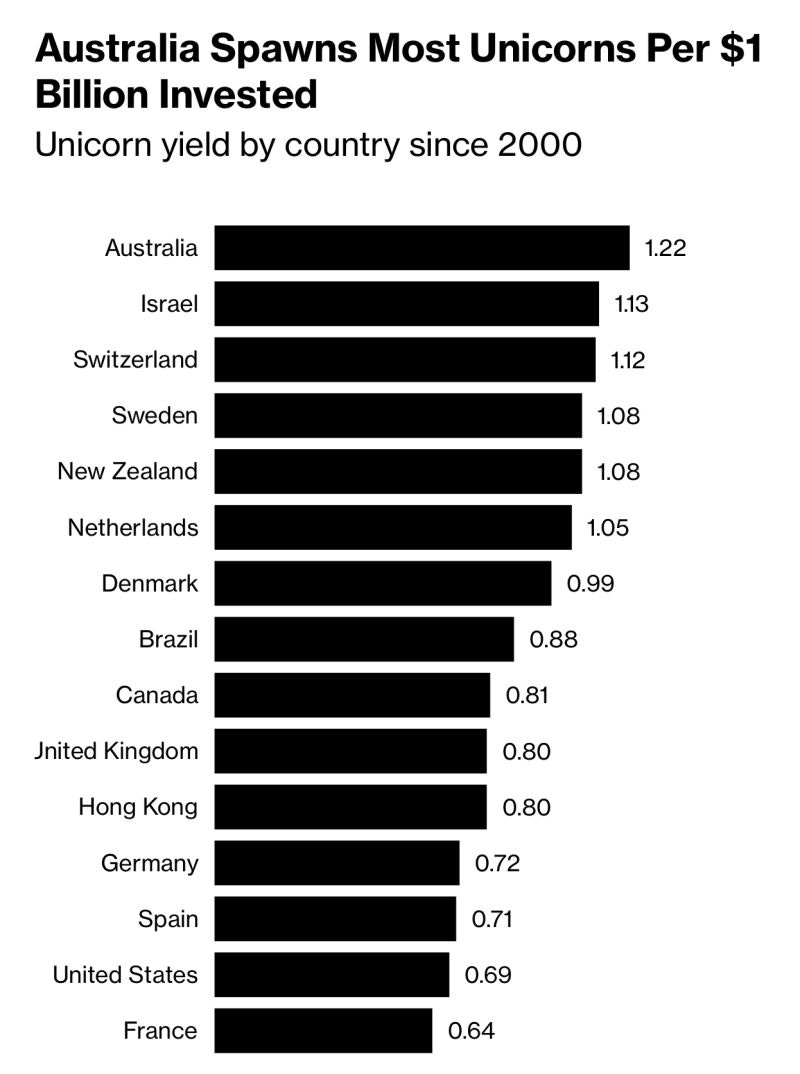

Unicorn Success Per Dollar Invested 🦄

Australia leads with 1.22 unicorns per $1B invested, outpacing the US, but funding remains scarce. High potential, low capital - Australia’s startup scene is an untapped goldmine.

New Funds 💰

Circulate Capital closed a $75.8M fund to boost the circular economy in Latin America and the Caribbean.

Propel Venture Partners fund V is live at $100M, backing the next big high-growth startups.

British Business Bank a £500M package to back diverse and emerging UK fund managers.

Cyberstarts launched a $300M fund to help cybersecurity employees cash out.

Rittenhouse Ventures closed Fund III to fuel more early-stage startup investments.

Ego Death Capital raised $100M for bold, next-gen investments with their second fund.

Boldstart Ventures fund VII is a go with $250M to back enterprise software startups.

Heavybit raised over $180M across two funds to back developer-first startups.

OnePrime Capital closed $305M for Secondary Fund III, focused on late-stage tech.

That’s a wrap for this week.

If you want to stay ahead of the curve, make sure you're subscribed. No fluff, just real startup insights delivered straight to your inbox.

See you next time 🚀

The convergence of AI acceleration, shifting VC strategies, and breakout founder stories makes 2025 feel like a turning point. Appreciate the clarity and signal through the noise!

Great summary here guys. Keep up the good work.